Weekly Media Recap #46

EOW closing BTC price: $69,638

Date range: June 3 - June 9, 2024

In this report: How the mainstream media covered these major stories:

- Mining Industry Consolidation ⛏️

- Michael Saylor's Tax Settlement 💸

- ETF Funds' Promotional Bitcoin Run 🏃🏻➡️

Weekly Snapshot

Mining Industry Consolidation

The Bitcoin mining industry is showing signs of consolidation and strengthening market positions post-halving. Companies are making significant investments, acquisitions, and strategic stake purchases to further their operational capacities and competitive edge.

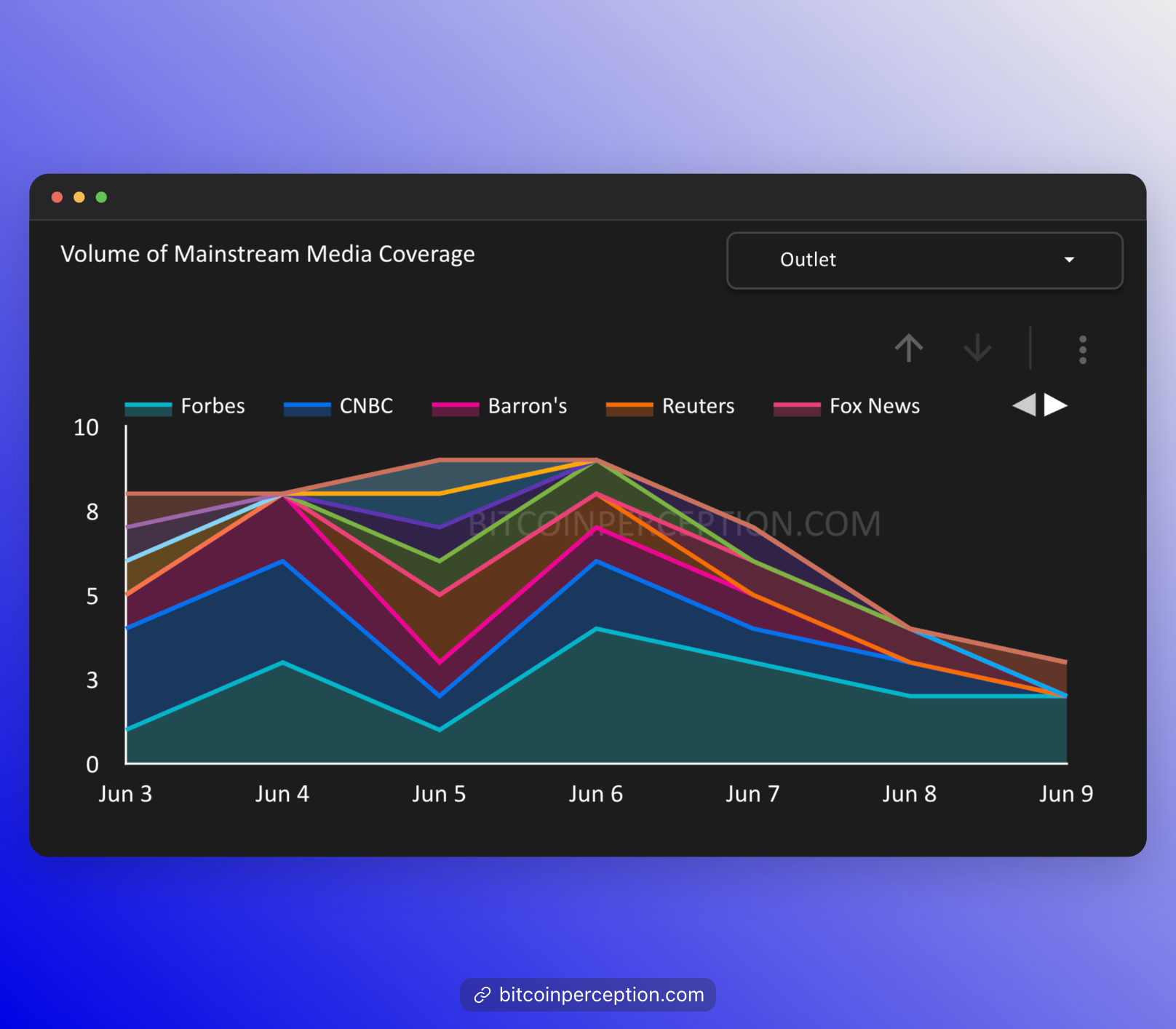

But interestingly, only Reuters and CNBC has given coverage to these significant moves, which is curious considering the strategic importance.

But this makes sense when you look at Bitcoin Perception data, where it's clear that mining represents just 5.56% of the total coverage out of 6,385 pieces since 2023.

