EOW closing BTC price: $65,713

Date range: April 8 - April 14, 2024

In this report:

- Bitcoin is Coming After Gold

- The Deutsche Bank Survey

- A Classic Bull Cycle Indicator

Weekly Snapshot

Main Topics of the Week

Bitcoin is Coming After Gold

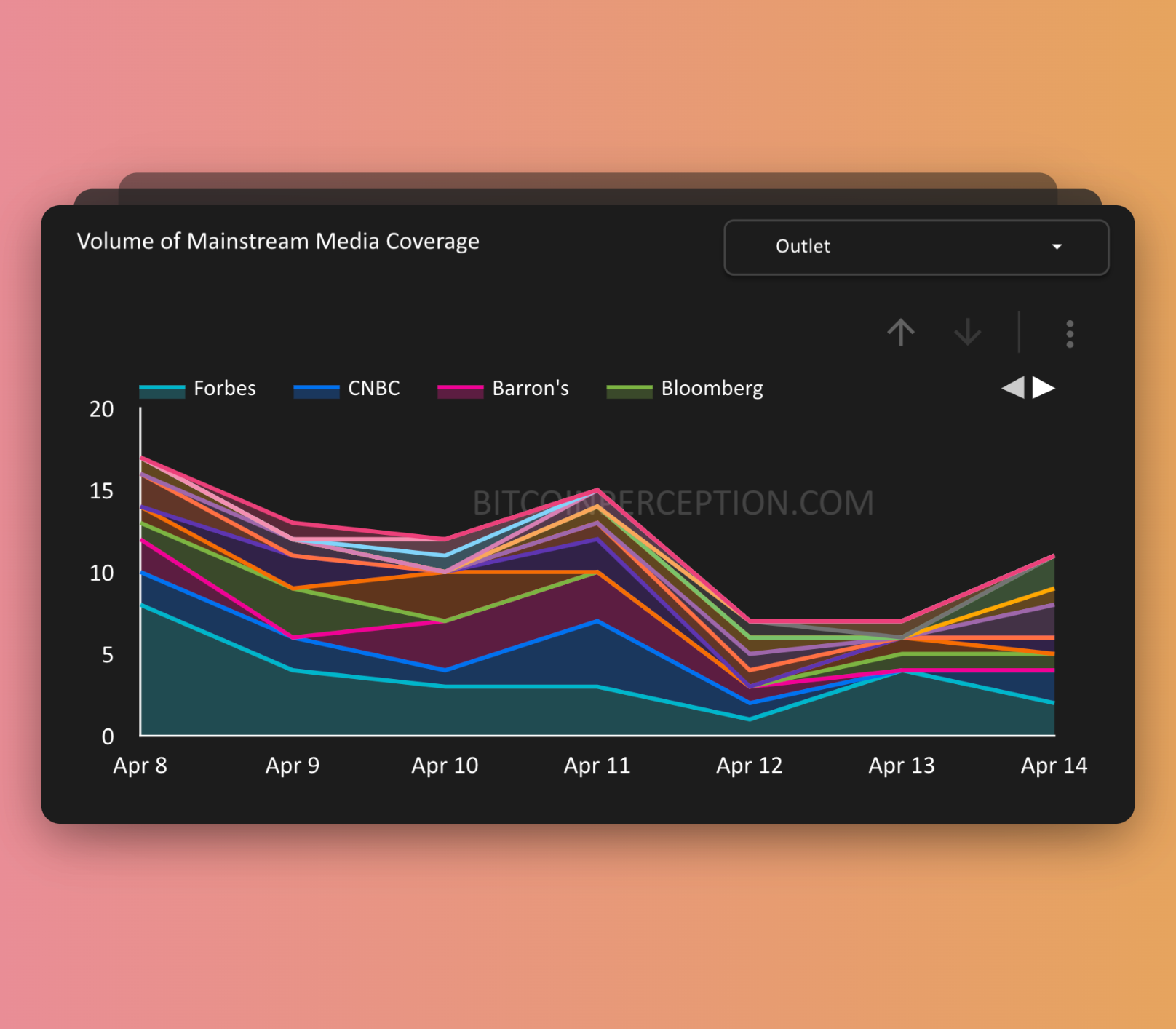

It's been an interesting week watching various media outlets all of a sudden analyze the relationship between gold and Bitcoin.

