Weekly Media Recap #32

EOW closing BTC price: $63,154

Date range: February 26 - March 3, 2024

In this issue:

- The Halving Grabs Mainstream Media Attention

- Vanguard's Bitcoin Resistance

- The Bitcoin Mining Industry vs. the US Department of Energy

Weekly Snapshot

The best in Bitcoin, carefully curated by an alien from the future.

Sign up for free here.

Get the highest signal-to-noise ratio in the Bitcoin space. No clickbait, 100% free, unsubscribe anytime.

Main Topics of the Week

The Halving Grabs Mainstream Media Attention

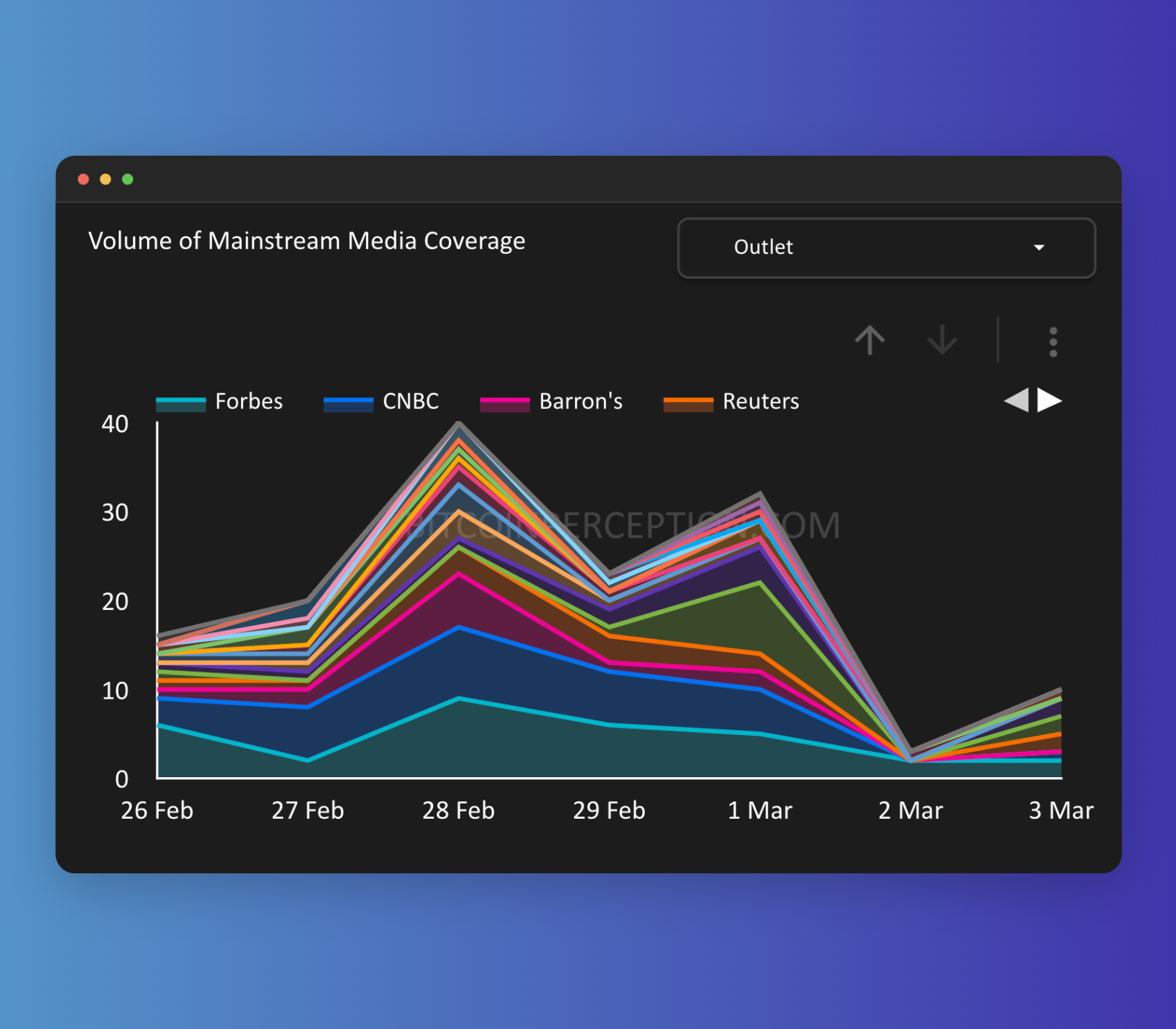

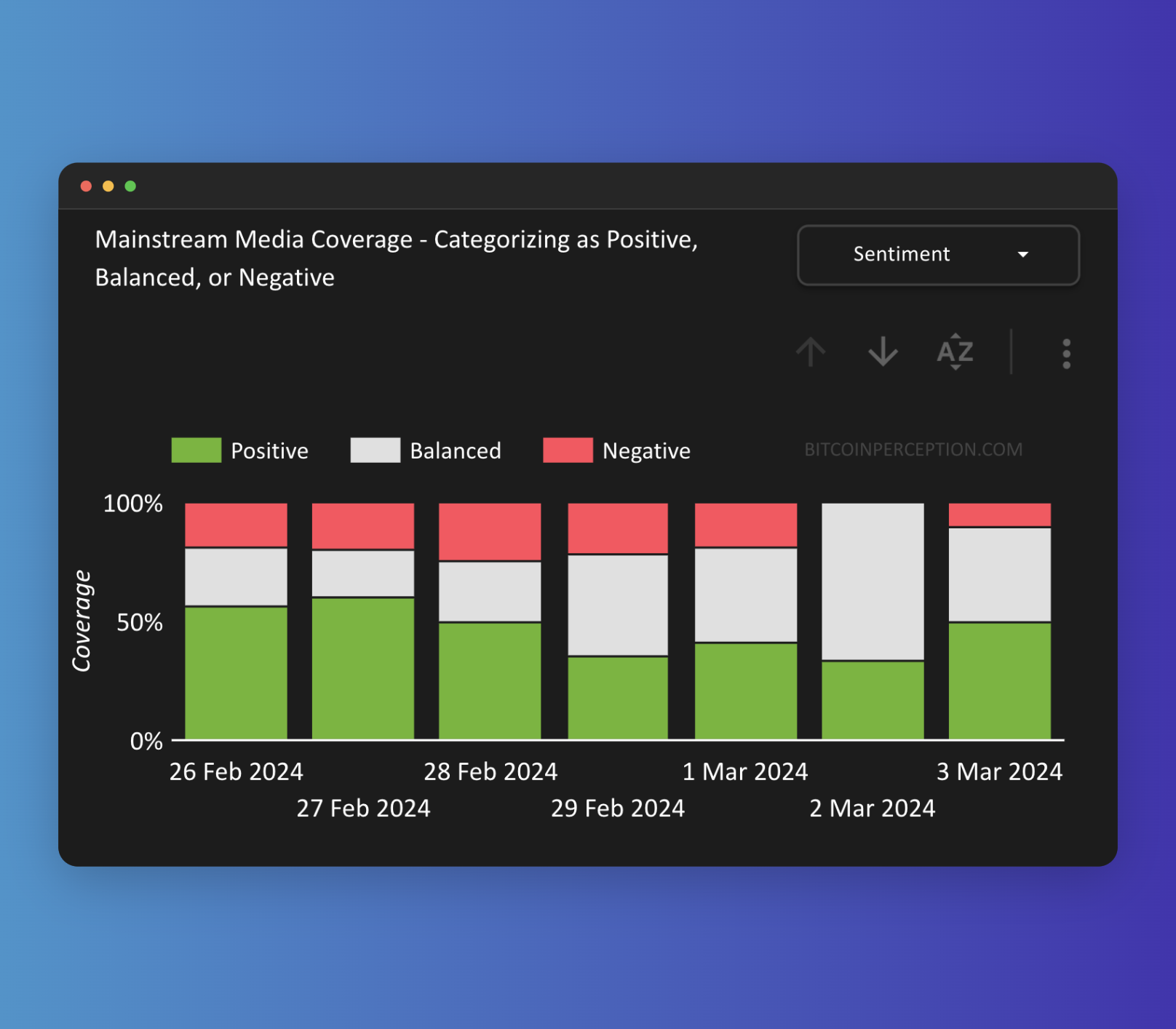

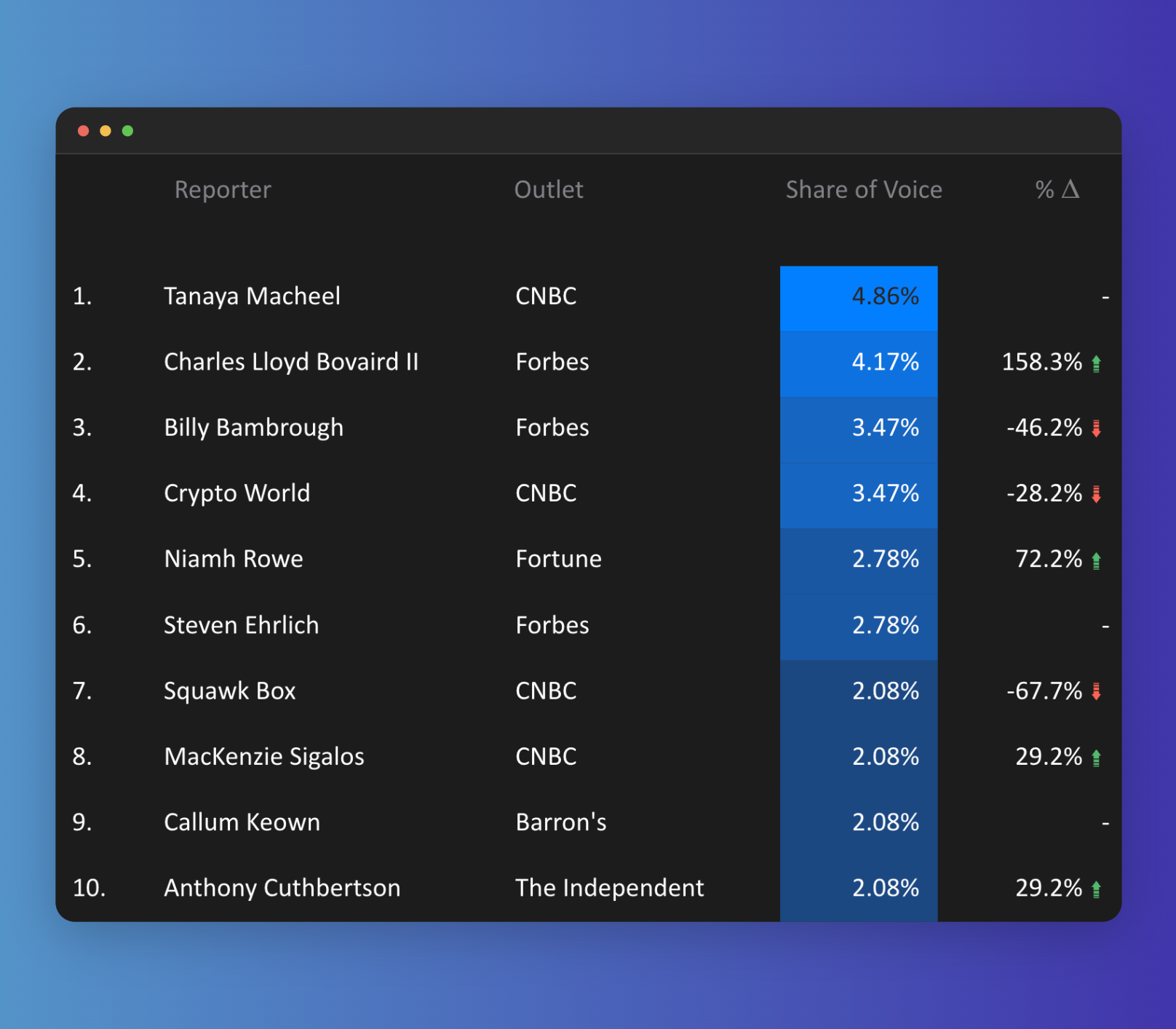

The mainstream media's focus on Bitcoin's upcoming halving event is an interesting moment in the narrative to me. The halving seems to be transitioning from a niche topic to a subject of broad financial interest, with articles from Forbes, CNBC, and The Independent not only amplifying the halving's anticipated impact on Bitcoin's market dynamics but also illustrating the growing mainstream interest in its financial mechanisms.

