Executive Summary

Mainstream media sentiment toward Bitcoin in Q1 2025 was decisively polarized, with a minority of outlets demonstrating constructive engagement and the majority exhibiting a cautious, often adversarial stance.

While coverage volume remains strong across all major financial and general news platforms, the qualitative divergence in tone and topic selection provides meaningful insight for allocators assessing institutional readiness, retail narratives, and broader regulatory sentiment.

We ranked outlets from most to least favorable based on positive-to-negative sentiment ratio and depth of topic engagement, and with at least 10 published articles or videos during the quarter.

Bitcoin narratives move faster than the media’s quarterly cycle.

Track sentiment shifts, media bias, and institutional narratives in real time.

👉 perception.to is your command center for Bitcoin narrative intelligence.

🏆 Most Constructive Outlets on Bitcoin (Q1 2025)

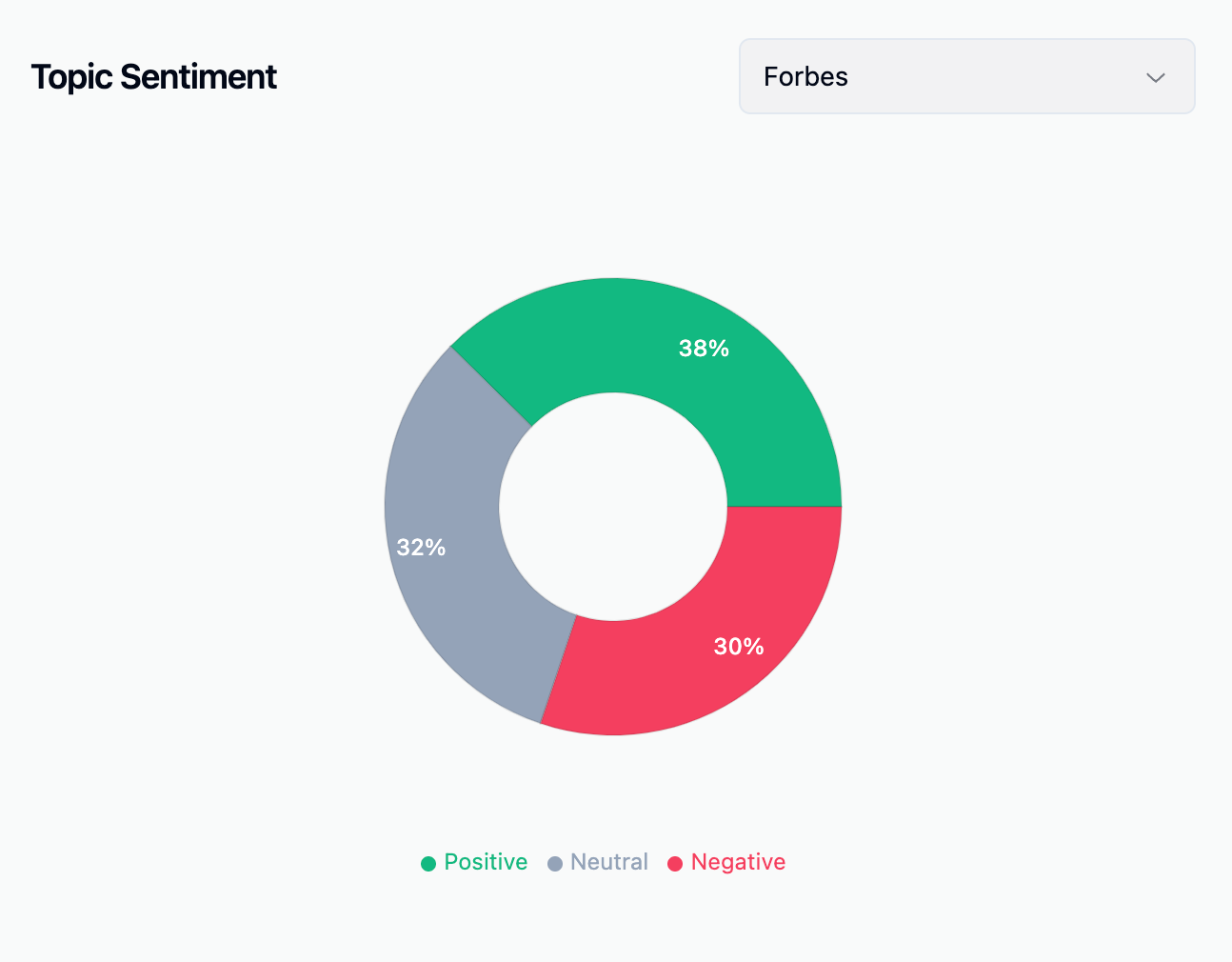

1. Forbes

Volume: 335 articles

Sentiment: 38% Positive / 30% Negative

High-Signal Topics:

- Retail Adoption: 78% Positive

- Institutional Adoption: 100% Positive

- Investment Vehicles: 44% Positive

- Banking & Finance: 60% Positive

- Use Cases / Scaling / AI: All covered positively

Narrative Positioning: Forbes consistently frames Bitcoin as an evolving financial infrastructure, balancing innovation with policy context.

Positive coverage is strongest in the adoption and investment verticals, where it resonates with its investor-oriented readership.

