Date Range: January 1 – March 31, 2025

Executive Summary

Q1 2025 was defined by a tension between institutional fatigue and grassroots resurgence. Major announcements like the U.S. Strategic Bitcoin Reserve (SBR) and Bitcoin briefly crossing the $100,000 mark marked narrative peaks early in the quarter, but institutional interest waned quickly thereafter. In contrast, retail and cultural themes—especially self-custody and use cases—gained traction.

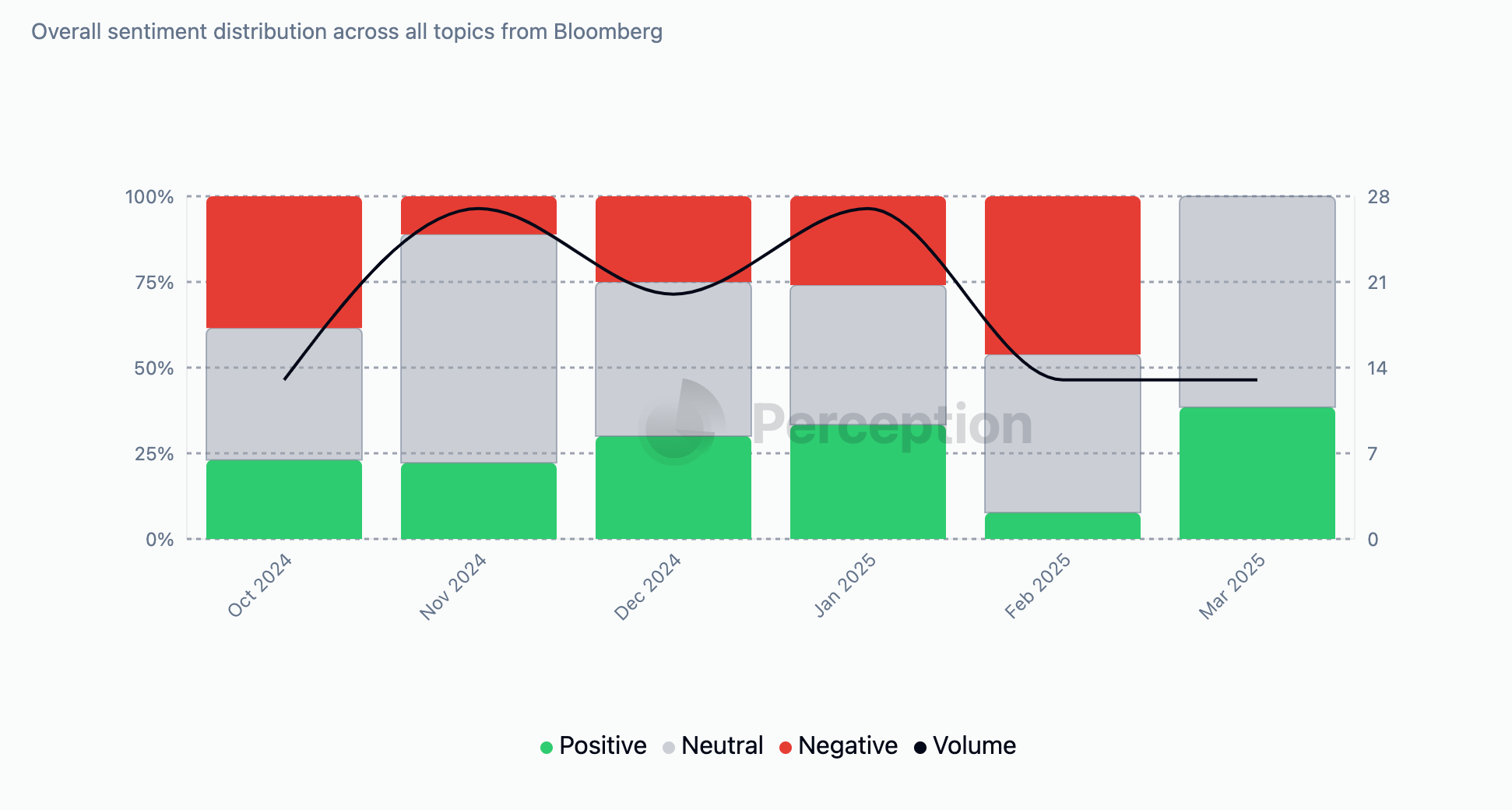

Media sentiment fluctuated sharply, with a low point in January coinciding with Trump’s inauguration. Bloomberg notably corrected its tone in March after a particularly negative February.

Meanwhile, Forbes led with the most positive coverage, and the Perception Index hinted at a possible decoupling from market price trends.

Key Narrative Themes

1. Self-Custody Surges Post-SBR Announcement

- The announcement of the U.S. Strategic Bitcoin Reserve on March 2 triggered a sharp rise in self-custody discourse.

- Reddit and developer communities focused on wallet setup, hot vs. cold storage, and sovereign ownership themes.

- This spike represents a renewed grassroots emphasis on individual control over Bitcoin assets.