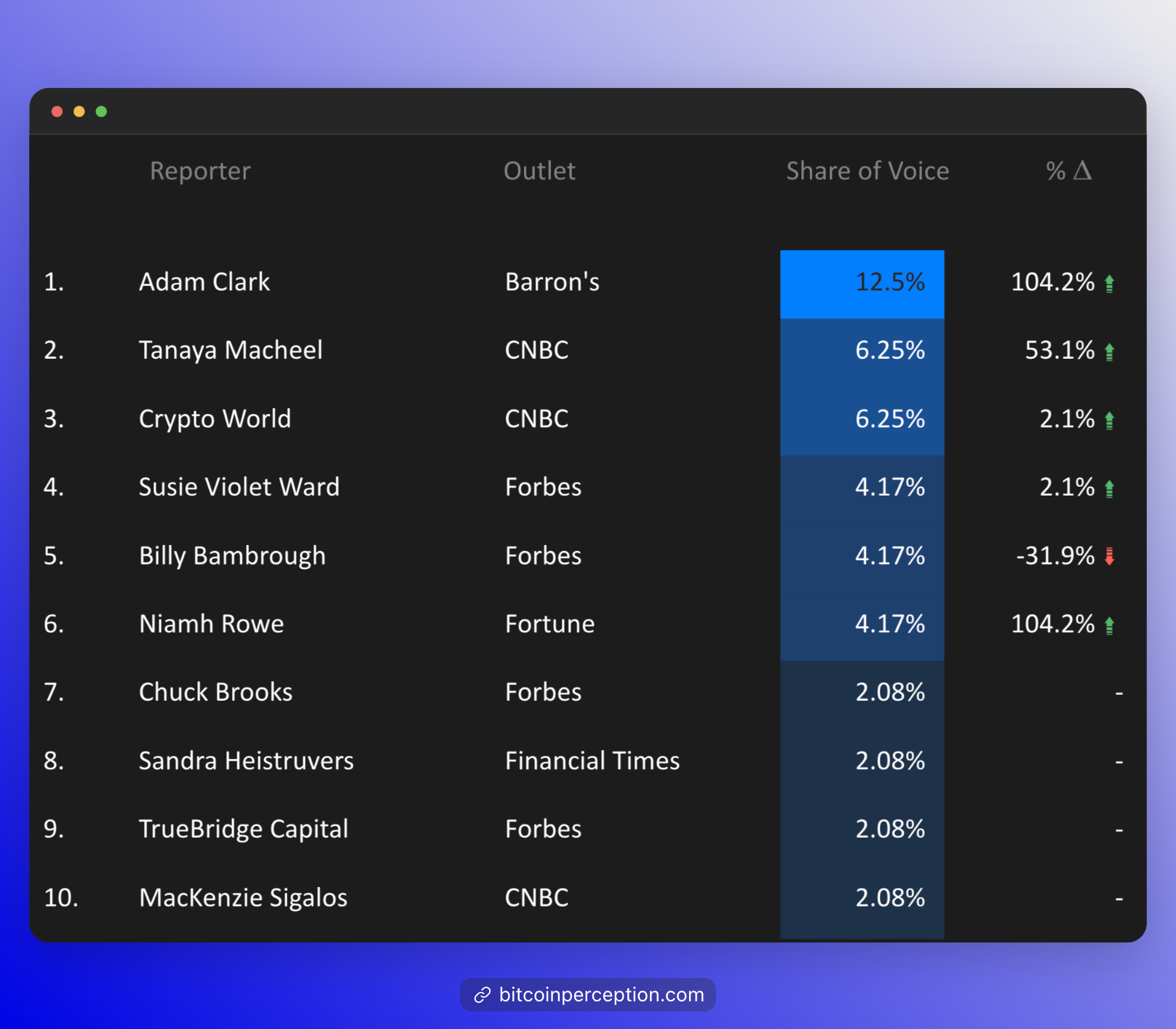

Reuters' Disha Mishra covered Riot Platforms' acquisition of a 12% stake in Bitfarms while Core Scientific's rejection of CoreWeave's buyout offer was covered by CNBC's Mackenzie Sigalos and Reuters' Jaiveer Singh Shekhawat.

Singh Shekhawat noted that Bitcoin miners are increasingly targeted by larger peers and AI technology companies seeking to consolidate power supply for their operations, which is an interesting trend to follow.

However, the language used by Singh Shekhawat —terms like "miners use vast amounts of electricity" and calling miners "energy-hungry enterprises"—reflects a poor perception of the industry.

