Executive Summary

Mainstream media coverage of Bitcoin in Q2 2025 revealed a deeply polarized narrative landscape, with 1,116 articles published across 18 major outlets. The overall sentiment tilted negative at 31% positive, 41% neutral, and 28% negative, masking dramatic divergence between outlets.

Perhaps most striking was the near-silence from elite financial publications: The Wall Street Journal published only 2 Bitcoin articles, while the Financial Times managed 11 and the New York Times just 11. A remarkable absence given Bitcoin's status as the best-performing asset of the last decade. This editorial blindness from agenda-setting outlets reveals more about their institutional capture than Bitcoin's relevance.

High-volume financial media (Forbes, CNBC, Barron's) filled this vacuum with extensive coverage, while traditional news outlets concentrated on crime and controversy.

This created three distinct narratives: enthusiastic adoption (Forbes/CNBC), willful blindness (WSJ/FT/NYT), and persistent skepticism (traditional media).

Don't wait three months to see the story take shape. Track sentiment shifts, media bias, and institutional narratives in real time. The gap between financial media's constructive coverage and elite media's head-in-the-sand approach creates both opportunity and risk for institutional positioning.

The Ostrich Strategy: Elite Media's Self-Inflicted Irrelevance

Before examining high-volume coverage, we must address the emperor's new clothes: The Wall Street Journal published 2 Bitcoin articles in Q2 2025. The Financial Times managed only 11. The New York Times, just 11.

This isn't Bitcoin's legitimacy crisis. It's theirs.

While Bitcoin posted another quarter of outperformance, while companies added billions to corporate treasuries, while ETF volumes soared, these outlets covered Bitcoin less than they cover quarterly earnings from declining retailers.

The FT and WSJ—outlets that breathlessly report every basis point move in Italian bond yields—have decided the best-performing asset of the century warrants less coverage than European Central Bank meeting minutes.

When Barron's publishes 65 Bitcoin articles while its parent WSJ publishes 2, when CNBC publishes 141 while the FT publishes 11, we're not witnessing Bitcoin's failure to gain institutional acceptance. We're watching legacy financial media fail to serve their readers' informational needs.

Strategic Implication: Elite financial media's ostrich strategy creates massive information asymmetry. Institutional investors relying on WSJ/FT for market intelligence are systematically underinformed about a transformative asset class.

This isn't Bitcoin's blind spot. It's theirs.

Most Constructive Outlets (High Volume)

