Not Your Typical Full-Year Roundup

Hey, it’s Fernando. Hope your holidays went great.

Let me start by saying that this isn't your typical full-year roundup.

Since Bitcoin Perception only kicked off in August, you're technically looking at a 'partial-year' review.

But hey, in Bitcoin, a few months feels like a year - so let's dive into the 2023 retrospective, armed with the best snippets from this late start.

But first; a massive shoutout to the 700 subscribers on both the newsletter and on LinkedIn (where the real cultural battle happens) - thanks for being part of this journey where every like, share, and comment is a tiny revolution in the making.

As a thank you, a gift is waiting for you at the end of this edition. Please check it out and let me know what you think!

Now, let's look at the 6 biggest Bitcoin Perception reports that marked 2023... or at least, the part of 2023 Bitcoin Perception was around for!

1. Regulatory Dance and ETF Hopes

The year's story was partially written by the regulatory dance around Bitcoin ETFs.

The potential mainstream adoption of Bitcoin ETFs, juxtaposed against the changing stances of financial giants, marked a significant stride towards institutional acceptance.

It’s almost like a slow but inevitable acceptance dance in the financial ballroom.

2. High-Stakes Drama - FTX and Binance

2023's legal drama, particularly the trial of Sam Bankman-Fried and CZ’s plea deal, mirrored a high-stakes thriller, significantly impacting Bitcoin’s regulatory future.

This saga wasn't just a legal wrangle but such a significant narrative that, in my opinion, will influence regulators’ thoughts on the legislative side of things.

3. Environmental Reckoning and Bitcoin's ESG Narrative

Remember when Bitcoin was the environmental bad boy?

Well, the environmental narrative began shifting towards a more nuanced understanding in 2023, as highlighted in the "You Are Not Bullish Enough" edition.

Bitcoin’s journey from an energy pariah to a potential ESG asset (I’m doubtful about that term’s longevity) was like watching the misunderstood rebel in a movie finding a path to redemption.

4. LATAM's Bitcoin Embrace

The Latin American narrative, particularly in El Salvador and Argentina, also captured in "You Are Not Bullish Enough", witnessed a new chapter in Bitcoin’s global adoption story.

As an Argentine emigrant, the adoption of Bitcoin in Latin America, especially in my homeland, resonated deeply.

It’s great to see LATAM countries signalling openness to economic innovation and empowerment, building on the transformative narrative of Bitcoin in emerging economies.

5. The MSM’s Changing Tune - A Narrative Shift

The mainstream media's perspective on Bitcoin underwent a noticeable transformation this year.

The "Narrative Shift" report, one of the year’s most-read pieces, underscored a changing media stance, from skepticism to a more balanced view.

Another noteworthy trend was the media starting to distinguish Bitcoin from the broader crypto market, as seen in "Jamie Dimon vs. Nayib Bukele". This nuanced understanding marked Bitcoin's growing recognition as a unique asset class.

Coupled with the financial sector's warming up to Bitcoin (looking at you, Larry Fink and Jamie Dimon), it felt like watching skeptics turn into cheerleaders - a very strange feeling because, to me, there's more to than what meets the eye.