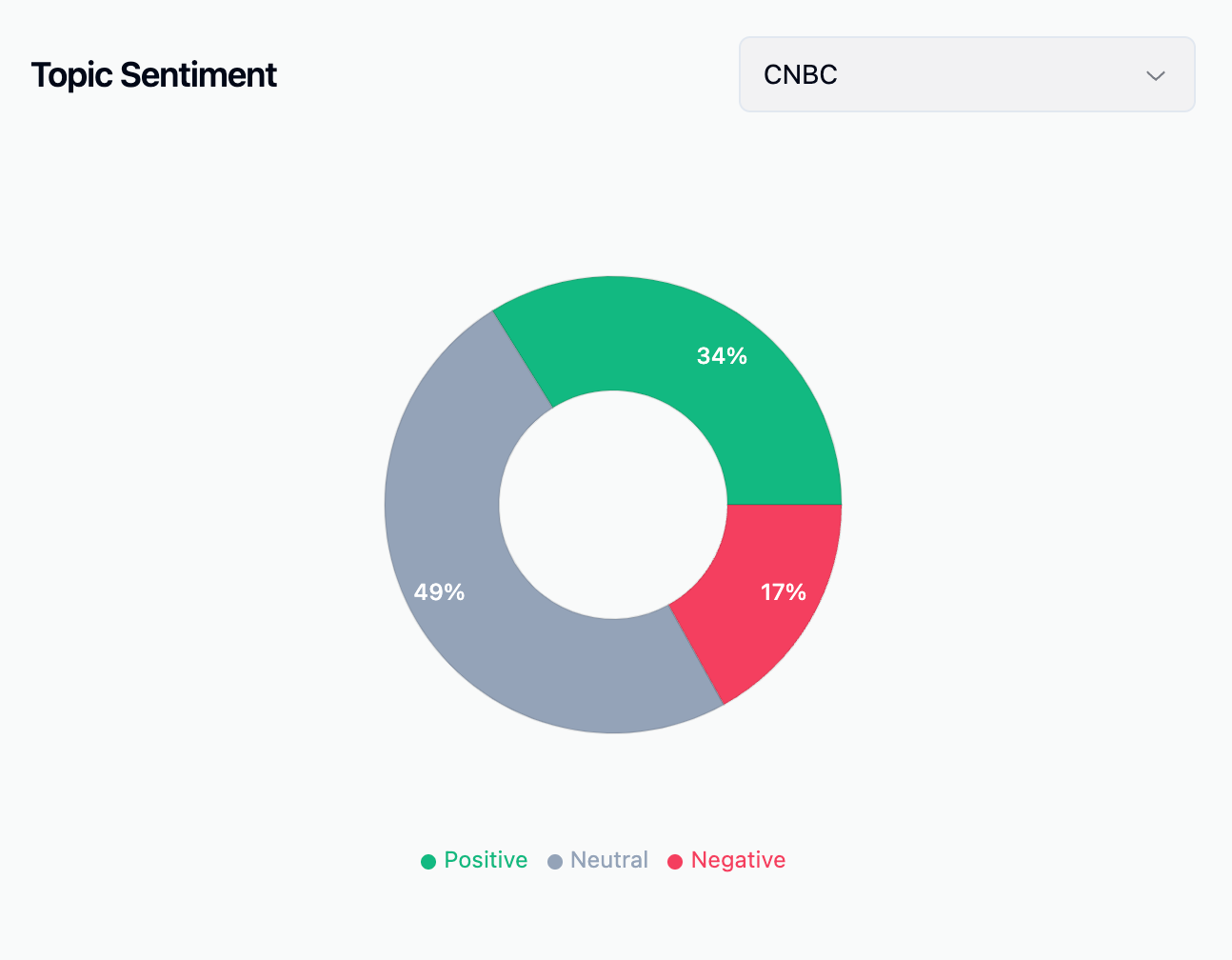

2. CNBC

Volume: 124 articles

Sentiment: 34% Positive / 17% Negative

High-Signal Topics:

- Banking & Finance: 55% Positive

- Investment Vehicles: 34% Positive

- Regulatory Updates: 25% Positive

Narrative Positioning: CNBC emphasizes Bitcoin as a legitimate financial instrument. Its balanced, investor-friendly tone contrasts with the negative skew found in most generalist outlets.

