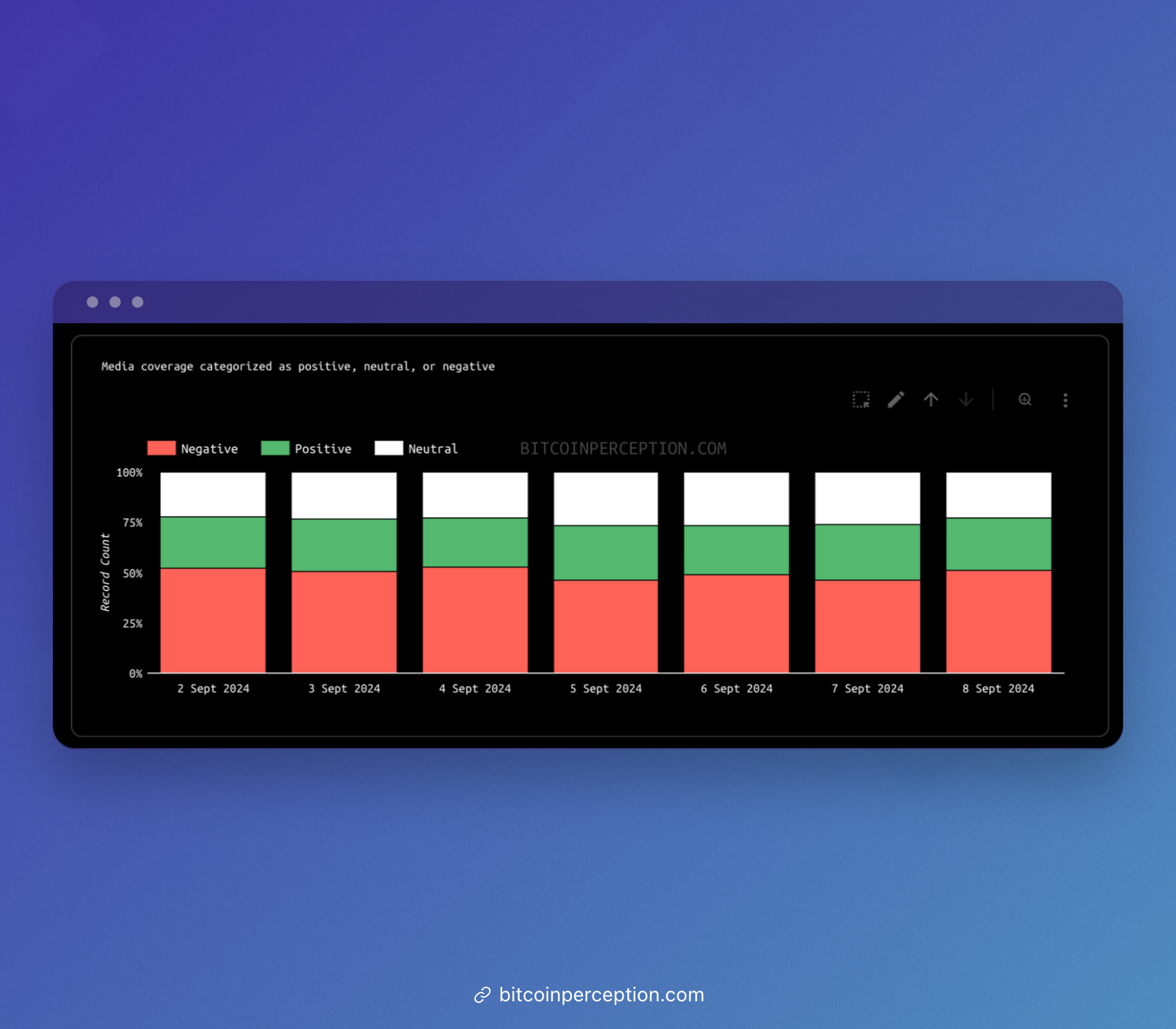

Date range: September 2 - September 8, 2024

Weekly Snapshot 📸

News 🗞️

1. Metaplanet's partnership with SBI Holdings' crypto division to enhance Bitcoin trading capabilities

- Mainstream media focused on Metaplanet’s aggressive Bitcoin accumulation strategy, comparing it to MicroStrategy’s model.

