Welcome to the latest edition of Bitcoin Perception.

Leading companies like Swan, Galoy, Braiins, Blockstream, and BTC Media rely on these weekly reports for insights.

Join them and many others in discovering how mainstream media is shaping the narrative around Bitcoin.

EOW closing Bitcoin price: $43,794

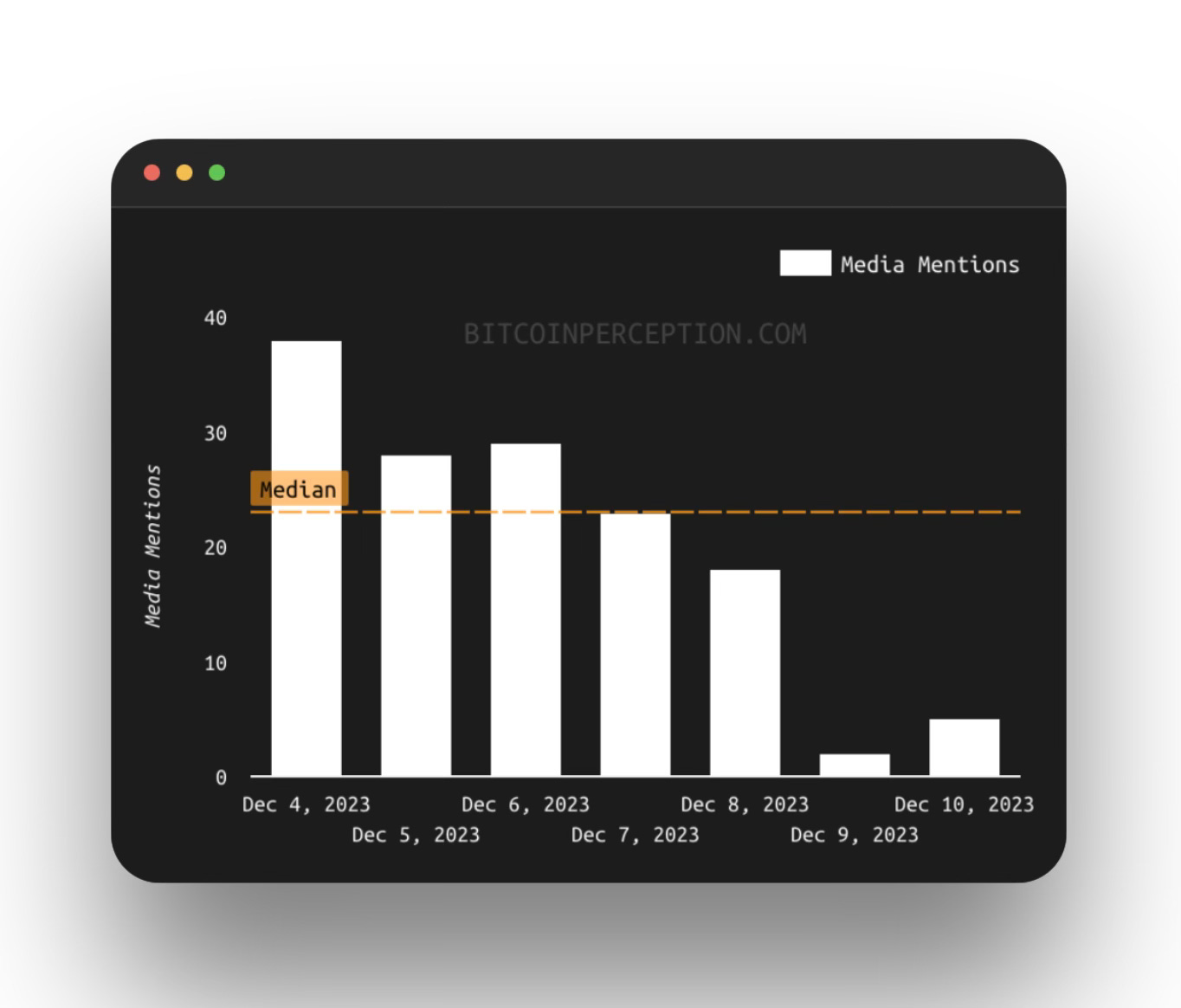

Date range: December 4 - December 10, 2023

Main Topics: Advancing Talks on Bitcoin ETF; Jamie Dimon; Nayib Bukele

This week's spotlight: Bloomberg

Weekly Snapshot

Main Topics Of The Week

Advancing Talks on Bitcoin ETF

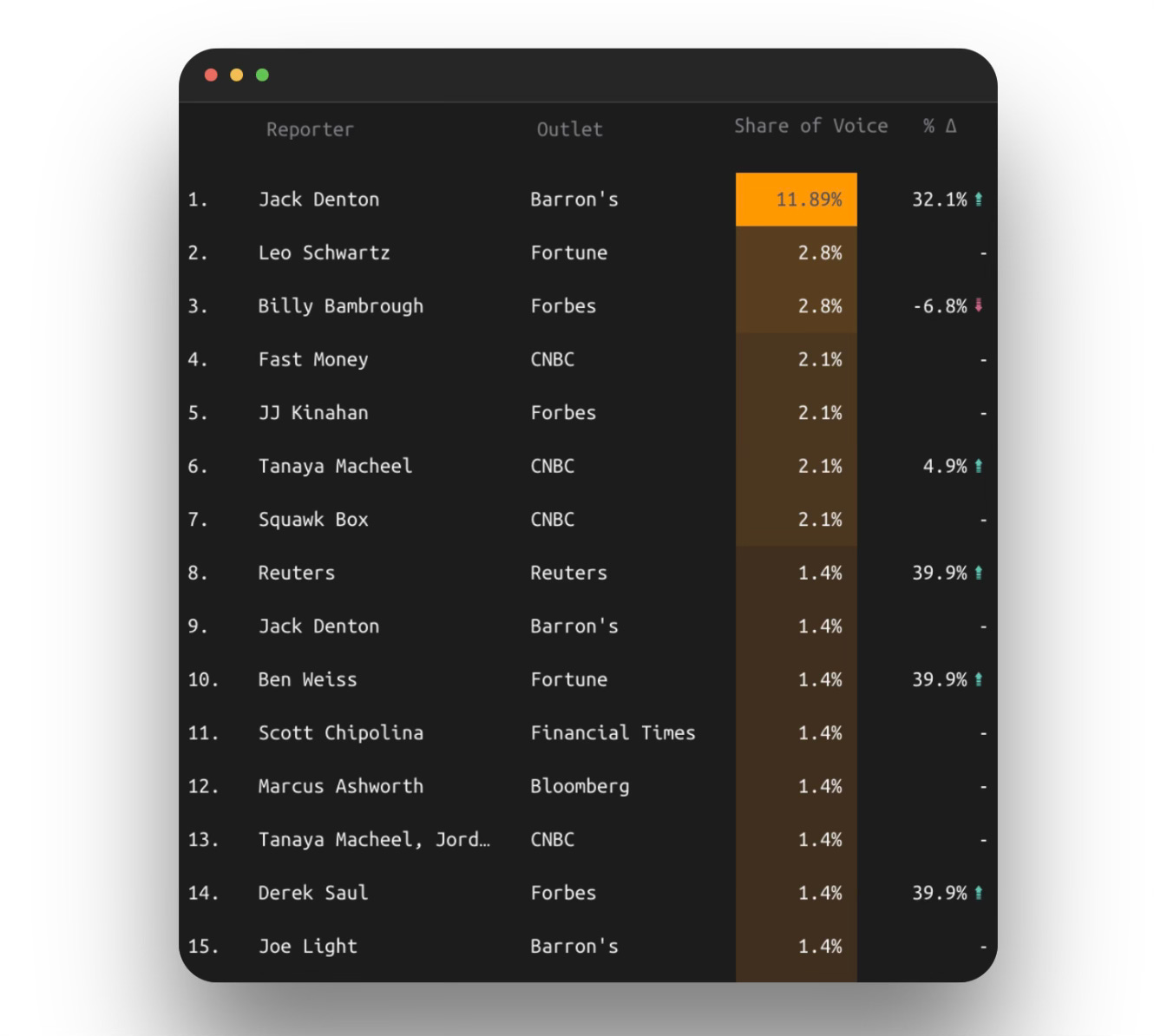

The possibility of a Bitcoin ETF has been a topic of speculation for years, but recent reports suggest that approval may be closer than ever. Forbes discussed the advancement in ETF talks, highlighting the optimism among investors and the potential market impact. Reuters also reported on the accelerated meetings between the SEC and investment funds regarding the Bitcoin ETFs, indicating a shift in the regulatory stance.

Jamie Dimon

Bitcoin's price has reached a year high, demonstrating significant resilience and attracting investor interest, but despite the rally, figures like Jamie Dimon, CEO of JPMorgan Chase, have criticized Bitcoin. Dimon's stance was covered by CNBC and other outlets.

In contrast, Mike Novogratz, a well-known crypto investor, has been one of the few mainstream voices defending Bitcoin. An unfortunate choice, as he might be the worst candidate to represent the opposite view of Dimon.

Nayib Bukele