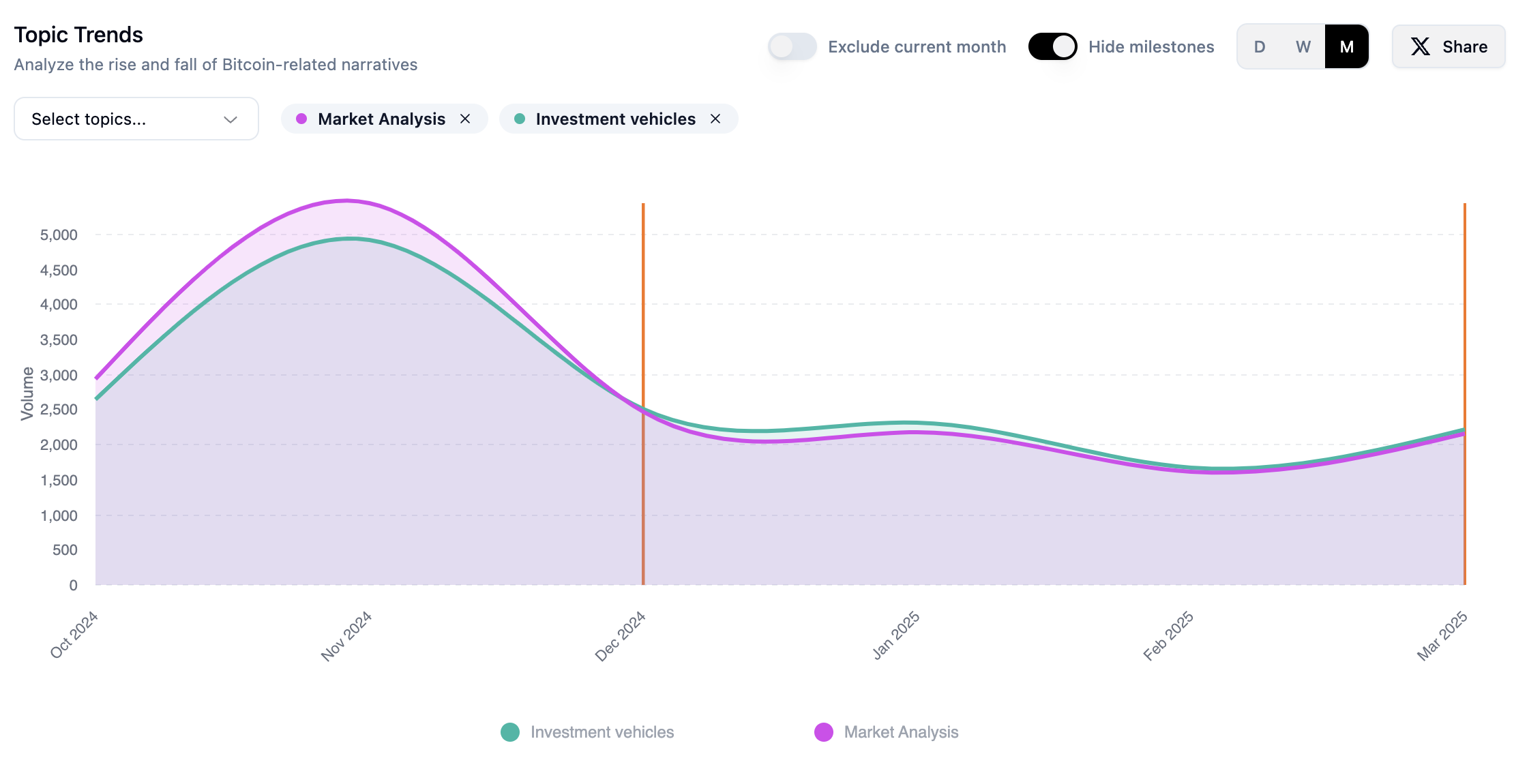

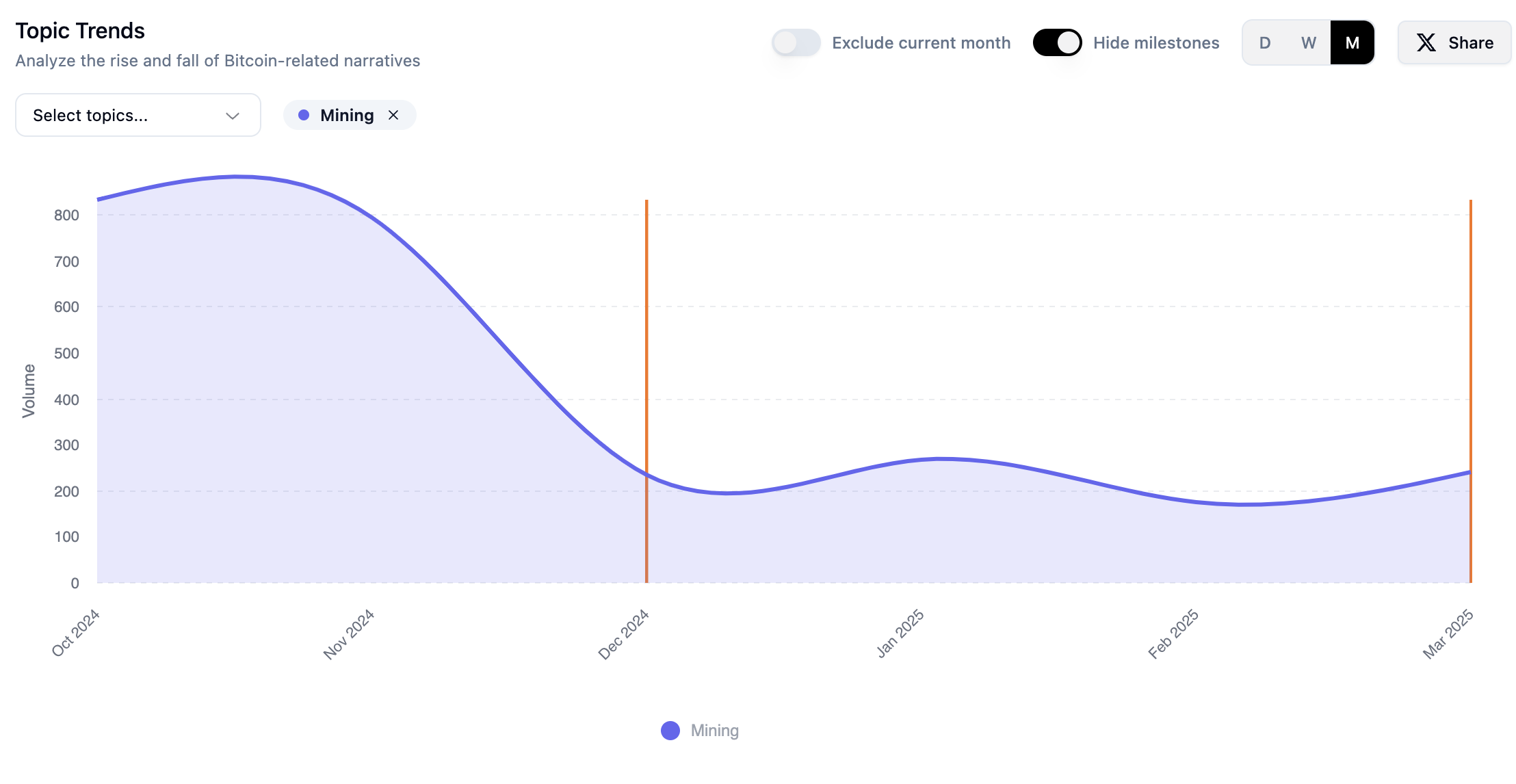

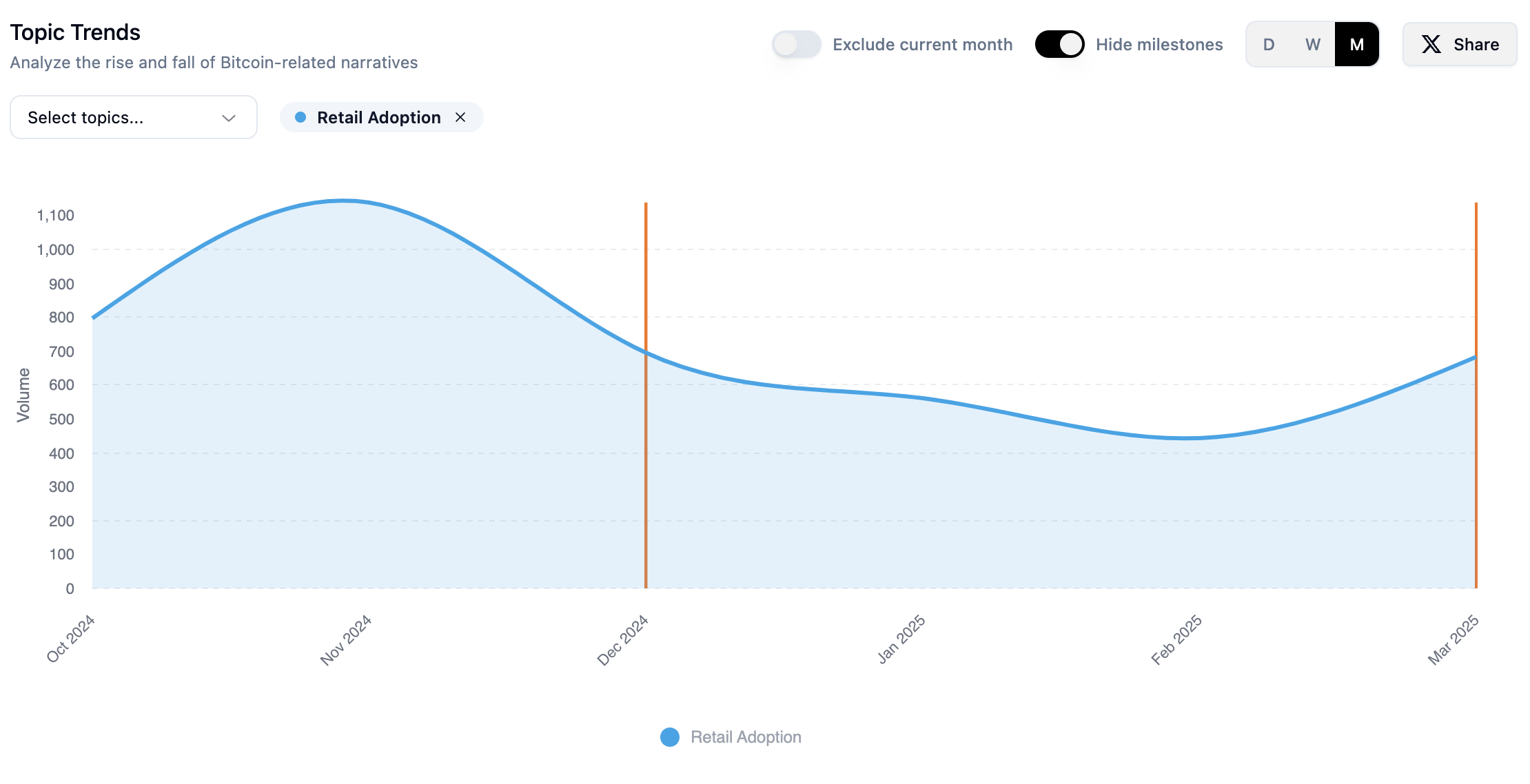

2. Institutional Interest Pullback After BTC Hits $100K

- Institutional adoption narratives grew steadily through Q4 2024 but contracted following major milestones (BTC > $100K and SBR news).