- Discussions on X reflected optimism about the potential to stabilize Bitcoin’s role in Metaplanet’s portfolio, with users expressing confidence in institutional growth.

Sentiment: Positive ✅

2. Trump’s NFTs: A Risky Investment

Trump’s NFTs face skepticism regarding their long-term value.

- Mainstream media emphasized expert critiques, labeling the cards as a bad bet.

- Crypto media reflected on the NFT market’s volatility and past performance trends.

- Social media saw mixed responses on platforms, with some fans supporting the venture while others express doubt.

Sentiment: Negative 😡

Money Talk 💰

1. U.S. Dollar Crisis and Bitcoin’s Potential Surge

Speculation around a looming U.S. dollar crisis is fueling expectations of a Bitcoin price surge, with analysts predicting a critical tipping point.

- Mainstream media highlighted a dovish Fed stance and its effects on Bitcoin, indicating a potential market rally.

- Crypto media discussed Bitcoin’s ETF popularity and implications for institutional investment.

- X users expressed optimism about Bitcoin’s resilience amidst macroeconomic fears.

Sentiment: Positive ✅

2. Bullish Outlook for Bitcoin Amid Fed Policy Changes

Analysts point to potential Fed rate cuts and macroeconomic factors as positive signals for Bitcoin’s future performance.

- Mainstream media focused on the potential for Bitcoin’s resurgence linked to monetary easing.

- Crypto media discussed how recent economic conditions may have created a tactical bottom for Bitcoin.

- Analysts on X anticipated a renewed bull run, citing historical data.

Sentiment: Positive ✅

3. ETFs Surge in Popularity

The rise of ETFs, particularly Bitcoin-focused funds, signals growing institutional confidence and investment.

- Mainstream Media: Reports on the substantial inflow of assets into Bitcoin ETFs, reflecting increasing acceptance.

- Crypto Media: Discusses implications for market dynamics and investor behavior.

- Social Media: Enthusiastic community responses highlight optimism around Bitcoin’s future as ETF popularity rises.

Sentiment: Positive ✅

Ideas 💡

1. Bitcoin Price Set for Late September Breakout

Analysts suggest a potential Bitcoin breakout in late September 2024, referencing historical trends post-halving.

- Mainstream media highlights historical performance and consolidation risks for September. Crypto analysts emphasize the Puell Multiple nearing favorable buying levels.

- Social media debates potential impacts of upcoming legal rulings, with mixed sentiments on immediate price effects.

Sentiment: Negative 😡

2. Bitcoin-Powered Pools and Bathhouses

Bathhouses in NYC leverage Bitcoin mining heat to maintain pool temperatures, merging wellness with cryptocurrency.

- Mainstream media showcases innovative energy solutions through Bitcoin mining.

- The forum community views this as a practical use case, while environmentalists raise concerns about broader sustainability issues, reflecting a nuanced discussion on energy consumption.

Sentiment: Positive ✅

3. U.S. Fed Rate Cut Could Push Bitcoin Down 20%

Analysts anticipate a potential decline in Bitcoin’s price following a Federal Reserve rate cut, contrary to typical market assumptions.

- Mainstream media analysis underscores historical volatility correlating with rate cuts.

- Crypto media expresses skepticism about market reactions

- Social media reflects divided opinions on investment strategies amidst macroeconomic shifts.

