So the debut of the Bitcoin ETFs was already a movie, but it ended up being a blockbuster, pulling in a cool $2 billion in days.

But the mainstream financial media seemed to have watched a different movie altogether, as a staggering 83% of the total coverage was negative at the end of the working week.

Now, if you had to take a wild guess where the biggest pushback came from, you’d probably guess correctly.

But for fun’s sake, let’s name them The Usual Suspects, The Davos Elite, and The Gold Bugs.

Let’s take a closer look.

The Usual Suspects

The New York Times, always thinking about your well-being, cautiously noted, or concern trolled, writing that "putting crypto into a traditional investment wrapper does not paper over the underlying risks."

But if you, for whatever crazy reason, would still be interested in getting exposure to Bitcoin through an ETF, the NYT ended the article with a last warning for you:

Meanwhile, the Financial Times, discussing Vanguard's decision to avoid Bitcoin ETFs, seemed to jump on the bandwagon and wrote a similar to piece to echo the negative sentiment, but ended up just sounding like yet another granddad politely declining to use a smartphone.

Because I have to pinch myself sometimes and ask: Are these reporters using typewriters and fax machines to dispatch their “cautionary” tales?

What will it take for Bitcoin ETFs to gain the nod of approval from these financial stalwarts?

Because this is the strangest thing to write right after Bitcoin surpassed silver to become second largest ETF commodity in the US:

The Davos Elite

Building on this theme of willful blindness - the financial elite.

Because, guess what: It's that time of year where Jamie Dimon is done talking about Bitcoin again!

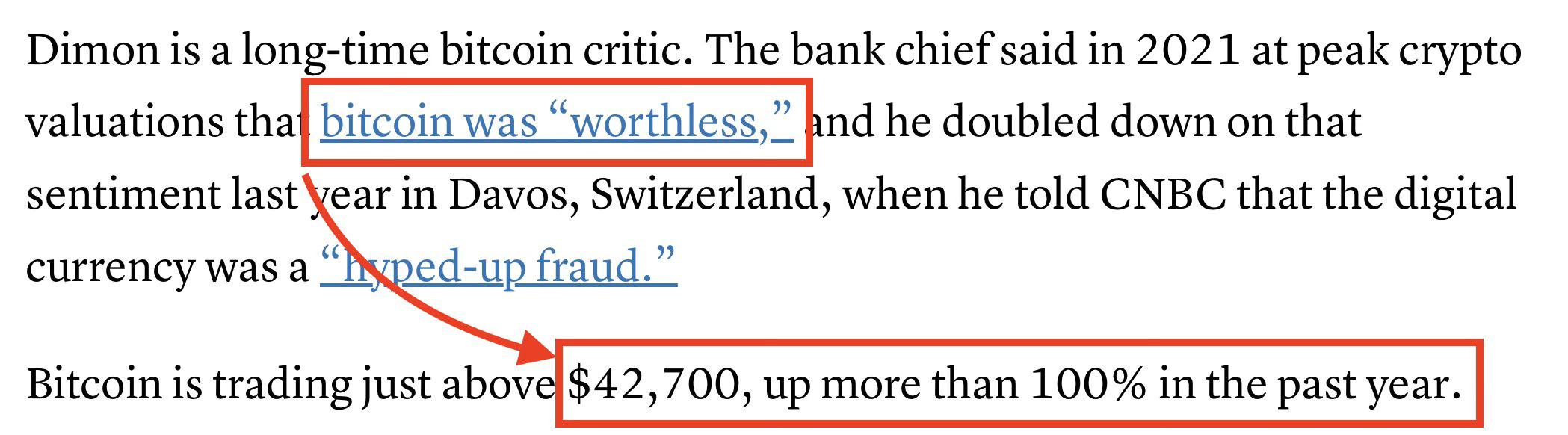

The irony, of course, is that while Dimon dismisses Bitcoin as a 'pet rock' for the nth time, Bitcoin just continues to gain traction and evolve, not caring by the predictable critique from the high altitudes of Davos.

A cool thing to point out, though, is MacKenzie Sigalos covering the story but adding a nice little touch in her reporting:

But hey, at this point, Dimon's comments have become a seasonal sport - just another pebble on the path to mainstream acceptance.

The Gold Bugs

But the cast of villains does not stop there. Last week, the spotlight on Bitcoin ETFs has stirred the pro-gold, anti-Bitcoin army.

Forbes, NYT and CBS seemed to anoint themselves as defenders of gold's honor, standing firm against the Bitcoin tide.

Forbes came out swinging, profusely claiming that ‘Bitcoin Will Never Be ‘Money’ Precisely Because It’s Nothing Like Gold’ while The New York Times just sounded like The Peter Schiff Times:

Over at CBS News, the narrative took a similar turn. With Bitcoin's price experiencing a dip, the article seems almost gleeful in suggesting that now might be the perfect time to turn to gold.

It paints a picture of gold as the wise old sage of investments, a safe haven in times of economic turmoil, as opposed to the wild, unpredictable nature of Bitcoin:

I guess a return of 12% in 20 years seems cool for some people?

To wrap it up for the week - you’d think the timing of these pieces, coinciding with Bitcoin's moment in the ETF spotlight, would be less like coincidence and more like a coordinated counter-attack from several anti-Bitcoin camps.

The reality is, with every paradigm shift there’s just so many different segments and flavors of the status quo defenders. This shift is palpable when you keep track of all the biggest mainstream media outlets as their voices grow louder the more advancement Bitcoin experiences.

It’s real easy to see. Bitcoin is winning.