EOW closing Bitcoin price: $51,731

Date range: February 19 - February 25, 2024

In this issue:

- Reactions Against Elisabeth Warren & the EIA

- The ECB Recycles FUD

- A Narrative Shift is Happening

Weekly Snapshot

Main Topics Of The Week

Reactions Against Elisabeth Warren & the EIA

It's interesting to see how Bitcoin is experiencing a shift as critics face growing opposition. Two events signal a pivotal moment in the dialogue around Bitcoin, as organized resistance begins to reshape the narrative.

John Deaton, a cryptocurrency advocate, has launched a Senate campaign against Elizabeth Warren, aiming to challenge her skeptical (read:hypocritical) stance on cryptocurrency. Politico has the scoop on this political face-off.

Simultaneously, the mining sector has won a temporary legal halt against a Department of Energy survey demanding data on their energy consumption, representing a significant pushback against regulatory scrutiny.

This is all happening while a top house Republican says the Biden administration are abusing their power to target bitcoin miners, according to Fox News.

This legal victory for the Texas Blockchain Council underlines the ongoing debate over the environmental impact of Bitcoin mining. Check out the details on Forbes.

The ECB Recycles FUD

Oh dear.

The ECB is at it again with their favorite pastime: Bitcoin bashing.

Despite Bitcoin's latest rally, thanks to the SEC's nod to spot Bitcoin ETFs, Forbes covered how ECB officials are singing the same old tune, concern trolling over the recent approval of U.S. spot ETFs and the subsequent rally in Bitcoin's price, which has soared past $50,000.

Always thinking about your best interest, the ECB experts warn of "massive collateral damage" from this boom, saying Bitcoin is not 'living up to its promise' as a decentralized digital currency due to its minimal use in legitimate transactions.

Barron's covered how the dynamic duo of Ulrich Bindseil and Jürgen Schaaf argued that the ETF approvals do not change Bitcoin's fundamental unsuitability as either a payment method or an investment vehicle, underscoring Bitcoin's lack of intrinsic value and its vulnerability to price manipulation.

One thing is how the market does not care at all since despite these continued 'warnings', Bitcoin prices have neared their highest levels since late 2021.

The bigger issue is how certain media outlets sometimes copy/pastes misinformation.

The issue isn't just what the ECB says, but the echo chamber amplifying it. pic.twitter.com/LYZPYFampq

— Fernando Nikolić 🇦🇷 🟠 (@basedlayer) February 22, 2024

A Narrative Shift is Happening

On the flipside, the Financial Times has thrown a playful jab at the ECB following its critical stance on Bitcoin.

The FT's response? "Nobody in the year of our Lord twenty twenty four really cares what the ECB says about Bitcoin." 😂

Meanwhile, Newsweek, traditionally cautious in its coverage of Bitcoin, has taken a surprising turn by labeling Bitcoin as a "hard asset."