1. Forbes

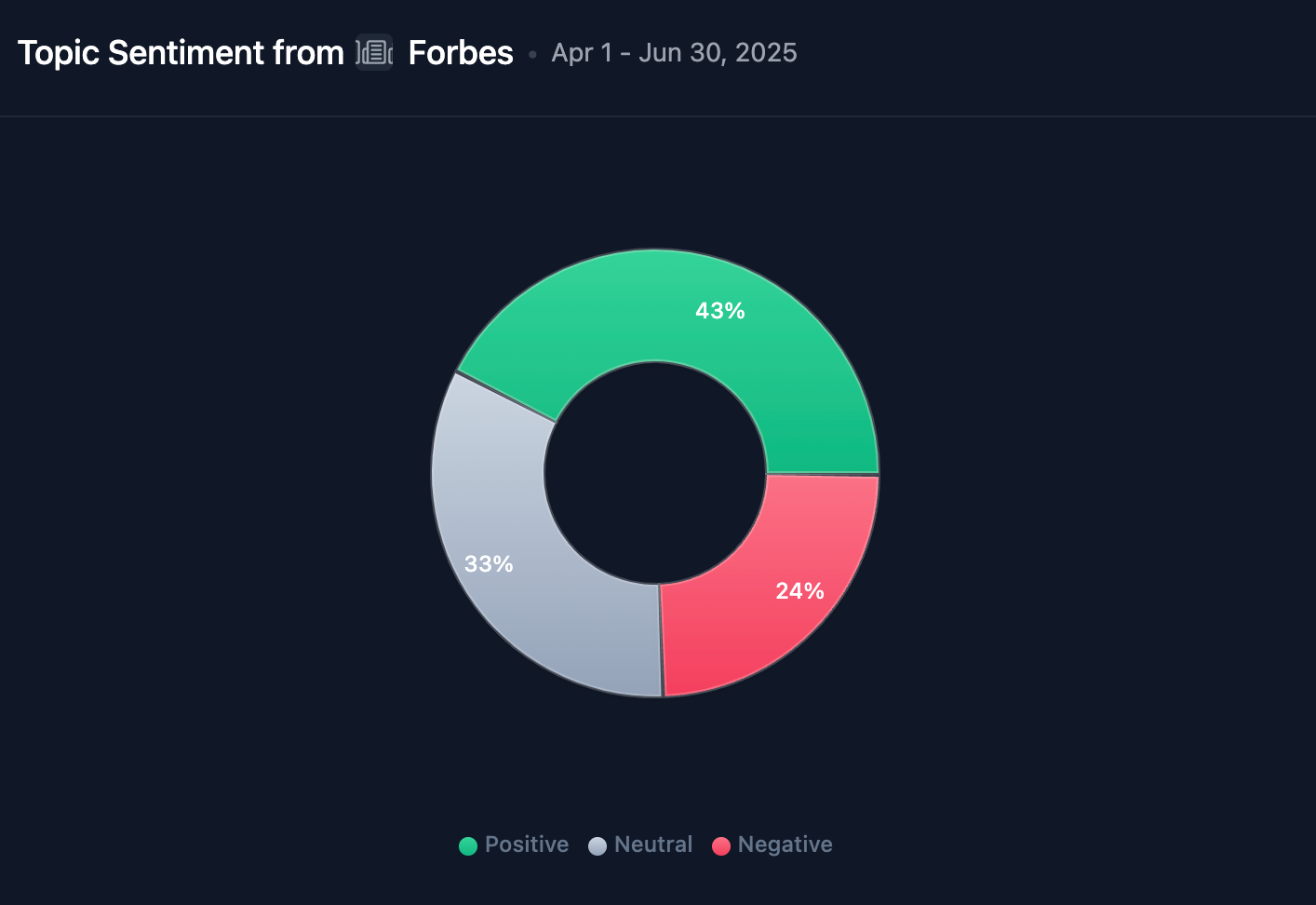

Volume: 194 articles | Sentiment: 43% positive, 24% negative (1.8:1 ratio)

High-Signal Topics:

- Retail Adoption: 75% positive

- Mining: 71.4% positive

- Institutional Adoption: 100% positive

Narrative Positioning: Forbes has essentially replaced the Wall Street Journal as the financial publication of record for the digital asset economy. Their 194 articles versus WSJ's 2 doesn't reflect editorial bias. It reflects market reality.

While the WSJ clings to 20th-century asset classes, Forbes covers what's actually moving markets and reshaping finance.

