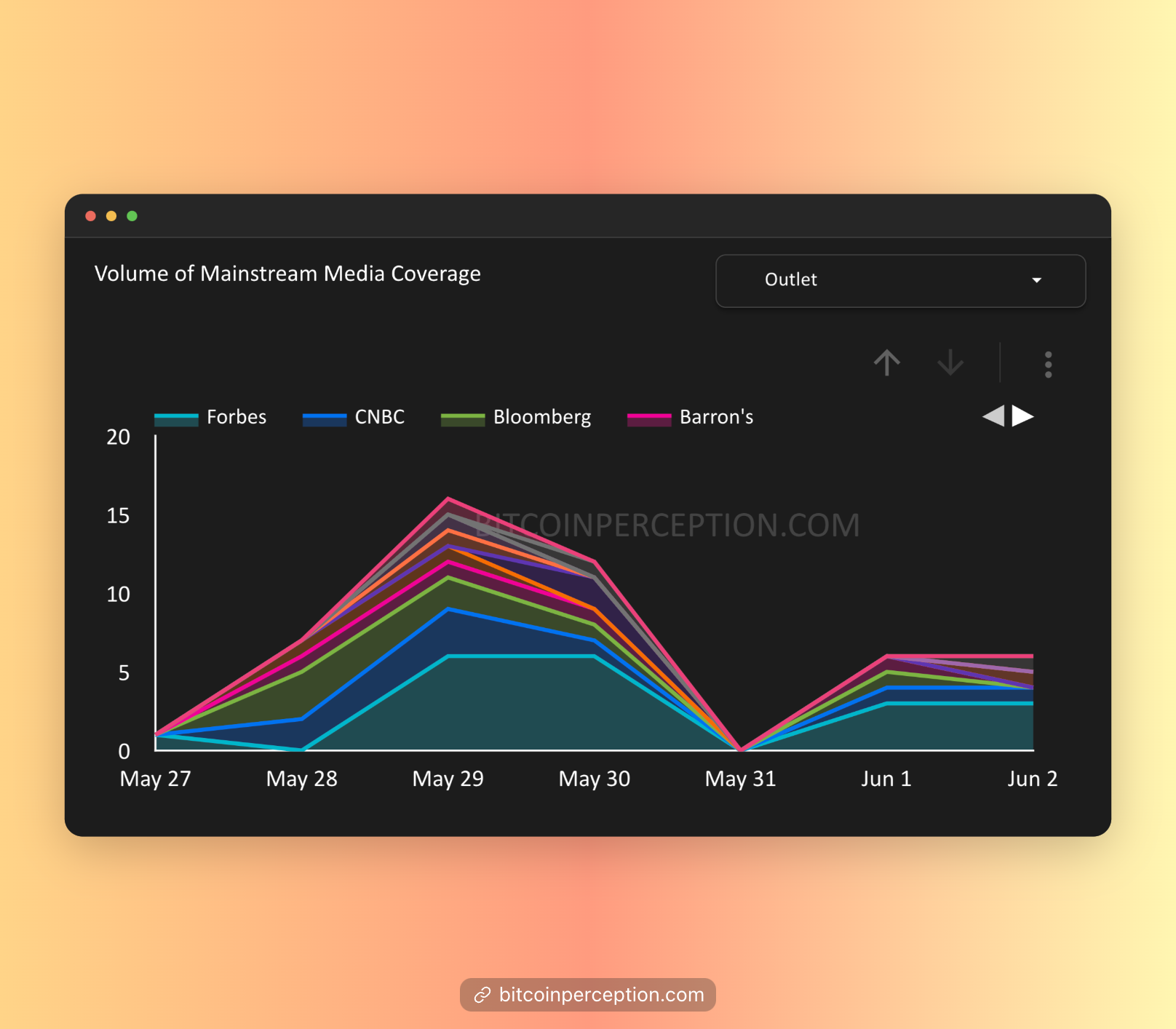

EOW closing BTC price: $67,736

Date range: May 27 - June 2, 2024

In this report: How the mainstream media covered these major stories:

- BlackRock’s Bitcoin Trust becoming the largest spot Bitcoin ETF 📈

- Miners diversifying into AI to expand revenue streams 🤖

- Gemini’s $2.2 billion return to users 💰

Weekly Snapshot

BlackRock’s Bitcoin Trust becoming the largest spot Bitcoin ETF

Last week, BlackRock’s IBIT overtook Grayscale's GBTC as the largest spot Bitcoin ETF.

