This data-driven platform is designed to empower professionals like you—whether you’re a research analyst, journalist, content creator, or investor—by delivering key sentiment analysis and trend discovery on Bitcoin in real time.

If you’d like to access this valuable data on-demand, we invite you to fill out a short 9-question survey based on your professional group:

→ research analysts

→ journalists and content creators

→ investors/VCs

Your feedback will help us refine the platform to meet your needs and provide the most relevant, timely information.

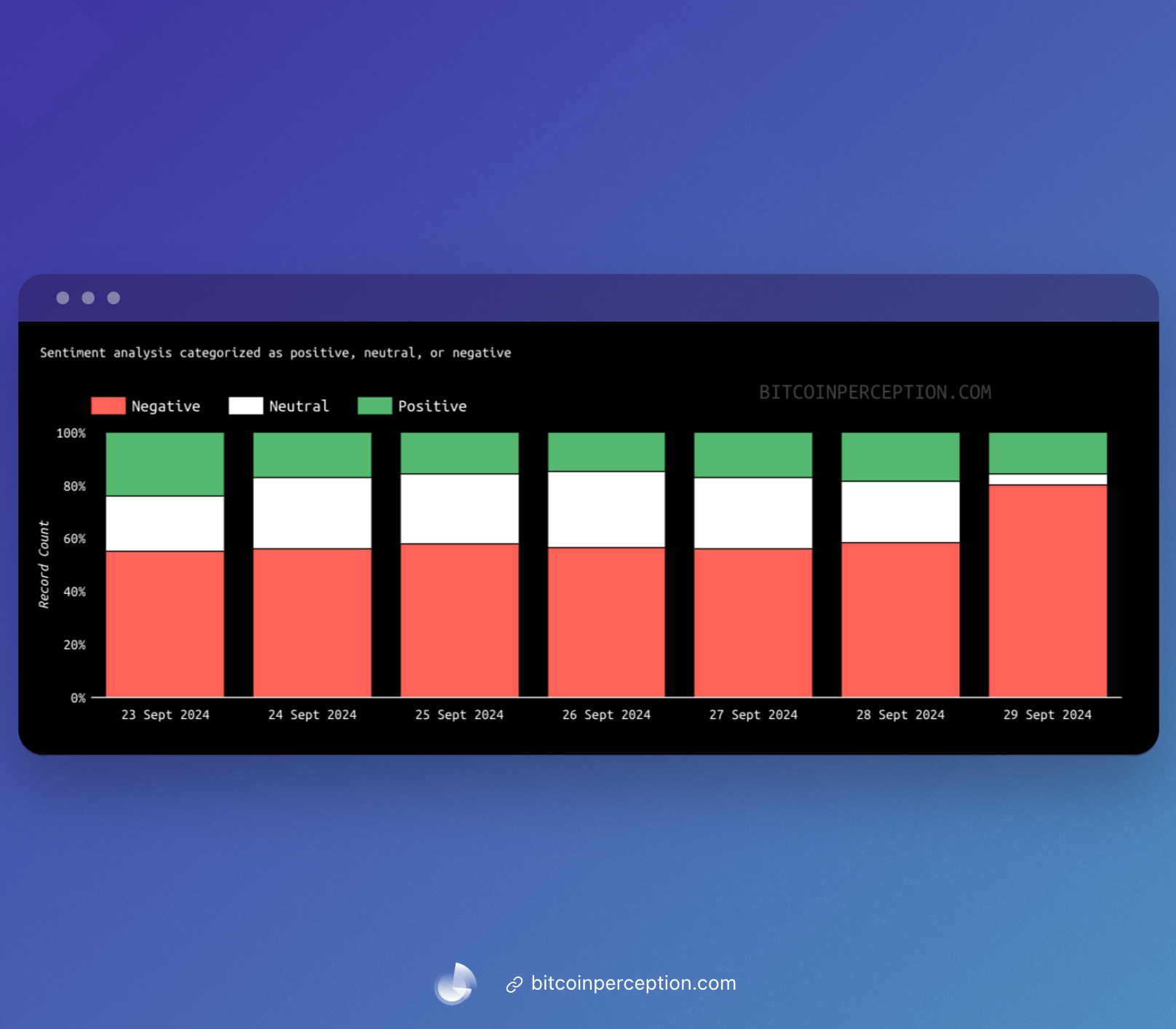

Date range: September 23 - September 29, 2024

Weekly Snapshot 📸

Hot Discussions 🔥

Recent discussions had centered around gold hitting a record high amid a supportive U.S. Federal Reserve interest rate cut, while Bitcoin also showed significant upward movement.

