Weekly Media Recap #37

EOW closing BTC price: $69,388

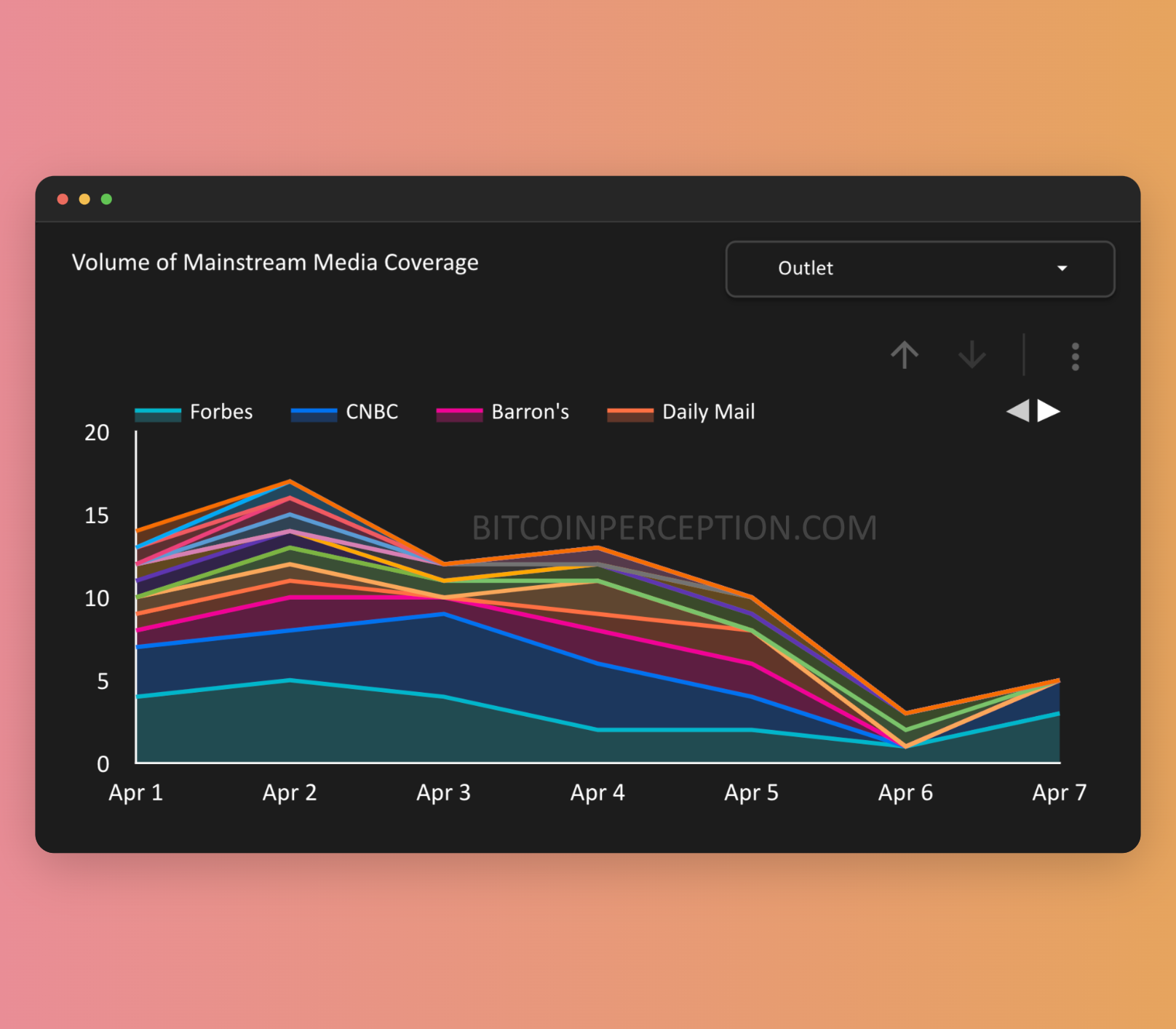

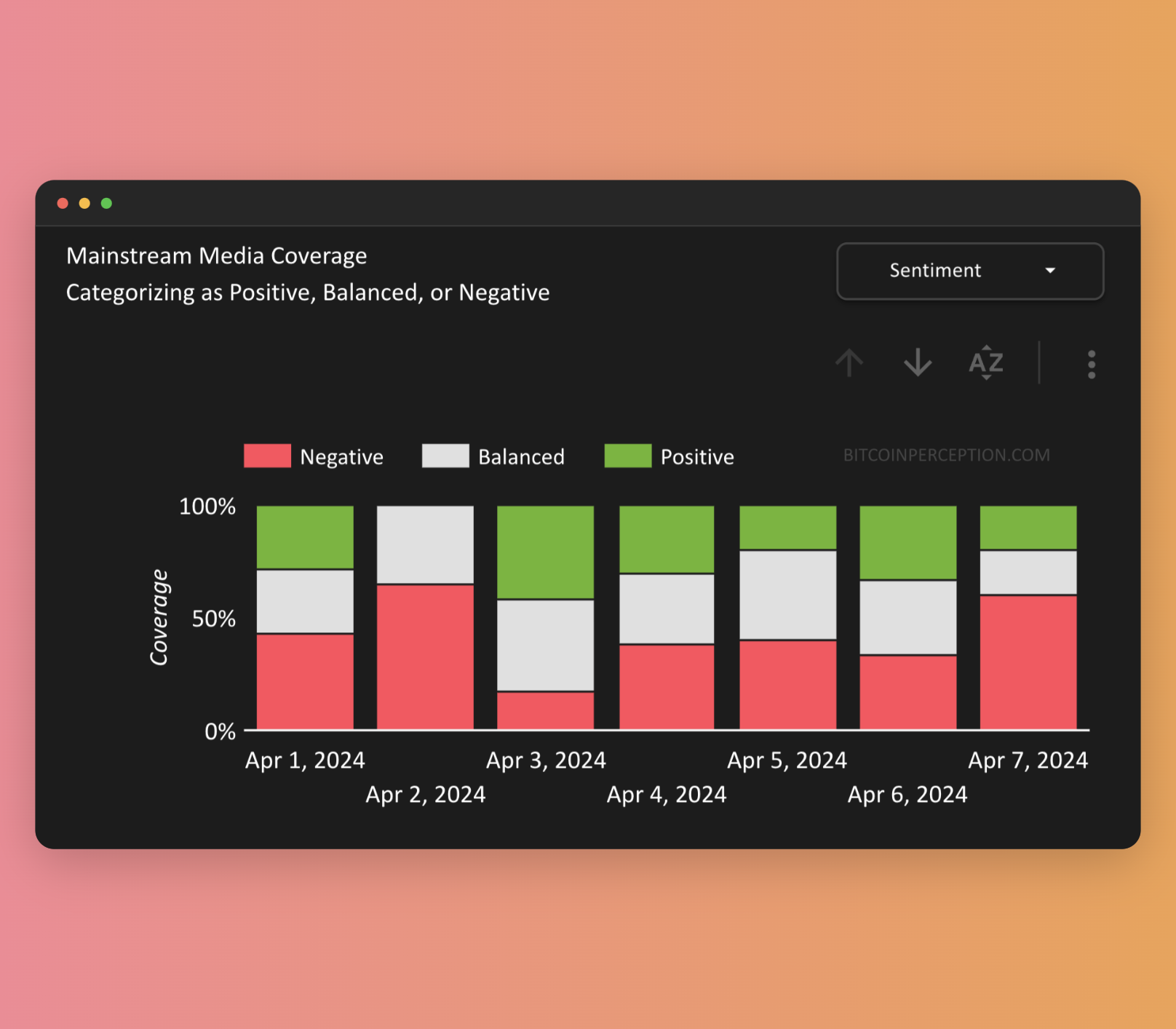

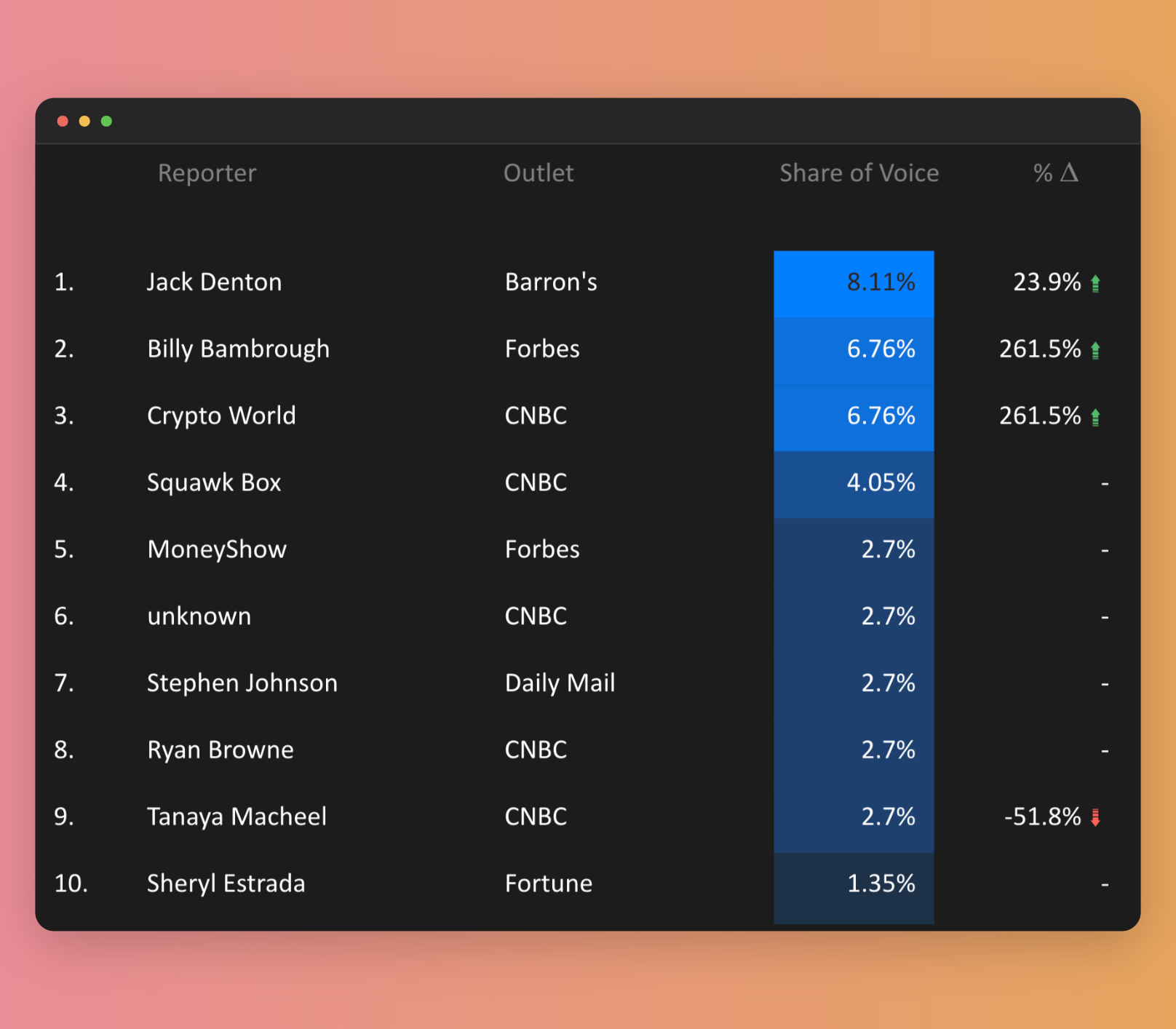

Date range: April 1 - April 7, 2024

In this report:

- The $70,000 Barrier

- Fed Policies Stir the Pot

- The Halving: A Focal Point of Anticipation

Weekly Snapshot

Main Topics of the Week

The $70,000 Barrier

We've previously covered how a price jump (or fall) in the ten thousands always has a psychological effect, and the $70,000 mark is the threshold du jour for Bitcoin, drawing significant attention and sparking a variety of analyses.

Barron's had a bullish note, stating that the fluctuation around this price level signifies more than just market volatility, but rather a deeper reassessment of Bitcoin's value.

Not too shabby.

Meanwhile, CNBC underscored bitcoin's responsiveness to broader economic indicators and investor sentiment.

More about that up next.

Fed Policies Stir the Pot

These broader economic indicators can be seen as the interplay between Bitcoin, traditional stock markets, and Federal Reserve policies which has been spotlighted by several sources.