- Topics such as mining, market analysis, and investment vehicles all saw similar downturns.

- Retail adoption topics, in contrast, bounced back in Q1, showing growing traction from the ground up.

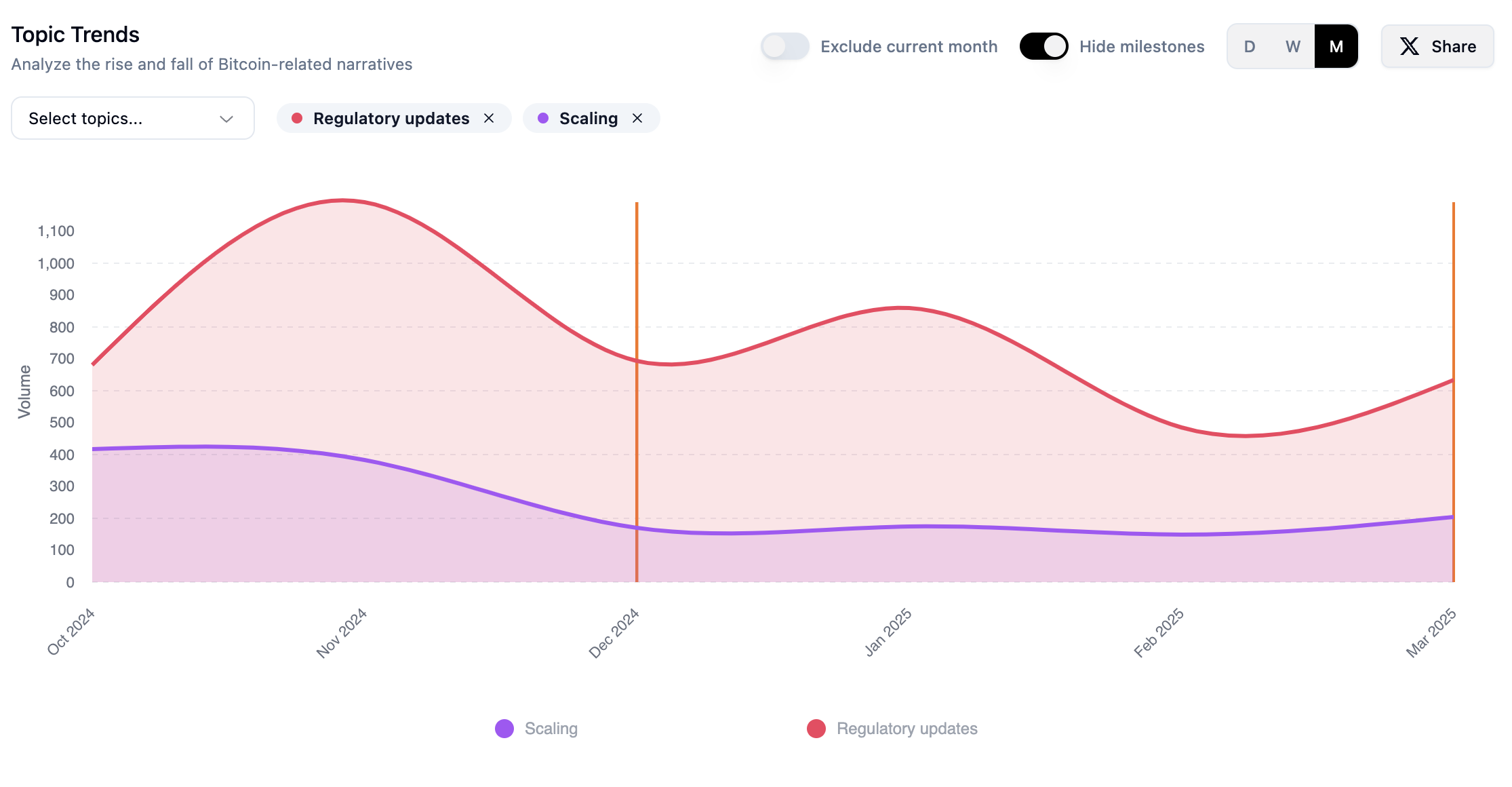

3. Regulatory Coverage Outpaces Scaling

- Regulatory updates became one of the most discussed topics in both crypto and mainstream outlets.

- Compared to Lightning and broader scaling discussions, regulatory friction drew more sustained interest, particularly from CNBC, Forbes, and Financial Times.

