Welcome to the latest edition of Bitcoin Perception.

If you want to join other readers from companies such as Swan, Galoy, Braiins, Blockstream, and others learning about how the mainstream media covers Bitcoin, subscribe below:

You can check out the archive for older media reports and follow BP on Twitter too!

Bitcoin price: $25,142

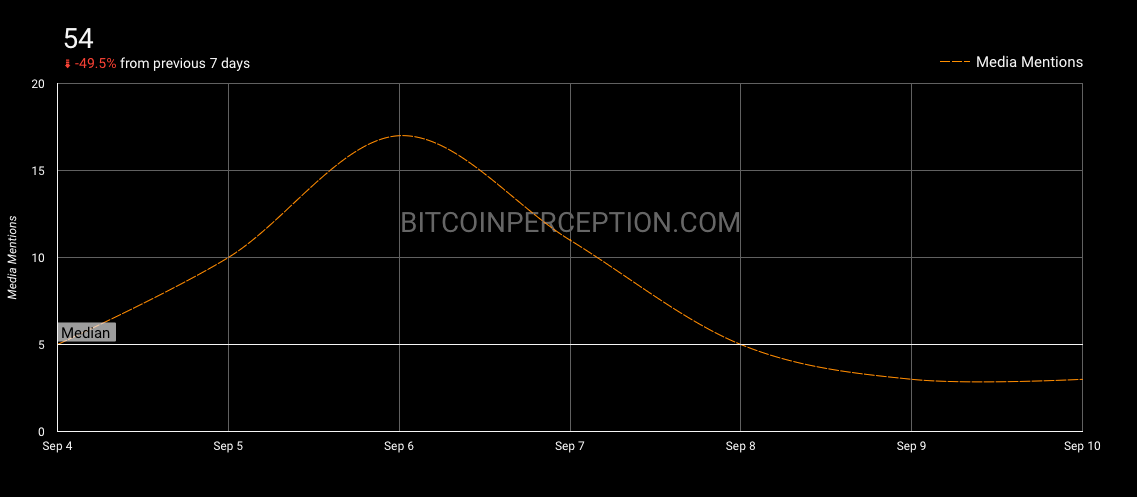

Date range: September 4 - September 10, 2023

Bitcoin Perception Index (BPI): 27/100 - trending towards fear

Main coverage: Regulatory and Legal Developments, Economic Impact and Financial Integration, Bitcoin's Market Performance and Predictions, Technological and Infrastructure Developments