2. CNBC

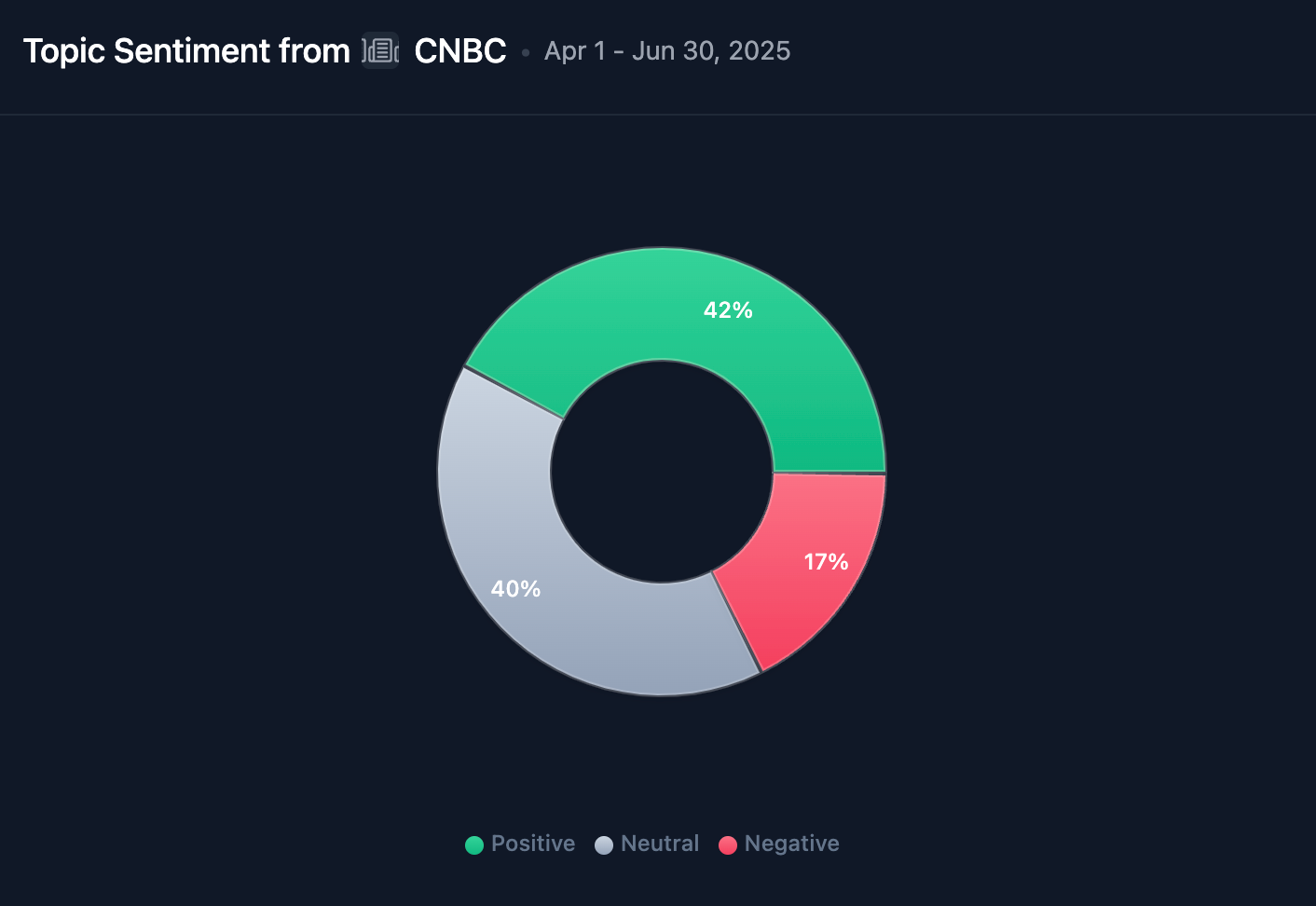

Volume: 141 articles | Sentiment: 42% positive, 17% negative (2.5:1 ratio)

High-Signal Topics:

- Banking & Finance: 47.4% positive, 10.5% negative

- Market Analysis: 47% positive, 18.2% negative

- Investment Vehicles: 40.2% positive, 14.6% negative

Narrative Positioning: CNBC's 141 articles demonstrate what financial media looks like when it follows markets rather than dinner party consensus.

Their coverage ratio (70x the WSJ's) shows who's serving traders and investors versus who's protecting institutional orthodoxy.

CNBC treats Bitcoin as what it is: a major market that moves billions daily.

