EOW closing BTC price: $67,205

Date range: March 18 - March 24, 2024

In this report:

- The MSM's Bitcoin Coverage in a Nutshell

- The Financial Press' Attempts to Understand Volatility

- The Press' Shiny Object Syndrome Continues

Weekly Snapshot

The best in Bitcoin, carefully curated by an alien from the future.

Sign up for free here.

Get the highest signal-to-noise ratio in the Bitcoin space. No clickbait, 100% free, unsubscribe anytime.

Main Topics of the Week

The MSM's Bitcoin Coverage in a Nutshell

The week kicked off quietly but took a downturn on Tuesday, as bitcoin faced a significant price correction that set the tone for negative market sentiments, influencing coverage for the rest of the week.

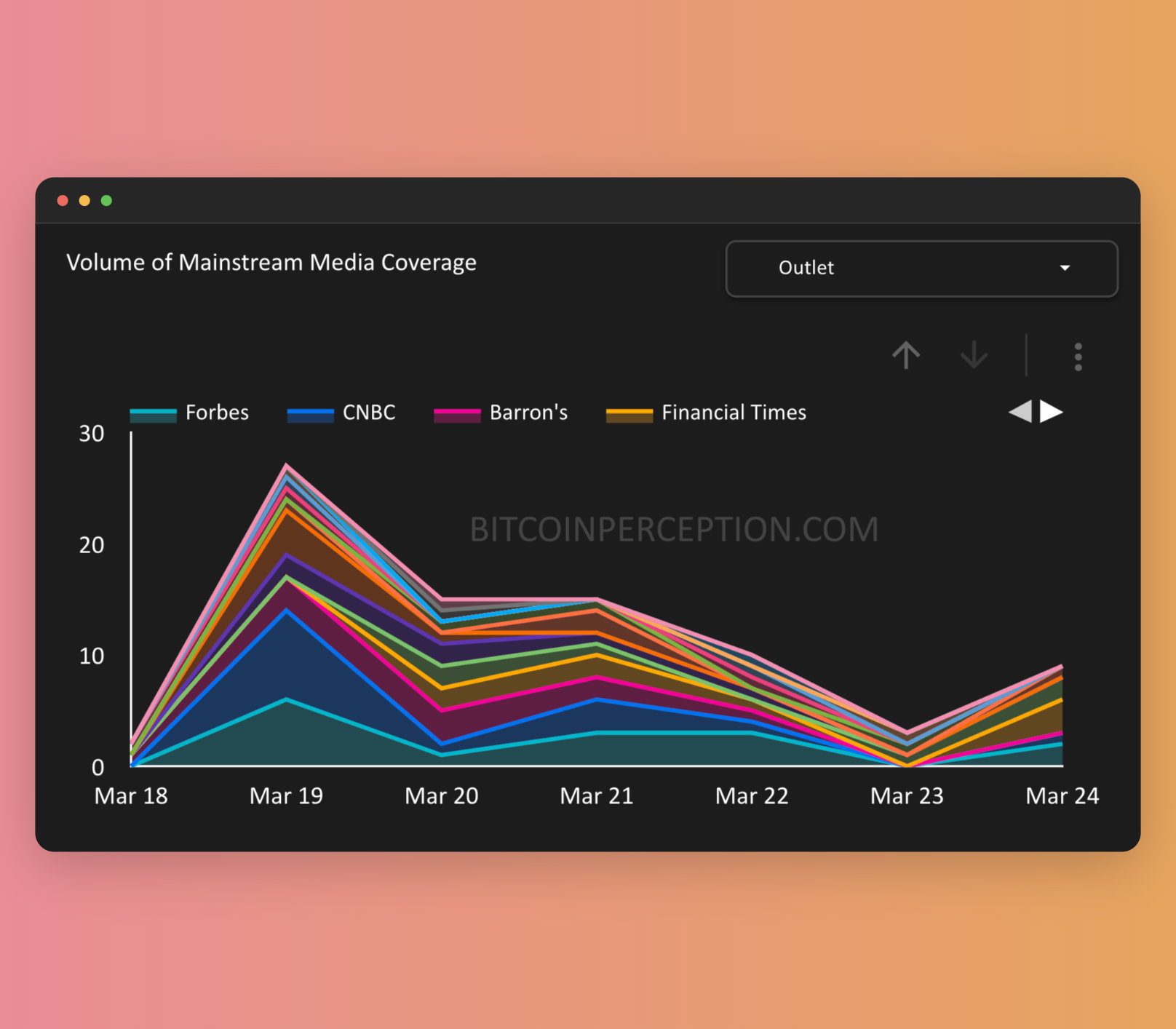

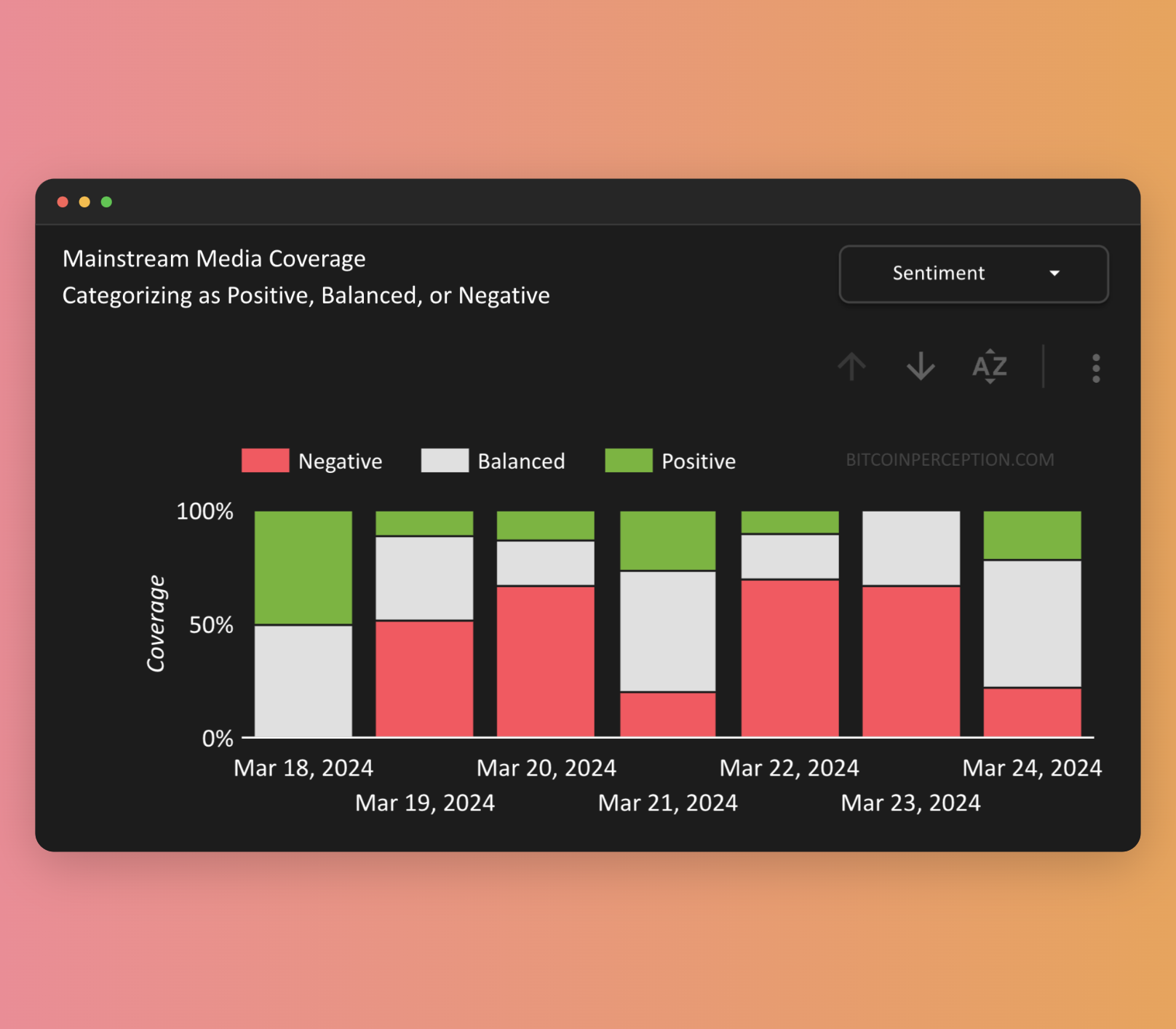

The MSM most certainly added fuel to this atmosphere, with a total of 49% of Bitcoin coverage being negative:

March 19's sharp price correction led to a wave of negative media coverage.

