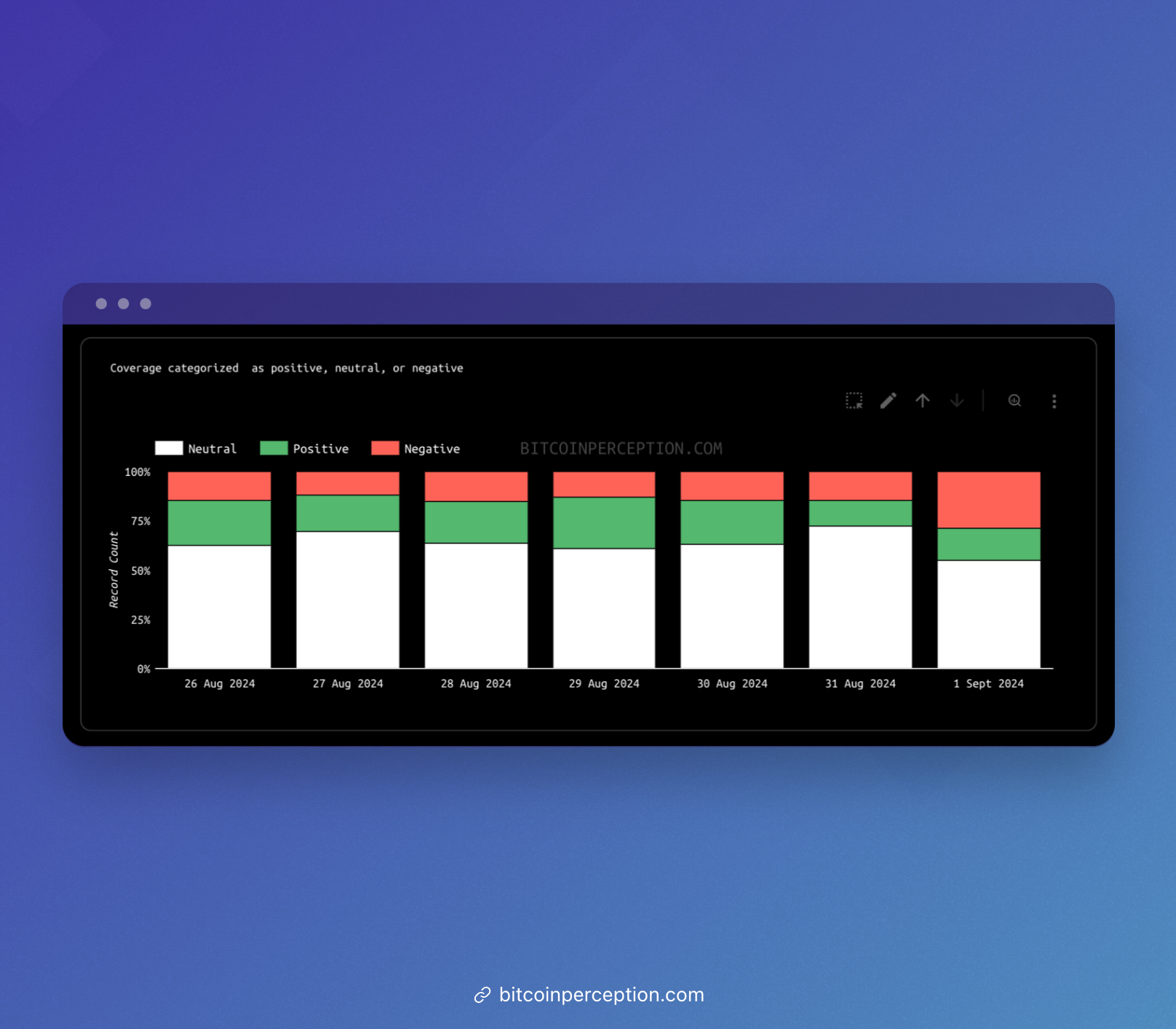

Date range: August 26 - September 1, 2024

Weekly Snapshot 📸

News 🗞️

NOSTR as a Telegram Substitute

Sentiment: Neutral

Mainstream media has yet to cover NOSTR extensively, while crypto media discussed its current capabilities, emphasizing its focus on note-sharing rather than direct messaging.

Social media platforms reflect a mix of curiosity and skepticism among users regarding NOSTR’s potential, with users sharing experiences and speculating on its future functionalities.

New Zealand’s Energy Policy Shift

Sentiment: Neutral

Insights: Mainstream media framed this as a pragmatic response to economic pressures, while crypto media interprets it as a commentary on the volatility of renewable energy.

Social media reactions vary, with some users criticizing the move as a failure of green policies, while others support the need for reliable energy sources, reflecting a complex debate on energy strategies.

Canada’s Tariffs on Chinese Imports

Sentiment: Neutral

Insights: Mainstream coverage emphasized the economic implications of these tariffs, while crypto media discusses potential impacts on related markets.

Social media, particularly X, showed a mix of support for protecting local jobs and criticism of escalating trade tensions.

Users highlighted concerns over increasing costs for consumers, indicating a nuanced public sentiment toward trade protectionism.

Mt. Gox Bankruptcy Settlements

Sentiment: Neutral

Insights: Mainstream media has largely overlooked this topic, while crypto outlets analyze the potential market effects of users cashing out.

On Reddit, users expressed relief and curiosity about the payouts, with some speculating on market impacts, illustrating a blend of personal finance and community sentiment in the crypto sphere.