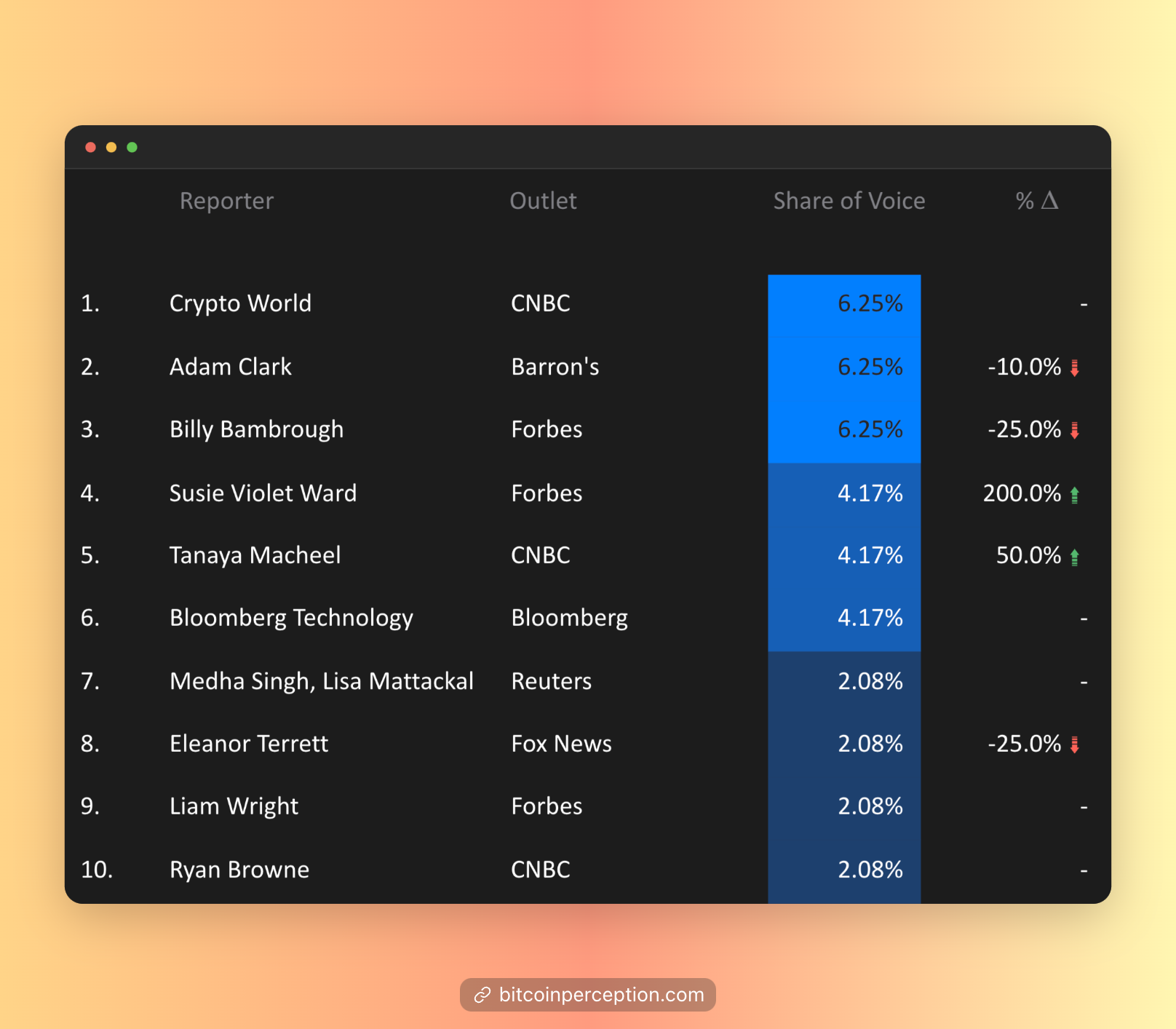

CNBC reporters Jordan Smith and Talia Kaplan highlighted BlackRock’s strong distribution network and financial advisors' growing interest.

Reuters' Suzanne McGee focused on the key facts, noting that BlackRock's IBIT holds nearly $20 billion, surpassing Grayscale.