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) March 23, 2024

Short thread ↓ pic.twitter.com/pLkDbdc1HG

Negative sentiment swept through mainstream media, with only four outlets managing to publish at least one positive story. pic.twitter.com/GpzxteDvdS

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) March 23, 2024

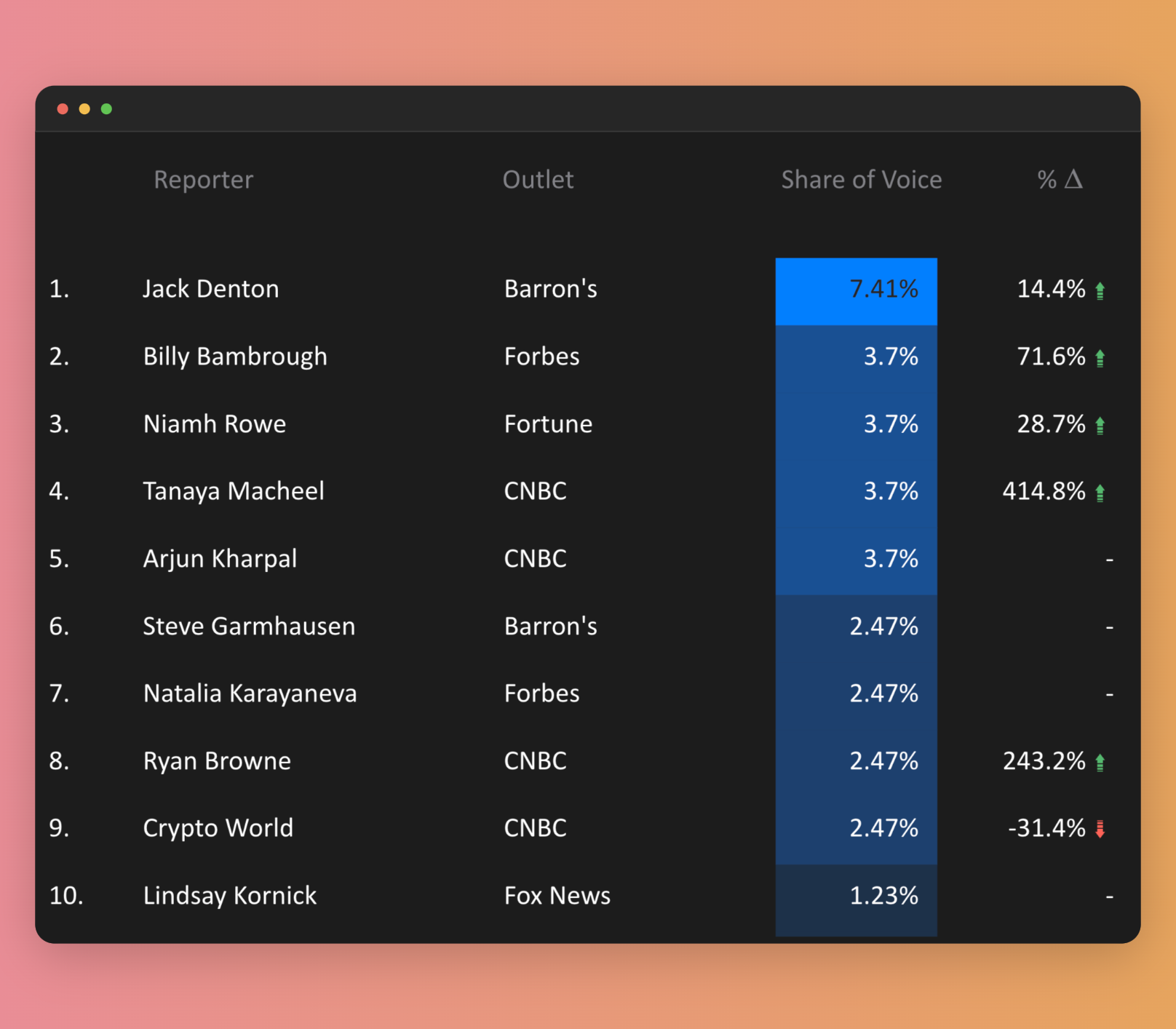

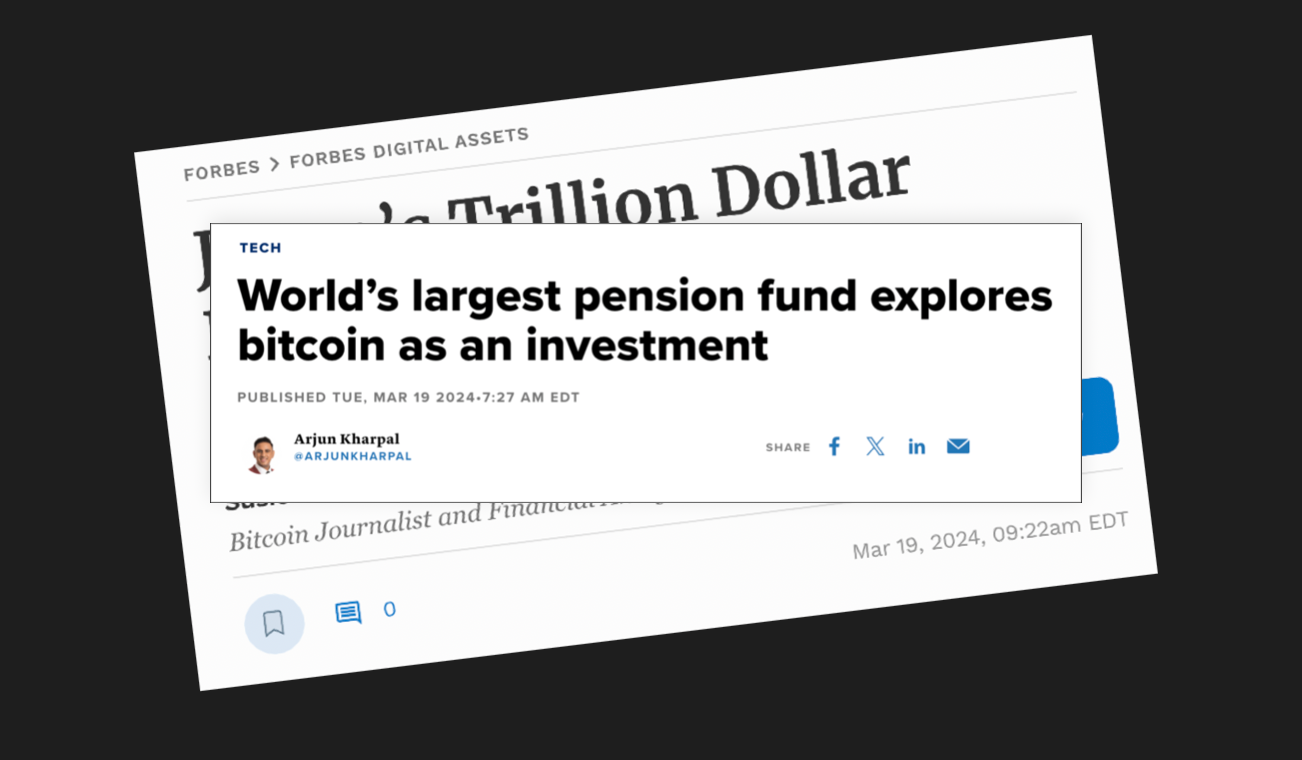

But some positive news made its way through, highlighting Japan's largest pension fund's interest in diversifying into bitcoin.

This rare piece of good news in an otherwise red week received positive attention from CNBC and Forbes, which helped balance the scales amidst the dominant negative price narrative.

This interplay between negative market dynamics and strategic institutional interest is interesting to highlight because it is the MSM's Bitcoin coverage in a nutshell: A never-ending struggle to balance the different narratives surrounding Bitcoin's integration into the traditional financial landscape.

The Financial Press' Attempts to Understand Volatility

In attempts to pinpoint the causes of last week's volatility, a significant portion of the discourse zeroed in on ETF outflows, with CNBC, Financial Times and Fortune particularly spotlighting the activity around Grayscale's GBTC.

What's interesting about this focus is that it's not just about charting bitcoin's price; but it rather reflects the broader effort to weave Bitcoin into the fabric of mainstream financial products, which are more familiar to everyday investors who these outlets are catering to.