Barron's and Forbes both pointed out the synchronized movements of BTC and the S&P 500, while Fortune and CNBC emphasized the impact of ETF outflows and treasury yield spikes, respectively, linking these trends directly to Fed decisions.

This narrative is complemented by The Independent, which observed the global market's reaction, indicating a worldwide ripple effect stemming from Fed policy adjustments.

What's interesting about these outlets drawing these parallels is that they're actively doing something in order to get normies onboarded to bitcoin.

If their understanding is directly attributed towards BTC as the superior asset, so be it.

All it takes is to open one door - any door.

The Halving: A Focal Point of Anticipation

As we approach The Halving, mentions in the mainstream media have surged, with the first week of April witnessing an astonishing 50% of March's entire coverage.

Since the start of 2024, The Halving's mentions have been on a steady rise each month.

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) April 6, 2024

Just the first week of April has hit 50% of March's record-breaking mainstream media coverage.

Anticipate an even bigger surge in the weeks ahead. pic.twitter.com/RaGziO9nfE

CNBC discussed the diverse purposes Bitcoin serves for different stakeholders, highlighting the strategic preparations by entities like Marathon Digital for the block reward reduction.

The otherwise not-so-friendly Financial Times seems to get around this concept as well, and chose to actually educate their readers on not only the Halving, but also its relation to the inflows/outflows dynamic of the ETF.

Here is the FT's digital finance news editor Philip Stafford:

Bloomberg shared insights into Bhutan's efforts to upgrade its mining capabilities, while Forbes projected a significant "Bitcoin Boom" in 2024, spurred by the Halving.

So Bhutan is ramping up their mining operations with a massive 500 MW upgrade.

Meanwhile, Bloomberg's breaking down the halving and difficulty adjustment for their readers.

We're entering a few weeks of interesting media coverage before The Halving takes place.

You are not bullish enough.