This data-driven platform is designed to empower professionals like you—whether you’re a research analyst, journalist, content creator, or investor—by delivering key sentiment analysis and trend discovery on Bitcoin in real time.

If you’d like to access this valuable data on-demand, we invite you to fill out a short 9-question survey based on your professional group:

→ research analysts

→ journalists and content creators

→ investors/VCs

Your feedback will help us refine the platform to meet your needs and provide the most relevant, timely information.

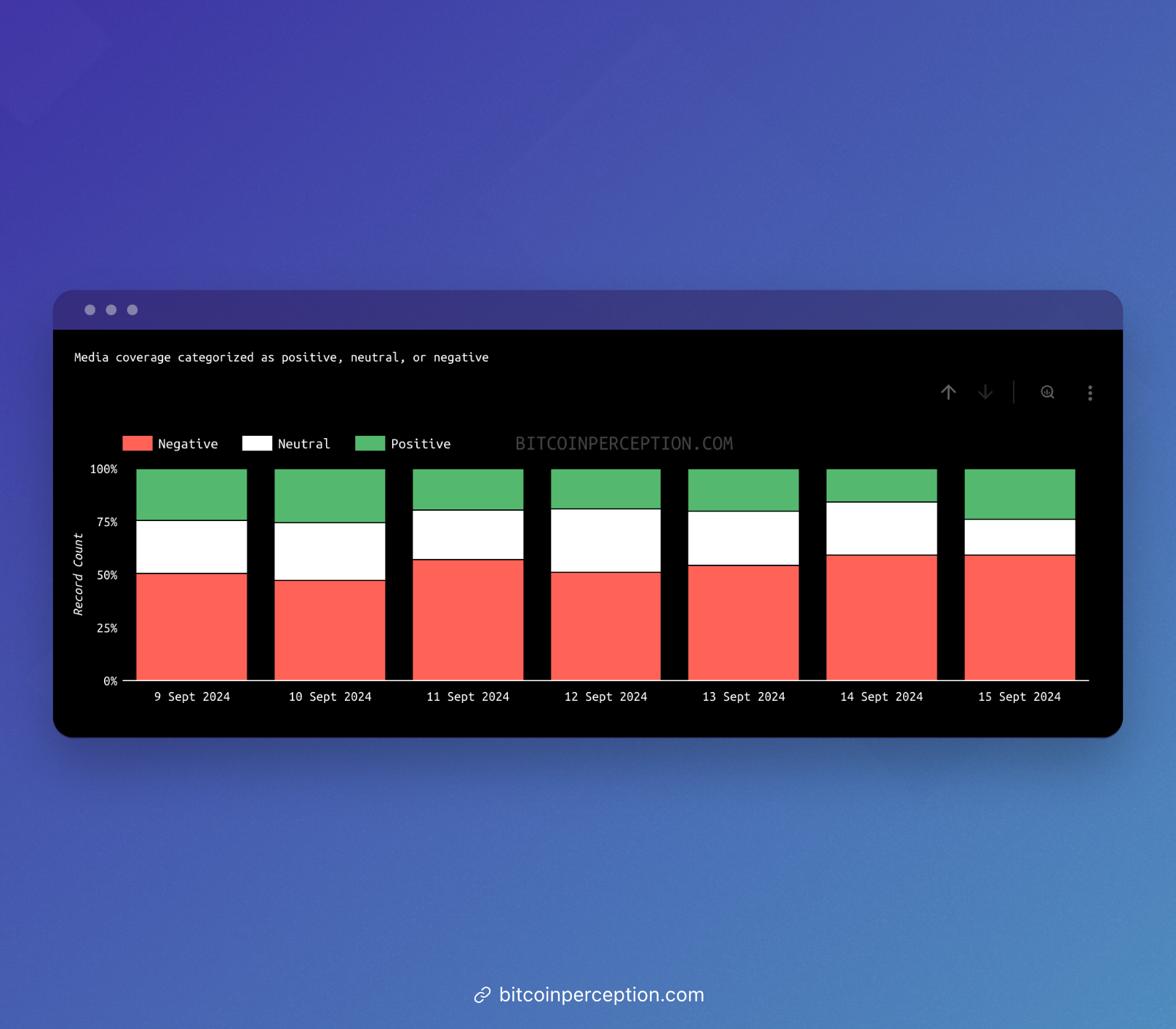

Date range: September 9 - September 15, 2024

Weekly Snapshot 📸

News 🗞️

1. Bitcoin Order Book Liquidity and Market Bottoms

Analysts are buzzing about Bitcoin’s low liquidity in the order books, which some believe signals a market bottom and sets the stage for a potential bullish trend.

