Weekly Media Recap #18

Welcome to the latest edition of Bitcoin Perception.

If you want to join other readers from companies such as Swan, Galoy, Braiins, Blockstream, and others learning about how the mainstream media covers Bitcoin, subscribe below:

EOW closing Bitcoin price: $37,086

Date range: November 6 - November 12, 2023

Main Topics: Bitcoin ETFs, Bitcoin Mining Profitability, Security Concerns, Market Sentiment

This week's spotlight: The Washington Post

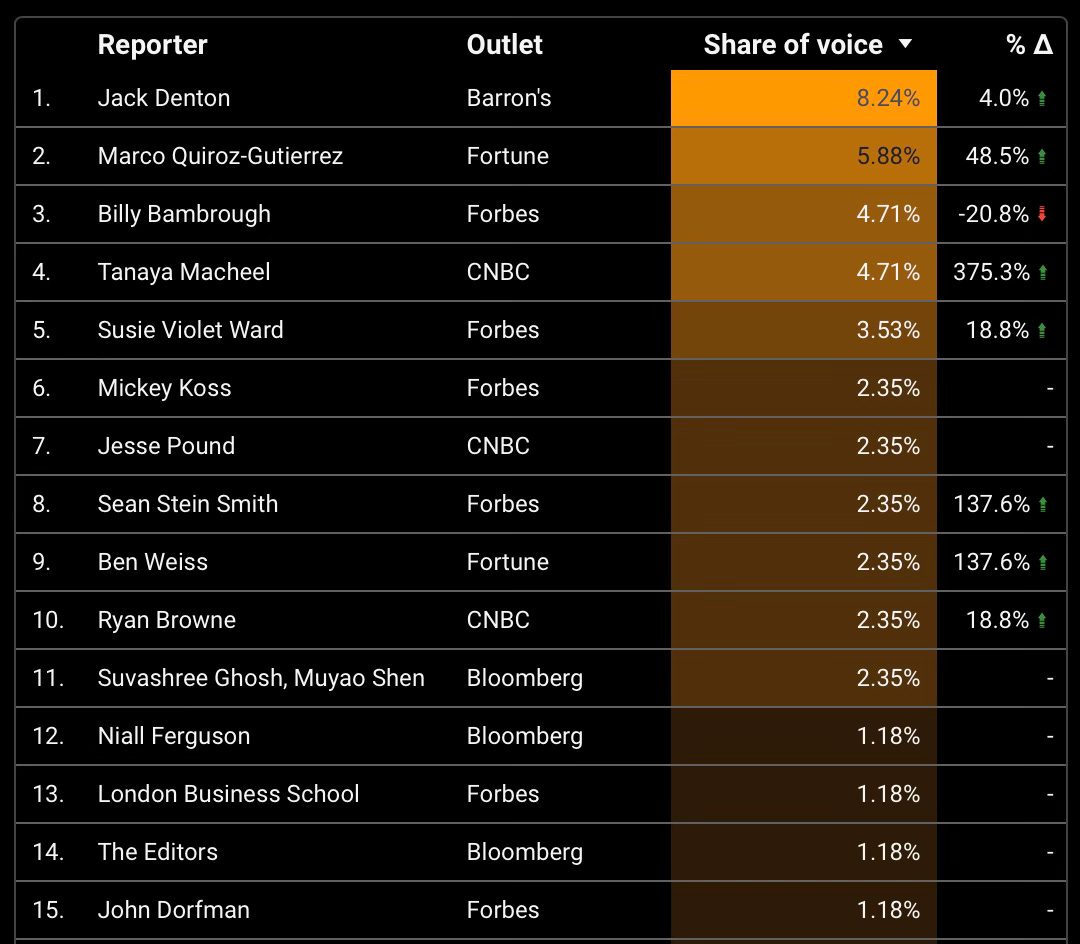

Weekly Snapshot

Main Topics Of The Week

1. Bitcoin ETFs

The anticipation and potential approval of Bitcoin ETFs have, yet again, been a significant focus. This development is seen as a gateway for traditional investors to enter the Bitcoin market, potentially leading to increased mainstream adoption and investment. The involvement of major financial institutions in Bitcoin-related products signifies a growing institutional interest.