Forbes highlights the event through contributor Clem Chambers, who emphasizes the halving's historical role in propelling Bitcoin's value upwards. Chambers suggests a bullish future, stating, "the next big move would be driven by the 'halvening.'"

CNBC's Mike Winters and Douglas Boneparth are starting to understand the halving's simple economics, stating "When supply goes down, price goes up, assuming demand remains the same or greater". It is almost surreal that this is something that needs to be walked through at this point, but it goes to show how early we are, I guess.

The Independent captures the pre-halving price surge, with Anthony Cuthbertson reporting on the record inflows into Bitcoin and the market's overall bullish sentiment. Highlighting the strategic timing of the halving and its scarcity effect, Cuthbertson quotes Athena Miao: "The halving event slated for April might compound the scarcity that institutional investment is fuelling".

Vanguard's Bitcoin Resistance

As Bitcoin solidifies its role in modern portfolios, the call for traditional institutions to recognize its significance grows louder.

But there are still those out there that just refuse to accept this and choose to keep their arms crossed forever, media outlets and financial institutions alike.

Vanguard's and the Los Angeles Times' shares this fear towards Bitcoin which not only highlights a complete misunderstanding of the asset's value but also a greater generational disconnect.

This reluctance to adapt will do two things: Alienate forward-thinking investors and stand as a cautionary tale of missed opportunity in the history books.

Los Angeles Times supports Vanguard's Bitcoin aversion, stating that's "a smart and responsible policy that places the interests of Vanguard’s clientele ahead of those of the greedy promoters and scamsters infecting the entire cryptocurrency field."

Fortune's Jeff John Roberts hints at a possible shift in Vanguard's Bitcoin stance post-CEO Tim Buckley's departure, amidst a Bitcoin ETF surge led by industry giants.

Yet, Vanguard's conservative stance, echoed by the Los Angeles Times' Michael Hiltzik, misses Bitcoin's of unmatched growth and its emerging status as a portfolio cornerstone with about a decade.

Time is of the essence to realign with the financial zeitgeist, guys.

The Bitcoin Mining Industry vs. the US Department of Energy

The U.S. Department of Energy's (DOE) 'Bitcoin mining survey' (I'm writing that sarcastically) has ignited a debate on regulatory transparency and industry privacy, highlighting the sector's resistance to oversight.

This initiative, while innocently called a 'survey' to assess the energy consumption of Bitcoin mining operations has sparked a notable legal and regulatory confrontation, as detailed in reports from The Guardian, Fortune, and Reuters.

The Guardian highlights the DOE's halted emergency survey following industry pushback, emphasizing the environmental concerns tied to Bitcoin mining's significant energy demands.

Fortune covers the legal challenge by Riot Platforms and the Texas Blockchain Council against the DOE's survey twice, leading to its cancellation and the deletion of collected data. This move reflects the mining industry's concerns over privacy and the rushed nature of the survey.

Reuters reports on the DOE's consideration of a new, more transparent survey approach with a 60-day comment period, aiming to balance regulatory data needs with industry concerns.

This Atlas Shrugged interplay between industry growth and regulatory oversight typically seen when any novel sector grows to the point that the government think it needs to step in and control it.

No doubt this is strikingly clear when it comes to the Bitcoin mining sector.