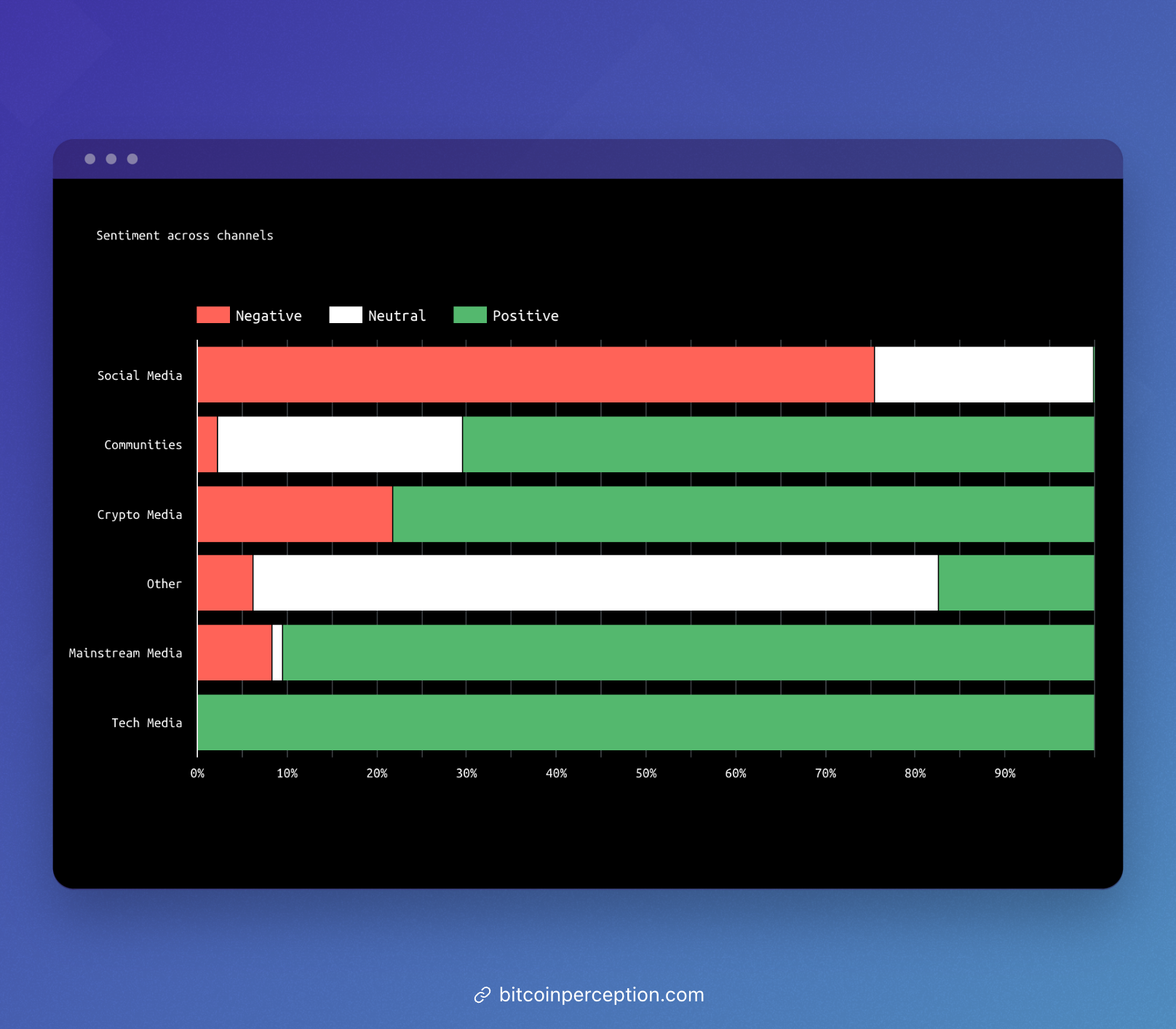

• Mainstream Media: CoinDesk highlighted insights from Shubh Verma, focusing on how order book patterns often correlate with price reversals.

• Social Media: Discussions on X reflected optimism, with traders interpreting the liquidity dip as a buy signal.

Sentiment: Positive ✅

2. Bitcoin Mining’s Role in Energy Stabilization

Bitcoin mining continues to grab headlines for its potential to stabilize energy grids, particularly in Texas, where miners are tapping into excess renewable energy, with similar initiatives emerging in Japan.

