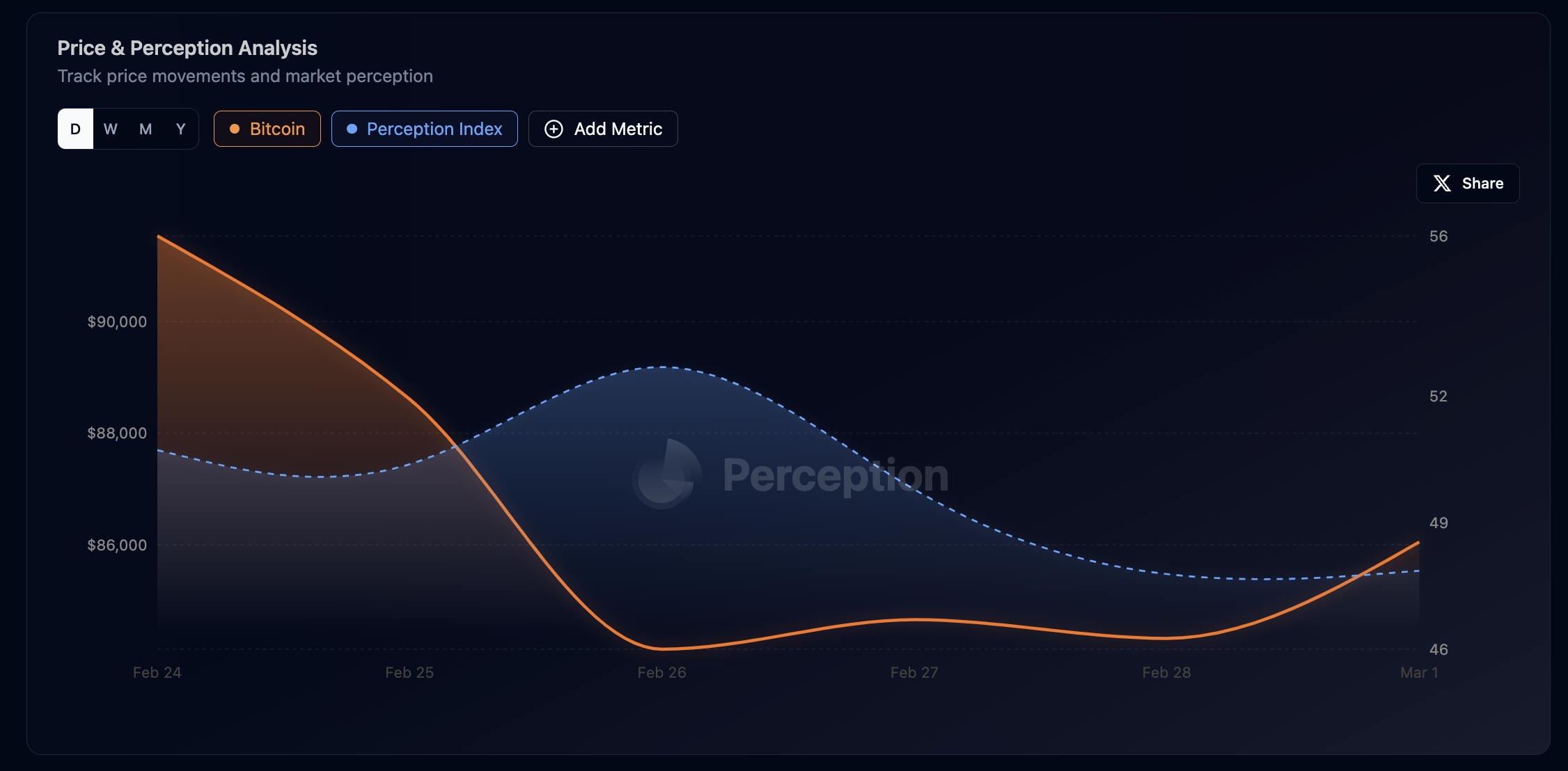

ETF outflows and security concerns dampen market sentiment, while state-driven Bitcoin initiatives and corporate adoption fuel optimism.

Industry snapshot

🔥 Hot Discussions

Bitcoin ETF Outflows

- Sentiment: Negative

- Insights:

- Mainstream Media: Coverage highlights the historic $1.14 billion outflow from U.S. Bitcoin ETFs, attributing the movement to U.S.-China trade tensions and broader macroeconomic concerns.

- Crypto Media: Emphasizes that only 44% of ETF inflows are for long-term holding, with the remaining 56% tied to short-term trading strategies, revealing a lack of sustained institutional commitment.

- Social Media: Discussions reflect concerns about market volatility, with debates over whether ETFs truly represent Bitcoin adoption or are merely trading instruments for asset managers.

Montana's Bitcoin Reserve Bill Failure

- Sentiment: Negative

- Insights:

- Mainstream Media: Frames the bill’s rejection as a partisan issue, with fiscal conservatives opposing it due to risks of taxpayer money exposure.

- Crypto Media: Contrasts Montana’s failure with other states considering Bitcoin reserves, highlighting broader adoption trends.

- Social Media: Bitcoin advocates express disappointment, while critics cite concerns over financial prudence and the necessity of clearer regulatory frameworks.

Georgia's Bitcoin Reserve Legislation

- Sentiment: Positive

- Insights:

- Mainstream Media: Reports on Georgia’s move to introduce a second Bitcoin reserve bill as a sign of increasing state-level Bitcoin adoption.

- Crypto Media: Highlights the bipartisan nature of the initiative, indicating a shift in political sentiment toward Bitcoin.

- Social Media: Optimism among Bitcoin advocates, with discussions centering around the potential for more states to follow suit.

Institutional Adoption by HK Asia

- Sentiment: Positive

- Insights:

- Mainstream Media: Covers HK Asia Holdings' acquisition of 7.88 BTC, reflecting corporate confidence in Bitcoin’s long-term value.

- Crypto Media: Focuses on trends in corporate treasury diversification into Bitcoin.

- Social Media: Positive reactions celebrating the company’s strategic move and its implications for broader institutional adoption.

🔎 Additional Insights

Memecoins Under Fire Amidst BTC Price Stagnation

- Sentiment: Negative

- Insights:

- Mainstream Media: Highlights historical parallels, suggesting liquidity shifts toward speculative assets.

- Crypto Media: Discusses memecoins diverting liquidity from Bitcoin.

- Social Media: Concerns over market fragility and speculative trends.

SEC Relief for Coinbase and Robinhood

- Sentiment: Neutral

- Insights:

- Mainstream Media: Questions regulatory motives and potential favoritism.

- Crypto Media: Focuses on regulatory clarity and its impact on the broader market.

- Social Media: Mixed reactions, balancing optimism with skepticism about political influence on regulations.

Real Estate and Crypto in Dubai

- Sentiment: Positive

- Insights:

- Mainstream Media: Emphasizes Dubai’s proactive approach in integrating cryptocurrency into real estate.

- Crypto Media: Highlights benefits of tokenization and international transactions.

- Social Media: Enthusiasm for the potential of blockchain in revolutionizing real estate investments.

Security Incident: ByBit Hack and Bitcoin’s Price Drop

- Sentiment: Negative

- Insights:

- Mainstream Media: Focuses on security concerns and the impact on investor confidence.

- Crypto Media: Analyzes historical recovery trends post-security incidents.

- Social Media: Twitter reflects panic, while Reddit discussions explore long-term security improvements.