There's no single "public" anymore to reach. Just a thousand small publics that don't talk to each other.

A message hits one group as obvious truth and another as total delusion.

This is because they're living in different information ecosystems with different priors and different trusted voices.

I believe this fragmentation is permanent and it's the reason why I built Perception.

The signal won't come from consensus anymore. They come from having all the context from all pockets of the ecosystem at the right time.

Which is something that most people will never get as long as they are still optimizing for the monoculture that died in 2021.

Consider Perception as your hedge.

I hope you enjoy the Q3 report. -Fernando

September 27, 2025: Google quietly took a 5.4% stake in Cipher Mining. TeraWulf seeks $3B for "data center expansion." IREN stock soars on "AI cloud optimism."

What financial media saw: AI infrastructure investments.

What Perception saw: Big Tech's Bitcoin mining pivot disguised as AI plays.

While JPMorgan's CEO was warning about Bitcoin crashes, Google was deploying billions into Bitcoin infrastructure.

Welcome to Q3's biggest story that nobody understood.

Part 1: The Infrastructure Convergence

Q3 was the quarter when Bitcoin mining was essentially rebranded as "AI data centers".

The evidence:

- Google acquires 5.4% stake in Cipher Mining

- TeraWulf seeks $3B for Google-backed data center

- IREN surges on Wall Street AI cloud optimism

The pattern: Every major Bitcoin miner is suddenly an "AI data center company." Every Big Tech investment is for "cloud infrastructure."

The narrative shift is happening now.

What this means: Big Tech needs Bitcoin's energy infrastructure. Bitcoin miners need Big Tech's capital.

They're merging under the "AI" narrative, which grew consistently throughout Q3.