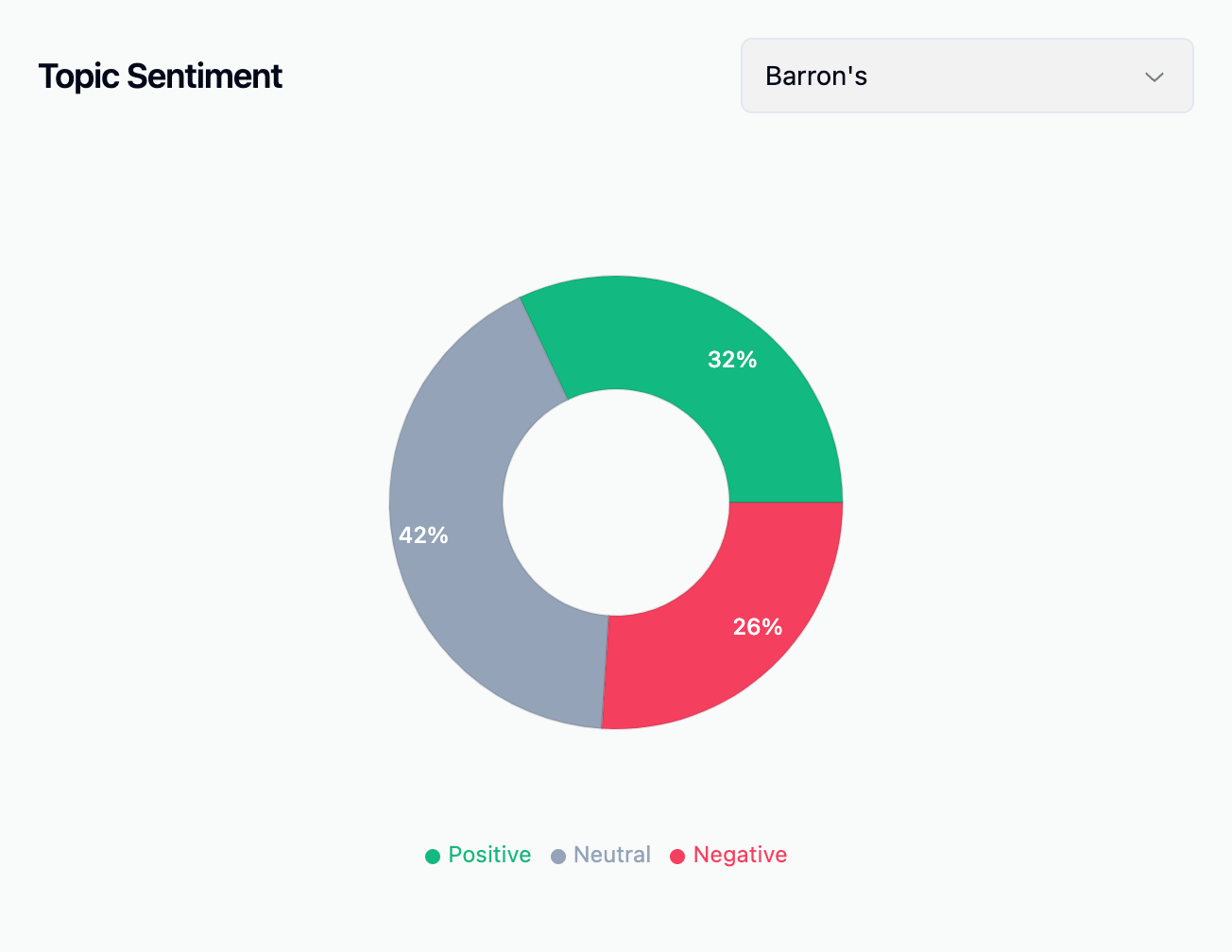

3. Barron’s

Volume: 51 articles

Sentiment: 31% Positive / 27% Negative

High-Signal Topics:

- Investment Vehicles: 33% Positive

- Regulatory Updates: 100% Positive

Narrative Positioning: Barron’s leans heavily into structured analysis of ETFs, regulatory evolution, and macro positioning. Institutional investors would find this coverage reflective of long-term strategic framing.

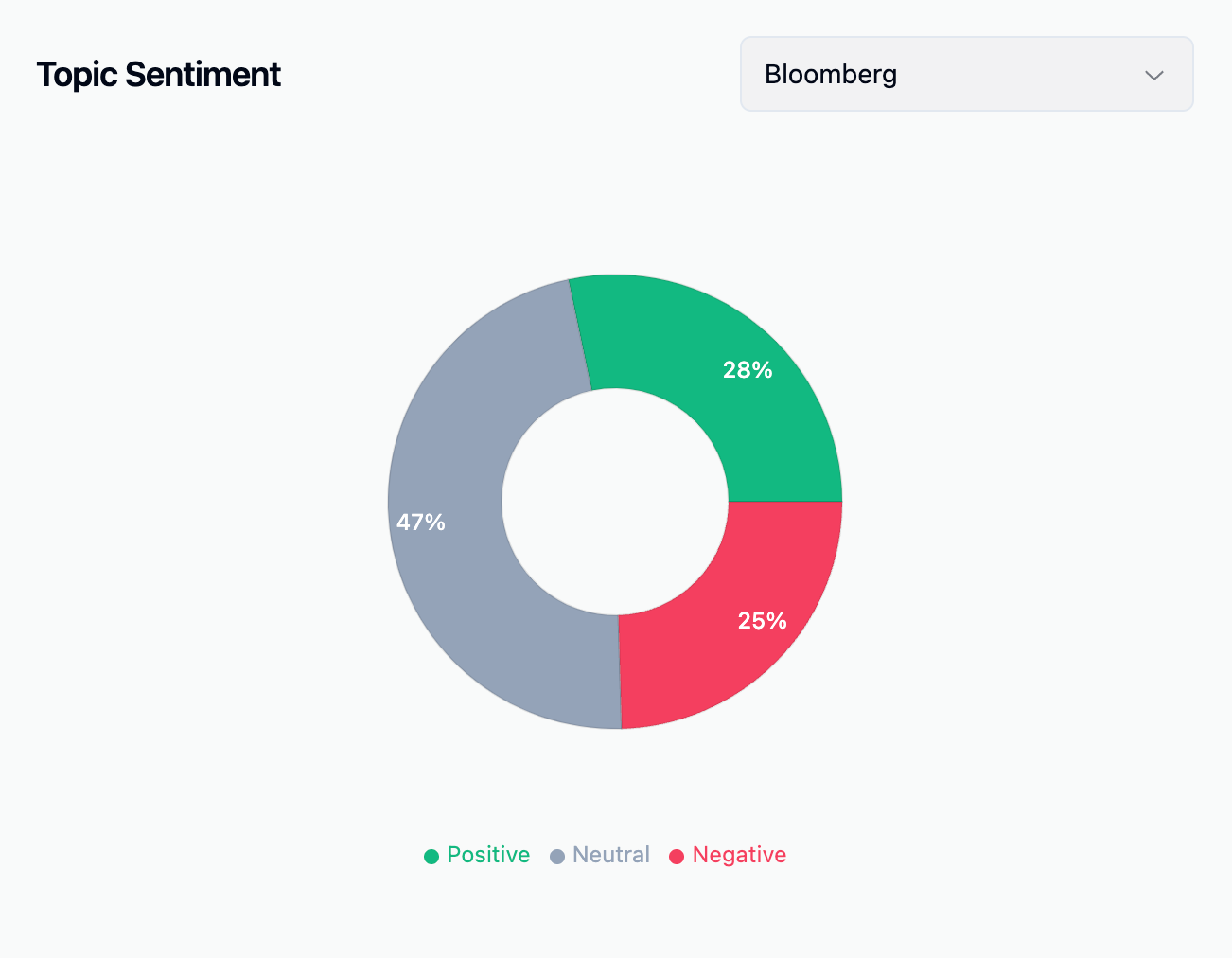

4. Bloomberg

Volume: 53 articles

Sentiment: 28% Positive / 25% Negative

High-Signal Topics:

- Banking & Finance: 56% Positive

- Investment Vehicles: 42% Positive

- Institutional Adoption: 50% Positive

Red Flags 🚩

- Market Analysis: 80% Negative

- Crime & Cybersecurity: 100% Negative

Narrative Positioning: Bloomberg maintains a bifurcated tone: optimistic in capital markets, but sharply negative on volatility and crime. Suitable for allocators parsing regulatory vs. reputational risk.

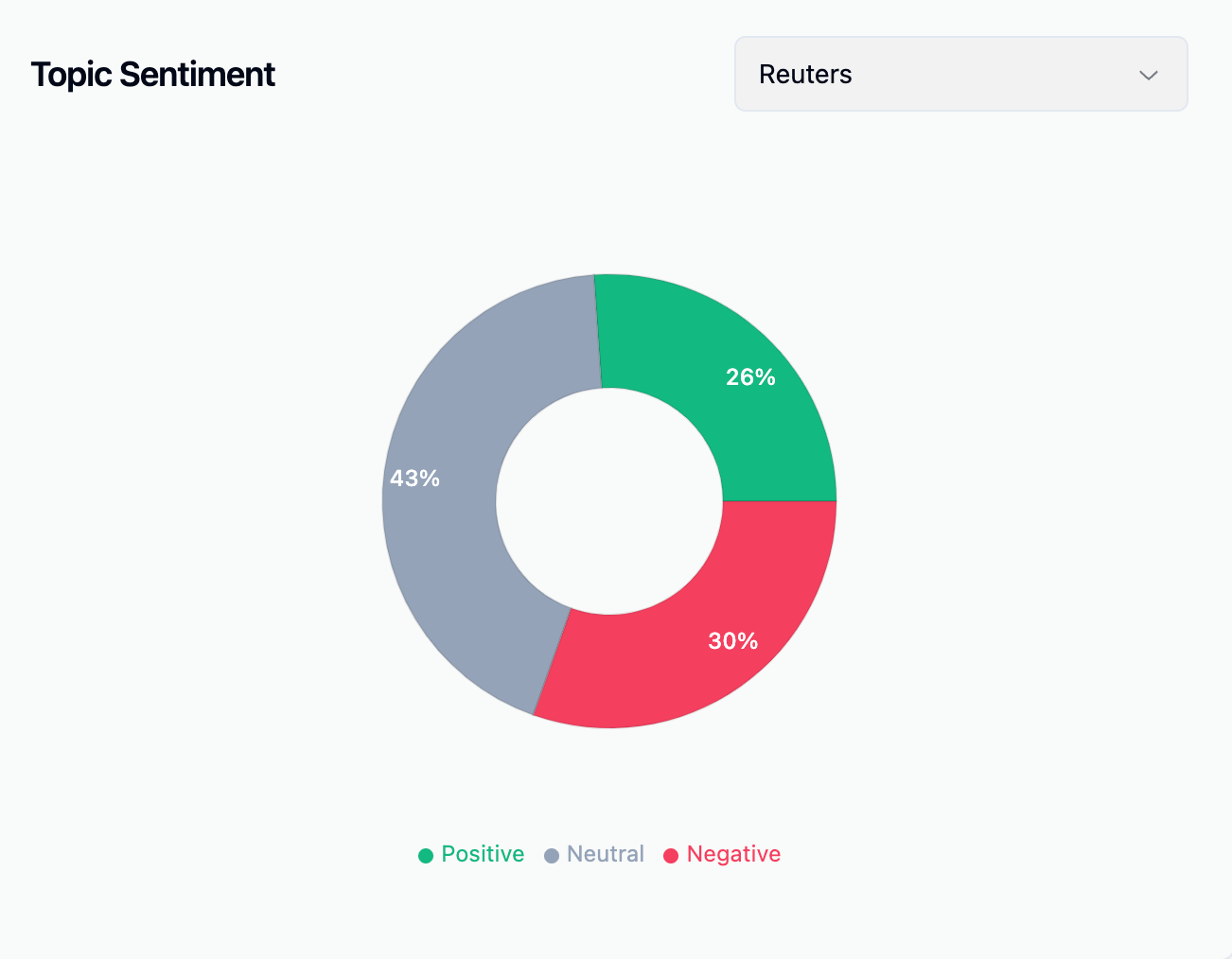

5. Reuters

Volume: 23 articles

Sentiment: 26% Positive / 30% Negative

High-Signal Topics:

- Institutional Adoption: 100% Positive

- Self-custody: 100% Positive

- Investment Vehicles: 40% Positive

Narrative Positioning: Focused, concise, and policy-centric, Reuters offers a sober institutional lens with surprising support for Bitcoin infrastructure and governance.