• Crypto Media: CryptoSlate and Bitcoin Magazine emphasized how Bitcoin miners are utilizing wasted energy to stabilize power grids, promoting sustainability.

• Social Media: X users praised the eco-friendly approach, with many expressing confidence in mining’s potential to drive renewable energy adoption.

Sentiment: Positive ✅

3. Political Factors Influencing Bitcoin’s Future

A new Bernstein report suggests that Bitcoin’s price could skyrocket to $90K if Trump is re-elected, while political uncertainty could dampen the market.

• Mainstream Media: CoinDesk covered the speculative analysis, highlighting how political volatility could impact Bitcoin’s future.

• Social Media: X users debated the likelihood of Trump’s win and its potential effect on Bitcoin’s value, leading to mixed, yet hopeful, sentiments.

Sentiment: Positive ✅

4. TEPCO’s Renewable Energy Bitcoin Mining Initiative

Japan’s largest electric utility, TEPCO, is leveraging surplus renewable energy for Bitcoin mining, marking a win for both green energy producers and Bitcoin advocates.

• Crypto Media: Bitcoin Magazine lauded TEPCO’s initiative, with many seeing this as a model for future clean energy integration with Bitcoin mining.

• Social Media: Users on Reddit expressed optimism, viewing this as a key step in combining sustainable practices with Bitcoin mining.

Sentiment: Positive ✅

5. Analysts’ Cautious Optimism Amidst Inflation Concerns

Despite a recent uptick in Bitcoin’s price, analysts are urging caution, citing inflationary pressures and historical patterns.

• Mainstream Media pointed out that Bitcoin’s current price structure mirrors 2019, leaving room for both bullish and bearish outcomes.

• Social Media: Analysts on X shared mixed takes, with some seeing the price increase as a positive sign, while others warned of macroeconomic risks.

Sentiment: Positive ✅

Money Talk 💰

1. Bitcoin Mining’s Positive Impact on Energy Grids

Bitcoin mining is once again in the spotlight for its role in absorbing excess energy and stabilizing power grids, especially in Texas and Japan.

• Mainstream Media: Forbes reported on Bitcoin mining’s potential to cut carbon emissions and assist in grid stabilization, sparking new discussions on the industry’s environmental impact.

• Crypto Media: Bitcoin Magazine featured TEPCO’s renewable energy project as a game-changer for sustainable Bitcoin mining.

• Social Media: X and Reddit users praised the initiative, seeing it as a win for both Bitcoin and the environment.

Sentiment: Positive ✅

Ideas 💡

1. Bitcoin Price Set for Late September Breakout

Analysts predict a potential breakout for Bitcoin in late September, citing historical post-halving trends.

• Mainstream Media: Outlets discussed how Bitcoin’s price could consolidate before a major breakout.

• Crypto Media: Analysts pointed to the Puell Multiple, signaling favorable buying conditions.

• Social Media: Discussions were mixed, with some users optimistic about a price rally and others concerned about upcoming legal rulings impacting the market.

Sentiment: Mixed ⚖️

2. Trump’s Crypto Agenda

Trump’s potential re-election could see a significant shift in the crypto landscape, with analysts predicting a $90K Bitcoin price if he wins.

• Mainstream Media: Forbes highlighted Trump’s agenda as favorable for crypto, but warned of potential regulatory challenges.

• Crypto Media: Analysts are optimistic about how Trump’s stance could influence Bitcoin’s market.

• Social Media: X and Reddit users debated the political influence on Bitcoin, leading to mixed sentiments about the future.

Sentiment: Mixed ⚖️

Opportunities 🤔

1. MicroStrategy’s Bitcoin Accumulation Strategy

Analysts are pointing to MicroStrategy as a top choice for investors seeking Bitcoin exposure without directly buying ETFs.

• Mainstream Media: Reports focused on MicroStrategy’s continued accumulation of Bitcoin and the strategic benefits of holding the asset long-term.

• Crypto Media: Outlets praised MicroStrategy’s leadership in leveraging Bitcoin as a core asset.

• Social Media: Users expressed confidence in MicroStrategy’s long-term strategy, citing its aggressive acquisition of Bitcoin as a bullish signal.

Sentiment: Positive ✅

2. Bitcoin ETF Growth

Bitcoin-focused ETFs are gaining momentum, signaling growing institutional confidence.

• Mainstream Media: Reports covered the surge in ETF investments, reflecting Bitcoin’s rising acceptance.

• Crypto Media: Discussions focused on the implications of institutional adoption through ETFs.

• Social Media: The Bitcoin community is optimistic, seeing ETF growth as a positive indicator for future price action.

Sentiment: Positive ✅