Bitcoin Perception will soon offer real-time data on hot discussions, trends, and sentiment within the Bitcoin ecosystem, complete with charts that show correlations between market sentiment and price movements.

The product will also feature trend discovery tools and an API, set to launch soon, bringing comprehensive and actionable insights to market analysts, journalists, and investors alike.

Stay tuned for the launch!

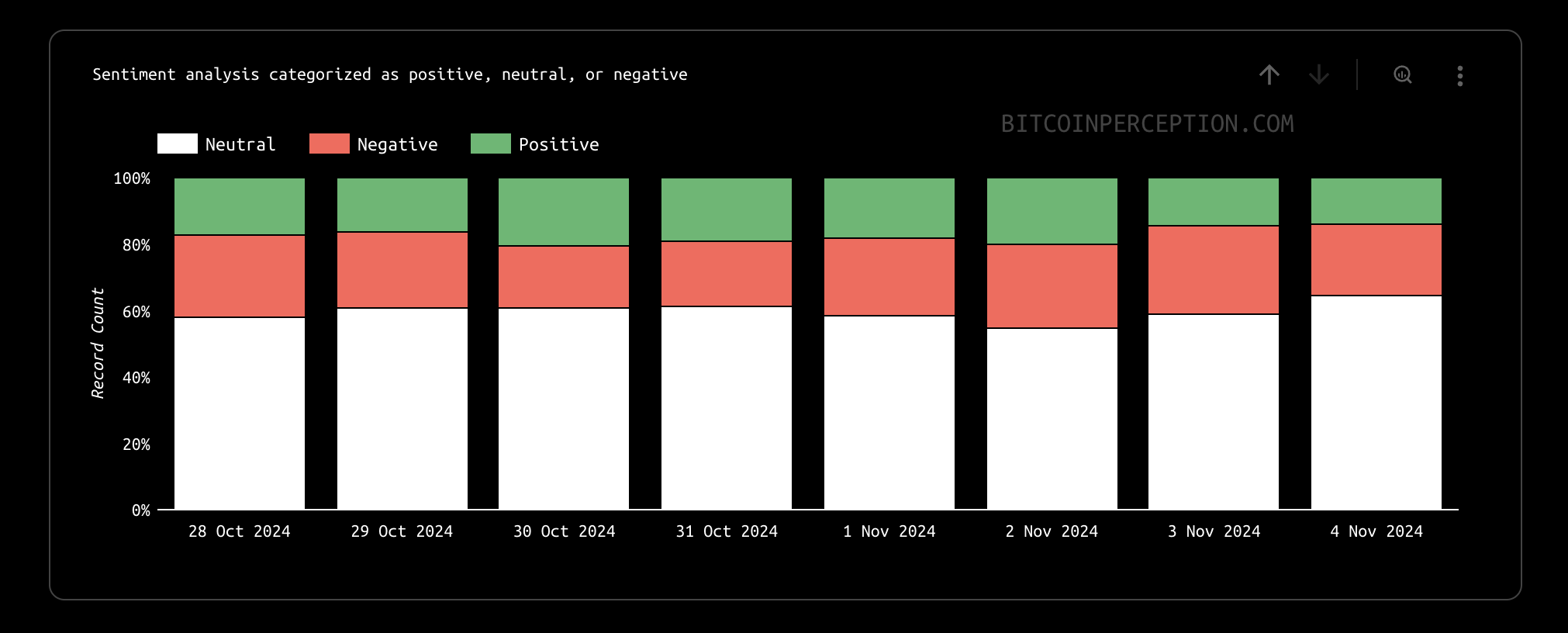

Sentiment Overview

Positive ✅: Metaplanet’s Bitcoin accumulation, institutional adoption trends, political engagement in Bitcoin, market shifts.

Neutral ⚖️: Bitcoin’s correlation to macroeconomic factors, Bitcoin adoption among younger demographics.

Negative ❌: Investor concerns about ETF impacts on Bitcoin’s value, political divides on Bitcoin’s role in governance.

Weekly Snapshot 📸

Hot Discussions 🔥

Metaplanet’s Bitcoin Accumulation

Japan’s Metaplanet has become Asia’s largest Bitcoin holder by acquiring over 1,000 BTC, signaling a strategic shift toward cryptocurrency as a reserve asset.

