Weekly Media Recap #13

Welcome to the latest edition of Bitcoin Perception.

If you want to join other readers from companies such as Swan, Galoy, Braiins, Blockstream, and others learning about how the mainstream media covers Bitcoin, subscribe below:

You can check out the archive for older media reports and follow BP on Twitter too!

EOW closing Bitcoin price: $27,980

Date range: September 25 - October 1, 2023

Bitcoin Perception Index (BPI): 40/100 - some fearfulness in the air

Main Topics: Regulatory Landscape, Market Trends, Mining Trends, Global Perspectives

This week's spotlight: CNBC

Weekly Snapshot

Main Topics Of The Week

Regulatory Landscape

SEC Delays and Approvals

The SEC has been in the spotlight this week, delaying decisions on spot Bitcoin ETFs. Despite these delays, Valkyrie Funds received approval for Ether futures in their ETF, marking a regulatory milestone.

Governance and Legislation

Lawmakers are urging the SEC to approve Bitcoin spot ETFs immediately. Meanwhile, the crypto industry faces an uphill struggle in Washington, with Coinbase CEO advocating for clear rules.

Market Trends

Quarterly Losses and Gains

Bitcoin is ending September with its first quarterly loss this year. However, MicroStrategy continues to invest, now holding $4.68 billion in Bitcoin.

The Role of Influencers

Elon Musk and other key figures are still affecting market sentiment around Bitcoin amid wild price swings, making it feel like it’s 2021 again. The market remains volatile but resilient.

Mining Trends

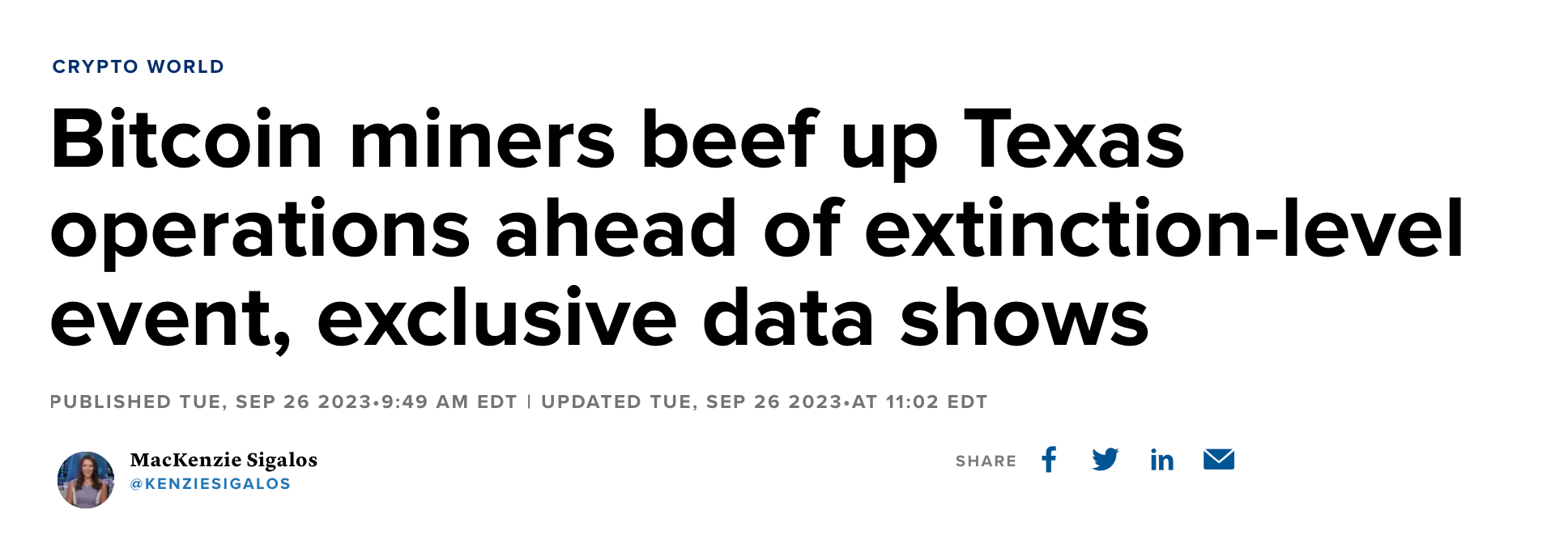

More Bitcoin miners are flocking to Texas, indicating a shift in the mining landscape and potentially impacting the network's decentralization.

Global Perspectives

Pro-Bitcoin Candidates

From Vivek Ramaswamy in the U.S. to Javier Milei in Argentina, pro-Bitcoin presidential candidates are emerging around the globe, signaling that the shift in political attitudes towards Bitcoin is not a short-lived trend.

This Week's Spotlight: CNBC

Source: CNBC

Texas has emerged as a significant player in the Bitcoin mining industry, accounting for 28.50% of the U.S. hash rate as of July 27, 2023. This is a huge increase from the 8.43% it held at the end of 2021.

Needless to say, the Lone Star State has strengthened its status as a significant player in the Bitcoin mining landscape. CNBC's MacKenzie Sigalos provides a comprehensive look into this development.

