Weekly Media Recap #1

Bitcoin price: $30,263

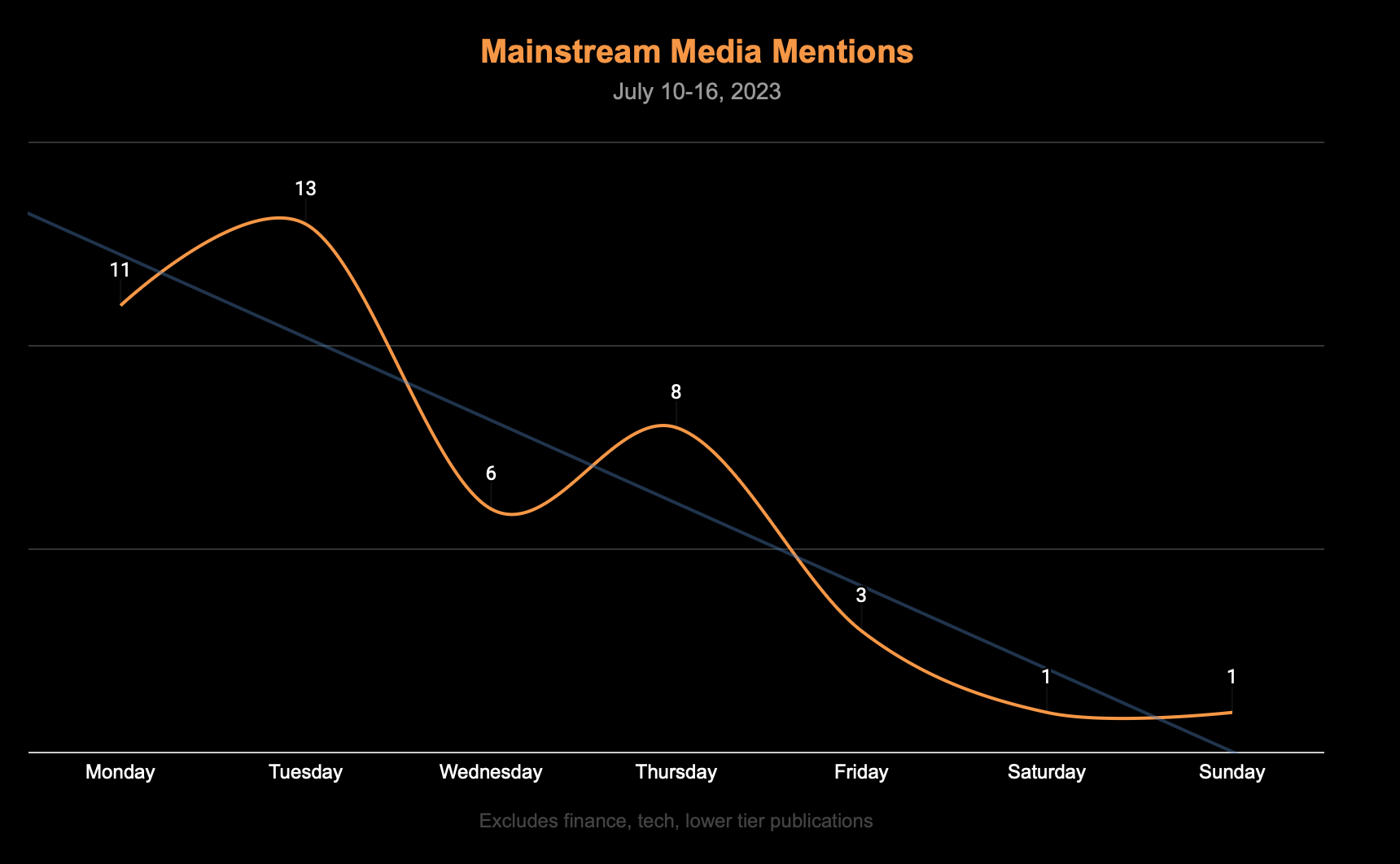

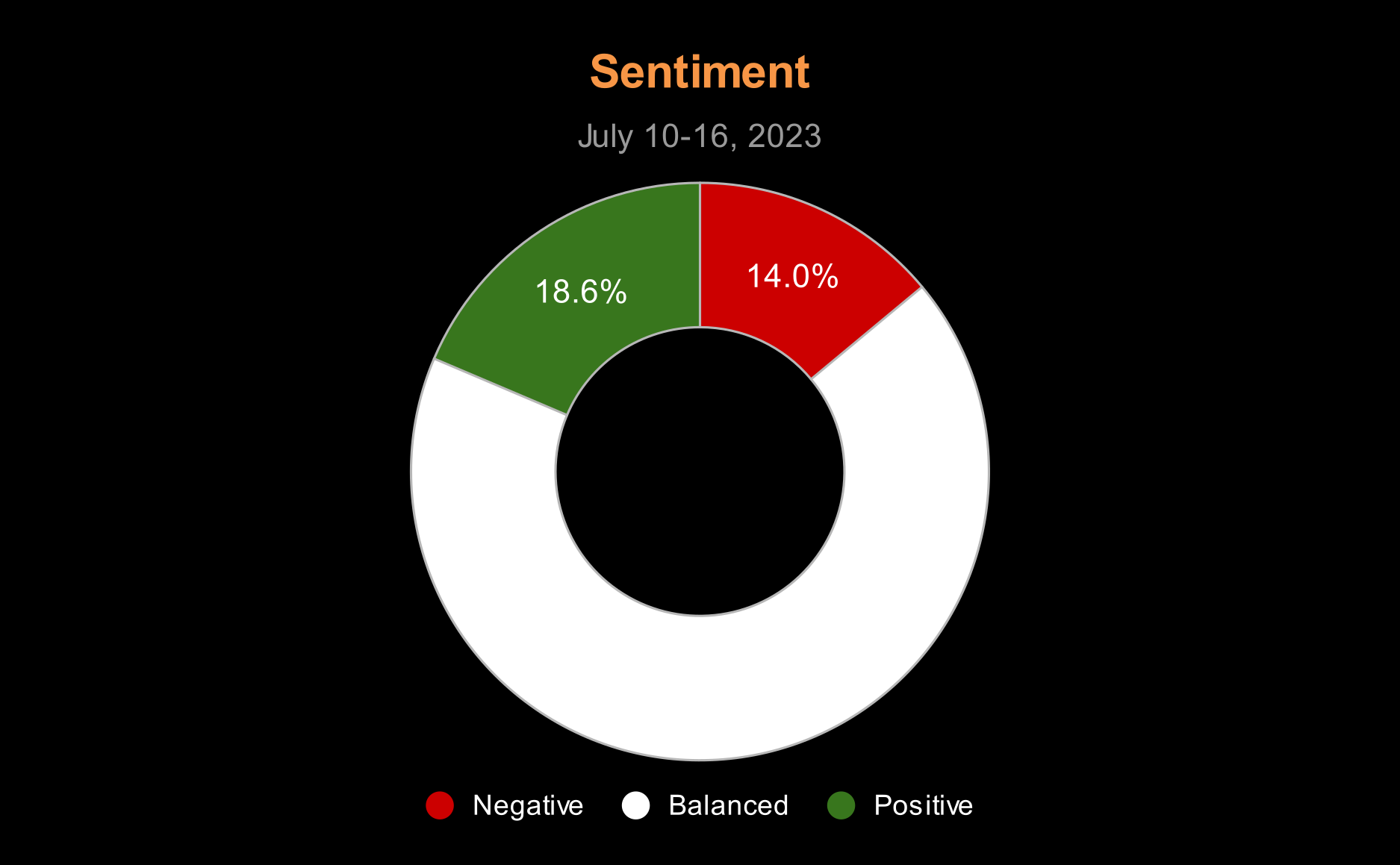

Date range: July 10-16, 2023

Bitcoin Perception Index (BPI): 50.68 - Neutral

Main coverage: Investments, Predictions, Legal and Regulatory Issues, Industry Developments (source)

This week's spotlight: Politico

Weekly snapshot

Main topics of the week

1. Investments and Predictions

Several articles discuss Bitcoin as an investment and focus on the price, a very common thing when the BPI is in the neutral range. Stories include Robert F. Kennedy Jr.'s holdings and Standard Chartered's prediction of Bitcoin reaching $120,000 by the end of 2024. Other articles discuss the potential approval of Bitcoin ETFs and the performance of stocks like Coinbase.

2. Legal and Regulatory Issues

Some articles cover legal disputes and regulatory issues in the broader crypto industry, such as the conflict between the Winklevoss twins and Barry Silbert, the SEC's authority over crypto, and the court ruling in favor of Ripple in the SEC lawsuit.

3. Industry Developments

Several articles discuss developments in the industry, such as the launch of Europe's first Bitcoin ETF, and a focus piece on Hive (the first publicly traded crypto miner) removing “blockchain” from their brand name because they're pivoting to AI. Knowing how much exciting things are currently being built in the Bitcoin space, it is important to know where the MSM chooses to pay attention.

4. Personal Stories and Opinions

Some articles share personal stories and opinions faintly related to Bitcoin, such as Scale AI co-founder's frugal lifestyle until she made $10 million, and Ben McKenzie's transition from The OC heartthrob to a critic of Bitcoin. It is not a focus on any of the articles, and Bitcoin is mentioned as a by-the-way. Lacklustre coverage, to say the least.

5. Other Topics

Other articles cover a variety of topics, including leadership lessons from ex-South Carolina GOP gubernatorial candidate John Warren, and the potential for government-issued digital money, which is this week's spotlight below.

Spotlight on Politico