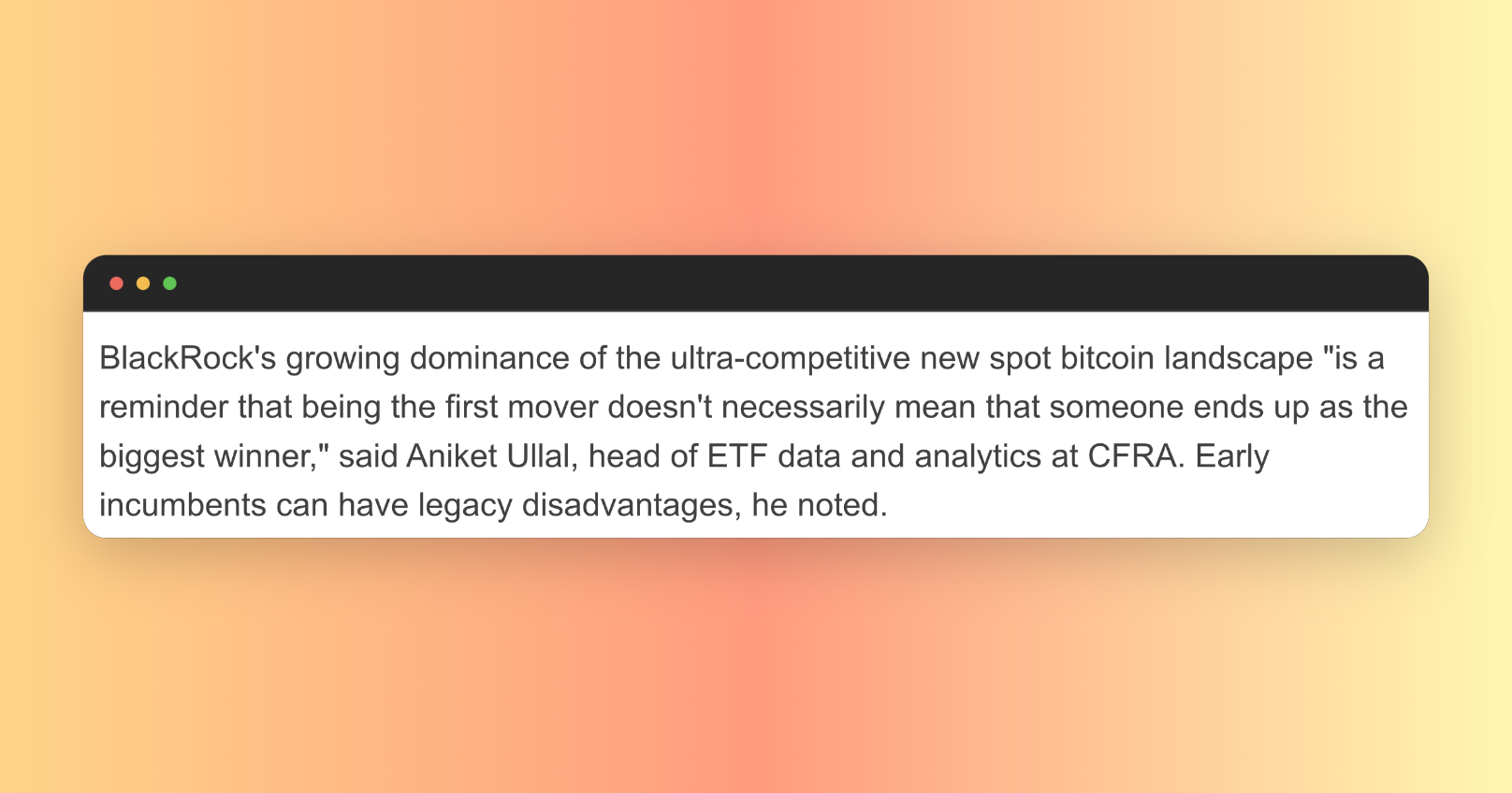

The article emphasized the competitive landscape and regulatory impacts, with a notable quote from Aniket Ullal, head of ETF data and analytics at CFRA:

"This is a reminder that being the first mover doesn't necessarily mean that someone ends up as the biggest winner"

Miners diversifying into AI to expand revenue streams

The Halving is in the rear view mirror, and there's a lot of focus from the media on how miners are going to adapt.

Bloomberg reporters Matthew Monks and David Pan highlighted Riot Platforms' strategic $950 million bid for Bitfarms as a significant industry consolidation post-halving. This move positions Riot to become the largest Bitcoin miner, showcasing its aggressive expansion strategy in a competitive market.

Forbes contributor Abubakar Nur Khalil highlighted Marathon Digital’s partnership with Kenya’s Ministry of Energy, emphasizing the strategic importance for renewable energy use in Bitcoin mining.

But a noticeable trend is how the focus on AI together with Bitcoin is shaping up.