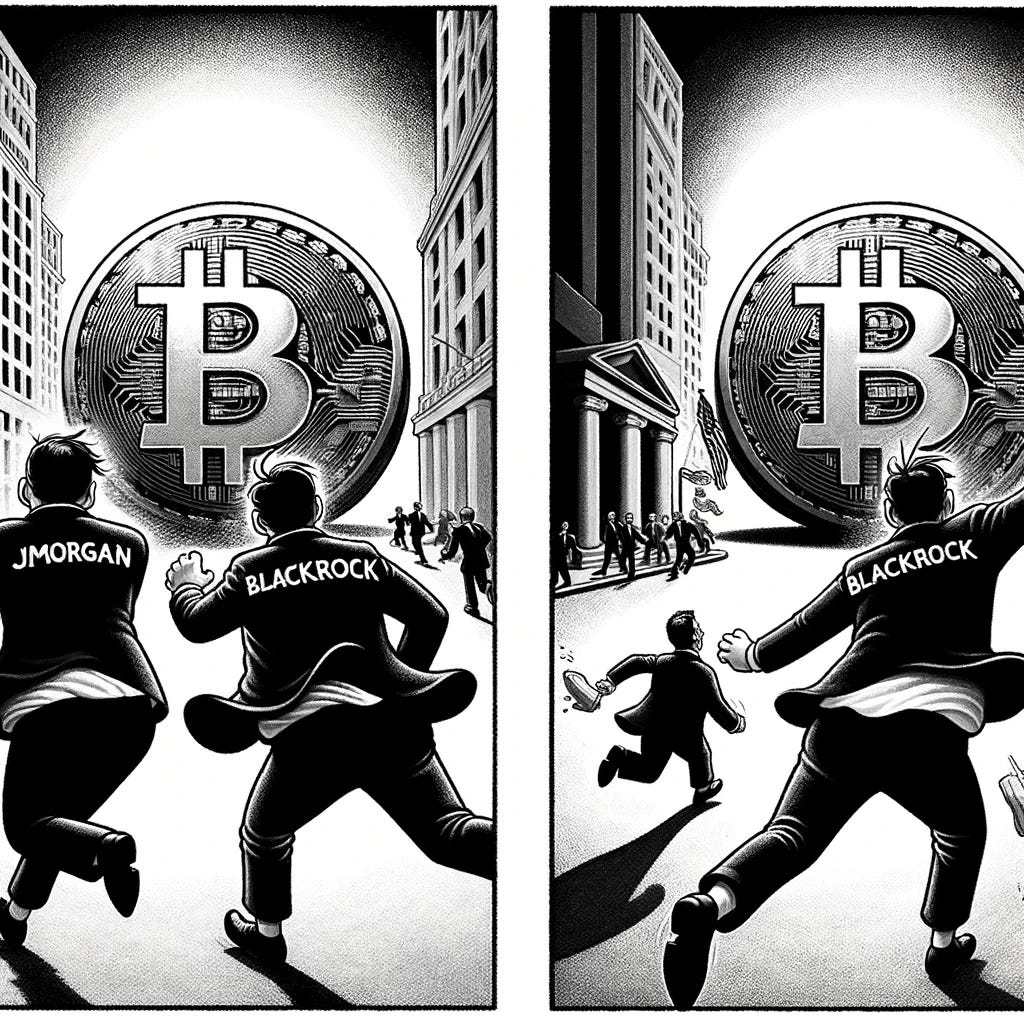

6. The Irony of JPMorgan and Blackrock

Speaking of Larry Fink and Jamie Dimon, their pivot on Bitcoin was a huge plot twist, as discussed in "You Are Not Bullish Enough".

Fink’s leap from calling Bitcoin an "index of money laundering" to “a fight to quality”, and Dimon's recycling his negative view just before JPMorgan was named a Bitcoin ETF broker, underscore a deeper truth:

There's a vast realm of actions and decisions happening behind the scenes that we're not privy to.

To truly understand these changing tides, one must look beyond public statements and 'follow the money.'

It's in the unspoken and unseen maneuvers where the real story often lies.

***

As we wrap up our unique slice of 2023, it's clear that we're standing on the cusp of a monumental narrative shift in Bitcoin history, particularly with the anticipated ETF approval in 2024.

Now, more than ever, it's crucial to delve into the nuances of how different narratives around Bitcoin are shaped and propagated.

In the Bitcoin industry, where perception can swiftly become reality, understanding these narratives is not just insightful – it's essential.

Whether you're a miner, investor, enthusiast, or skeptic, the stories we tell and hear about Bitcoin can significantly influence its future.

Recognizing the importance of this narrative evolution, I am thrilled to announce that all the data collected and used to make these reports will soon be available for free.

Yes, you read that correctly – free!

By making all the Bitcoin Perception data accessible to everyone, the aim is to empower anyone to engage more deeply with the narrative currents shaping Bitcoin’s journey.

It's time for everyone to have the tools to understand and contribute to the conversation.

So, keep your eyes peeled for this exciting release.

Thanks again, see you in 2024! -Fernando