Sentiment: Positive ✅

Opportunities 🤔

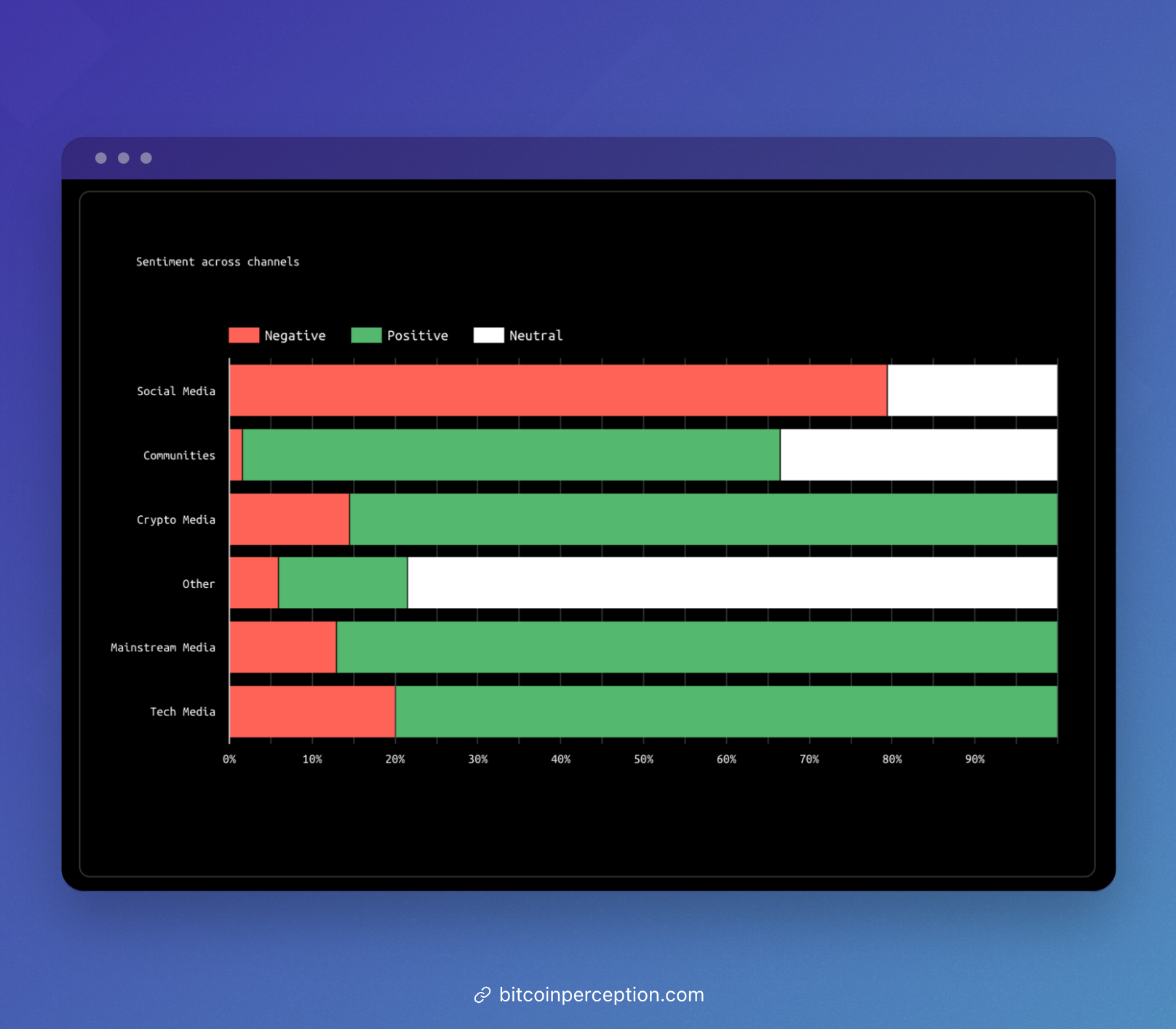

- Mainstream Media Insights: Analysts emphasize Bitcoin’s historical breakout patterns and the legal legitimacy of cryptocurrencies as a growing trend.

The Canadian court ruling on Bitcoin loans signals increased acceptance in financial systems, potentially boosting investor confidence. - Crypto Media Insights: The Puell Multiple indicates favorable buying conditions for Bitcoin, while ETF investments exceeding $60 billion reflect institutional interest and market confidence.

The recent partnerships in sports marketing highlight a resurgence in crypto sponsorships. OKX has upgraded its Smart Arbitrage bot to facilitate Bitcoin arbitrage, where outlets like CoinDesk reported positively on OKX’s enhancements to trading technology, emphasizing accessibility for traders.

- Social Media Insights: Discussions on platforms like Twitter and Reddit focus on the implications of Bitcoin’s technical indicators and legal rulings, with users expressing excitement about upcoming opportunities in the market.

The sentiment leans toward optimism as community engagement increases around new projects and legal advancements.