EOW closing BTC price: $71,256

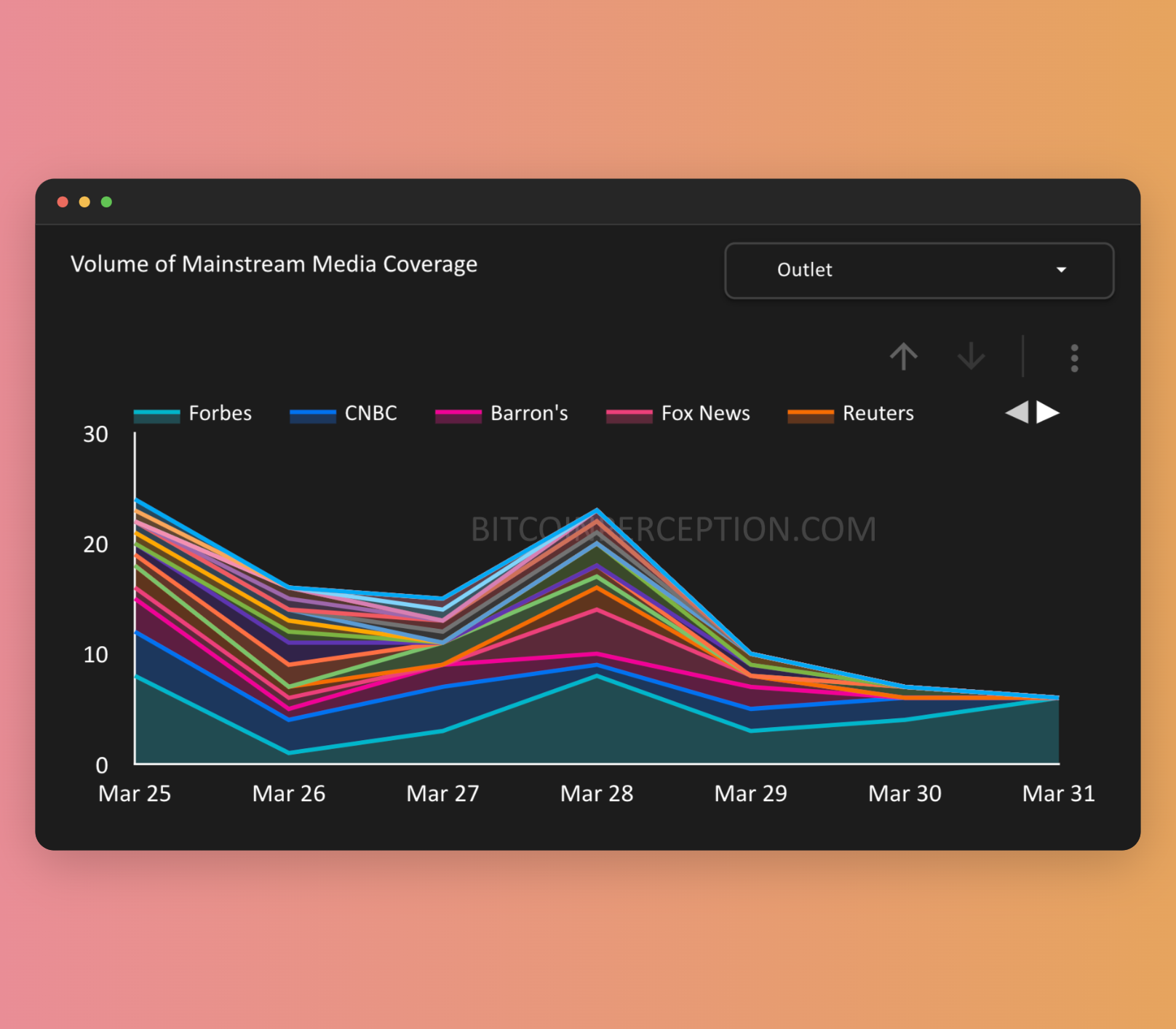

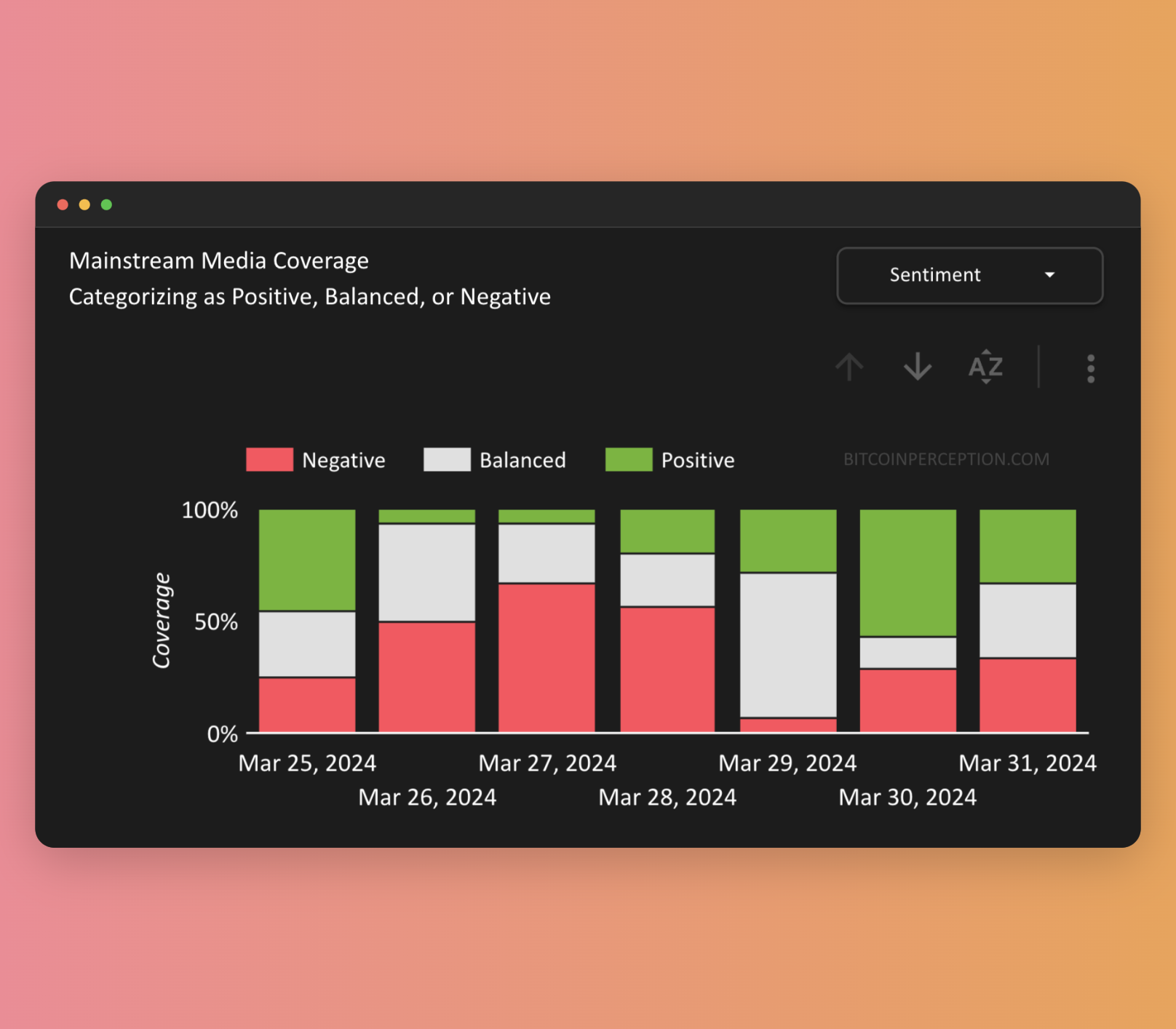

Date range: March 25 - March 31, 2024

In this report:

- Bitcoin is Digital Cayenne Pepper

- Finding the Next SBF

- I Can't Believe It's Not Mining FUD!

Weekly Snapshot

The best in Bitcoin, carefully curated by an alien from the future.

Sign up for free here.

Get the highest signal-to-noise ratio in the Bitcoin space. No clickbait, 100% free, unsubscribe anytime.

Main Topics of the Week

Bitcoin is Digital Cayenne Pepper

The more mainstream Bitcoin gets, the more fun it is to write these reports each week.