3. Fortune

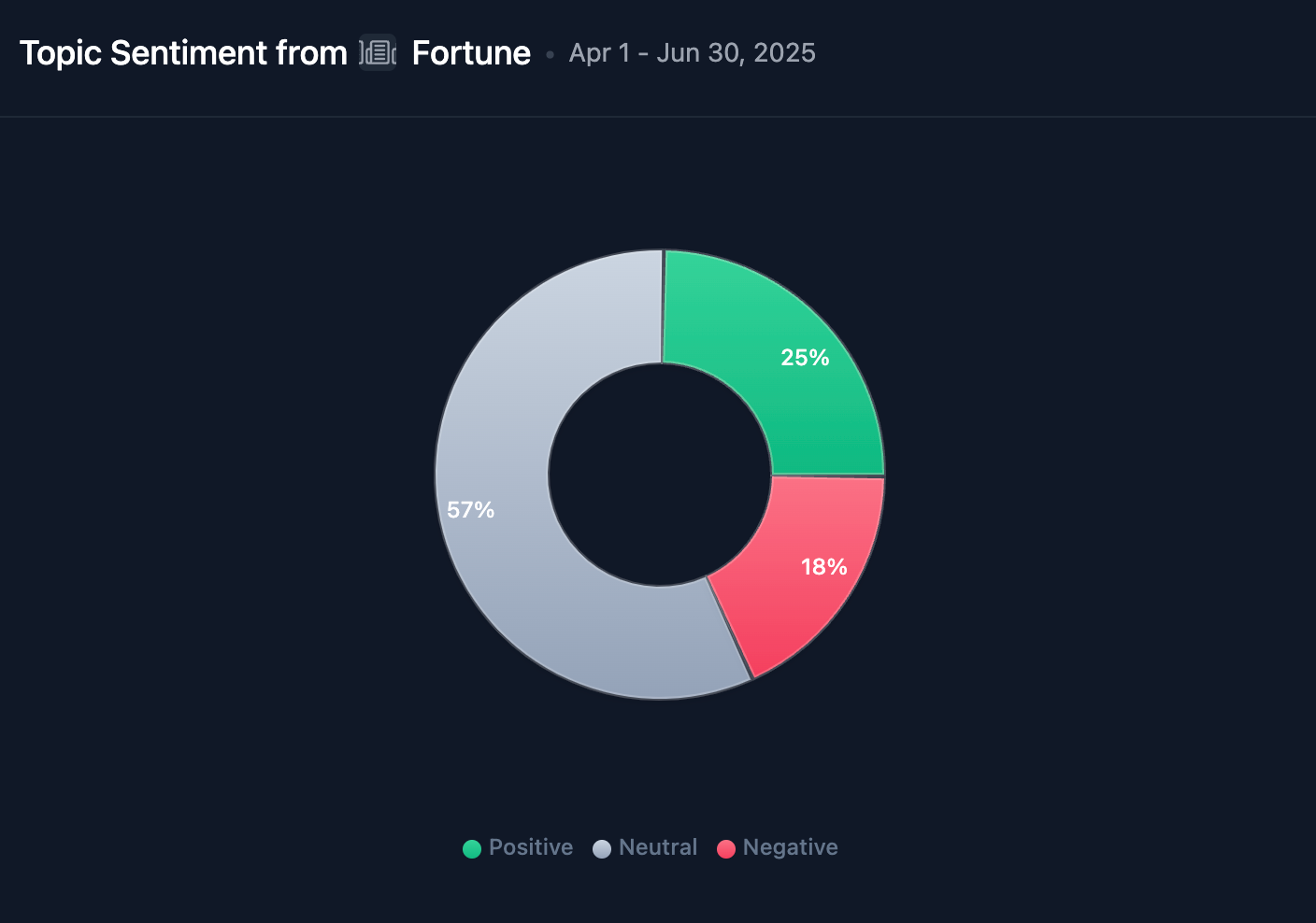

Volume: 117 articles | Sentiment: 25% positive, 18% negative (1.4:1 ratio)

High-Signal Topics:

- Mining: 66.7% positive, 33.3% negative

- Banking & Finance: 38.1% positive, 9.5% negative

- Market Analysis: 41.2% positive, 23.5% negative

Narrative Positioning: Fortune demonstrates how to cover Bitcoin seriously without abandoning skepticism.

With 58x the WSJ's coverage, Fortune proves you can maintain credibility while acknowledging market reality.

Their balanced approach shows the false choice between boosterism and blindness.

Most Negative Outlets (High Volume)