🚫 Most Negative Outlets on Bitcoin (Q1 2025)

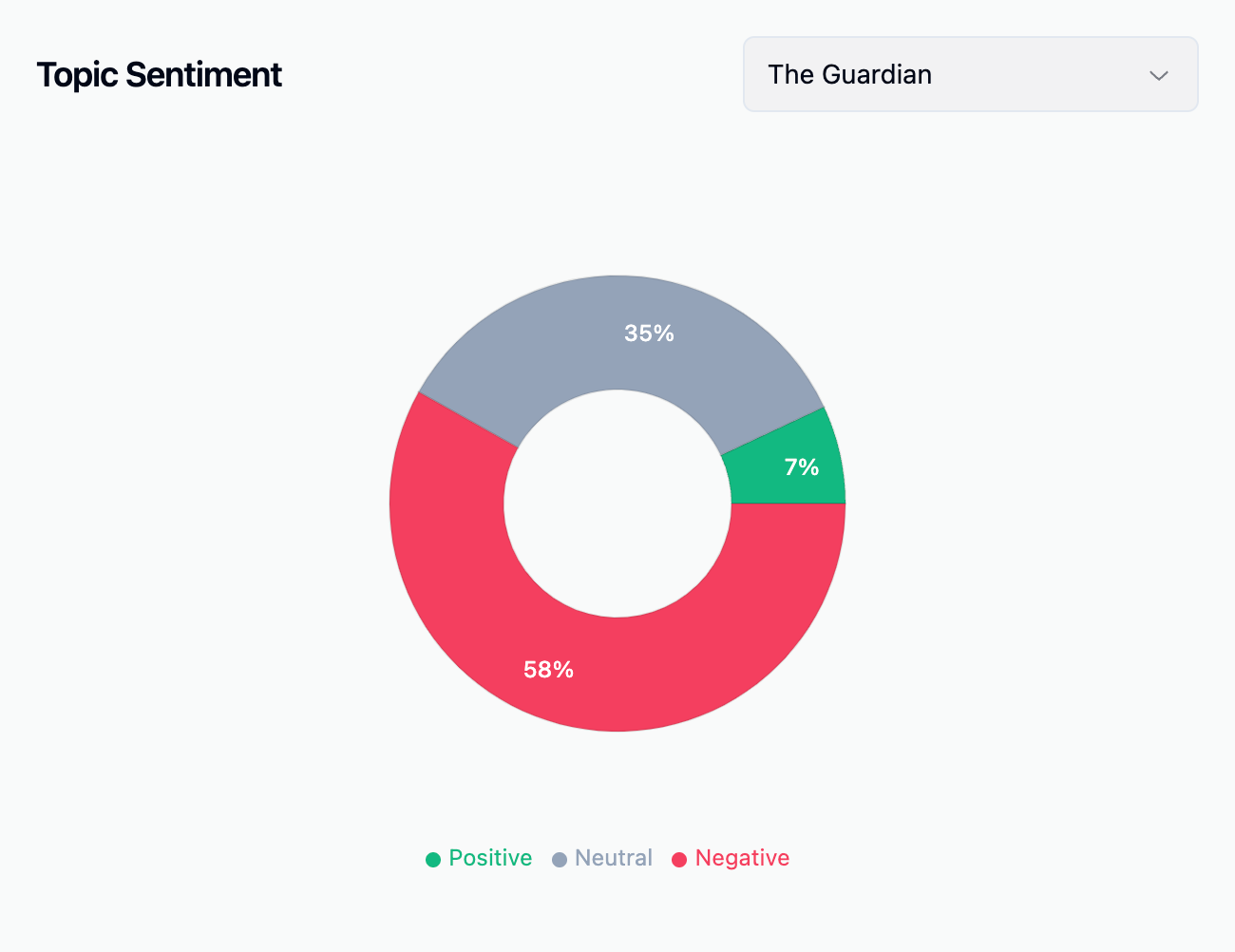

1. The Guardian

Volume: 43 articles

Sentiment: 7% Positive / 58% Negative

Key Negatives:

- Crime & Legal, Market Analysis, Cybersecurity: All heavily negative

- Investment Vehicles: 50% Negative

Narrative Positioning: Bitcoin is largely painted as a social harm vector. This outlet continues to conflate criminality and systemic risk, with minimal exploration of institutional or innovation narratives.