Part 2: The 2,948-to-1 Intelligence Gap

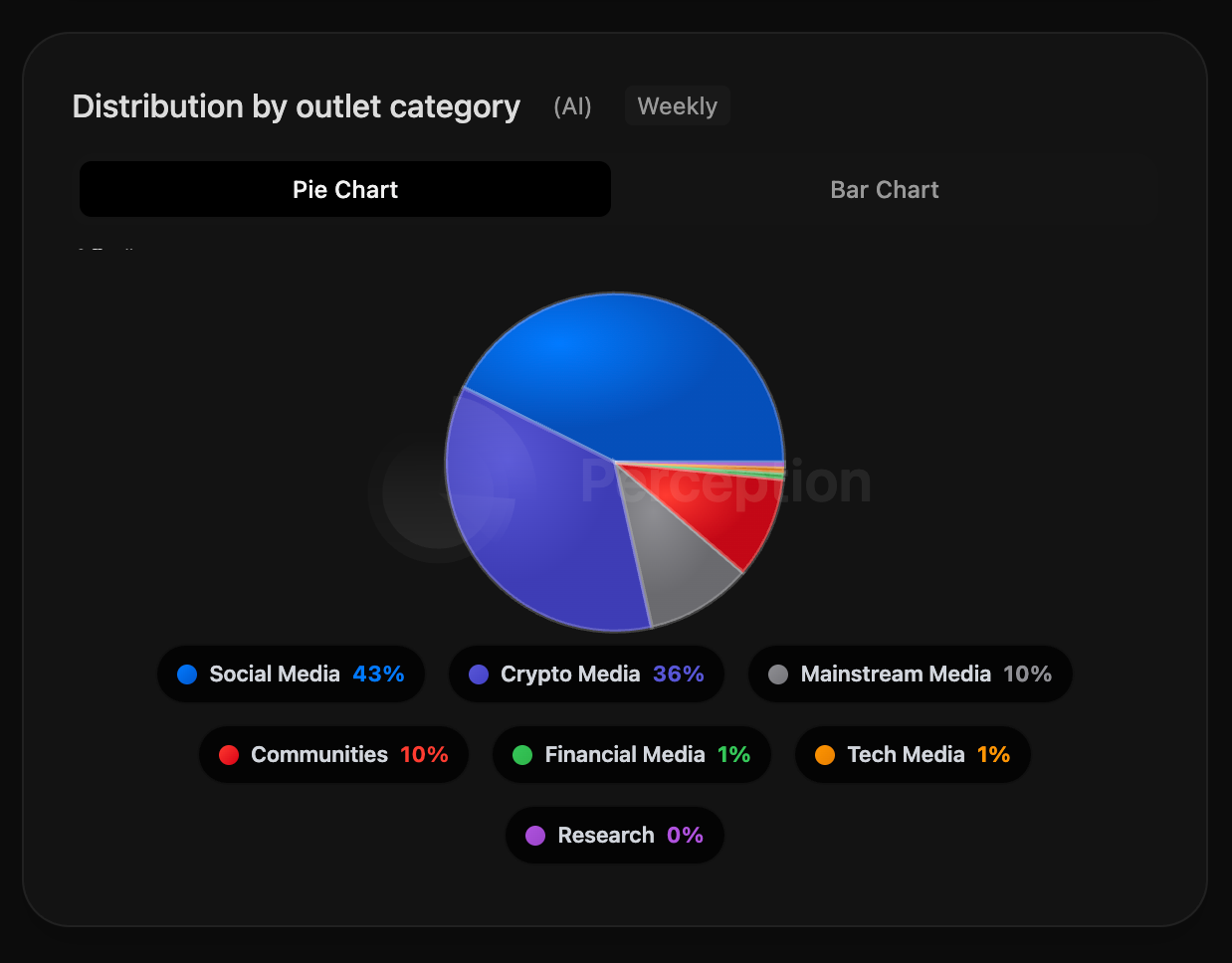

Here's what financial and tech media completely ignored in Q3.

The data:

- Social media: 2,948 mentions of Bitcoin development

- Crypto media: 27 mentions

- Financial and tech media: 2 mentions

Meanwhile:

- BlackRock launches Bitcoin yield ETF (Cointelegraph)

- Bitcoin Core vs Knots governance debate intensifies (Bitcoin Mag)

- ZK rollups unlock Bitcoin's potential (The Block)

Even BlackRock sees what's being built. Financial and tech media choose to ignore it.

It's worth mentioning that no research has been done on this subject but we understand creating these reports take time and hope to see publications about this subject in Q4.

At any rate: This intelligence gap is real and measurable.