1. The Independent

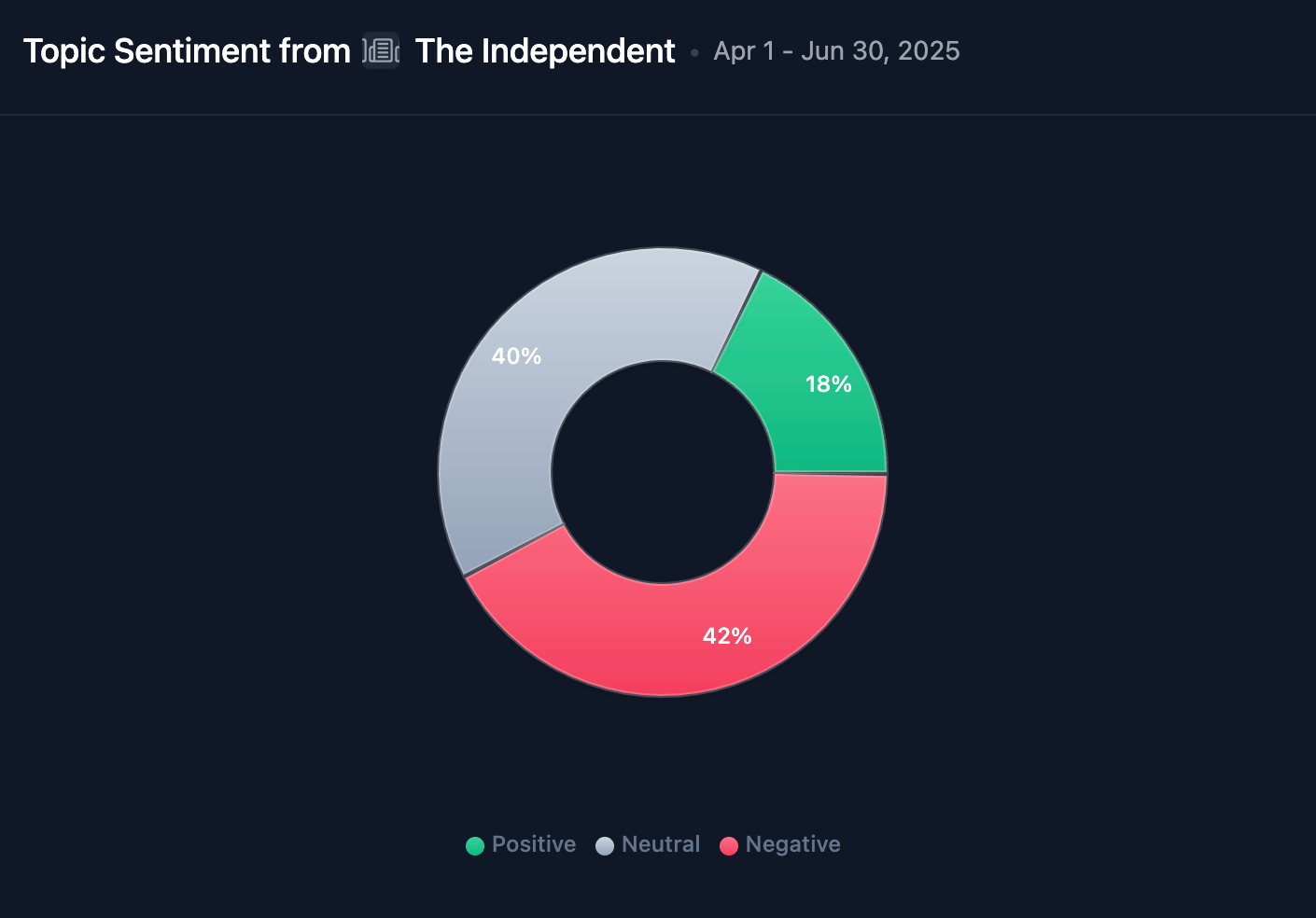

Volume: 45 articles | Sentiment: 18% positive, 42% negative (1:2.3 ratio)

Key Negatives:

- Investment Vehicles: 54.5% negative

- Crime & Legal: 100% negative

- Cybersecurity: 100% negative

- Market Analysis: 44.4% negative

Narrative Positioning: The Independent publishes 22x more Bitcoin content than the Wall Street Journal, albeit with persistent skepticism.

Their high-volume negative coverage at least acknowledges Bitcoin's newsworthiness—a step ahead of elite outlets pretending it doesn't exist.