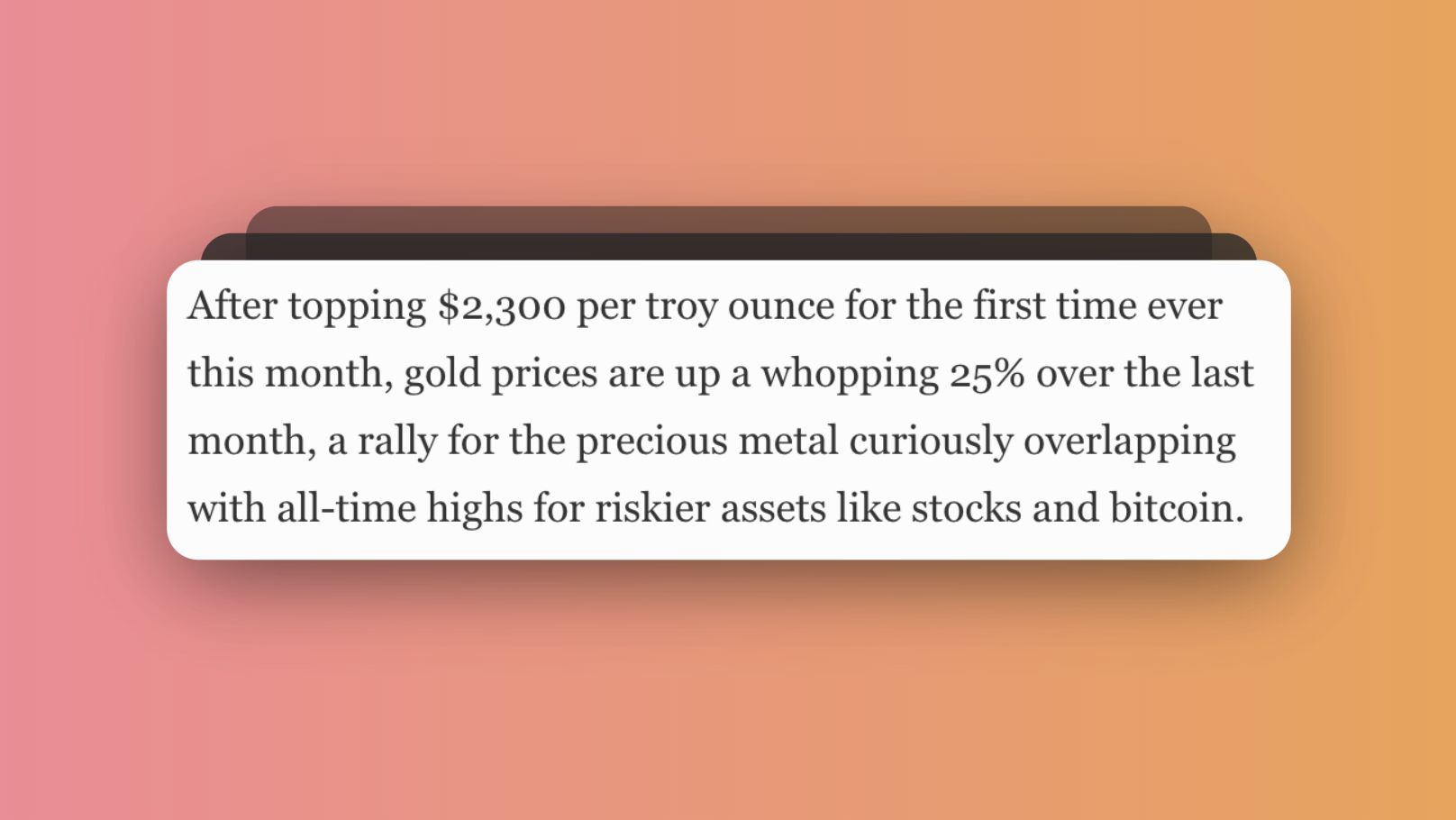

While discussions about Bitcoin potentially challenging gold’s market cap have been around for years, recent reports add some new twists to the tale as gold hit new all-time highs.

The question to ask: Is this a major step for introducing this narrative to the mainstream so BTC can reach gold's market cap in the coming years?

Maybe, if you ask Forbes and The Economist - CNBC remains skeptical about the idea of these two assets going head-to-head across all fronts.

From left: Quotes from Forbes, The Economist and CNBC

The Deutsche Bank Survey

Last week brought up a fun classic—big banks conducting surveys that aim to criticize Bitcoin, only to reveal more support for it instead.

Deutsche Bank surveyed over 3,600 consumers and found that 52% now see cryptocurrencies as an "important asset class and method of payment transactions" for the future. That's a jump from less than 40% in a similar survey from September 2023.

While Reuters reported on this without much ado, Bryce Elder from the Financial Times had a more colorful take, comparing the opinions of Deutsche Bank's clients to a cymbal-clapping monkey living inside Homer Simpson's head.

A pretty dismissive view of regular people’s opinions on Bitcoin!

A Classic Bull Cycle Indicator

As markets surge, a classic indicator that we're in a bull market is the way institutions—from Wall Street to Silicon Valley to multinational corporations—embrace Bitcoin. They're always looking for the next big market trend or wave to ride.

Last week, several mainstream media outlets showcased a diverse range of topics that hint at potential major trends in this bull cycle, including Bitcoin Layer-2 solutions (Fortune), corporate blockchains (Forbes), and asset tokenization (Bloomberg).

Bloomberg highlighted that venture capital investment in crypto startups hit $2.5 billion in the first quarter of 2024, marking a 32% increase from the previous quarter.

But the question remains: How much of this investment surge is actually funneling back into Bitcoin itself?