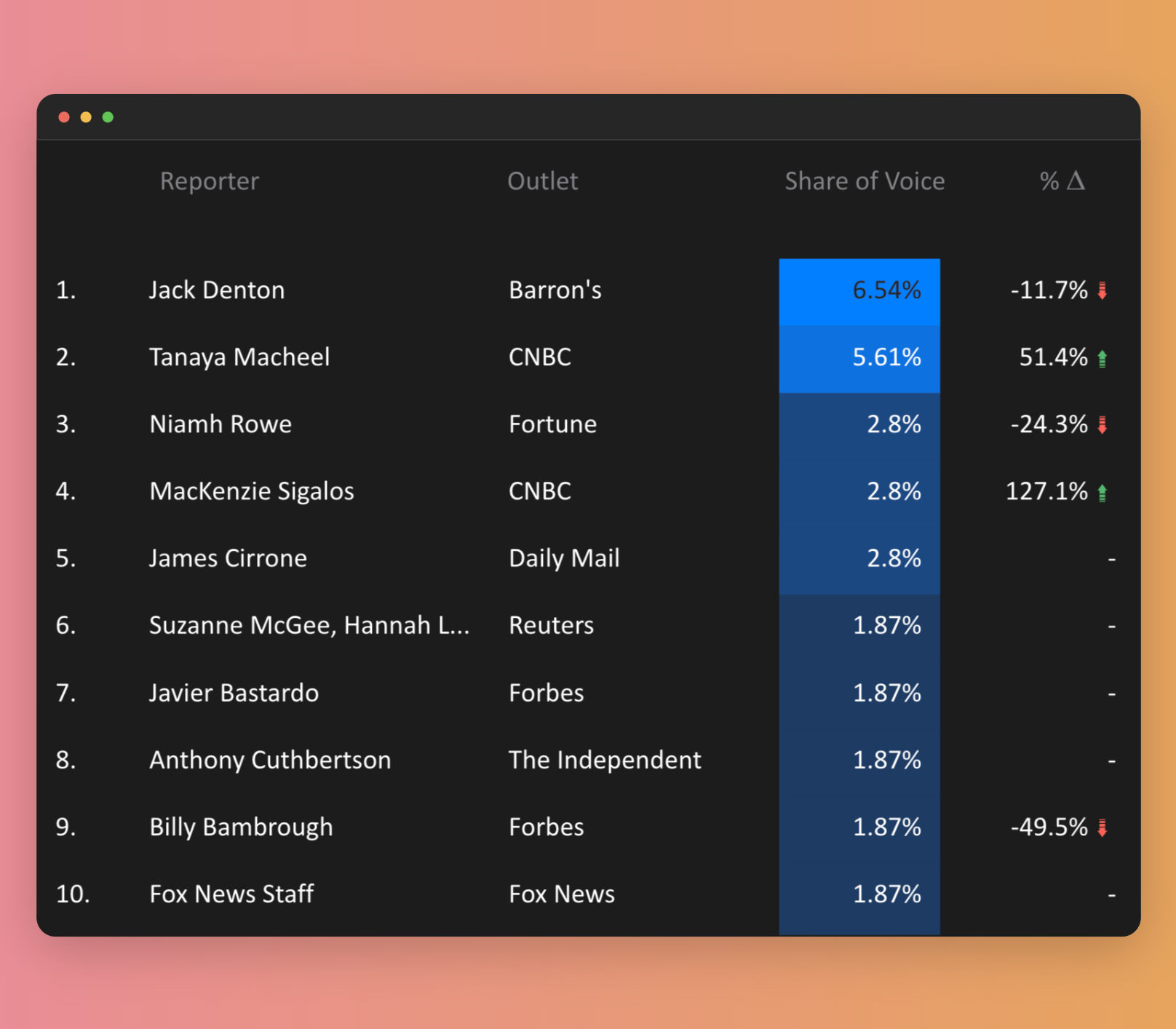

Case in point: CNBC promoting BTC portfolio diversification using an analogy comparing a strategic Bitcoin investment to adding cayenne pepper for just the right amount of kick.

This analogy not only highlights how the financial segment of mainstream media is promoting Bitcoin but also shows the growing acceptance of allocating 1-3% to Bitcoin as a smart strategy to boost portfolio returns with manageable risk.

That's a big step.