Sentiment & Media Breakdown

Sentiment Trends

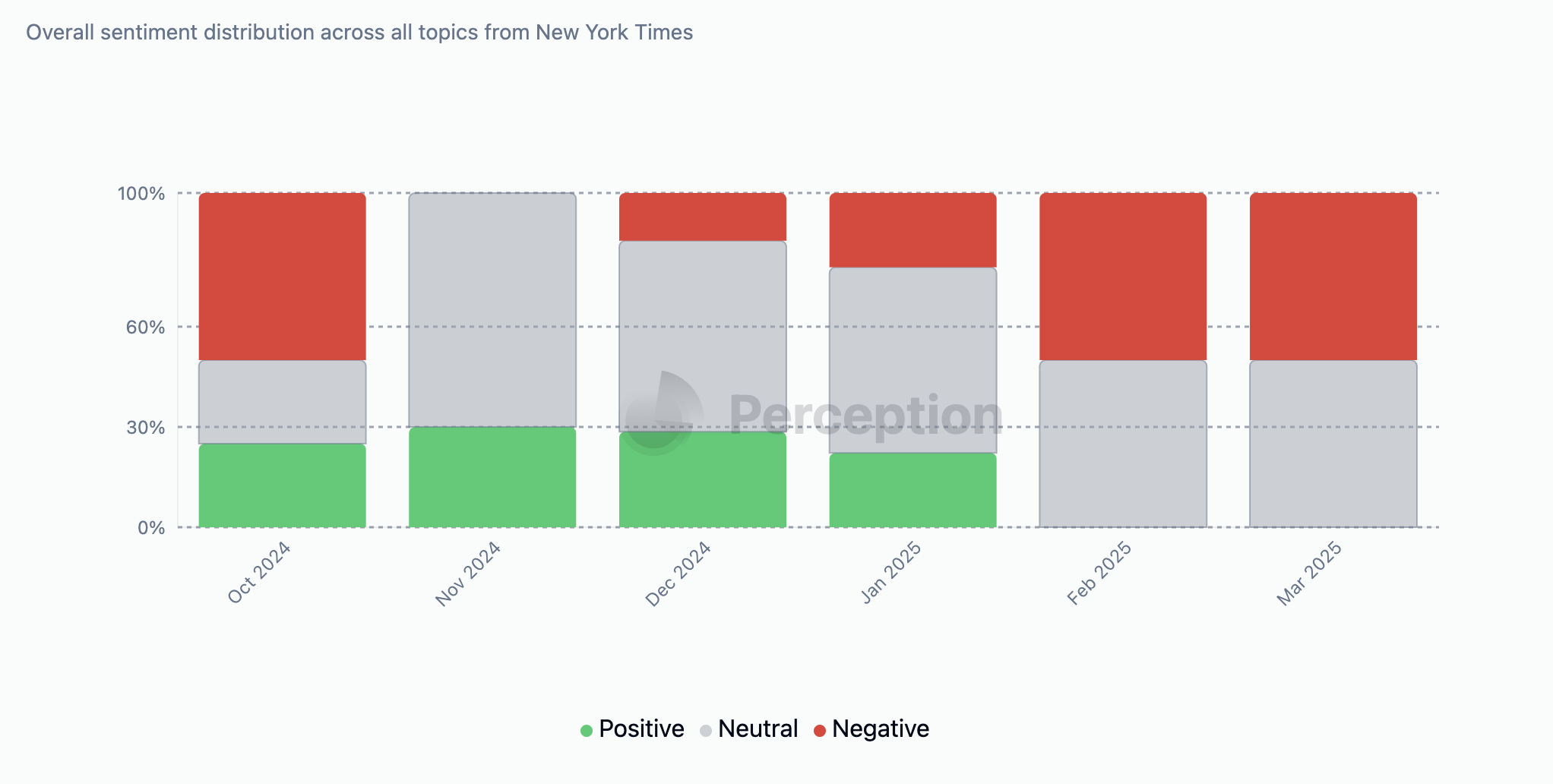

- January saw the lowest monthly positive sentiment in six months at 17%, coinciding with Trump’s inauguration.

- February saw a bounce, but March ended slightly lower, indicating a broader cooling of attention.