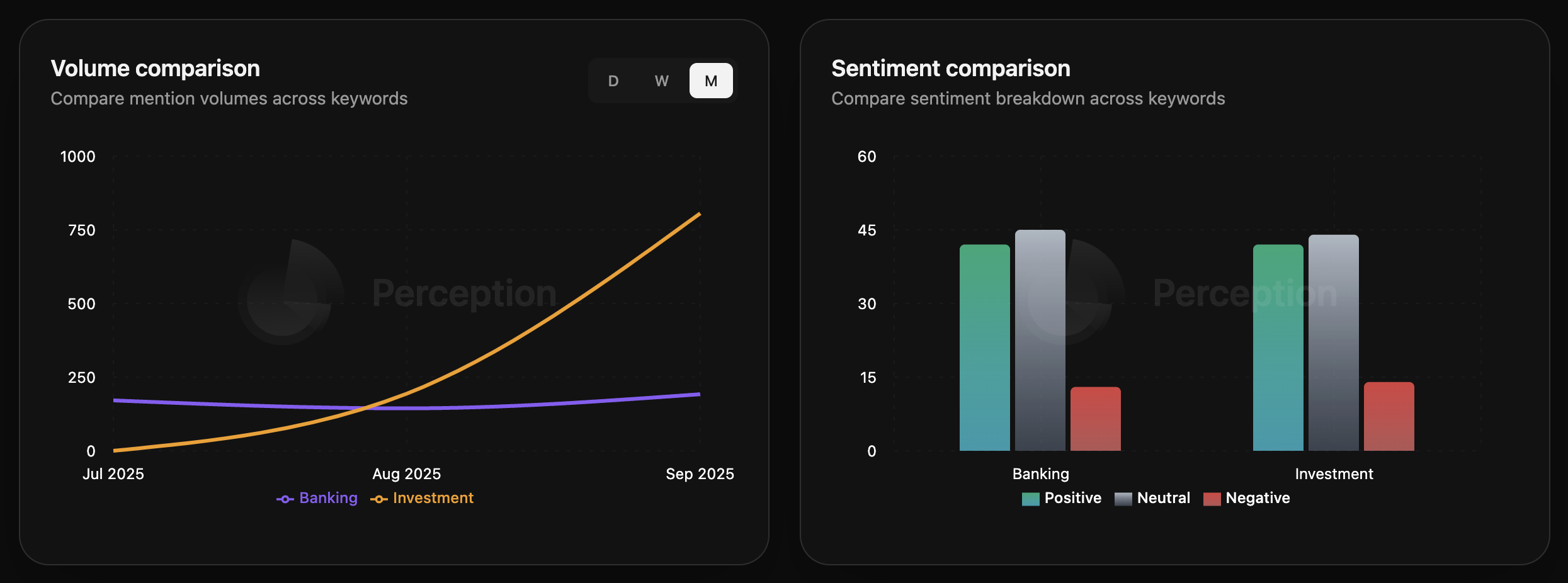

Part 3: The Sentiment Divergence

This is where narratives split:

Banking integration sentiment:

- Crypto Media: 47.8% positive

- Social Media: 24.4% positive

- Gap: 23.4 percentage points

Investment products sentiment:

- Social Media: 57.5% positive

- Financial Media: 37.3% positive

- Gap: 20.2 percentage points

These are current measurable gaps in narrative positioning.

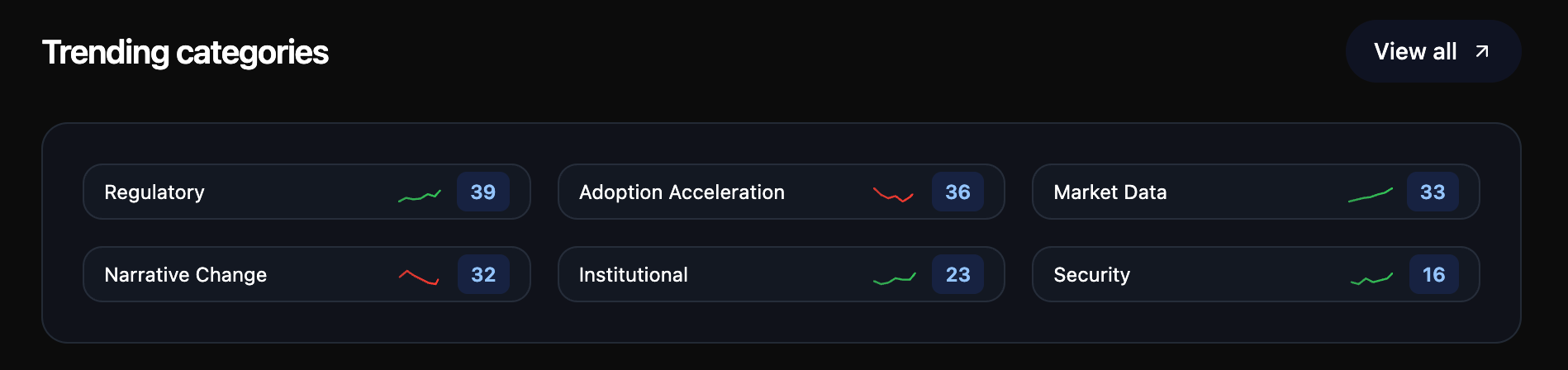

Part 4: The 254 Classified Trends

Here's where Q3's action concentrated:

- Narrative change (39.4%) - Infrastructure rebranding dominates

- Market data (34.6%) - Price obsession misses structural shifts

- Capital flow (31.1%) - Billions to miners, not exchanges

- Adoption acceleration (25.2%) - Global merchants accepting Bitcoin

- Regulatory shift (18.1%) - "AI infrastructure" avoids crypto scrutiny

These are pre-aggregate categories you can follow daily on the Perception platform.

Part 5: Q4 2025 Positioning

What's clear based on Q3 evidence:

- Big Tech is investing billions in Bitcoin mining infrastructure

- Financial media has effectively stopped covering Bitcoin development

What to track:

- Further Big Tech mining investments

- Treasury company narrative evolution

- Development happening in social channels

- Infrastructure rebranding acceleration

The best way to track this is to start your free, 7-day trial to the platform and see everything for yourself.