The interplay between traditional commodities and cryptocurrencies was a focal point for analysts and investors.

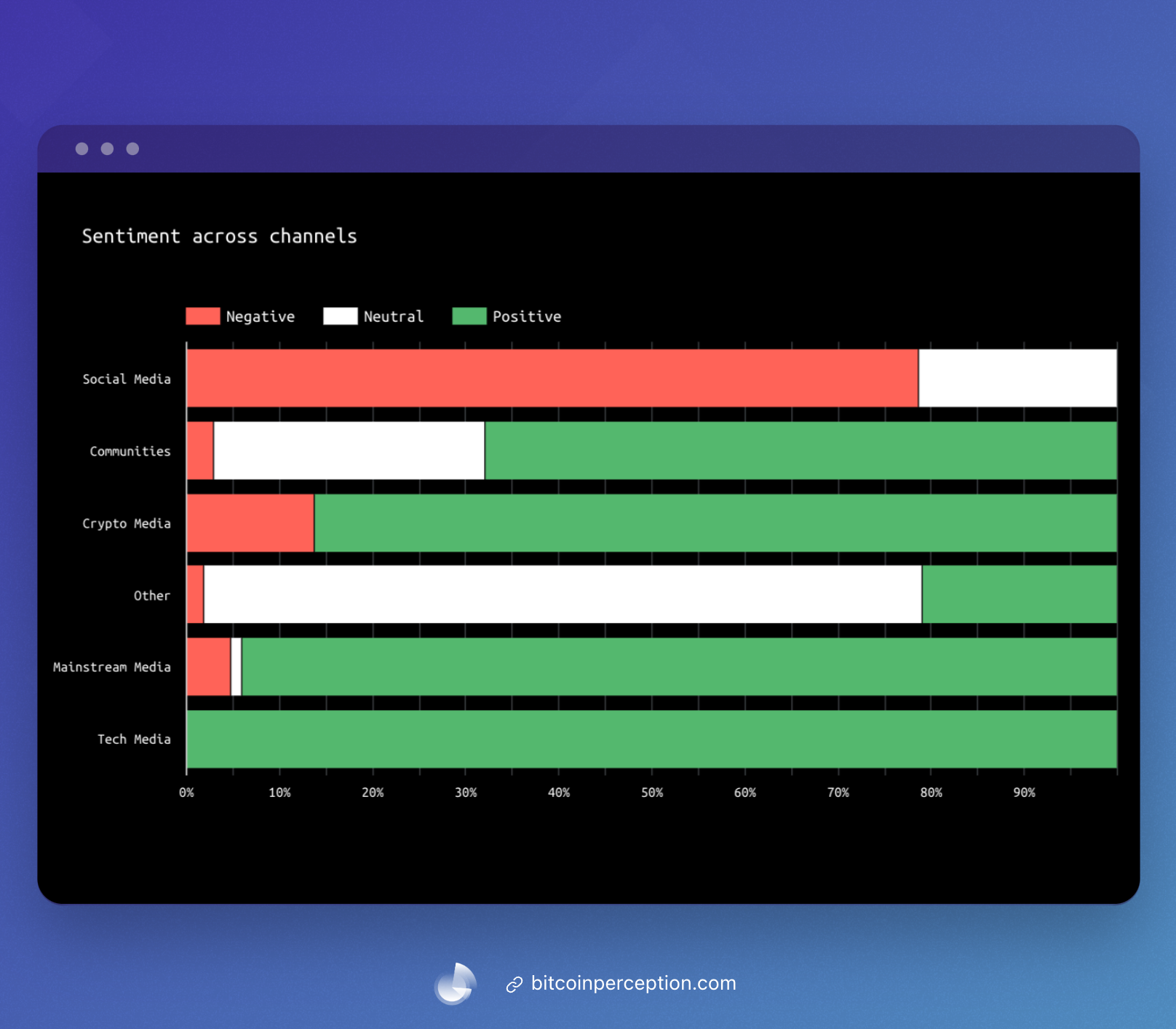

- Mainstream Media highlighted gold’s surge to $2,629 per ounce driven by geopolitical tensions and central bank purchases. Insights from Goldman Sachs suggested ongoing interest in gold, predicting a rise to $2,700.