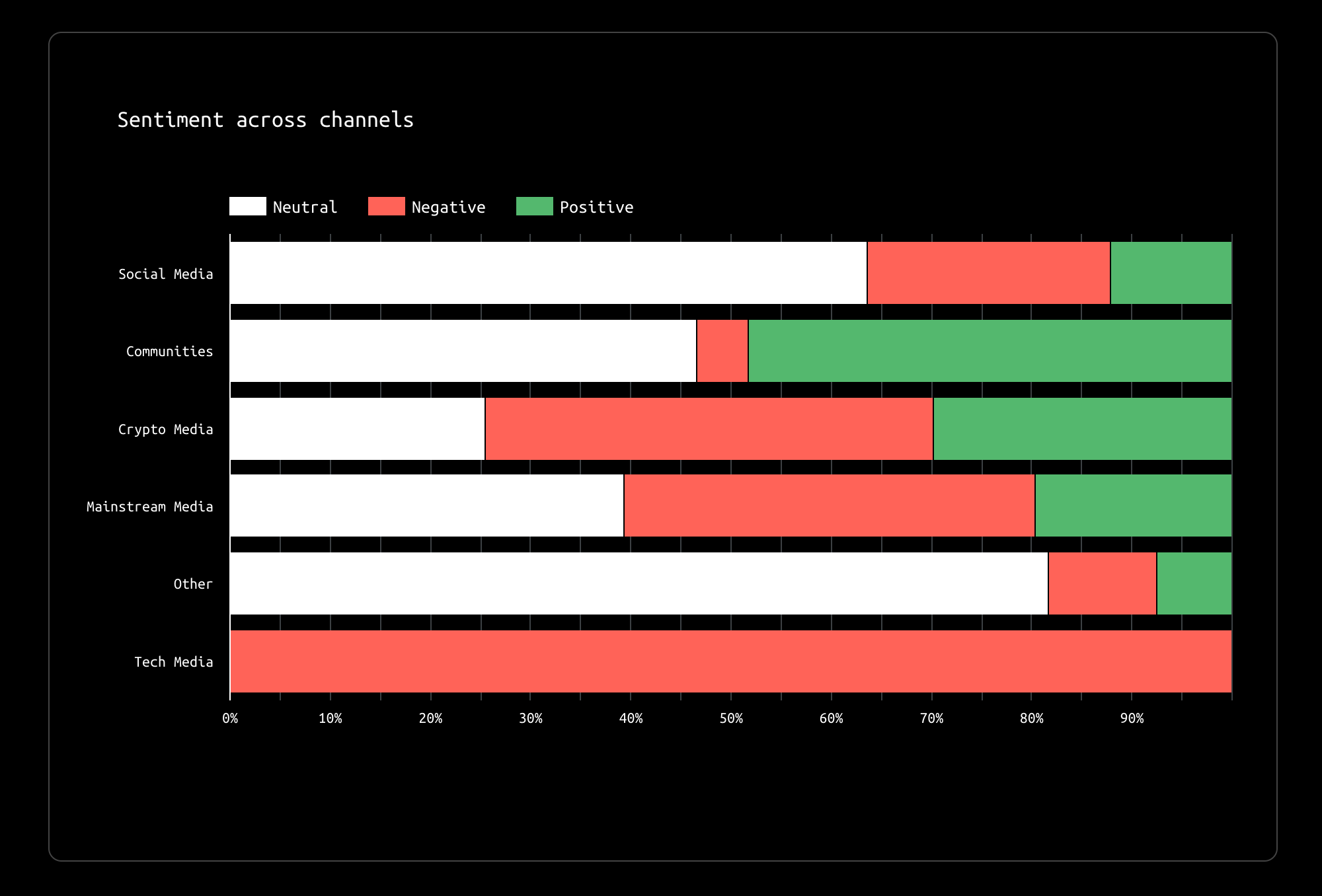

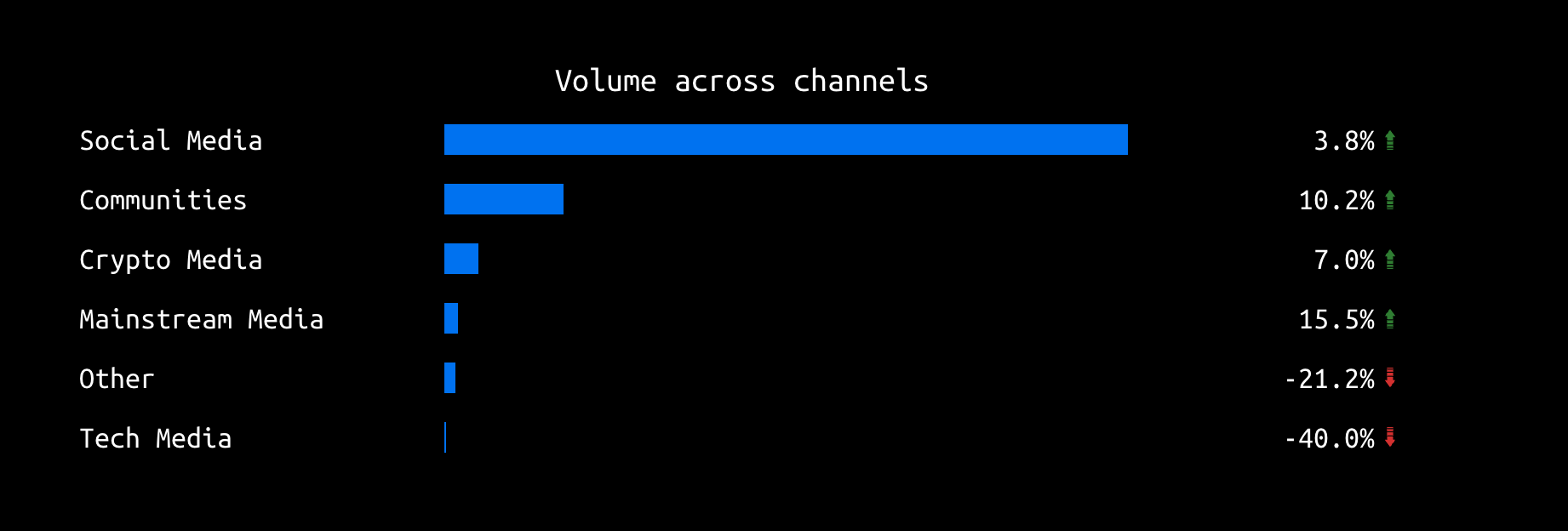

- Mainstream Media: Reports praise Metaplanet’s strategic move, positioning it as a pioneering player in Asia’s Bitcoin market.

- Crypto Media: Focuses on Metaplanet’s institutional adoption of Bitcoin and its potential influence on Asian market dynamics.

- Social Media: Positive discussions celebrate the milestone, with conversations about Bitcoin’s role as a treasury asset.

Sentiment: Positive ✅

Bitcoin Market Dynamics

Bitcoin’s bullish momentum faces challenges from a declining copper-gold ratio, raising concerns about risk assets’ performance.

- Mainstream Media: Links Bitcoin’s potential to larger economic indicators, suggesting Bitcoin’s value is impacted by global macroeconomics.

- Crypto Media: Highlights the importance of monitoring market indicators like the copper-gold ratio for potential impacts on Bitcoin.

- Social Media: Cautious optimism as users debate external economic signals affecting Bitcoin’s trajectory.

Sentiment: Neutral ⚖️

MicroStrategy’s Market Position

Analysts warn that MicroStrategy’s premium over its Bitcoin holdings may diminish, especially with the growth of Bitcoin ETFs.

- Mainstream Media: Analyzes potential stock valuation risks if Bitcoin ETFs become widely adopted.

- Crypto Media: Discusses possible impacts of ETFs on Bitcoin investment strategies and on MicroStrategy’s market position.

- Social Media: Investor concerns surface regarding long-term stability and holding strategies amid ETF developments.

