Weekly Media Recap #23

Welcome to the last edition of Bitcoin Perception of 2023!

We are taking a break from reporting during the holidays, but we will be active on X because who really leaves the Internet, ever?

Thanks for reading, and see you in 2024!

Leading companies like Swan, Galoy, Braiins, Blockstream, and BTC Media rely on these weekly reports for insights.

Join them and many others in discovering how mainstream media is shaping the narrative around Bitcoin.

EOW closing Bitcoin price: $41,410

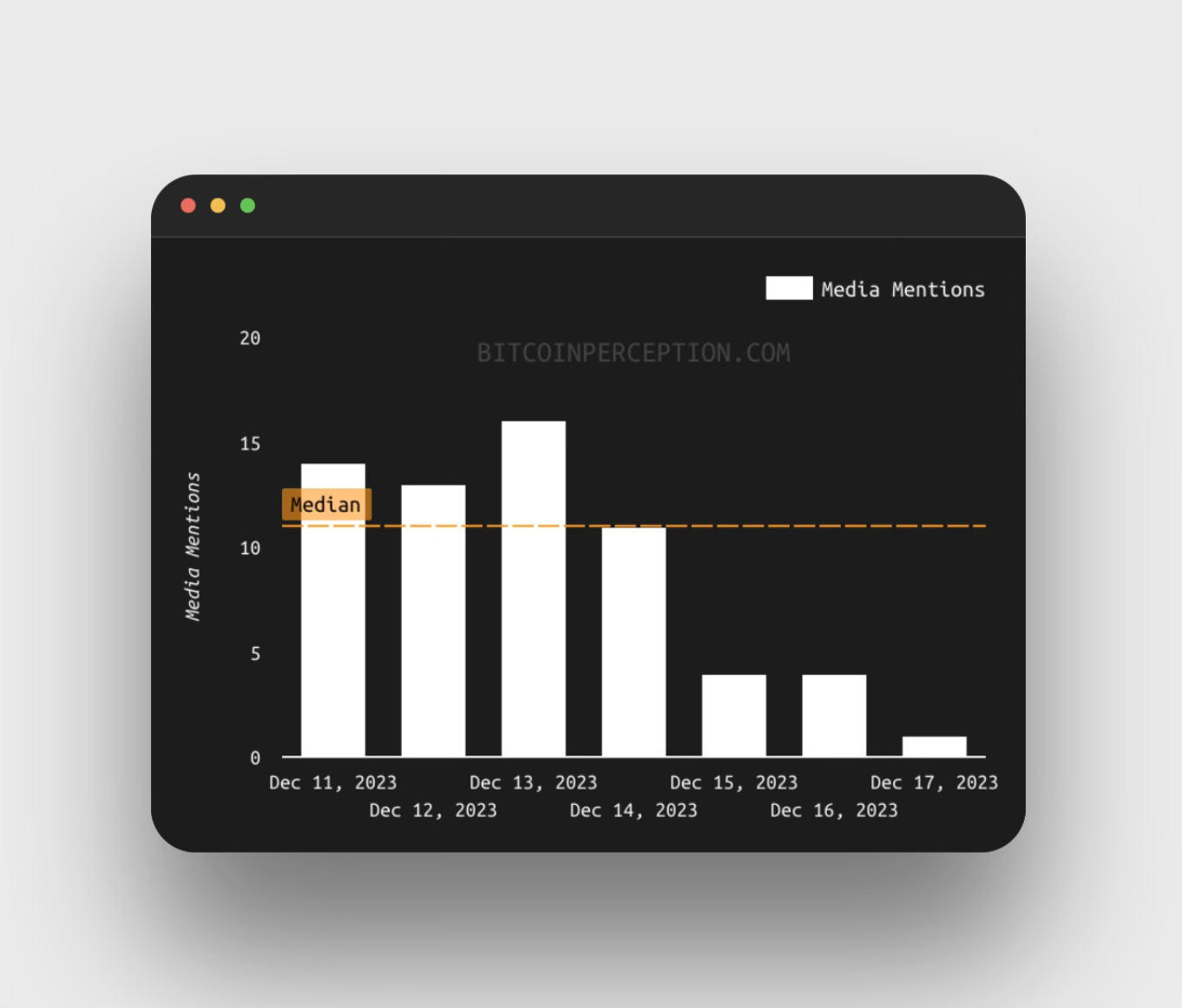

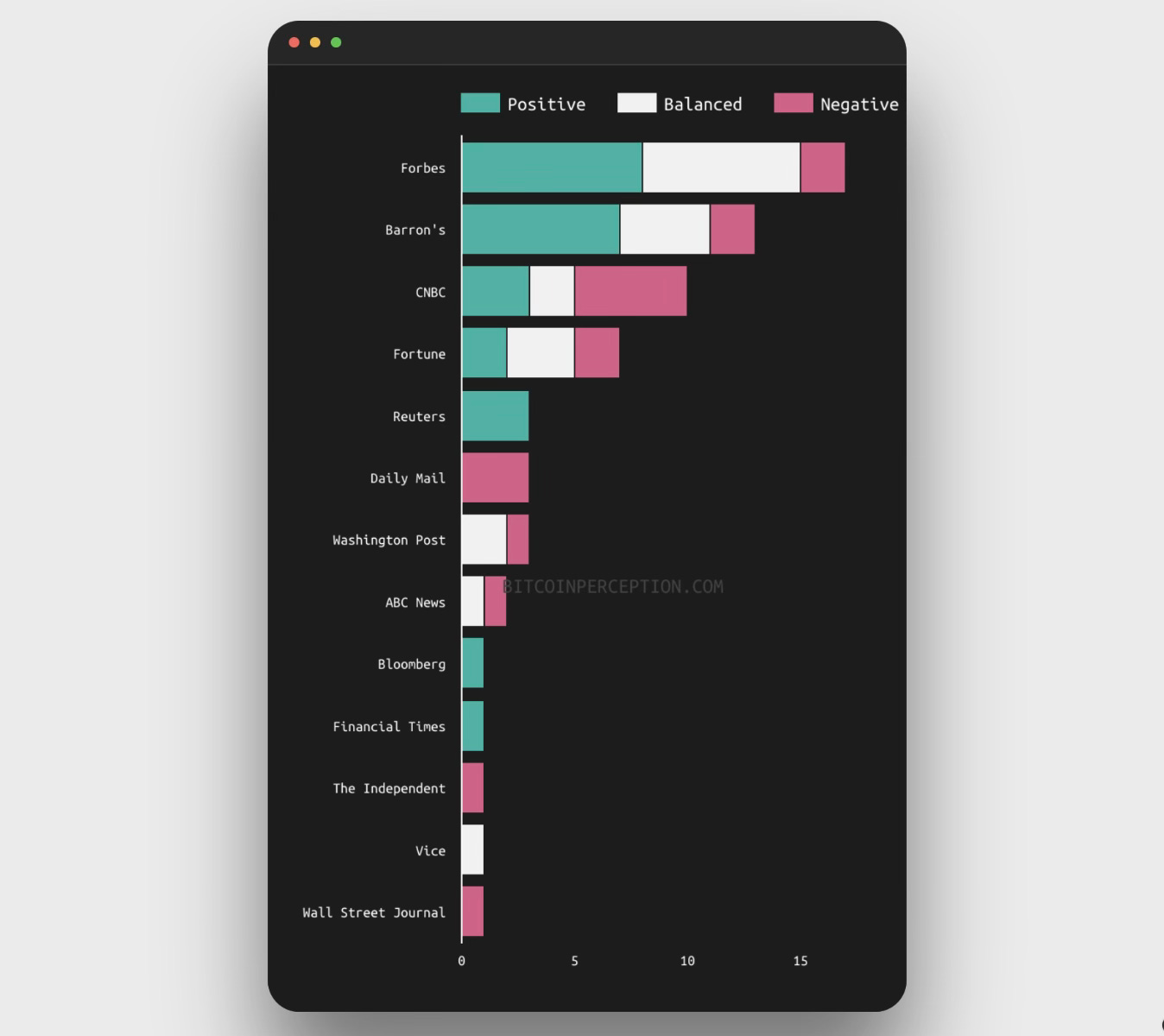

Date range: December 11 - December 17, 2023

Main Topics: LATAM; Bitcoin Price; JPMorgan

This week's spotlight: The Financial Times

Weekly Snapshot

Main Topics Of The Week

1. LATAM

The focus on Latin America in the context of Bitcoin revolves around significant developments in countries like El Salvador and Argentina.