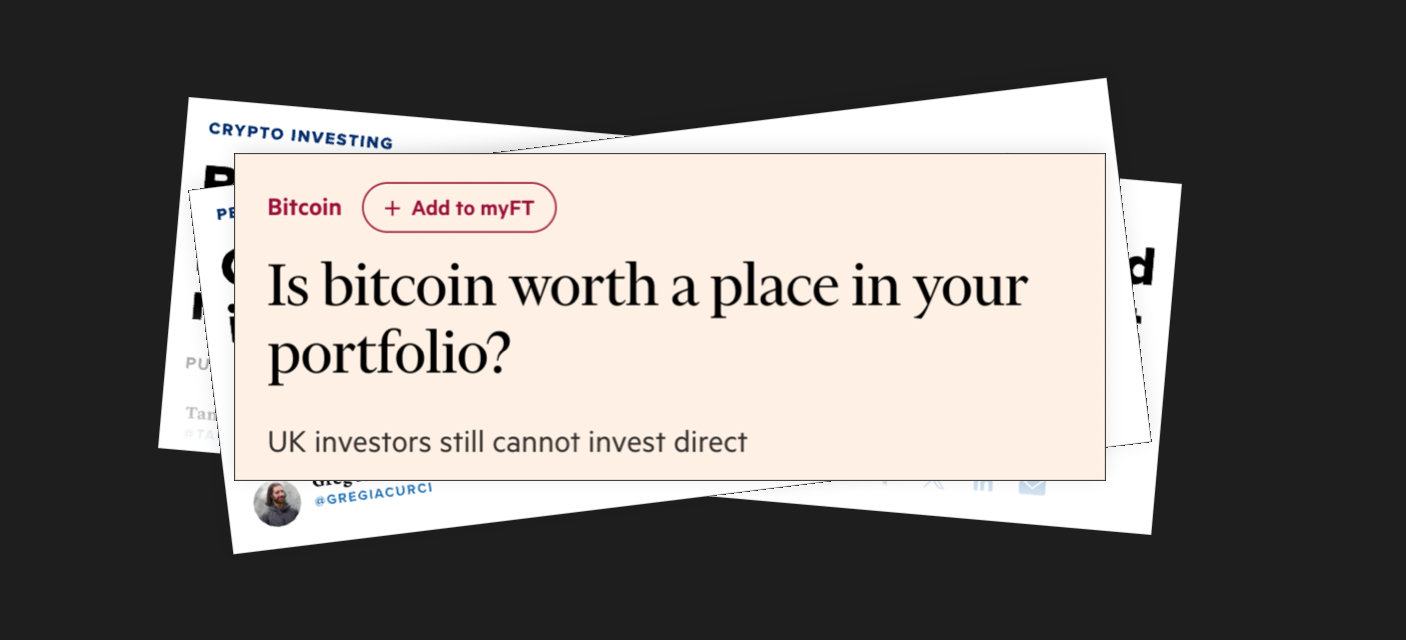

Over in the UK, the Financial Times has noticed an increasing sense of FOMO among investors. They've launched a survey to gauge their readers' interest in Bitcoin exposure. I'll be following closely to see what stories come out as a result.

Finding the Next SBF

This week, all eyes were on SBF's sentencing, sparking a flurry of speculation about potential outcomes and even the prison he might be sent to.

While the coverage of the actual sentencing has been exhaustive, I'll spare you the recap and highlight an interesting shift: It appears some media outlets are already scouting the next big story, with Forbes and the New York Post spotlighting Do Kwon.