Outlet-Specific Sentiment & Focus Areas

Bloomberg

- Pulled back coverage in Feb–Mar

- March: 0% negative coverage, indicating tone correction

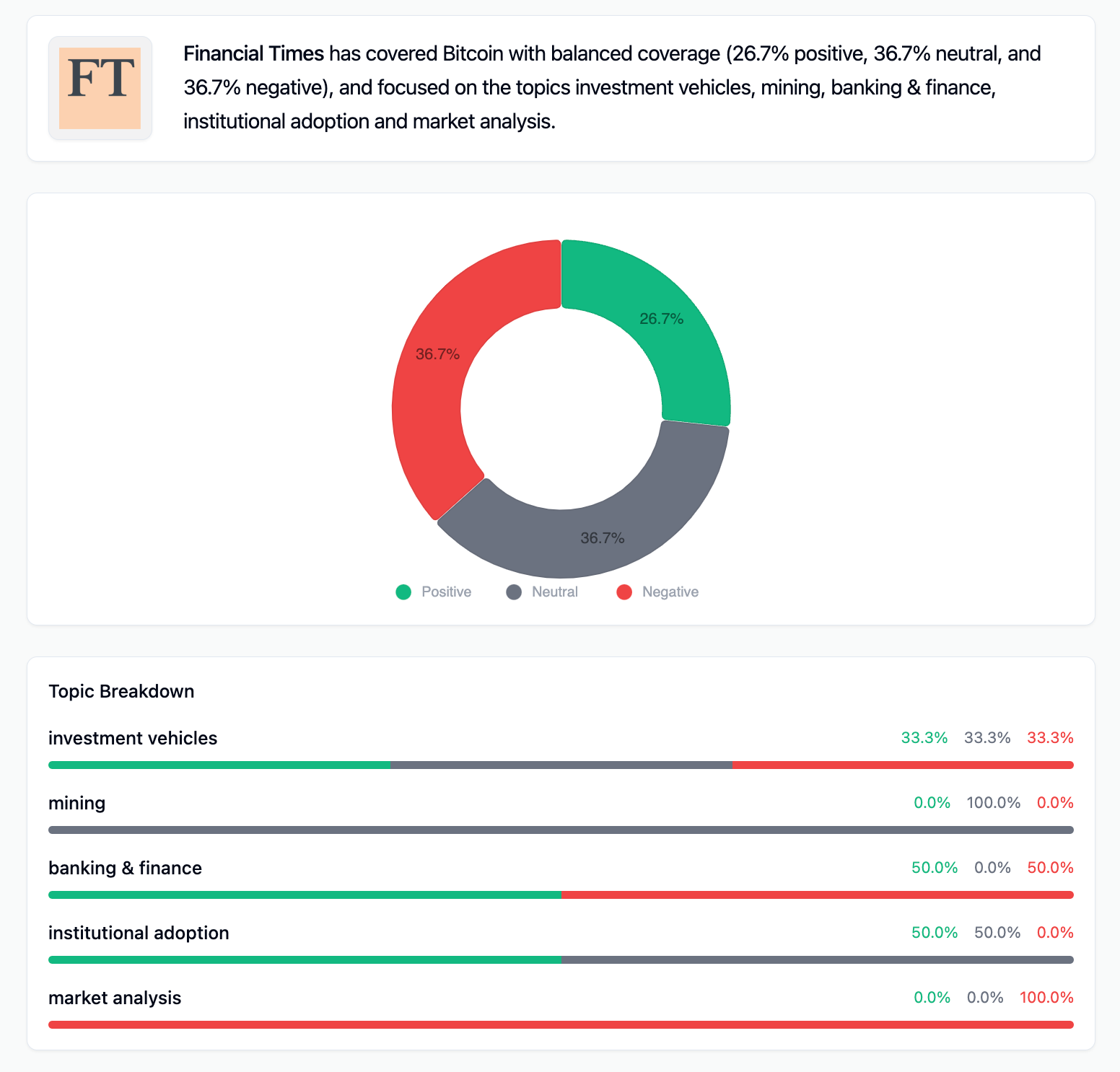

Financial Times

- 26.7% positive, 36.7% neutral, 36.7% negative

- Focus: investment vehicles, market analysis, mining, banking & finance, institutional adoption

