EOW closing BTC price: $62,668

Date range: June 24 - June 30, 2024

1. Trends in Bitcoin Mining

2. Focus on Mt. Gox Payouts

3. Political, Social, and Regulatory Developments

Weekly Snapshot

Trends in Bitcoin Mining

The Bitcoin mining sector is still in the mainstream media focus as they keep experiencing significant changes and strategic shifts post-Halving, with investments in AI, takeover attempts, and mergers and acquisitions leading the trends.

Key Points:

- David Pan from Bloomberg reported that Riot has called for a special shareholder meeting at Bitfarms to vote on three new board nominees. This follows Bitfarms' rejection of Riot's $950 million buyout offer and the adoption of a poison pill strategy to prevent a hostile takeover.

- Niket Nishant from Reuters also highlighted Riot's pursuit of board seats, emphasizing the ongoing struggle.

- CNBC's Crypto World covered Bitcoin miner Hut 8's stock surge of over 15% after announcing a $150 million AI investment.

- Andrew R. Chow from Time noted that Bitcoin miners are increasingly adopting AI, replacing traditional equipment to optimize operations and reduce costs.

- Ryan Browne from CNBC reported on a wave of mergers and acquisitions in the industry, with miners leveraging their data centers for AI applications.

Focus on Mt. Gox Payouts

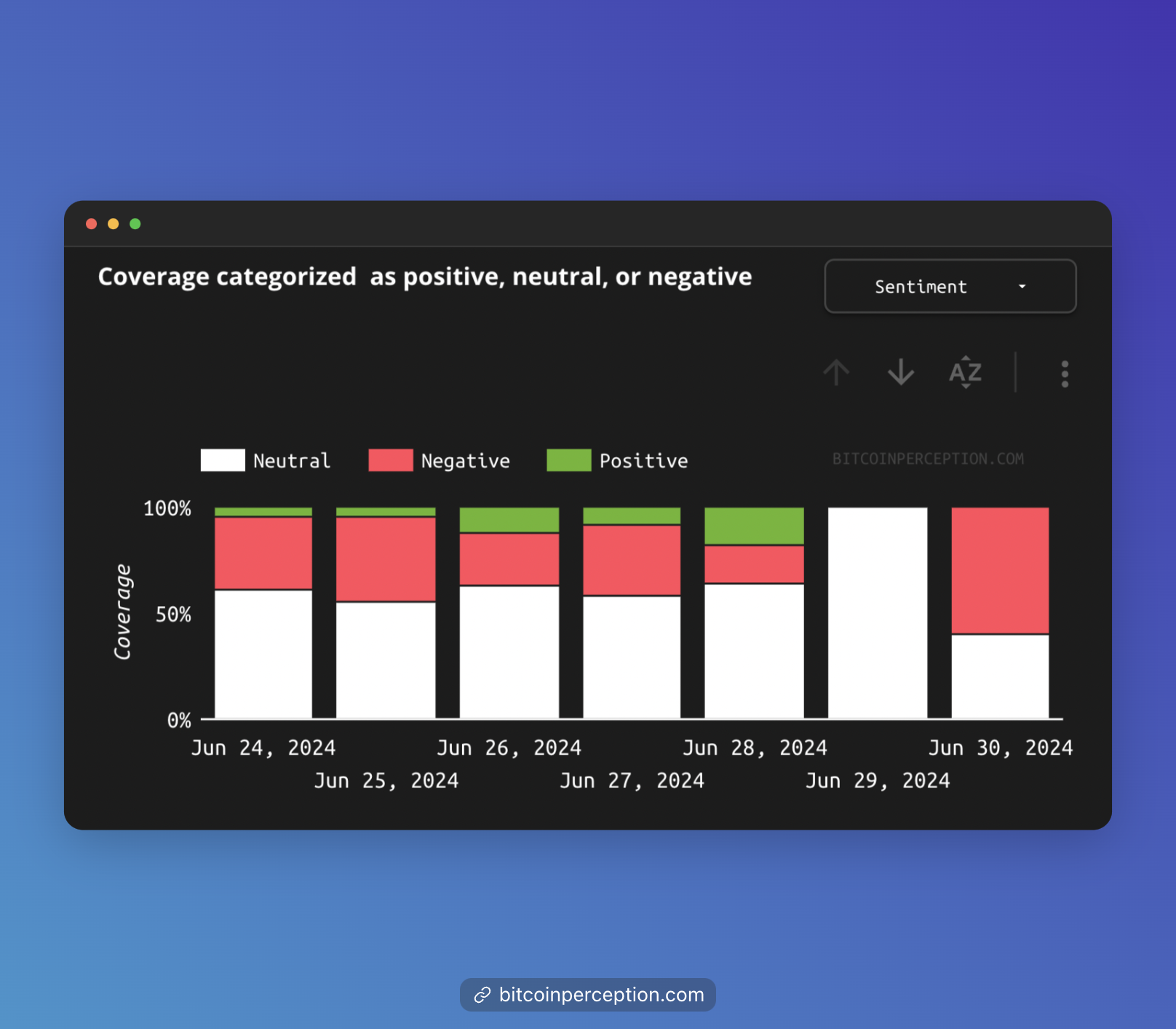

Recent developments surrounding the Mt. Gox payouts have significantly impacted Bitcoin's market dynamics. Overall, the coverage of the Mt. Gox payouts reflects mixed market sentiments, balancing concerns about short-term instability with optimism for long-term recovery.

Key Points:

- Nina Bambysheva from Forbes reported on the $9 billion payout by Mt. Gox, returning funds to customers after the 2014 exchange failure. While some fear market destabilization from this influx of Bitcoin and Bitcoin Cash, others see it as an isolated event with limited long-term effects.

- Clem Chambers from Forbes explored Bitcoin's prolonged sideways trading post-Mt. Gox news, with investors eagerly awaiting the next price movement.

- Adam Clark from Barron's also reported on Bitcoin's price recovery, noting the market's resilience following initial fears over the Mt. Gox refunds.

Political, Social, and Regulatory Developments

Bitcoin continues to influence and be influenced by political, social, and regulatory landscapes. Its role spans legislative actions, fundraising for controversial figures, groundbreaking congressional bills, and humanitarian applications.

- Susie Violet Ward from Forbes reported that Louisiana passed a landmark bill to protect Bitcoin rights and ban Central Bank Digital Currencies (CBDCs), making it the second state to enshrine Bitcoin rights into law.

- Roger Huang from Forbes highlighted Julian Assange's family raising funds with Bitcoin through a BTCPay instance, underscoring Bitcoin's utility in supporting controversial figures where traditional financial channels are restricted.

- Billy Bambrough from Forbes reported on a "groundbreaking" Bitcoin bill introduced to Congress by U.S. Representative Matt Gaetz, aiming to create a robust regulatory framework for Bitcoin.

- Frank Corva from Forbes covered how refugees in Uganda are turning to Bitcoin due to national ID restrictions that prevent them from opening bank accounts.

- Abubakar Nur Khalil from Forbes reported how Bitcoin awareness among the youth has also been burgeoning, as thousands took to the streets of Nairobi in a youth-led protest against a controversial finance bill passed by the Kenyan Parliament.