The article "Government-issued digital money gets closer" from POLITICO journalist Ben Schrekinger discusses the increasing interest and progress in the development of Central Bank Digital Currencies (CBDCs) around the world.

Three key takeaways worth highlighting:

1. Wholesale CBDCs, which pertain to transactions between financial institutions, are gaining traction. The New York Fed and its partners recently announced “promising results” from a three-month digital dollar pilot for global payments.

2. Geopolitics is driving tech developments. Non-Western nations, particularly those affected by U.S. sanctions, are keen to develop alternative monetary arrangements to the dollar system. This has spurred many countries to accelerate their exploration of CBDCs.

3. Governments are borrowing from crypto. Despite the political unpalatability of "crypto" and associated terms, the world’s monetary technocrats are willing to try all available tools in the race to build the financial systems of the future. The successful experiment reported by the New York Fed and its partners made use of a (private, permissioned) blockchain.

Here's a statement from Sam Callahan, lead analyst at Swan Bitcoin, that made me chuckle:

He's not wrong. Funny how it was enough to label him a “crypto purist”.

Based on the content, the sentiment towards Bitcoin specifically is not directly addressed. However, the overall sentiment towards digital currencies and blockchain technology is positive, indicating a growing acceptance and exploration of these technologies by Politico when it comes from the hands of governments and financial institutions.

Interesting quotes from the article include:

"The world’s monetary authorities are demonstrating that they remain determined to move them forward."

"That has spurred many countries to accelerate their exploration of CBDCs — including calls for a gold-backed digital BRICS currency — which in turn has heightened the urgency around the West’s own CBDC efforts."

"While “crypto” and associated terms have acquired a taint that makes them politically unpalatable in many corners, the world’s monetary technocrats remain willing to try all available tools in the race to build the financial systems of the future."

Last thoughts

Always good to see Krugman talk about Bitcoin.