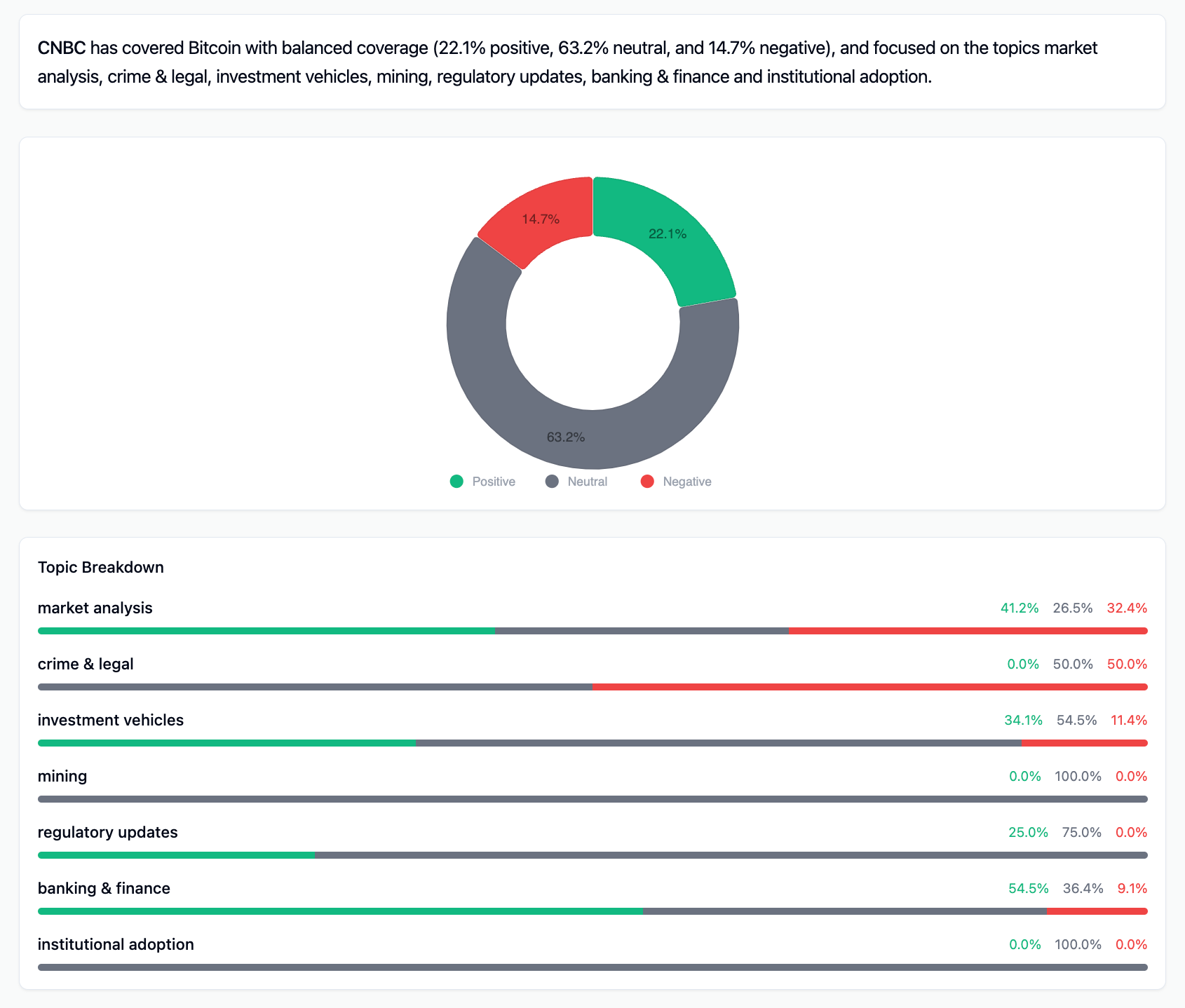

CNBC

- 22.1% positive, 63.2% neutral, 14.7% negative

- Broad coverage across banking, self-custody, crime, regulation, and market topics

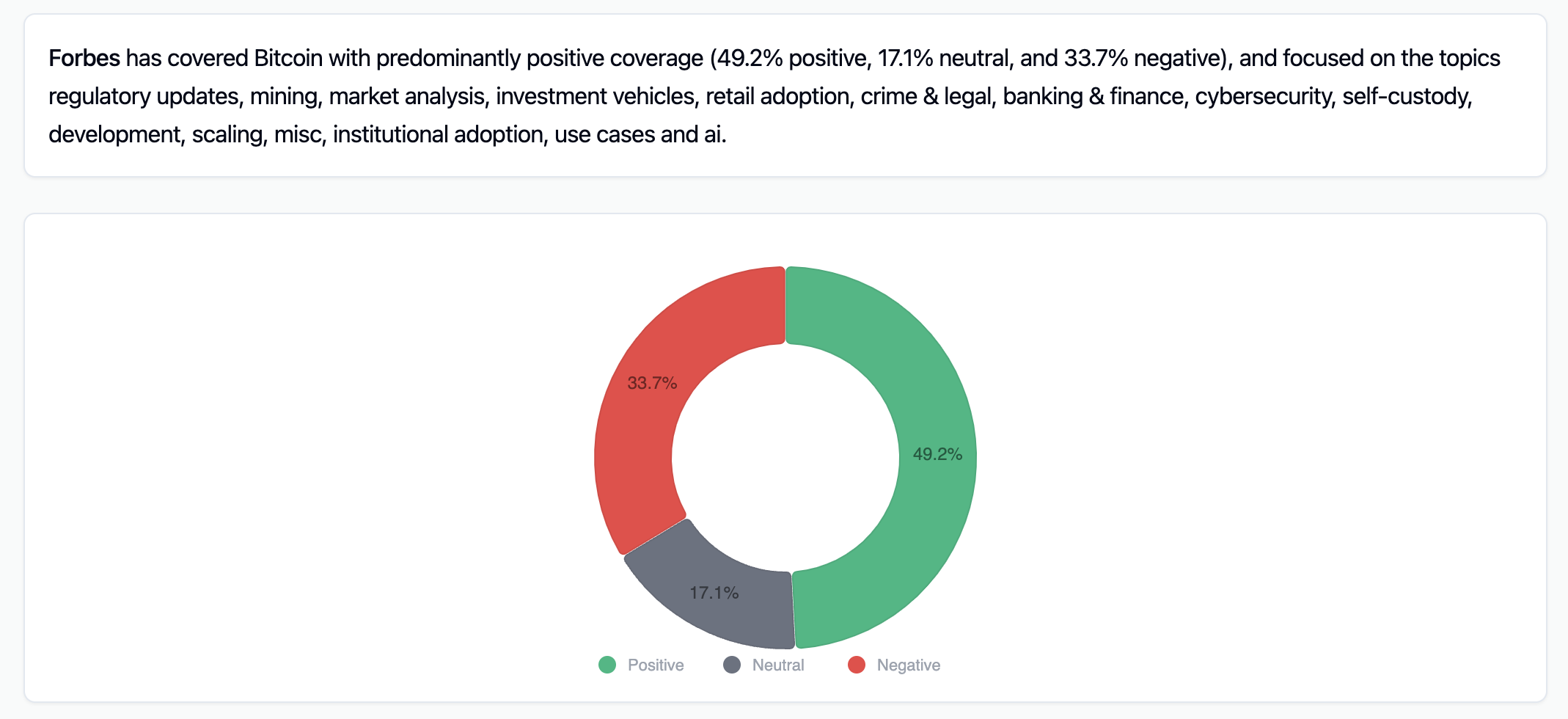

Forbes

- 49.2% positive, 17.1% neutral, 33.7% negative

- Most expansive topical range: from scaling to AI to energy, with strong coverage of use cases and retail adoption

New York Times

- Notable tone shift: went full month in November with 0% negative coverage, then steadily increased negativity post-Trump inauguration

Macro Trends

📈 Topic Volume Shifts (Oct–Mar)

| Month | Use Cases | Scaling |

|---|---|---|

| Oct | 208 | 415 |

| Nov | 269 | 382 |

| Dec | 223 | 169 |

| Jan | 188 | 173 |

| Feb | 136 | 151 |

| Mar | 268 | 206 |

- Use Cases rebounded +97% in March, while Scaling saw a +36% recovery.