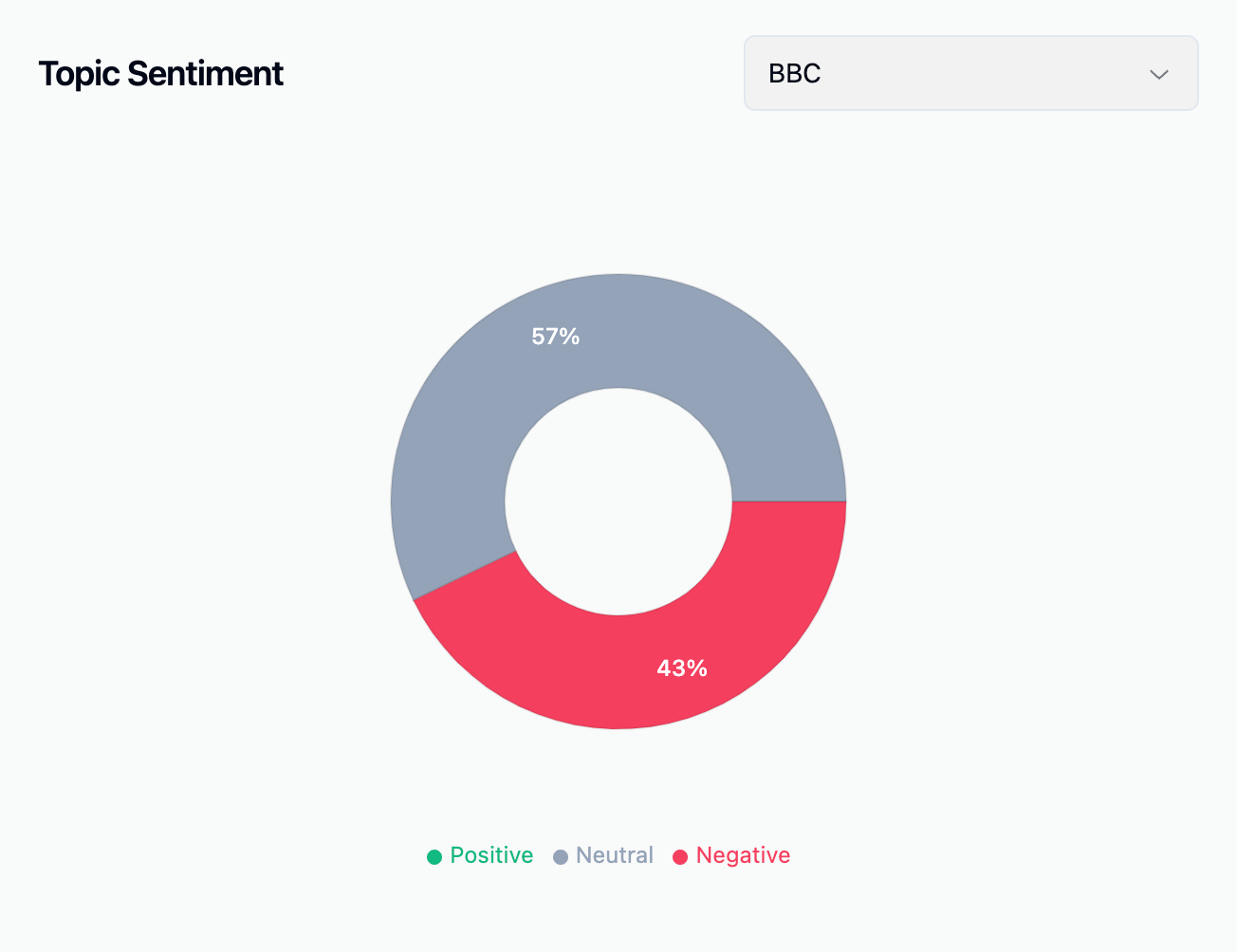

2. BBC

Volume: 14 articles

Sentiment: 0% Positive / 43% Negative

Key Negatives:

- Self-custody & Cybersecurity: 100% Negative

- Crime & Legal / Investment Vehicles: Balanced but skeptical

Narrative Positioning: The BBC sees Bitcoin primarily through a compliance and crime lens. Virtually no coverage acknowledges economic utility or capital markets relevance.

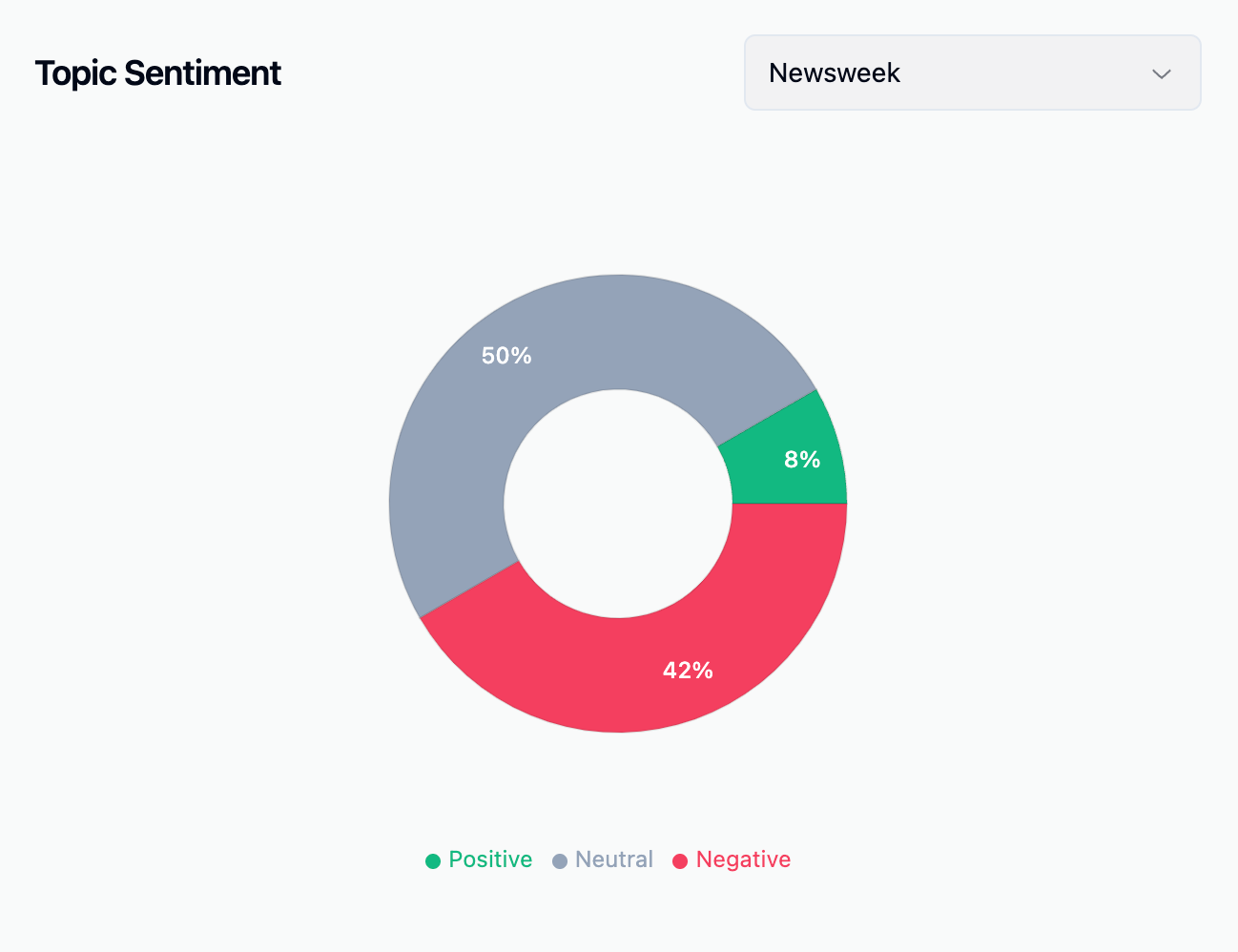

3. Newsweek

Volume: 36 articles

Sentiment: 8% Positive / 42% Negative

Key Negatives:

- Crime, Market Analysis, and AI: All dominated by negative tone

- Banking & Finance / Investment Vehicles: 50% Negative

Narrative Positioning: Newsweek positions Bitcoin as unstable, criminal-adjacent, and inherently risky.