As seen in our data, it is a growing focus since January 1st, 2023:

Looking at the type of coverage in this timeframe, it is mostly focused on mining diversification.

Luxor’s Colin Harper, who also is a contributor for Forbes, wrote two pieces last week covering Bitcoin’s hashrate reaching a new high post-halving and miners diversifying into AI and high-performance computing (HPC).

The topic of diversification into AI and HPC is interesting, as miners are exploring AI and HPC to offset reduced rewards post-halving.

As Colin Harper states, “AI and HPC promise more stable revenue and better margins, but they also require higher capital expenditures and complex operations.”

This was coincidentally echoed by CNBC’s MacKenzie Sigalos, who reported on Bitcoin miners retrofitting facilities for AI to diversify revenue streams.

The shift involves replacing ASICs with GPUs, with firms like Core Scientific and Hut 8 leading the way.

She interviewed Adam Sullivan, CEO of Core Scientific, who stated that “The best way to think about bitcoin mining facilities is that we are essentially powered shells to the data center industry.”

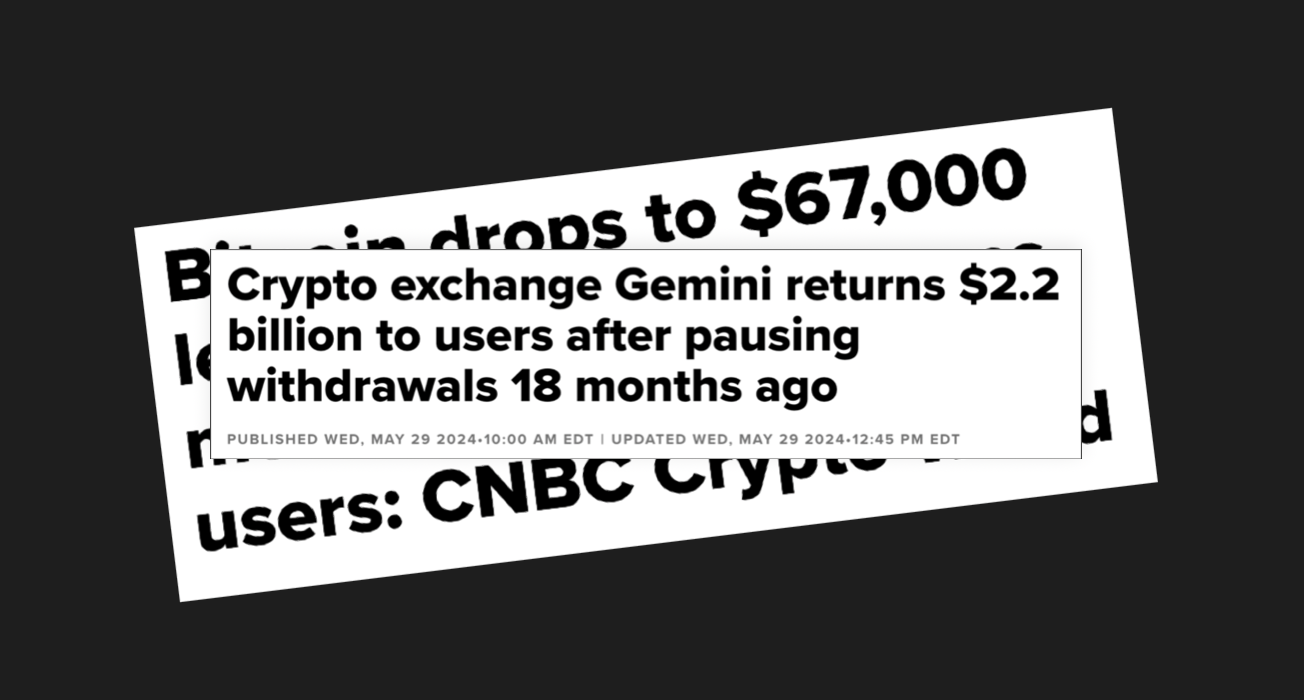

Gemini’s $2.2 billion return to users

Gemini’s return of $2.2 billion to its users seemed like a feel-good story compared to the FTX debacle, but received limited media coverage as CNBC was the only media outlet reporting the story.

CNBC Crypto World emphasized the positive resolution for Gemini users, detailing the background of the Earn program, the settlement with Genesis Global Capital, and the implications for the crypto industry.

Ryan Browne provided a clear timeline of events leading to the return of funds and explaining the New York Attorney General's settlement with Genesis.

Good news travels slow.