- Articles from sources like the Daily Mail and Fortune have discussed El Salvador's move to adopt Bitcoin as legal tender and its subsequent impact on the local community and economy. The country's venture into Bitcoin, including the development of Bitcoin City and the introduction of the Bitcoin Volcano Bond, has been a subject of interest.

- In Argentina, the election of President Javier Milei, known for his libertarian views and advocacy for economic freedom, including a favorable stance towards Bitcoin, has also been a topic of interest of Forbes. His approach contrasts with traditional economic policies and could influence Bitcoin's adoption in the country.

2. Bitcoin Price Dip

The recent dip in Bitcoin's price (a dip for ants, by the way), has been a point of discussion across various media outlets.

Articles from Barron's and Fortune have highlighted the volatility in Bitcoin's price, noting its recent decline after reaching significant highs. As we all know - sharp price declines make for clickable headlines.

Fair play to them, I guess?

3. JPMorgan: Bearish on BTC… Bullish On ETH?

JPMorgan's bearish stance on Bitcoin, particularly regarding the potential approval of Bitcoin ETFs and their sudden bullishness on Ethereum, has been covered with a hint of humor.

Seems like they missed the train and are doubling down:

- JPMorgan analysts have expressed “skepticism” about the impact of potential Bitcoin ETF approvals, contrary to the prevailing market excitement. They suggest that instead of attracting new capital, these ETFs might simply redistribute existing investments within the crypto space.

- In a somewhat amusing twist, JPMorgan seems to be betting on Ethereum to outshine Bitcoin in the coming year. They highlight Ethereum's upcoming technological upgrades as factors that could enhance its network efficiency and appeal, potentially giving it an edge over Bitcoin.

This Week's Spotlight: The Financial Times

The discourse surrounding Bitcoin's environmental impact has undergone a significant transformation, as highlighted in a recent Financial Times article titled "COP28: The struggle to say ‘fossil fuels’ out loud."

Once predominantly criticized for its substantial energy consumption, Bitcoin is now being reassessed for its potential alignment with ESG.

Let’s delve into the changing narrative and explore how Bitcoin is transitioning from being an environmental concern to a potential contributor to sustainable development:

Historically, Bitcoin has been at the center of environmental debates due to its energy-intensive mining process. Critics have, in a tiresome way, repeatedly likened its electricity consumption to that of entire countries, painting a picture of an unsustainable and environmentally damaging technology.

However, the narrative is shifting, as seen in the Financial Times article, which presents a more nuanced view of Bitcoin's energy usage.

The article goes into how Daniel Batten at CH4 Capital argue that “Bitcoin's high energy consumption could be environmentally beneficial if it utilizes excess renewable energy”.

What this POV does, is to challenge the traditional criticism and suggests that Bitcoin could contribute positively to the renewable energy sector.

By absorbing surplus energy, Bitcoin mining could support the development and viability of renewable energy infrastructure, particularly in regions with inconsistent energy demand.

These are points that have been made in previous coverage, but the surprising aspect of this particular piece is that is the article also highlights Bitcoin's potential social benefits - going beyond environmental considerations.

It suggests that Bitcoin could enhance the financial viability of small, local electrical grids linked to renewable energy in developing countries. This could lead to improved electricity access in underserved areas, contributing to social development and empowerment.

This is a considerable shift in opinion from what we usually have seen.

The article represents a pivotal moment in the mainstream media's portrayal of Bitcoin, marking a shift from viewing it solely as an environmental threat to considering its potential ESG benefits.

This reevaluation is crucial in understanding Bitcoin's role in the grand scheme of things, and how the MSM are slowly catching up.

We have covered other areas where the mainstream media’s narrative has shifted, in the context of the ETF, where Bitcoin has been distinguished with alt coins, where even the old “digital gold” narrative has been brought back.

Let that be the one thing that you take away from this year - as Christian Keroles says: “You are not bullish enough”.

Happy holidays - see you in 2024!