Sentiment: Negative ❌

Ideas 💡

Bitcoin Super Cycle

Bitcoin may be entering a “super cycle,” breaking traditional market patterns due to increased institutional interest and Bitcoin ETFs.

- Mainstream Media: Forbes explored the potential “super cycle” narrative driven by institutional investment and regulatory developments.

- Crypto Media: Analysts view Bitcoin’s trajectory as a parallel to tech stocks’ early growth phases, suggesting a market evolution.

- Social Media: Optimistic outlooks highlight Bitcoin’s growth potential and regulatory support, particularly ahead of the U.S. elections.

Sentiment: Positive ✅

Opportunities 🚀

Bitcoin Adoption and Gaming Parallel

Bitcoin adoption patterns resemble the gaming industry’s growth, with younger demographics driving increased demand.

- Mainstream Media: Highlights trends in Bitcoin adoption among younger investors.

- Crypto Media: Explores future Bitcoin market growth, especially with political support.

- Social Media: Social conversations draw parallels between Bitcoin and gaming culture, fostering a community of new investors.

Sentiment: Neutral ⚖️

Bitcoin Mining Stocks Surge

Bitcoin mining stocks experience gains due to favorable economic conditions and diversification into AI.

- Mainstream Media: Highlights the rise of mining stocks and their correlation with Bitcoin’s price.

- Crypto Media: Discusses potential benefits of AI diversification in the mining sector.

- Social Media: Celebratory discussions around mining stocks, with some caution regarding sustainability.

Sentiment: Positive ✅