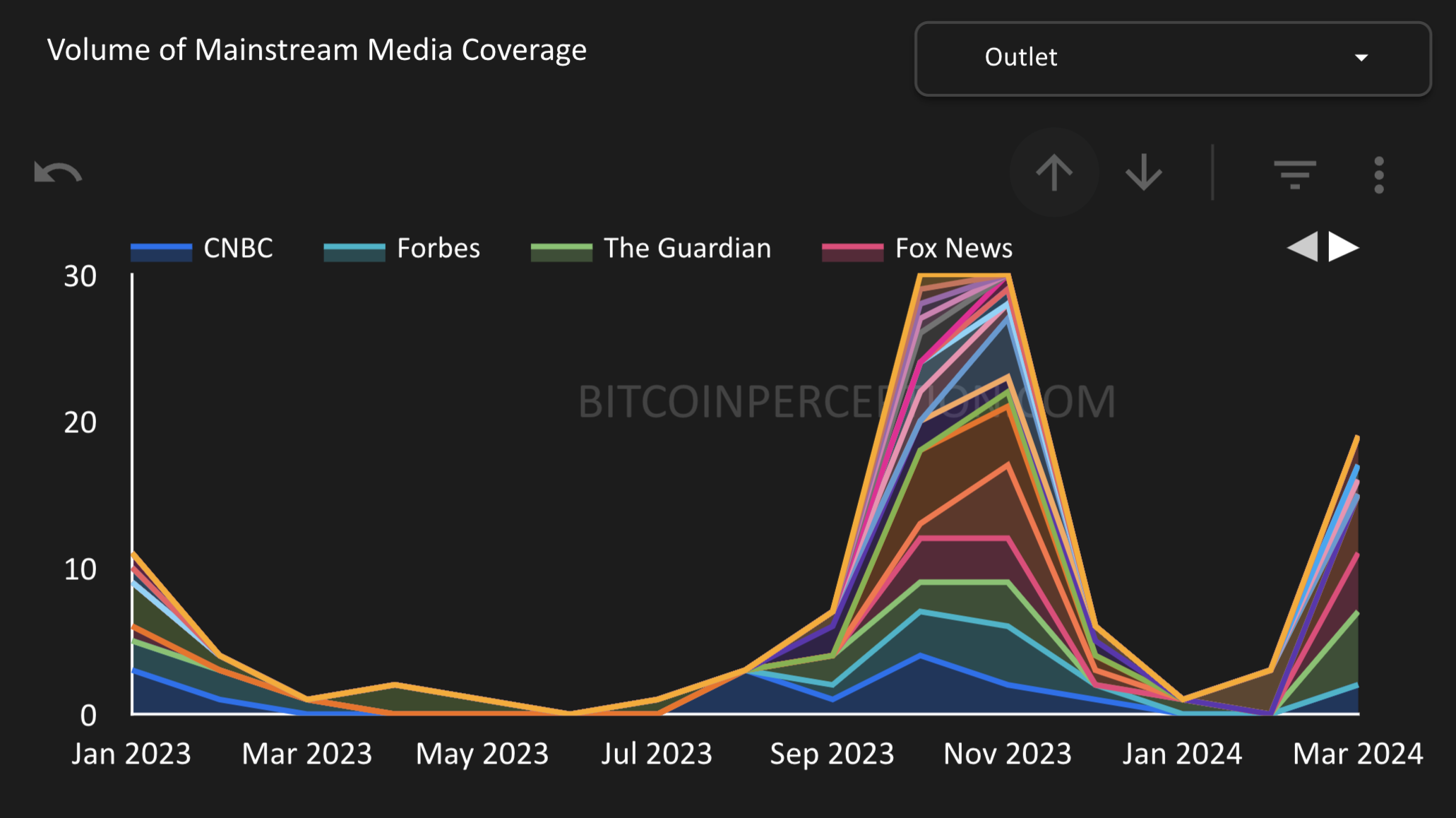

This speculative move makes sense knowing how much attention was put on SBF just since 2023. Covering the next 'crypto fraud' scandal is great if you're in the attention-grabbing business:

Something else worth mentioning is how Bitcoin just finds itself entangled in this negative coverage by virtue of being the market leader.

Bitcoin found itself entangled in SBF's sentencing on Friday.

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) March 30, 2024

Interestingly, it's the only cryptocurrency specifically mentioned by the MSM regarding the stolen funds in this case.

Guess that's what being number one entails. pic.twitter.com/D9FVnDKGXC

I Can't Believe It's Not Mining FUD!

This week saw a diverse range of mining-related stories, none of which dominated headlines but each offering a unique perspective.

Reuters wrote about how an environmental community group sued Stronghold Digital Mining, claiming the company's bitcoin mine in northeastern Pennsylvania that burns waste coal and old tires for energy is polluting nearby communities with dangerous chemicals.

Bloomberg wrote about how Bitdeer are in talks with private credit firms for capital, CNBC covered how Texan bitcoiners are starting to mine in Argentina, and Forbes offered a nuanced perspective on Iceland: its rich renewable energy attracts Bitcoin miners, yet the nation struggles with food self-sufficiency, relying on imports for essentials like grains and vegetables.

This variety showcases how mining's portrayal isn't uniform across outlets but varies greatly depending on individual reporters and their chosen narratives.

While I recognize this is a limited sample, it reinforces my observation that sections of the mainstream press are increasingly open to discussing mining from various angles.

It's encouraging not just that reporters are eager to explore these stories, but that their pieces are making it to publication.

A positive sign for the mining discourse.