2. Fox News

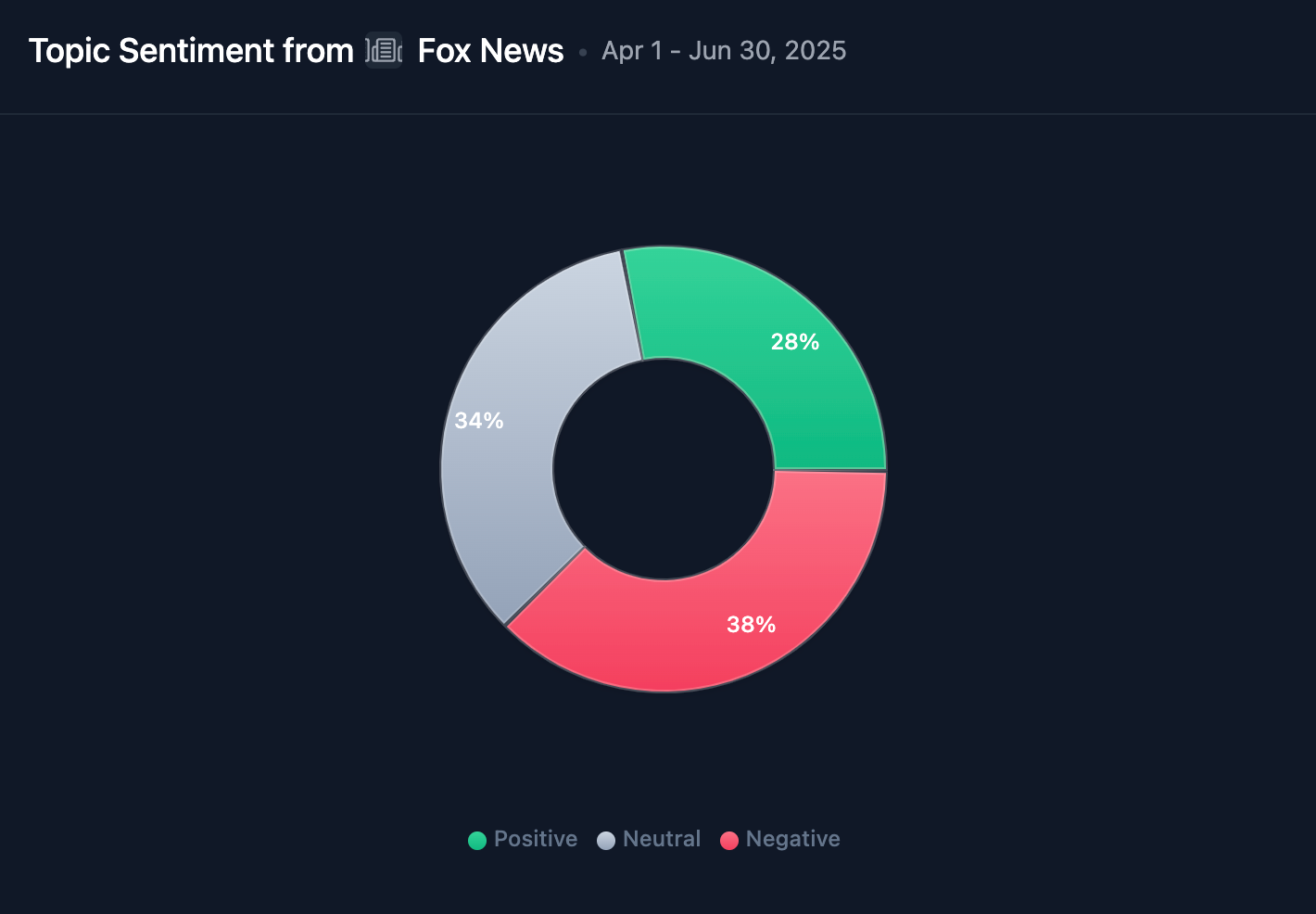

Volume: 32 articles | Sentiment: 28% positive, 38% negative (1:1.4 ratio)

Key Negatives:

- Crime & Legal: 100% negative

- Cybersecurity: 100% negative

- Investment Vehicles: 40% negative

Narrative Positioning: Fox News, hardly a bastion of financial sophistication, publishes 16x more Bitcoin coverage than the WSJ.

Their conflicted narrative, bouncing between legitimacy and fear, at least engages with reality rather than ignoring it entirely.

