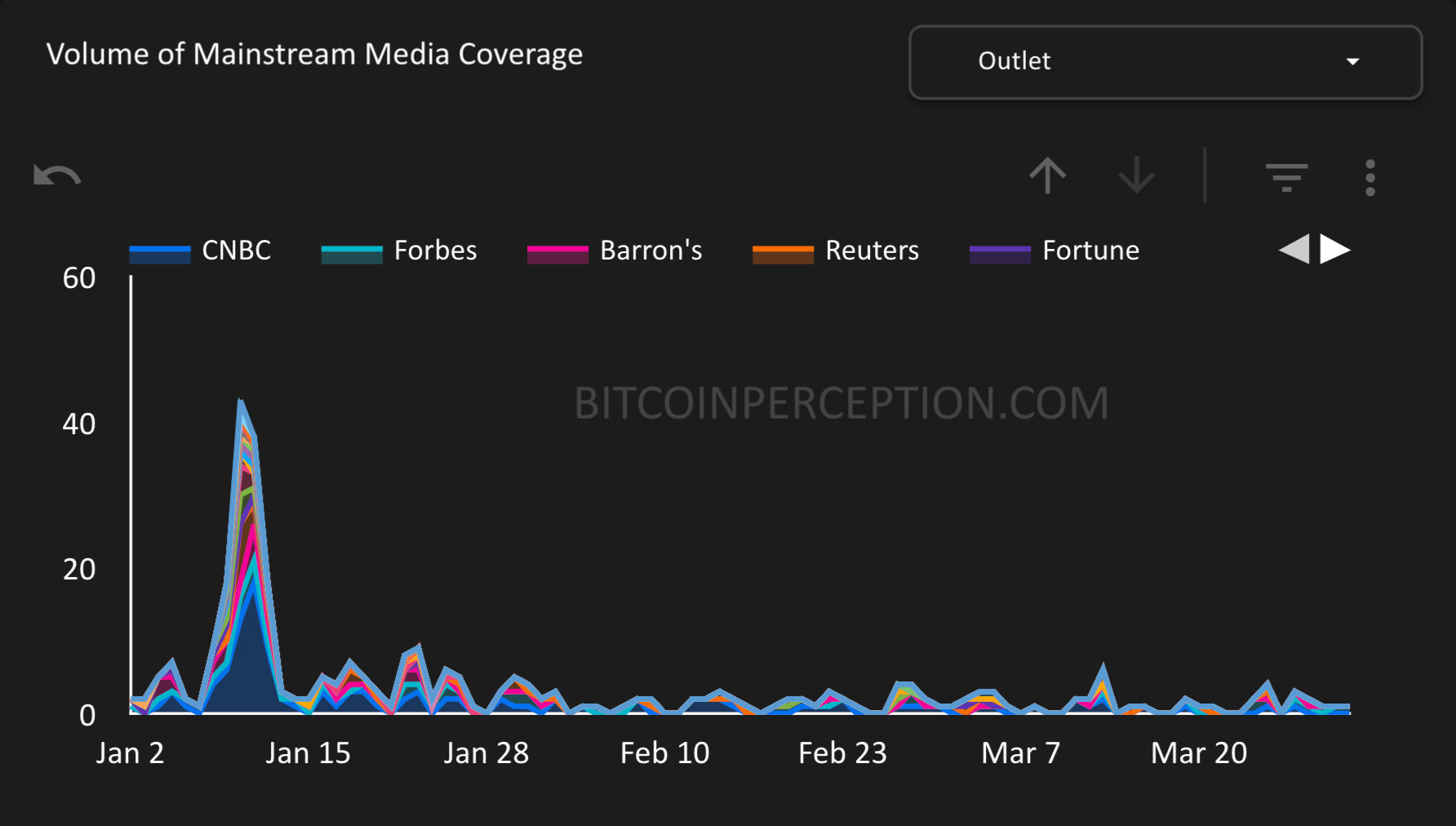

With a total of 1,484 pieces covering everything from the buzz of recent ETF approvals to the farcical unraveling of one of Bitcoin's most contentious characters, this report delves into the mainstream media's extensive coverage of Bitcoin in the first quarter of 2024.