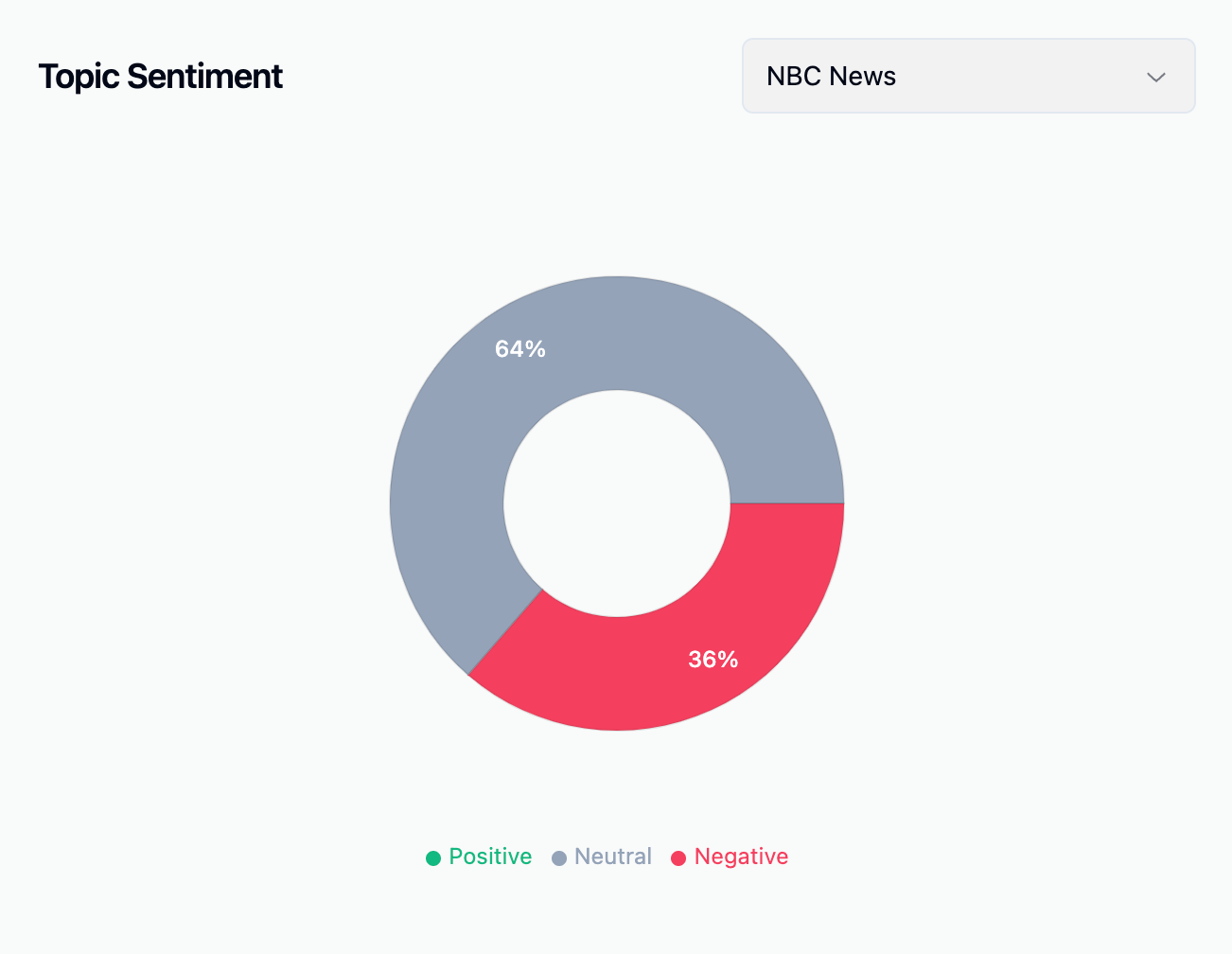

4. NBC News

Volume: 11 articles

Sentiment: 0% Positive / 36% Negative

Key Negatives:

- Cybersecurity & Crime & Legal: 100% Negative

Narrative Positioning: Similar to BBC, NBC appears anchored in risk framing, with no coverage exploring upside or innovation narratives.

