Welcome to the latest edition of Bitcoin Perception.

Leading companies like Swan, Galoy, Braiins, Blockstream, and BTC Media rely on these weekly reports for insights.

Join them and many others in discovering how mainstream media is shaping the narrative around Bitcoin.

EOW closing Bitcoin price: $37,463

Date range: November 20 - November 26, 2023

Main Topics: Javier Milei, Regulatory Developments, Ransomware Attacks, Bullish Market Dynamics

This week's spotlight: CNBC

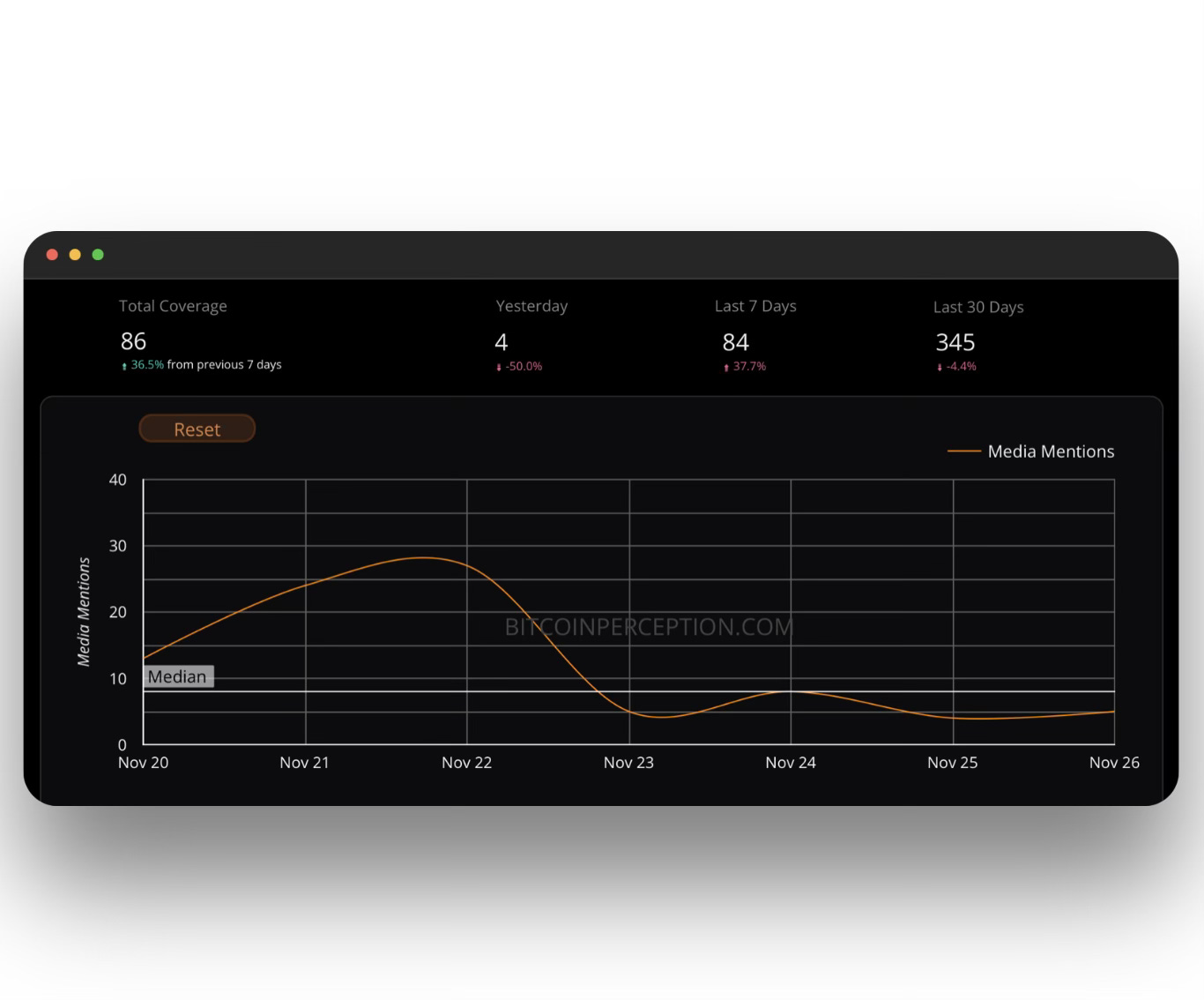

Weekly Snapshot

Main Topics Of The Week

1. Javier Milei 🇦🇷

Key Focus: The election of Javier Milei as Argentine President and its implications for Bitcoin.

Insights: Milei's pro-Bitcoin stance has sparked discussions about the potential for national-level adoption of Bitcoin and its impact on the country's economy and the global cryptocurrency market.

References:

2. Regulatory Developments

Key Focus: The evolving regulatory landscape for cryptocurrencies, particularly in relation to ETFs and legal actions against crypto firms.

Insights: Apart from the discussions revolving around the potential approval of a Bitcoin ETF, and regulatory actions against crypto exchanges, there’s a narrative shifting from lumping Bitcoin in the same bucket as crypto to a “Bitcoin, not crypto” narrative. More on this in this week’s spotlight below.

References:

3. Ransomware Attacks

Key Focus: The rise of ransomware attacks, particularly the British Library incident, and the emergence of new ransomware groups.

Insights: The increasing sophistication of cybercriminals and the challenges they pose to institutions and the broader digital landscape.

References:

4. Bullish Market Dynamics

Key Focus: The recent surge in Bitcoin's price, investment trends, and the potential influx of Wall Street investments into BTC.

Insights: The market is witnessing a significant shift with increasing interest from traditional financial sectors and the potential for a new wave of institutional investments.

References:

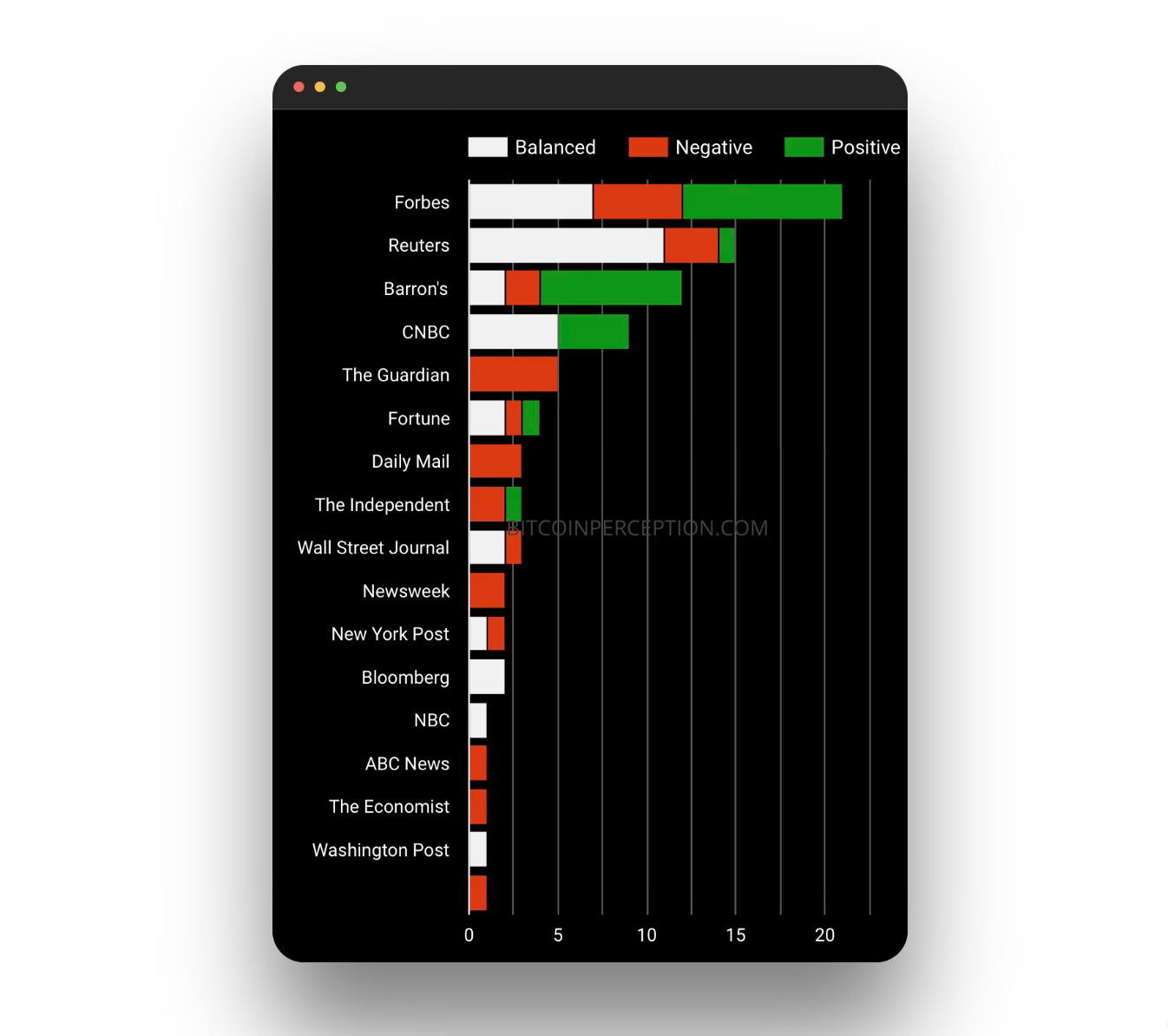

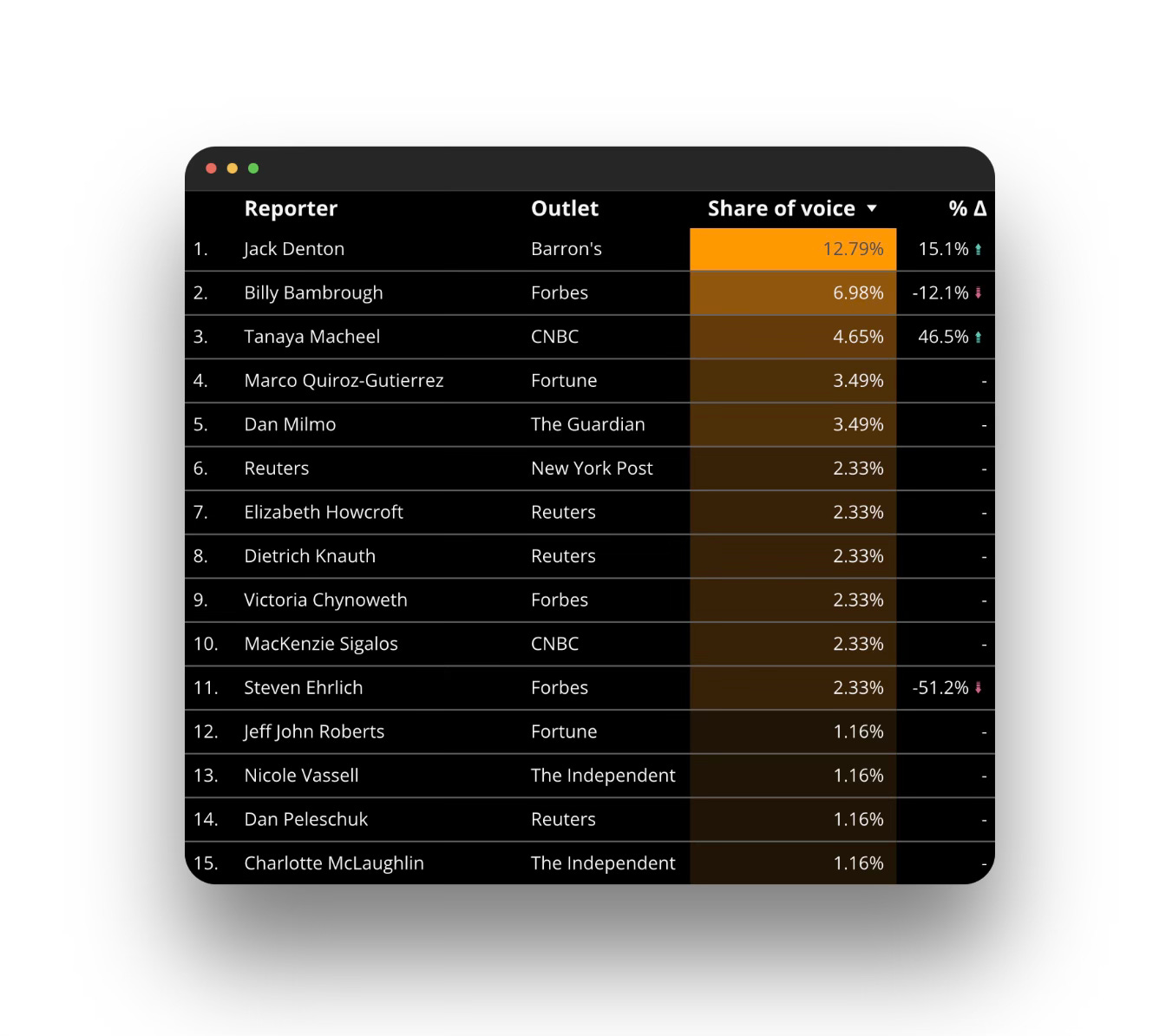

This Week's Spotlight: CNBC

Recent developments in the media's portrayal of Bitcoin, particularly in the context of regulatory discussions, mark a significant shift in the narrative surrounding Bitcoin.

We tweeted this change, noting that CNBC, along with The Washington Post and The Wall Street Journal, has started to differentiate Bitcoin from the broader category of cryptocurrencies. This distinction is crucial, especially in light of the growing trend of crypto crackdowns and regulatory challenges.

The CNBC Pro article titled "Regulation is the Main Sticking Point for Crypto as Bitcoin Inches to Another New 2023 High" underscores this.

But could this recognition by major media outlets be more than just a semantic change, but a reflection of a deeper understanding of Bitcoin's unique value proposition, separate from the rug-pully nature of the broader crypto market?