References:

- CNBC: A Bitcoin ETF seems to be just around the corner

- Forbes: Bitcoins Crossroads With Spot Bitcoin ETF

2. Bitcoin Mining Profitability

Bitcoin mining profitability has reached a four-month high, primarily due to an increase in transaction fees linked to the rising popularity of Bitcoin-based NFTs, especially BRC-20 tokens. This has led to a higher demand for block space on the Bitcoin blockchain. Concurrently, top crypto-mining companies are selling more Bitcoin than they produce in response to the recent price rally and in anticipation of the Bitcoin halving event in April 2024, which is expected to reduce mining rewards by half.

References:

- Forbes: Bitcoin Mining Profitability Just Hit a 4-Month High

- Bloomberg: Bitcoin Miners Sold More Tokens Than They Minted During October’s Crypto Rally

3. Security Concerns

Security issues continue to be a critical topic. Governments and regulatory bodies are increasingly focusing on what new policies and regulations to introduce to legislation. The security of Bitcoin remains a concern, with various incidents of hacks and cyberattacks reported.

References:

- CNBC: ICBC, the world's biggest bank, hit by ransomware cyberattack

- Daily Mail: Now shadowy hackers hit Hebrides, council services disrupted in latest cyber attack

4. Market Sentiment

The market dynamics and investor sentiment around Bitcoin have been fluctuating. Factors such as the performance of Bitcoin compared to traditional assets, investor behavior, and market trends are closely monitored. The overall sentiment is a mix of cautious optimism and scrutiny, especially considering past volatility and current global economic conditions.

References:

- Fortune: Bitcoin BTC $38,000, Ethereum Ether $2,000, ETF fever crypto markets

- Bloomberg: Bitcoin, Ethereum Price, Crypto Markets Today

This Week's Spotlight: The Washington Post

The recent guilty verdict of Sam Bankman-Fried has sparked a flurry of discussions and analyses, with the Washington Post contributing an opinion piece with a particularly provocative headline, stating that “regulating crypto might end it, and that’s just fine”.

Let’s look into it.

In its op-ed, the Post, almost predictably, intertwines the fate of Bitcoin with the misdeeds of SBF. This is a narrative that, while generally common in the mainstream media, demands a nuanced examination, especially from a standpoint that recognizes Bitcoin's unique role in the financial ecosystem.

A standpoint that seems to be very challenging for some outlets in the mainstream media to grapple with!

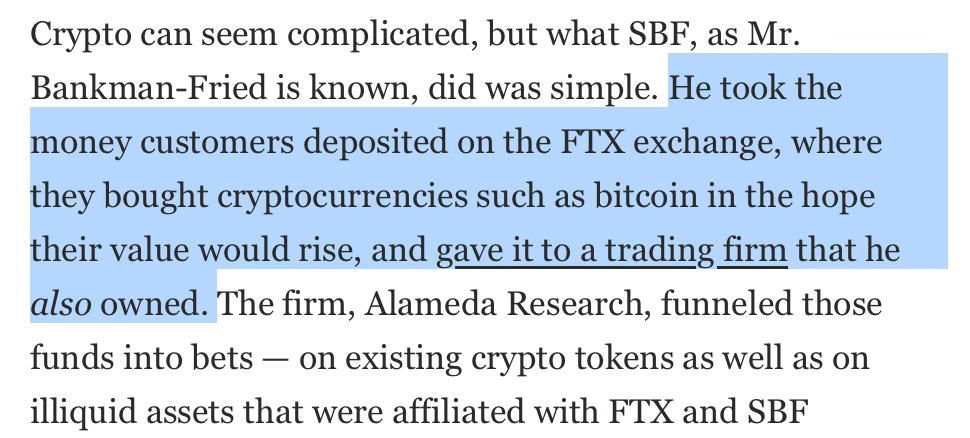

The op-ed unsurprisingly paints with a broad brush, tarring the entire industry with the brush of SBF's criminal activities, by simply listing a bunch of FTX’s wrongdoings, and subtly adding a “[customers] bought cryptocurrencies such as bitcoin in the hope their value would rise”.