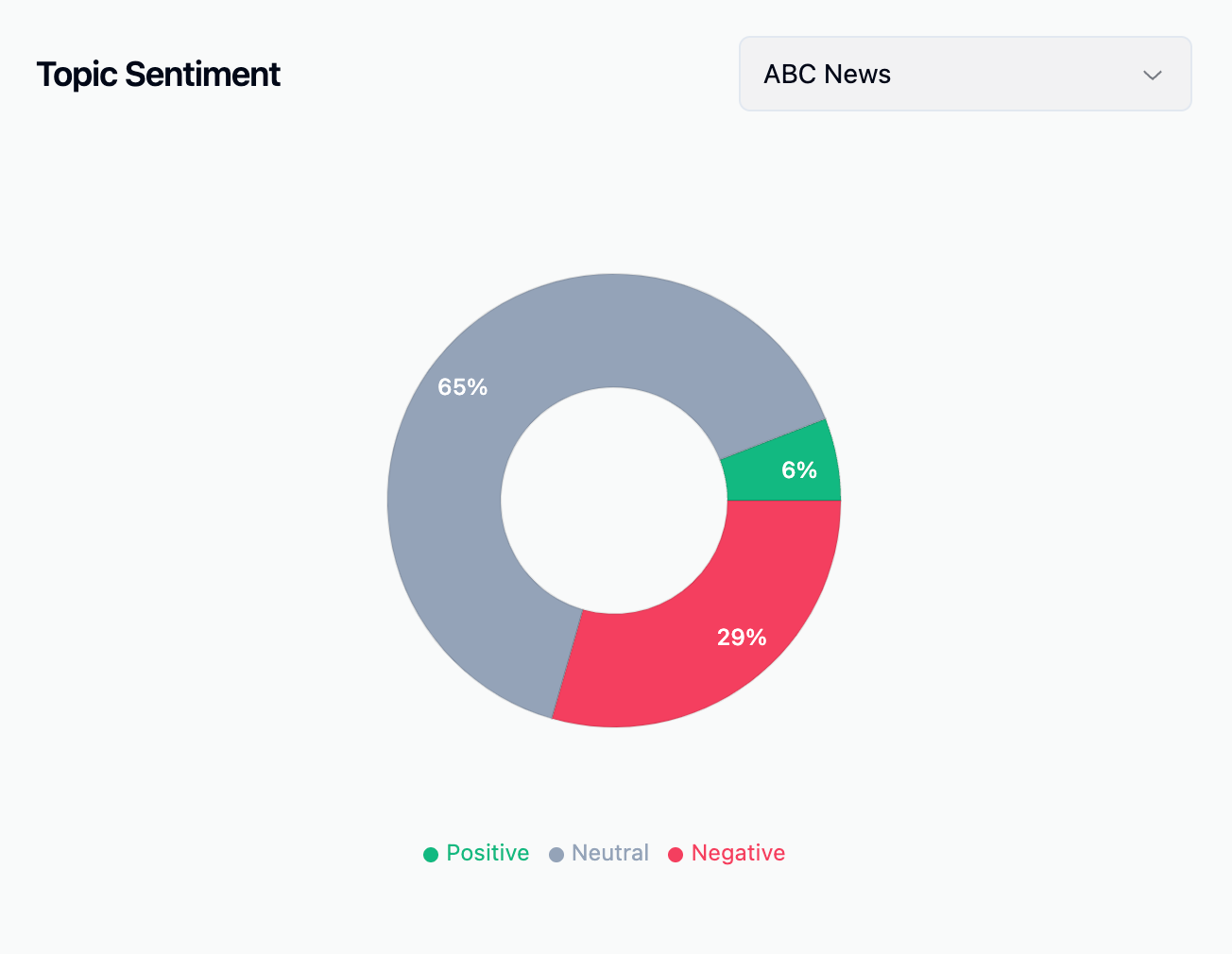

5. ABC News

Volume: 17 articles

Sentiment: 6% Positive / 29% Negative

Key Negatives:

- Market Analysis / Crime: 50% Negative

Narrative Positioning: Generally passive coverage, but where it engages, it defaults to fear-based framing.

Topic Heatmap: What the Media Talks About (and How)

|

Topic |

Most Positively Covered By |

Most Negatively Covered By |

|---|---|---|

|

Investment Vehicles |

Forbes, Barron’s, CNBC |

BBC, Newsweek, Guardian |

|

Banking & Finance |

CNBC, Bloomberg, Fox, Forbes |

Guardian, Newsweek |

|

Institutional Adoption |

Forbes, Bloomberg, NYT, Reuters |

– |

|

Retail Adoption |

Forbes, The Independent |

– |

|

Crime & Legal |

Universal negative framing |

All major outlets |

|

Cybersecurity |

100% Negative across outlets |

– |

|

Market Analysis |

Barron’s, Forbes (mixed) |

Bloomberg, Guardian, Newsweek |

|

Regulatory Updates |

Barron’s, Forbes, Bloomberg |

Guardian, Reuters (mixed) |

|

Self-custody |

Reuters (only positive) |

BBC, Forbes, The Independent |

Strategic Takeaways

- Narrative Concentration Around Risk: Outlets like the BBC, Guardian, and Newsweek concentrate heavily on crime, cybersecurity, and market instability, often with no counterbalancing discussion of institutional developments or economic use cases. Expect these to drive negative public perception and regulatory caution.

- Pro-Adoption Outlets Remain Niche but Influential: Forbes, CNBC, and Barron’s offer substantive, investment-relevant coverage, often highlighting the upside of Bitcoin as a financial instrument. These outlets are most likely to influence allocators, advisors, and asset managers.

- Regulatory Focus Is Growing: Several outlets (e.g., Bloomberg, Reuters) are closely tracking Bitcoin through a compliance lens. Positive sentiment around regulatory maturity (e.g., ETFs, KYC frameworks) appears to counterbalance earlier skepticism.

- Retail & Institutional Adoption Narratives Are Gaining Ground: While underrepresented in volume, coverage of institutional entry and retail utility is overwhelmingly positive when it does occur, offering strategic tailwinds for companies positioning Bitcoin as financial infrastructure.

Final Note

Q1 2025 showed a widening gap between legacy skepticism and capital-market embrace. While the tone of generalist outlets remains cautious or outright hostile, the narrative among finance-focused media has materially shifted.

For allocators, the signal lies not in the volume, but in the narrative depth and directional momentum of key financial voices.