- Indicates revived community experimentation and new user onboarding.

Perception Index vs Price

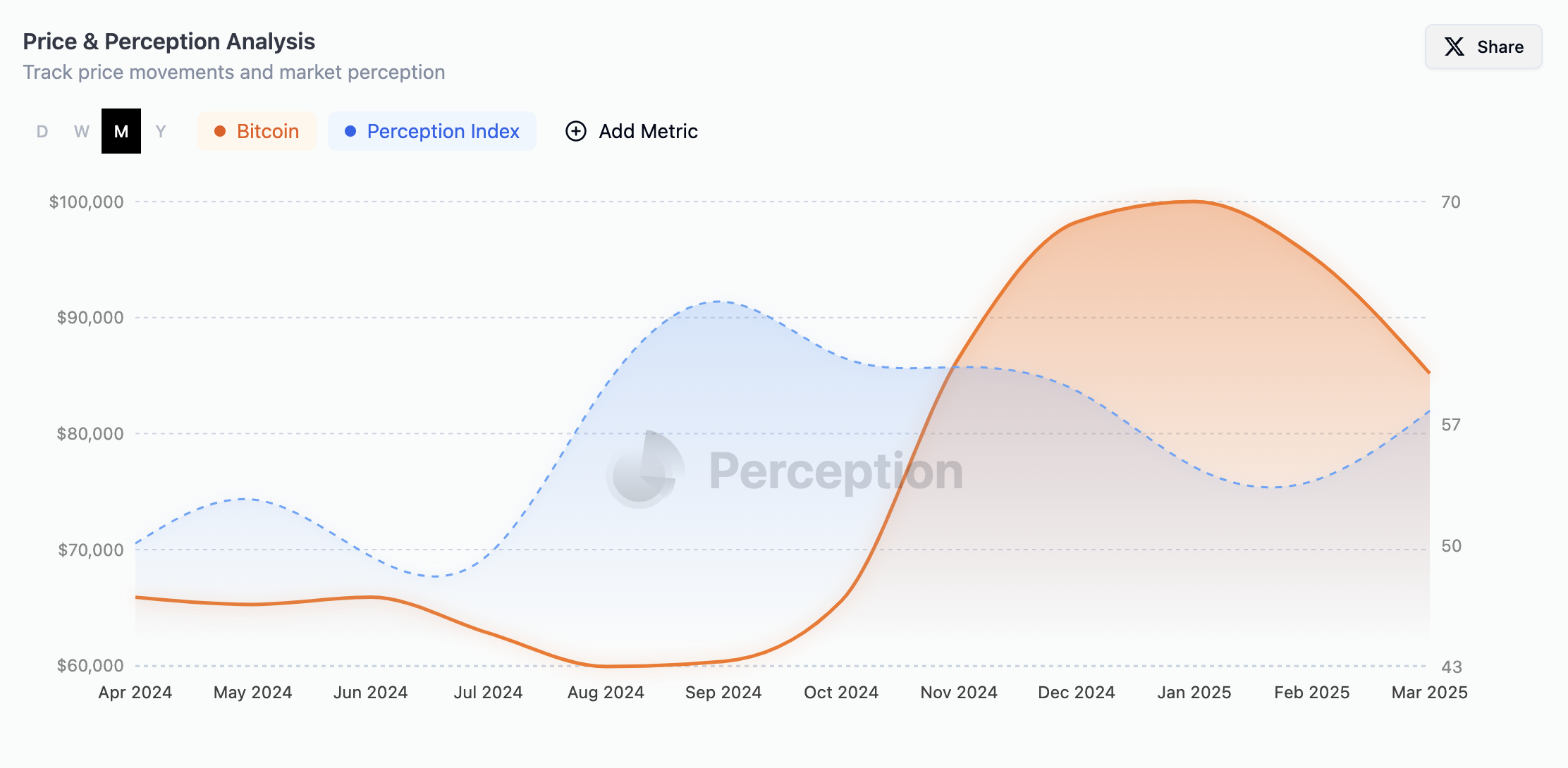

- From Oct to Dec, the Perception Index grew exponentially—followed by price soon after.

- In March, the Index rose again even as price declined—a potential leading indicator for Q2.

- Low negative sentiment volume suggests downside pressure may be muted.

Institutional Outlook for Q2

- Expect a second wave of self-custody narratives, especially if macro volatility picks up.

- Monitor Perception Index as a signal, particularly in divergence from price—early signs look promising.

- Watch for re-entry of institutional narratives as new regulatory frameworks materialize.

- Cultural and retail adoption themes are gaining long-term strength—ignore them at your peril.

This report was prepared using real-time analysis of 100+ media and community sources, cross-channel sentiment tagging, and trend aggregation via Perception.