President Nayib Bukele of El Salvador recently tweeted that the country's Bitcoin holdings are now in the black.

Bukele has been critical of the mainstream media for their coverage of El Salvador's Bitcoin adoption, particularly for focusing on the negative aspects when the price of Bitcoin was down. Now, he pointed out the lack of coverage that the country's Bitcoin investment has turned profitable.

Bitcoin Perception is working with the journalist Luis David Esparragoza on the Salvadorian media’s coverage of Bitcoin in 2023.

Stay tuned.

This Week's Spotlight: Bloomberg

Bloomberg has been perceived as a pro-Bitcoin voice in the mainstream media landscape. ‘Pro-Bitcoin’ in the sense of understanding some of the value propositions from a financial perspective, and reporting on that with a fair, balanced view.

However, recent articles from the past week suggest a notable shift in tone, veering towards a more critical stance on Bitcoin.

Let’s delve into this apparent change, and explore the nuances and implications of Bloomberg's recent coverage, particularly focusing on pieces by Joe Weisenthal, Vildana Hajric, and Lionel Laurent:

Joe Weisenthal's article highlights an intriguing contradiction: despite Bitcoin's significant price surge, public interest, as gauged by metrics like app store rankings and Google Trends, hasn't mirrored this enthusiasm. This piece, rather than focusing on the dynamics of Bitcoin itself, seems to reflect a broader editorial shift.