The Halving Event and Its Implications

The upcoming "halving" in April 2024 is a topic of much discussion. While it's tempting to focus solely on the potential for a Bitcoin price surge, it's crucial to consider the challenges for miners. Reduced rewards could tighten already slim margins. Kevin Zhang of Foundry calls it the "ultimate test" for the industry. It's a sentiment worth noting.

The Energy Debate

The energy consumption of Bitcoin mining is a recurring topic, but Texas offers a nuanced perspective. Thanks to its flexible energy grid, ERCOT, the state is turning what could be a challenge into an opportunity. It's an innovative approach that deserves attention.

The Geopolitical Shift

The westward migration of Bitcoin mining, particularly post-China's 2021 crackdown, has been beneficial for Texas. The state's regulatory environment and energy resources make it an increasingly attractive hub for mining operations.

Economic Incentives and Strategies

Innovation is key in the Bitcoin industry, and companies like Riot Platforms are leading the way. By selling energy back to the ERCOT grid, Riot has found a way to offset operational costs. It's a smart move considering the upcoming reduction in block rewards.

A Balanced View

While the article is optimistic about the future of Bitcoin mining in Texas, it's essential to maintain a balanced perspective. The halving event and environmental concerns are significant challenges that shouldn't be overlooked.

Also, the article points out that mining is becoming less lucrative by sharing some interesting numbers, with miners making an average of $66,400 per day per exahash of mining capacity, compared to nearly $342,000 at Bitcoin's peak in November 2021.

In summary, CNBC’s MacKenzie Sigalos provides a well-rounded view of the complexities and opportunities in Bitcoin mining in Texas.

If you’re in mining, you have quite interesting months ahead of you.

Final Thoughts

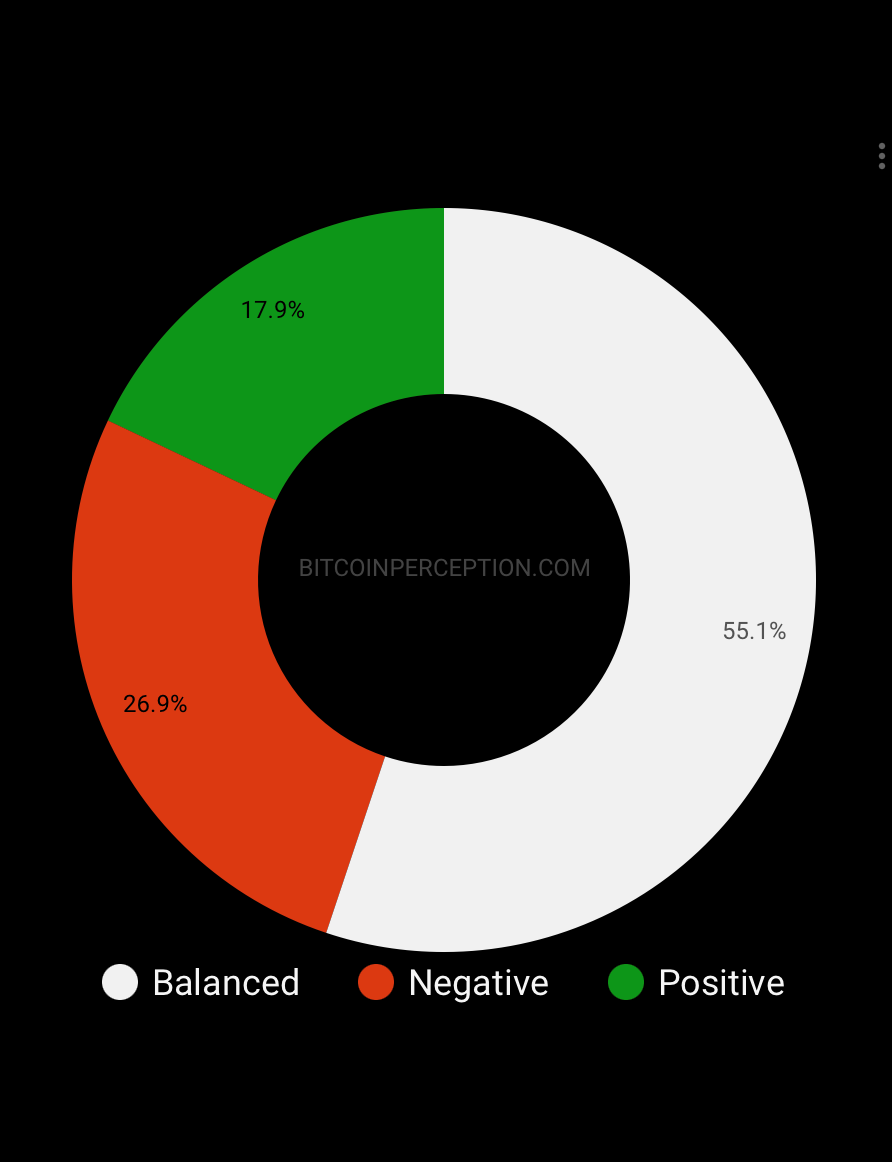

As we close out the third quarter, we observed a 21% decrease in overall media coverage compared to previous periods. Positive coverage declined by 18%, while negative coverage also saw a reduction of 26%.

What can you say? Bear market woes.