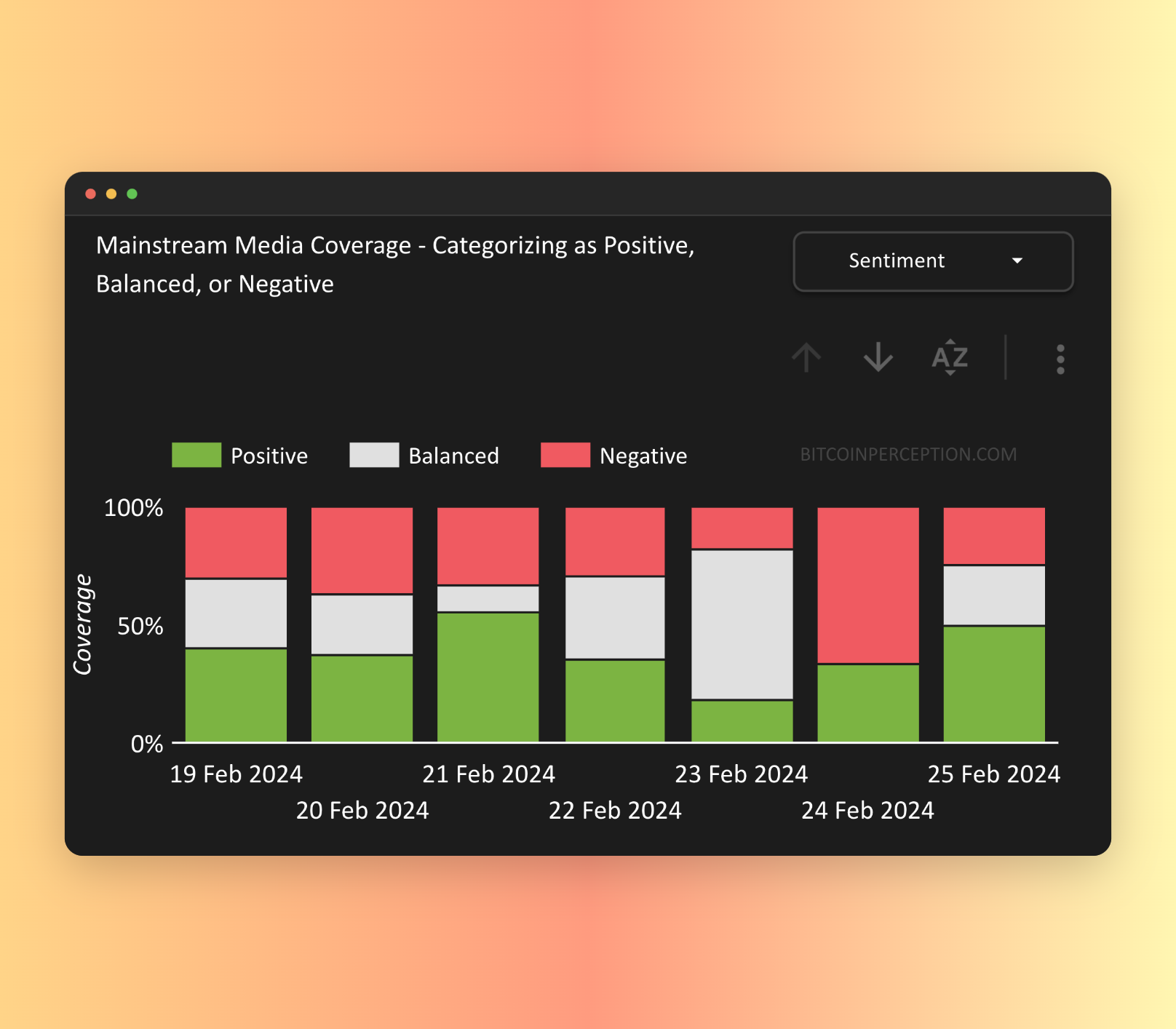

This marks a notable shift in narrative from an outlet that has, according to Bitcoin Perception data, historically leaned towards skepticism.

The Wall Street Journal, too, has offered its two cents, but in a sly, roundabout way.

While initially framing Bitcoin as the digital equivalent of a soon-to-be-obsolete BlackBerry in 2007, the article actually concludes with a nudge towards considering Bitcoin as part of a diversified investment portfolio!

These pieces from some of the financial world's largest publications reflect a evolution in the conversation around Bitcoin.

One can debate whether the conversation is nuanced or not but the narrative around Bitcoin is shifting, with a clear, underlying message: Bitcoin is becoming harder to ignore.

Thoughts to Start the Week

I remember how much I used to love Vice's reporting in the 2010s. Sad to see them die in irrelevance, but it's for the best. Good riddance.

Vice is laying off hundreds of staff members and closing down its flagship website.

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) February 24, 2024

Below is what could be the last article mentioning Bitcoin. pic.twitter.com/M0vrCR41O4