- Crypto Media emphasized Bitcoin’s rise to $64K and analysts predicted a breakout during the upcoming October-to-March window. The approval of BlackRock’s Bitcoin ETF options on Nasdaq further fueled optimism about Bitcoin’s future.

- Social Media discussions featured contrasting views, with gold advocates criticizing the crypto focus while others celebrated Bitcoin’s resilience and potential. The sentiment was largely positive across platforms, reflecting growing interest in both assets as inflation hedges.

Sentiment: Positive ✅

BlackRock’s Bitcoin ETF Options

• Mainstream Media centered on the SEC approving the Nasdaq listing for options on BlackRock’s Bitcoin ETF, signaling regulatory progress.

• Crypto Media analysis highlighted this as a pivotal moment for institutional adoption in crypto markets.

• Social Media reactions on Twitter and Reddit were enthusiastic about the implications for future ETF approvals.

Sentiment: Positive ✅

Asian Market Movements

- Mainstream Media reports emphasized Asian markets rising on stimulus expectations from China, linking back to global economic conditions.

- Crypto Media did not directly cover but implied effects on crypto investments due to market optimism.

- Social Media saw positive sentiment as users anticipated spillover effects into cryptocurrencies.

Sentiment: Positive ✅

Argentina’s Crackdown on Crypto Smuggling

Argentina’s tax authority conducted raids on a Bitcoin mining hardware smuggling ring, highlighting regulatory efforts in the cryptocurrency sector.

- Mainstream Media: The Financial Times reported on the implications of these raids for crypto regulations and ongoing enforcement efforts.

- Crypto Media: Crypto News discussed the impact on the mining industry and potential regulatory challenges.

- Social Media: Mixed reactions on Twitter and Reddit, with some supporting regulatory efforts and others concerned about operational costs and innovation stifling.

Sentiment: Mixed ⚖️

Ideas 💡

Bitcoin Rally Potential

Analysts suggested Bitcoin might see a rally by late 2024 due to upcoming FTX payouts and potential Federal Reserve rate cuts. Historical seasonal patterns also supported bullish sentiment.

- Mainstream Media focused on macroeconomic conditions and seasonal trends.

- Crypto Media: Highlighted the impact of liquidity and external catalysts.

- Social Media: Optimism about Bitcoin’s potential, with users sharing personal investment strategies.

Sentiment: Positive ✅

Bukele’s Governance in El Salvador

While El Salvador experienced reduced crime under President Bukele, concerns about authoritarianism and human rights violations rose.

- Mainstream Media praised crime reduction but questioned the means.

- Crypto Media warned of potential pitfalls in Bukele’s Bitcoin strategy.

- Social Media had polarized opinions, with some supporting stability and others condemning authoritarian approaches.

Sentiment: Negative ❌

MicroStrategy’s Bitcoin Lending

Analysts suggested MicroStrategy could enhance its yield by lending part of its Bitcoin holdings amidst a favorable market environment.

- Mainstream Media emphasized MicroStrategy’s strategic moves to leverage Bitcoin.

- Crypto Media highlighted institutional interest in crypto lending.

- Social Media: Excitement about passive income through Bitcoin lending, with discussions on lending platforms.

Sentiment: Positive ✅

Solution Requests 🛠️

Bitcoin DeFi Innovations

Recent innovations aimed to enhance interoperability within Bitcoin, with initiatives like the Hemi Network’s tunneling protocol and advancements in Bitcoin DeFi by projects like Babylon and Fractal, which aimed to introduce staking and improve scalability without compromising security.

- Crypto Media focused on how Babylon’s staking leveraged recent technological upgrades to enhance Bitcoin’s programmability, but other sources critiqued the practicality of Babylon and Asphere’s collaboration on Bitcoin L2 infrastructure, questioning its feasibility.

- Twitter and Reddit discussions reflected a mix of excitement about the potential of Bitcoin DeFi innovations like Babylon and skepticism regarding their implementation and security. Users expressed interest in scalability improvements while raising concerns about the viability of staking on Bitcoin, highlighting the need for robust security measures.

Sentiment: Mixed ⚖️