It also highlights the considerable impact that institutional investment strategies and macroeconomic events have on bitcoin's market performance, such as Federal Reserve decisions (CNBC, Barron's) and Bitcoin ETF movements.

This interplay between institutional mechanisms and macroeconomic factors continues to shape the narrative around Bitcoin's place in the financial landscape, which seems to keeping the audience of the financial mainstream press engaged and on the lookout for the next development.

The Press' Shiny Object Syndrome Continues

Switching gears to the oddball stories of the week: AI tokens and Ethereum's so-called Dencun Upgrade.

Does it feel strange to write about these things? Yes.

Is it interesting to see how these stories caught wind in the mainstream media's sails? Also yes.

Reuters' Medha Singh and Lisa Pauline Mattackal wrote that "AI tokens outpace record-breaking bitcoin" while Forbes contributor Natalia Karayaneva states that "while Bitcoin continues to dominate headlines, Ethereum has been undergoing a quiet revolution of its own".

To put these two stories in the same ring as Bitcoin is not really remarkable other than the fact that they just used Bitcoin's limelight to prop up stories about AI tokens and Ethereum.

Sad.

Give it a read.

Thoughts To Start The Week

Never in my wildest dreams did I think I would see the Financial Times using kindergarten analogies to teach their readers about how bitcoin mining works.

— Fernando Nikolić 🇦🇷 🟠 (@basedlayer) March 21, 2024

We are living in unprecedented times, folks. pic.twitter.com/yZZnLM5Iz9