Michael Saylor's Tax Settlement

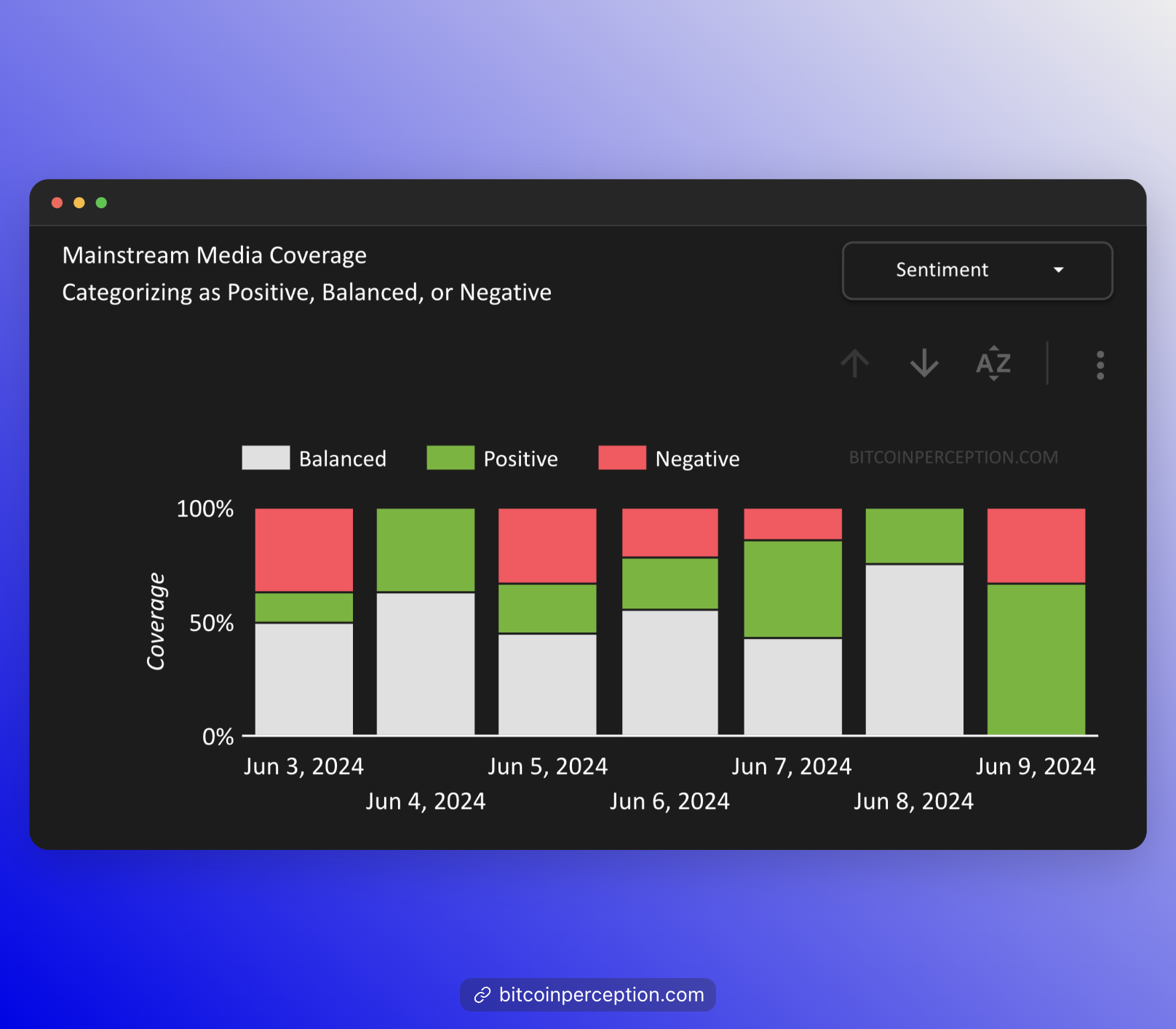

MicroStrategy's CEO, Michael Saylor, and the company's tax settlement saga have dominated headlines, though not in the most flattering light.

Major outlets covered this legal battle, focusing on the implications for both Saylor and MicroStrategy.

Notable authors include Andrew Ross Sorkin and his colleagues at the New York Times, Michael Laris at the Washington Post, and Rebecca Picciotto at CNBC.

While the coverage delve into the details of the tax settlement, it's also promoting the lawsuit as the very first one under the False Claims Act, which encourages whistle-blowers to file claims against residents who they say are hiding where they actually live.

Interesting.

Another thing to point out is that this extensive coverage of Michael Saylor's tax settlement could be seen as a reflection of the scrutiny faced by high-profile figures in the industry.

But it makes you wonder, though—would these articles even see the light of day if they couldn't use the term "Bitcoin billionaire"?

ETF Funds' Promotional Bitcoin Run

The ETF industry is pulling out all the stops to get Bitcoin into your portfolio.

Fidelity has been making a big push for small Bitcoin allocations, touting the benefits of diversification and a hedge against economic uncertainties. CNBC's Tanaya Macheel covered Fidelity's stance.

ETF provider Global X, on the other hand, has made a strategic move to cut fees on its European ETPs to zero. The Financial Times' Sandra Heistruvers reported on this competitive tactic to increase adoption.

These efforts by Fidelity and Global X show just how serious the ETF industry is about promoting Bitcoin as a solid investment option.

With aggressive pricing strategies and nonstop advocacy, they're making Bitcoin more accessible and mainstream than ever.