Could this be indicative of Bloomberg's changing stance on Bitcoin during this year's rally? The article's emphasis on public disinterest, despite a significant price increase, prompts us to question whether Bloomberg is adopting a more cautious or even skeptical approach to Bitcoin's recent market performance.

- Vildana Hajric's article takes a critical stance on the sustainability of Bitcoin's rally, suggesting it's driven by hype. The timing and tone of this piece raise questions about Bloomberg's editorial direction. Why has there been a noticeable shift towards a more critical perspective, especially during a period of significant market activity?

Lionel Laurent's piece drawing parallels between Bitcoin and the luxury watch market, seems to underscore a growing skepticism. This analogy, while creative, might also represent another example of a deeper editorial recalibration.

This piece, in conjunction with others, could be seen as part of a pattern indicating a shift in Bloomberg's overall narrative on Bitcoin.

On December 7th, we posted a tweet highlighting a decreasing trend in positive sentiment towards Bitcoin in Bloomberg's coverage since the end of the first half of the year. It leads us to ponder the reasons behind this change.

Has Bloomberg's editorial view on Bitcoin altered in response to market trends, regulatory developments, or internal reassessment of Bitcoin's role in the financial sector?

As the bull market continues and the landscape continues to evolve, so too does the media narrative surrounding it, challenging readers to discern between market realities and editorial perspectives.