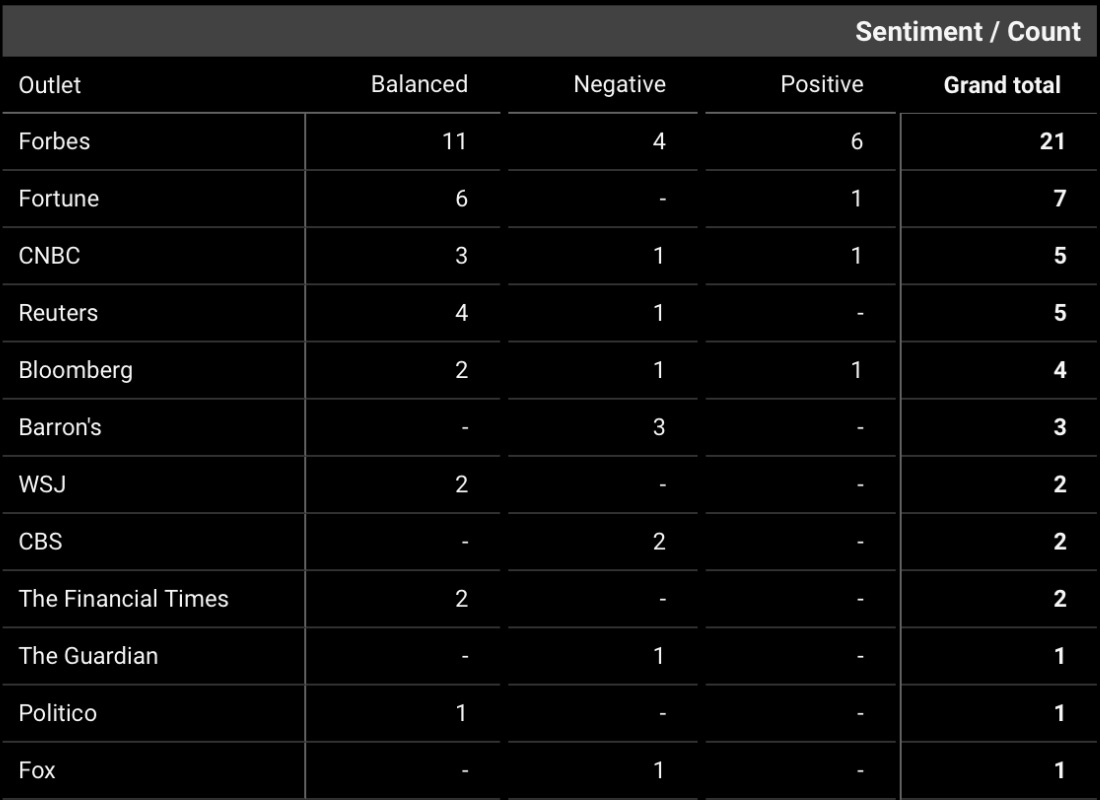

This week's spotlight: Bloomberg

Weekly Snapshot

Main Topics Of The Week

Regulatory and Legal Developments

SEC and ETFs:

The SEC's potential approval of Bitcoin ETFs has been a significant topic of discussion. The anticipation is that this approval could be a game-changer for the market, potentially priming it for a $1.5 trillion valuation.

IRS and Taxation:

The IRS is planning to increase its enforcement actions on crypto users, especially millionaires, partnerships, and those involved in “DeFi”.

Legal Victories:

The “crypto” industry has seen several legal victories, with Grayscale's win against the SEC being a notable one, spurring conviction that a potential Bitcoin ETF becomes real. These victories are seen as positive indicators for the industry's future integration into mainstream finance by the mainstream media, but it’s their only focus at the moment.

Economic Impact and Financial Integration

Bitcoin in El Salvador:

El Salvador's move to make Bitcoin legal tender has been met with skepticism and challenges. The country's population has shown slow adoption, indicating potential hurdles in mainstreaming Bitcoin at a national level. Lots of work still to be done here, anyway.

Bitcoin Mining's Impact:

Senator Ted Cruz has highlighted the positive impact of Bitcoin mining on the U.S. economy and grid.

Wall Street's Influence:

There are concerns that Wall Street might capitalize on the before mentioned legal victories, potentially overshadowing the core values of decentralization.

Bitcoin's Market Performance and Predictions

Bitcoin's Price Predictions:

Analysts have made predictions about Bitcoin's potential price movements, with some suggesting a possible decline. Such predictions play a crucial role in shaping investor sentiment.

Bitcoin Whales:

Bitcoin whales have shown bullish sentiment during market fluctuations, indicating their confidence in Bitcoin's long-term potential.

Technological and Infrastructure Developments

Bitcoin Mining in Texas:

Bitcoin miners in Texas face challenges due to the ongoing power crisis. This situation highlights the need for sustainable and efficient mining practices. More on this below, on this week’s spotlight.

Bitcoin Exchange and Storage:

A guide was provided to help users research and find the best Bitcoin exchange and storage solutions, emphasizing the importance of security and user-friendliness.

Spotlight on Bloomberg

Having gone through the article on Texas Bitcoin miners, I can't help but feel a mix of concern and intrigue. Texas, with its traditionally low-cost energy and miner-friendly regulations, has always been a hotspot for Bitcoin mining.

Companies like Riot Platforms Inc. and Marathon Digital Holdings Inc. have set up shop there, and for good reasons. But the recent power crises, especially with the extreme weather conditions, have thrown a wrench in the works.

The Biden administration's declaration of a power emergency in Texas due to a severe heat wave is a testament to the situation. It's quite telling when Lee Bratcher, the president of the Texas Blockchain Council, points out that over 90% of Bitcoin mining had to be curtailed daily during a week of tightened power conditions.

Most of the power that was left was just for office buildings and backup systems, sidelining the actual mining machines.

This isn't the first time miners had to hit the pause button, though. They had to do the same during a heat wave last summer. And with the looming challenges like low Bitcoin prices, rising electricity costs, and the upcoming halving in 2024, it feels like the miners are caught between a rock and a hard place.

However, it's not all doom and gloom. Some miners have shown resilience by locking in low prices with long-term power contracts or by participating in demand and response programs.

It's definitely a silver lining.

But here's what keeps me pondering:

- How sustainable is Bitcoin mining in Texas, given the recurring power challenges? It's like setting up a shop in a place where you know blackouts are frequent.

- The economic implications for Texas are massive. If Bitcoin mining operations continue to face disruptions, what's the long-term economic fallout for the state? After all, there's potential revenue and job opportunities tied to this industry.

- And lastly, how will the Bitcoin mining landscape in Texas evolve? Will they look for alternative energy solutions, or will they pack up and move to more stable regions?

It's a lot to think about, and only time will tell how things pan out.

Here's the article I'm referring to, in case you want to dive in.

Final thoughts

Crickets in the mainstream media after the Grayscale/SEC news died down.

Seems like the story of a potential Bitcoin ETF in the US is the only thing to be excited about?