Ideas 💡

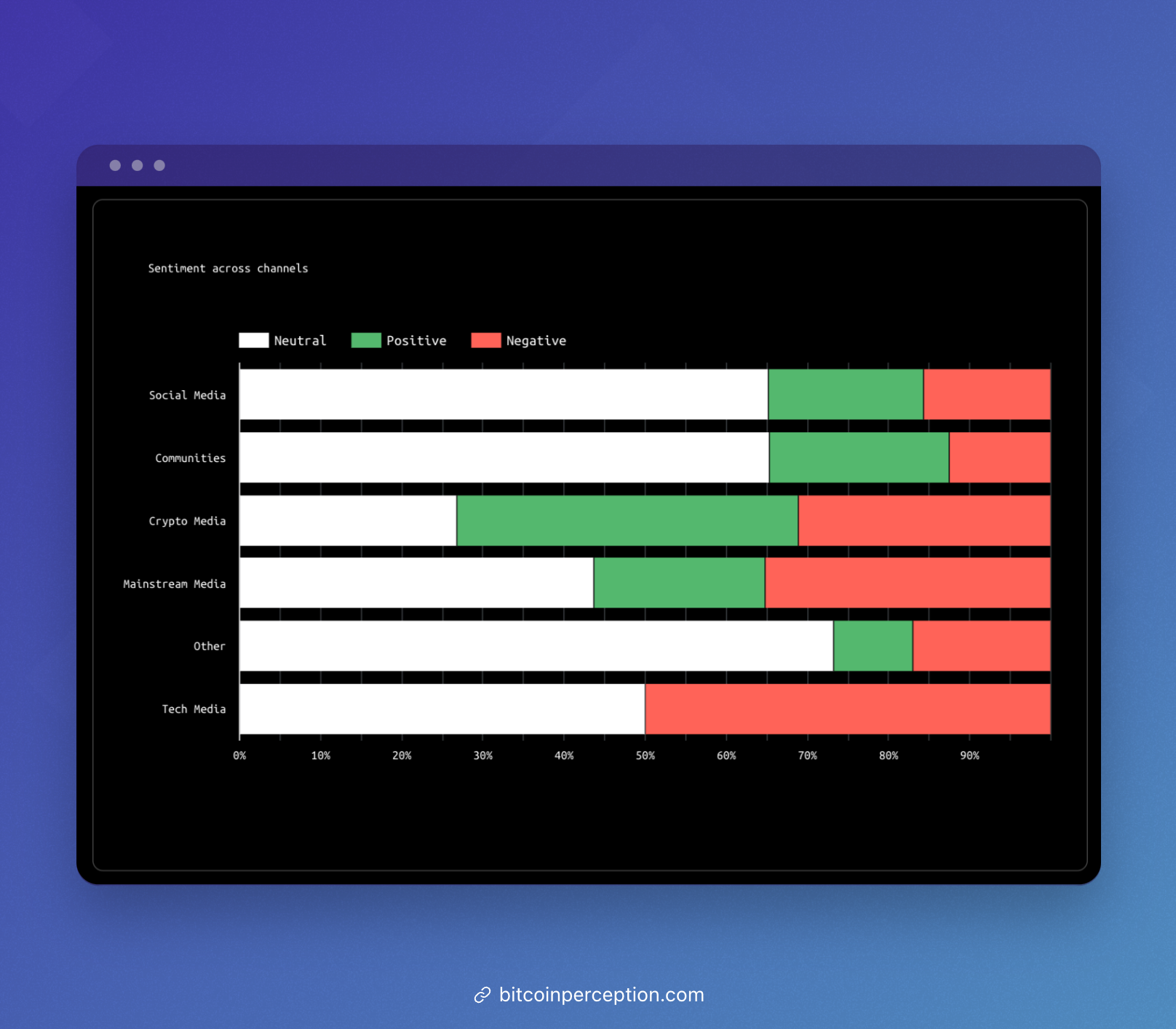

Mainstream Media

Mainstream outlets have not extensively covered niche topics this week, though discussions on the broader implications of Central Bank Digital Currencies (CBDCs) are emerging in financial publications.

Sentiment: Generally neutral, as these platforms often aim for balanced reporting.

Communities

Coverage: Platforms like Stacker News discuss the moral implications of CBDCs and propose Bitcoin as a countermeasure.

Sentiment: Positive towards Bitcoin as a solution to CBDCs.

Social Media

Sentiment: Neutral, reflecting community inquiries and shared experiences.

Summary: Users raises concerns about technical issues with Bitcoin nodes and philosophical discussions around Bitcoin, with strong community engagement but mixed sentiment towards the implications of CBDCs.

Solution Requests 🙏

- On X, users engaged in debates about Bitcoin’s usability and theoretical frameworks. Comments centered around user experience advancements and the need for practical solutions rather than ideological disputes.

- In the mainstream media, the focus on educational initiatives, such as improving reading comprehension about Bitcoin, reflects a growing interest in financial literacy.

- Coverage in the crypto media highlighted the need to demystify Bitcoin for older generations, emphasizing its technological potential over financial speculation.

- Reddit users were actively sharing personal experiences and advice, indicating a community-oriented approach to learning and investing. The recurring theme of prior losses in crypto gambling suggests a cautious yet hopeful sentiment toward informed investment strategies.

Opportunities 🤔

- A Reddit user seeks advice on creating a presentation linking Bitcoin and landscape architecture, emphasizing innovation and decentralization. Insights reflect a desire to educate a skeptical audience, aiming to present Bitcoin positively.

- On X, critiques of The Economist’s portrayal of Bitcoin mining’s electricity usage underscores the complex trade-offs and opportunities in the energy market related to mining.