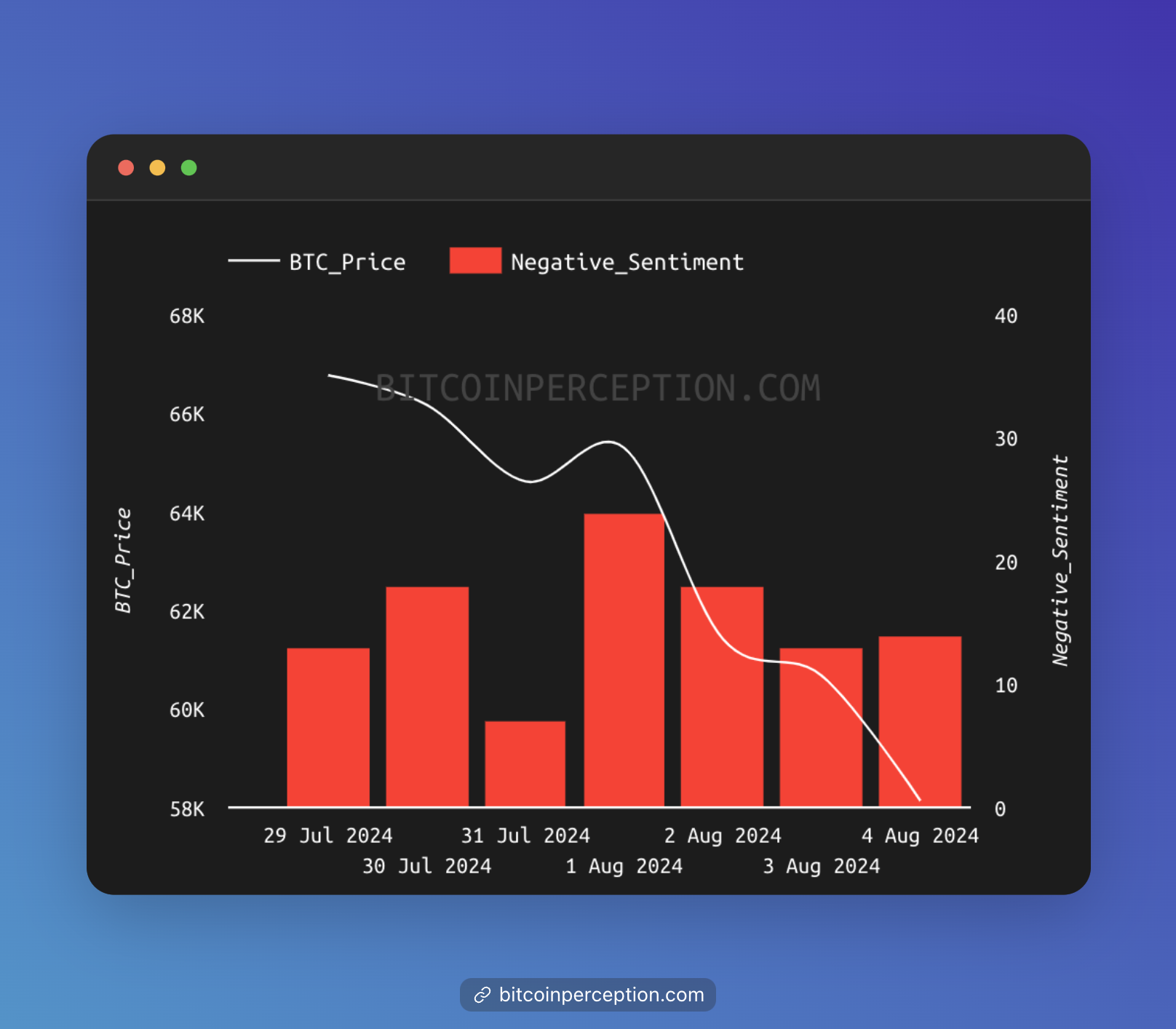

EOW closing BTC price: $58,138

Date range: July 29 - August 4, 2024

Weekly Snapshot 📸

This report sources information from mainstream media outlets, social media platforms like Twitter/X and Reddit, as well as specialized crypto news sources.

Hot Discussions 🔥

1. Legendary Bitaxe SOLO Bitcoin Miner Set-Up, Power Consumption

Discussions around the efficiency and effectiveness of the Bitaxe SOLO Bitcoin miner setup have gained traction. Users are sharing insights about power consumption, cost-effectiveness, and the return on investment for miners using this setup.

2. Bitcoin Price Fluctuation

A notable conversation emerged regarding Bitcoin touching $70,000 before retracting to $66,000. Users debated the market dynamics that led to this volatility, including market sentiment, macroeconomic indicators, and potential manipulation by larger traders.

Analysts shared divergent opinions on Bitcoin’s future price movement, with some predicting a drop below $60,000 while others anticipate a recovery towards $73,000 spurred by increased interest in mining hardware.

3. Trump’s Attempt to Connect with Bitcoiners

Trump’s campaign strategies, especially his outreach to Bitcoiners, were analyzed.

This included discussions on cultural discomfort within his campaign as he seeks to appeal to a demographic not traditionally aligned with his views.

4. Financial Literacy Issues

The ongoing discourse on personal finance management has highlighted that many individuals are still unfamiliar with managing their Bitcoin.

Educational initiatives are increasingly seen as essential in informing the public about effective investment strategies and the risks associated with digital currencies.

5. Political Grifting

Criticism arose regarding Trump’s embrace of Bitcoin, with people labeling it as opportunistic. Concerns were voiced about the implications of Bitcoin in politics.

6. Trump’s Bitcoin Sneakers

The release of Bitcoin-themed sneakers by Trump’s campaign has become a hot topic, with limited editions selling out quickly and being resold at inflated prices.

7. ETF Inflows

Bitcoin ETFs saw significant inflows, particularly BlackRock’s IBIT ETF, indicating growing institutional interest even while Ethereum struggles with outflows.

8. Government Bitcoin Reserve Bills

Senator Cynthia Lummis’s proposed bill to acquire a strategic reserve of Bitcoin has sparked debates about the implications of government involvement.

News 🗞️

1. Bitcoin Mining Difficulty

Discussions indicated that Bitcoin mining difficulty is expected to rise significantly, reflecting a healthy increase in the network’s hash rate.

2. U.S. National Debt and Bitcoin

Discussions about the potential for Bitcoin to address the U.S. national debt, which has reached $35 trillion, highlight the growing narrative of Bitcoin as a “hard money” alternative.

3. Market Liquidations

The market has faced significant liquidations as Bitcoin’s price fell below critical support levels, prompting concern among traders.

4. Legislative Moves

New bills aimed at establishing a Bitcoin reserve in the U.S. are being debated, showcasing the political dimension of Bitcoin in the upcoming elections.

Money Talk 💰

1. Economic Impacts

Bitcoin is seen as a potential hedge against the growing U.S. national debt and economic uncertainties, with discussions on its viability as an alternative financial solution.

2. Economic Indicators

With rising national debt and potential recession fears, Bitcoin’s role as an alternative investment is being re-evaluated.

Some analysts suggest that Bitcoin could serve as a hedge against inflation and economic instability, reinforcing its position as a “digital gold.”