EOW closing BTC price: $60,966

Date range: July 8 - July 14, 2024

1. Regulatory and Government Actions

2. Company News and Earnings

3. Environmental and Security Concerns

Weekly Snapshot

Regulatory and Government Actions

The intersection of government decisions and the Bitcoin market has been a focal point, with regulatory actions and political addresses influencing the sector. Coverage has spanned from the U.S. to international developments, underscoring the global impact of regulatory and governmental decisions on the market, to how BTC rose as Trump shooting saw his campaign increasing its re-election odds.

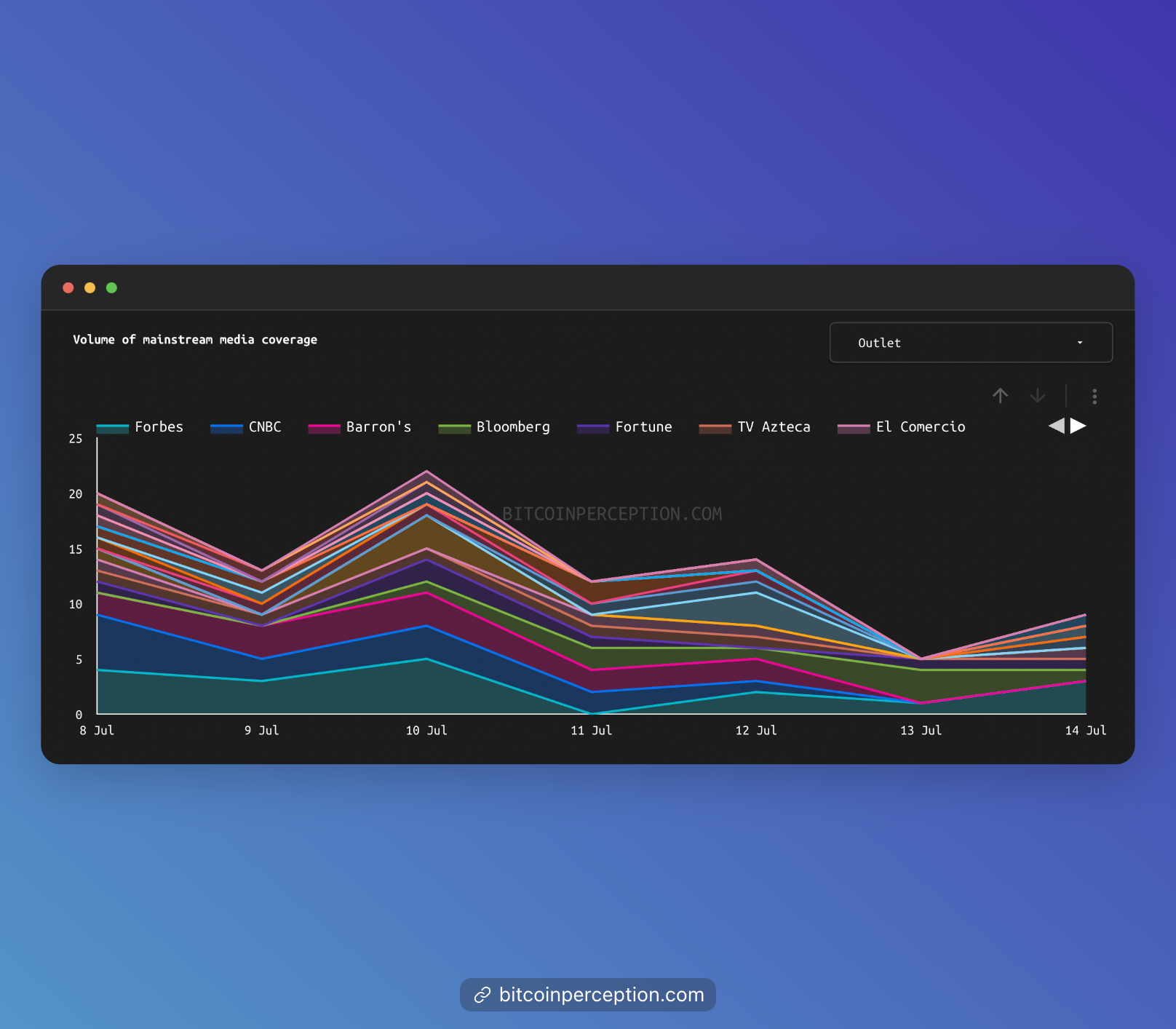

Fortune, Fox News, and Barron's had the most volume of coverage for this topic.

Key Points:

- Niamh Rowe from Fortune highlighted the negative market impact of the German government selling 0.25% of the world’s Bitcoin, leading to a 19% drop in Bitcoin's price. The sentiment was negative as the sale added to market jitters.