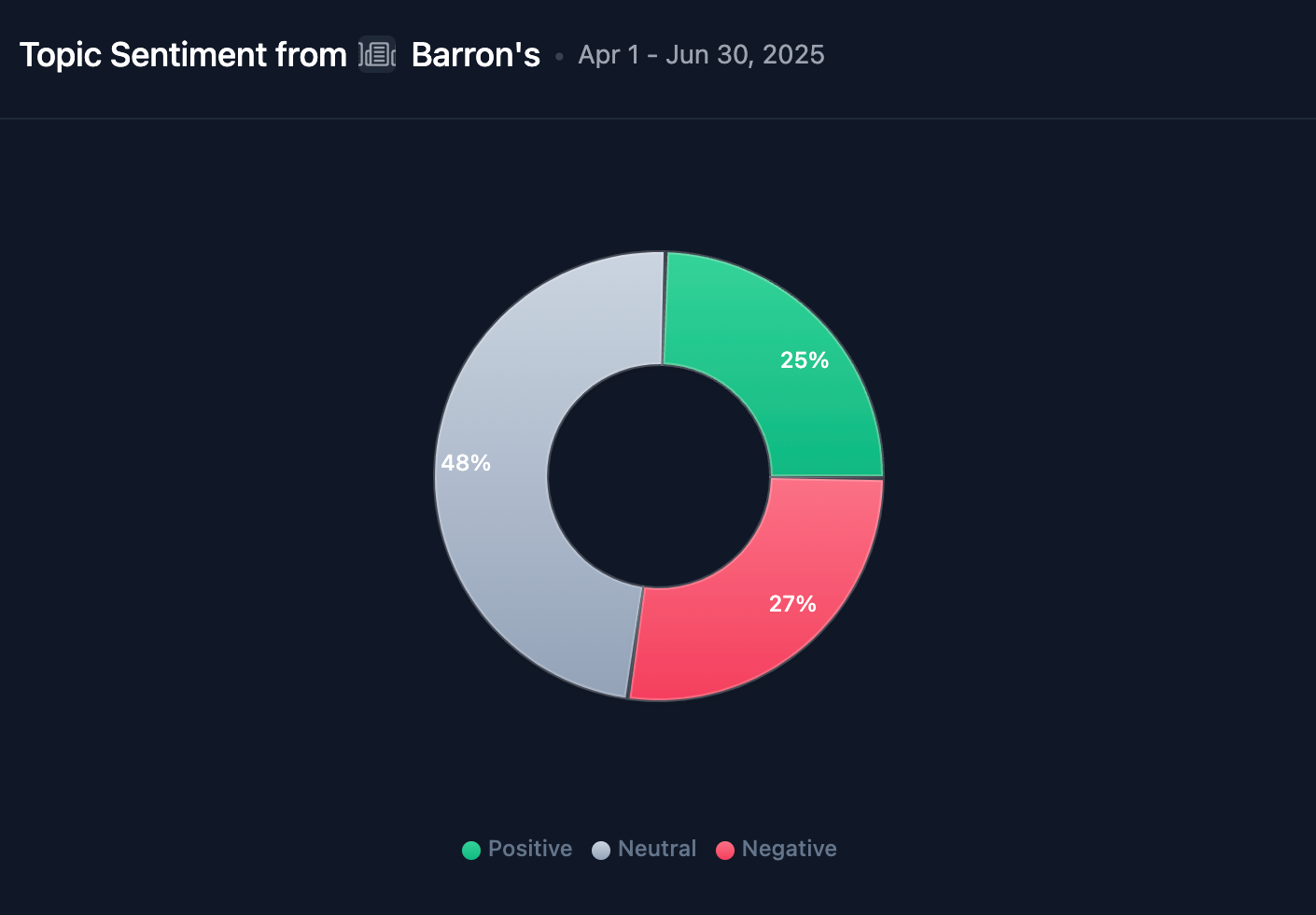

3. Barron's

Volume: 65 articles | Sentiment: 25% positive, 27% negative (1:1.1 ratio)

Key Negatives:

- Institutional Adoption: 100% negative

- Banking & Finance: 100% negative

- Investment Vehicles: 35.7% negative

Narrative Positioning: The Barron's paradox exposes the WSJ's editorial dysfunction. While the parent publishes 2 articles, its trading-focused subsidiary publishes 65.

Is the WSJ choosing institutional dinner party approval over market reality?

Final Note

The Q2 2025 numbers tell the story: WSJ published 2 Bitcoin articles. Forbes published 194.

This is editorial dereliction.

Investors reading WSJ/FT are systematically underinformed about the best-performing asset class. This creates alpha for those reading outlets that acknowledge reality.

While Bitcoin dominated returns, while companies added billions to treasuries, while ETFs hit records, the "paper of record" covered it less than municipal bond auctions.

Bitcoin doesn't need the WSJ anymore than Netflix needed Blockbuster's approval.

But investors relying on outlets that ignore the best-performing asset of the century aren't being protected from risk. They're being blinded to reality.

The question isn't whether Bitcoin is legitimate enough for the Wall Street Journal.

It's whether the Wall Street Journal still matters.

For real-time narrative intelligence and media sentiment tracking across global markets, visit the Perception app.