Let’s go on a limb here:

The most logical reason for the differentiation between Bitcoin and other cryptocurrencies is particularly relevant in the context of regulation.

As governments and financial authorities grapple with the challenges of regulating a diverse and rapidly evolving digital asset landscape, distinguishing Bitcoin from other crypto assets becomes the most obvious choice.

This distinction could lead to more nuanced and prudent regulatory frameworks that recognize the specific attributes and use cases of Bitcoin, as opposed to a one-size-fits-all approach that is associated with regulation in general.

But could this narrative change also be founded on a deeper understanding about Bitcoin's distinct identity?

It looks like Bitcoin's differentiation from the broader crypto market in media narratives aligns with its growing acceptance as a distinct asset class.

This shift is not merely about branding or effective ‘orange-pilling’; it reflects Bitcoin's maturation as a digital asset.

These attributes set Bitcoin apart from many other cryptocurrencies that are often seen as more speculative or experimental, but how strong is this belief among mainstream media reporters, really?

Have Bitcoiners finally educated the MSM on Bitcoin's unique value to the extent that they fully grok it?

Or is this narrative shift a strategic response to the targeting of major crypto players, potentially heralding a new era for the 'institutions are coming' meme?

Final thoughts

This is third outlet in two weeks making the 'Bitcoin, not crypto' narrative shift. Wild times.