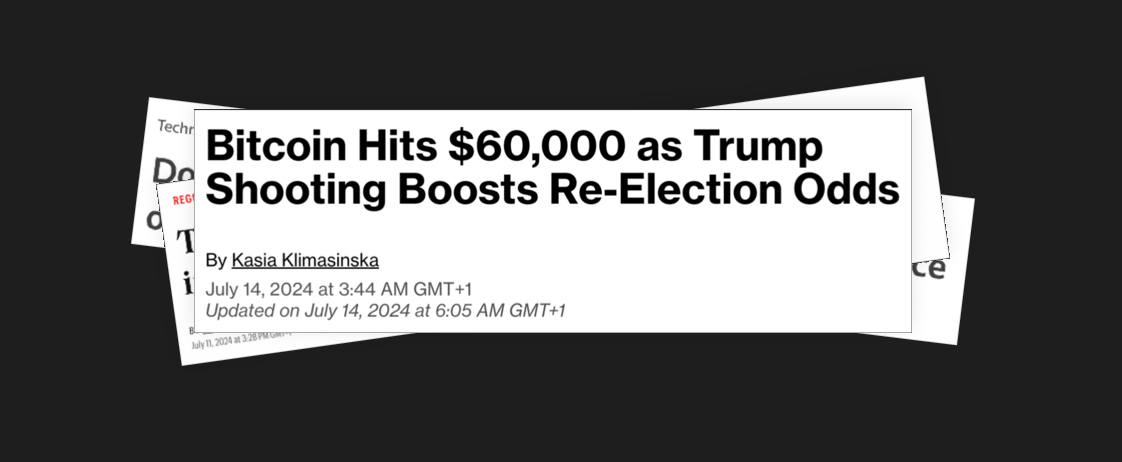

- Kasia Klimasinska from Bloomberg covered how Bitcoin rose above $60,000 after Donald Trump’s defiant response to an assassination attempt spurred speculation that his chances of winning the presidential election have climbed.

- Eleanor Terrett from Fox News reported on a meeting where industry leaders voiced their frustrations about regulatory crackdowns to a senior White House official, reflecting ongoing tensions between the industry and the administration.

- Eleanor Terrett from Fox News also covered the U.S. House vote expected to uphold President Biden's veto of an SEC-related resolution. The neutral sentiment piece highlighted the legislative process without indicating a direct market reaction.

- Kanishka Singh from Reuters announced Donald Trump's upcoming address at the Bitcoin 2024 conference, maintaining a neutral tone by focusing on the event's significance rather than potential market impacts.

- Niamh Rowe from Fortune also reported on Donald Trump’s upcoming appearance at Bitcoin Nashville

Company News and Earnings

Recent corporate activities involving companies heavily invested in Bitcoin, such as MicroStrategy and Bitfarms, have generated significant media coverage. This includes strategic decisions like stock splits and executive changes, reflecting the dynamic and responsive nature of these companies to the fluctuating market.

CNBC, Barron's, and Reuters had the most volume of coverage for this topic.

Key Points:

- Tanaya Macheel from CNBC reported on MicroStrategy's announcement of a 10-for-1 stock split, a strategic move by the largest corporate holder of Bitcoin. The sentiment was neutral, focusing on the mechanics and potential impacts of the stock split.

- Niket Nishant from Reuters covered Bitfarms appointing Ben Gagnon as its new CEO. The article emphasized his role in guiding the company through a strategic review and addressing a dispute with its major shareholder, Riot Platforms.

- Emily Dattilo from Barron's also reported on MicroStrategy's 10-for-1 stock split. The neutral tone mirrored other coverage, providing details on the decision and its timing relative to Bitcoin's market performance.

- Andrew Welsch from Barron's discussed the challenges faced by Vanguard's new CEO, presenting a comprehensive overview of the leadership transition. The sentiment was neutral, focusing on the broader implications for the company.

- Susie Violet Ward from Forbes highlighted significant developments in the Bitcoin mining industry, including Block and Core Scientific's agreement, Bitfarms' new CEO, and a study by Bitcoin Policy UK. This article had a positive sentiment, emphasizing progress and strategic moves within the industry.

Environmental and Security Concerns

The environmental impact and the rising security threats in the Bitcoin space have garnered substantial media attention. Reports highlight the significant increase in stolen bitcoin and concerns about the sustainability of mining.

Barron's, Fox News, and CNBC had the most volume of coverage for this topic.

Key Points:

- Robin Millard from AP (published in Barron's) reported on the UN's warning about the environmental damage caused by the digital economy, including the energy-intensive processes involved in mining. The sentiment was negative, focusing on the environmental risks and implications.

- Aislinn Murphy from Fox News highlighted a significant increase in cryptocurrency theft, noting that $1.38 billion was stolen in the first half of 2024, marking a 110% increase from the previous year. The sentiment was negative, emphasizing the security vulnerabilities in the crypto space.

- Sheila Chiang from CNBC also covered the rise in stolen cryptocurrency, reporting similar figures from TRM Labs. The sentiment was negative, reinforcing concerns about the increasing frequency and scale of hacking incidents.

- Benjamin Taubman from Bloomberg detailed the sharp decline in Iris Energy’s shares following questions raised by Culper Research about the company's AI aspirations. The sentiment was negative, highlighting doubts about the company's capability and market reaction.