This approach, however, overlooks a fundamental distinction: Bitcoin operates independently of the centralized machinations of platforms like FTX.

The misappropriation of funds and deceptive practices of an exchange or its founder should not be allowed to cast a shadow on Bitcoin itself. - It's like blaming a currency for the misdeeds of a bank that mishandles it.

Now, something interesting happens next:

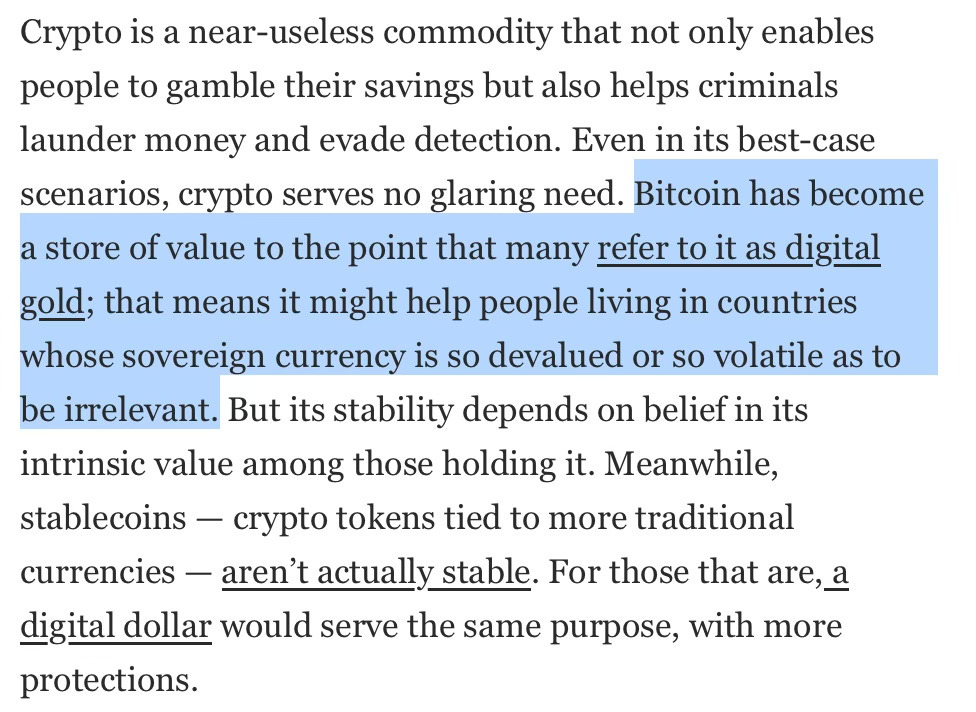

In a surprising move, the op-ed goes on to explain the inherent worthlessness of other crypto tokens and how the cryptocurrency market is plagued by manipulative schemes.

But it actually goes the extra length to differentiate these from Bitcoin, acknowledging the growing acceptance and utility of Bitcoin, especially in regions with volatile or devalued currencies.

Is this a sign of progress from one of the outlets that have covered Bitcoin almost exclusively in a negative way?

Time will tell. But what's important to recognize now is the double-edged sword that these calls for regulation represent.

While the need for regulatory measures to prevent fraud and abuse in the crypto space is undeniable, imposing traditional financial system regulations could undermine the unique properties of Bitcoin. The challenge lies in striking a balance – developing regulatory frameworks that protect consumers and ensure market integrity, without stifling the innovation and benefits that Bitcoin offer.

It seems like the mainstream media, in the wake of the SBF scandal, is mostly invested in putting the spotlight on the former without much consideration of the latter.