My New Year Resolution Is Bitcoin, Too

HEADS UP: The SEC’s Twitter/X account was just hacked, and a false post about ETF approval sent the internet into chaos. I'm dropping my piece on the Financial Times op-ed right now because this particular news gets older by the second.

Already digging into this mess for a detailed coverage piece. Stay tuned for next week's update. -Fernando

Stuart Kirk's recent op-ed in the Financial Times brings to light a critical issue in the Bitcoin space – the tension between the security of self-custody and the perceived safety offered by Bitcoin ETFs.

This is a crucial point of discussion, especially for retail investors who are often deterred by the complexities and risks associated with self-custody of digital assets.

Let’s have a closer look:

Kirk’s observation about the safety of ETFs highlights a fundamental appeal for a certain segment of investors, which I think people in the Bitcoin space need to stop LARPing about and instead start thinking seriously about:

Self-custody is not for everyone.

He notes, 'No one can 'steal' an ETF, of course, and gangs don’t have a clue where you hide your 'cold wallet' — if you prefer to hold bitcoins offline. The digital wallets ETFs will use are also secure.'

This underscores the sense of security that ETFs provide, especially against the backdrop of concerns about the safety of wallets and the potential for exchange hacks.

ETFs, by being part of a regulated financial system, offer a layer of security and ease that is appealing to those who may be intimidated by the technical aspects of Bitcoin.

However, this perspective contrasts sharply with the ethos of Bitcoin's self-sovereign nature, as pointed out by Michael Goldstein (Bitstein) in a tweet.

I agree with Bitstein. There’s nothing there to disagree with.

But I also understand the plea Stuart Kirk makes in his op-ed.

Bitcoin adoption has, thankfully, grown to the point where many cohorts are breaking out, all having their own needs within the spectrum of custody.

This dichotomy presents a significant challenge: While the path of Bitcoin ETFs offers a bridge for traditional investors into the world of Bitcoin, it also raises questions about the trade-offs between security, convenience, and the self-sovereign ethos of Bitcoin.

This tension is likely to persist and shape future narratives from the press.

Shifting the focus to the broader media landscape, it's always a bit of a surprise to stumble upon a Bitcoin article in the Financial Times. For a publication that's (highly) regarded as the gold standard of financial journalism, you'd expect a plethora of coverage on something as technologically and historically significant as Bitcoin.

Yet, when Bitcoin does make an appearance in the FT, it's often

a) unexpected

b) a bit out of place, and

c) mostly lacking enthusiasm.

So when an op-ed like Stuart Kirk's pops up with a positive slant towards Bitcoin, it gets the Bitcoin community going since FT has typically viewed Bitcoin with so much skepticism in the past.

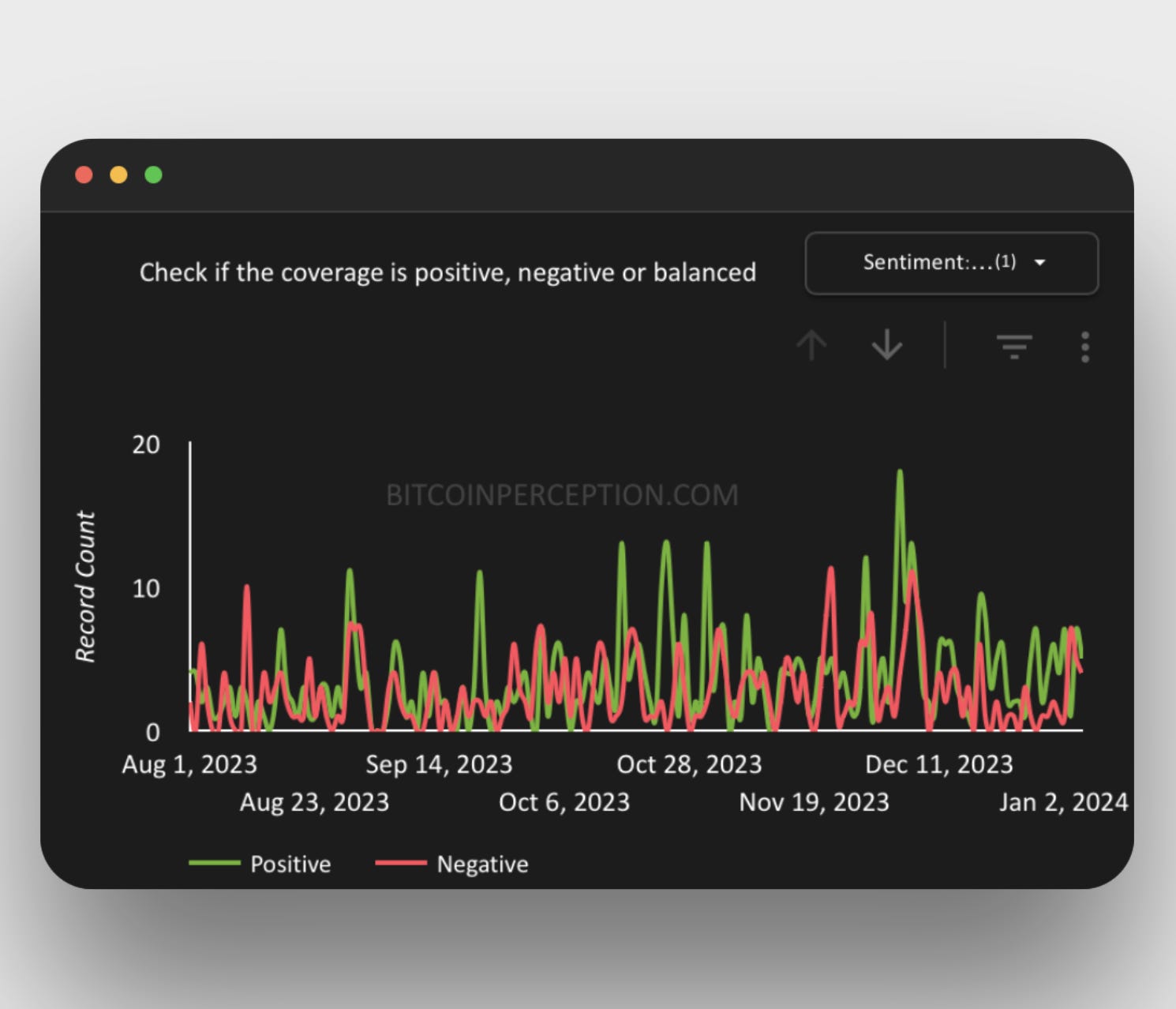

But the more fascinating thing is that this positive tone is not an isolated incident.

Like a trend that suddenly sees all the kids doing their hair like the Peaky Blinders, many outlets are now publishing pro-Bitcoin stories, with lots of spikes in positive sentiment since the ETF topic started trending:

So what is this collective pivot all about?

Could this change in heart coincide with a Bitcoin ETF on the brink of approval? I wonder…

The financial media's sentiment gauge swings with the pendulum of market potential and regulatory advancements, and this shift in narrative isn't just an anecdotal observation. Back in November, I had already caught onto this trend in the 'Narrative Shift' edition.

One thing is for sure: the financial media's dance with Bitcoin is an interesting case of life imitating art, where the media's evolving stance mirrors the very volatility and dynamism that characterize Bitcoin itself.