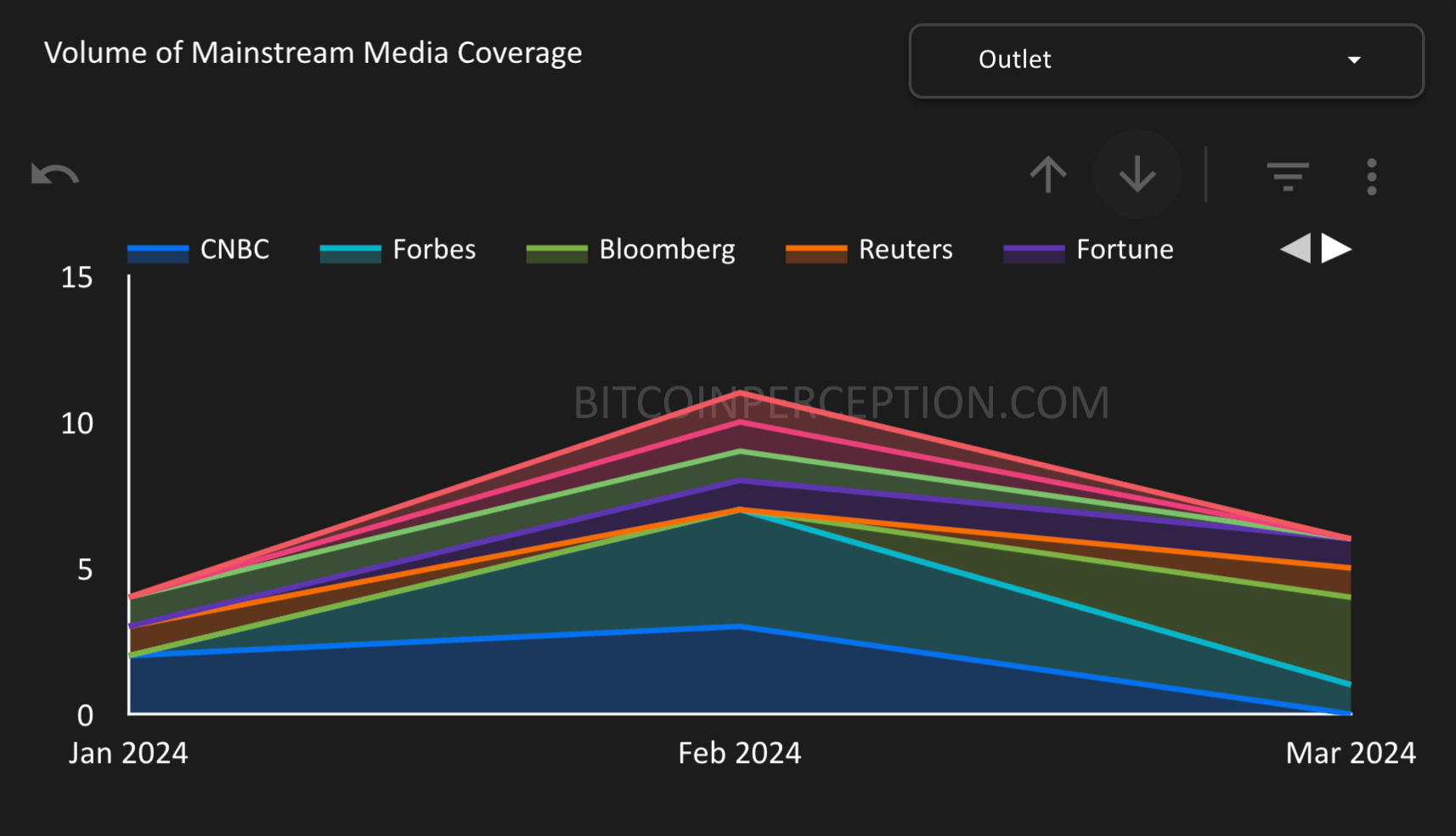

Seeing a 36.1% increase in coverage from previous quarter, the report will examine insights from over 40 leading English-language outlets.

To see how we retrieve the data, please see our Methodology page.

This research article was reviewed by Edward Moore.

Introduction

As Bitcoin continues to weave itself into the global financial tapestry, its portrayal in the mainstream media remains a critical barometer of its acceptance and broader societal understanding.

This report not only explores key media themes from Q1 2024 but also provides detailed analysis of these portrayals, assessing their accuracy and the media’s role in either championing or challenging Bitcoin’s integration into mainstream finance.

The Champions & The Challenged

1. Institutional Adoption and Regulatory Impact

Q1 saw significant developments in Bitcoin's regulatory landscape, notably with the U.S. SEC’s approval of several Bitcoin ETFs. This milestone symbolized a turning point for Bitcoin’s acceptance among traditional investors.

The narrative was largely positive, framing Bitcoin as stepping closer to mainstream financial endorsement.

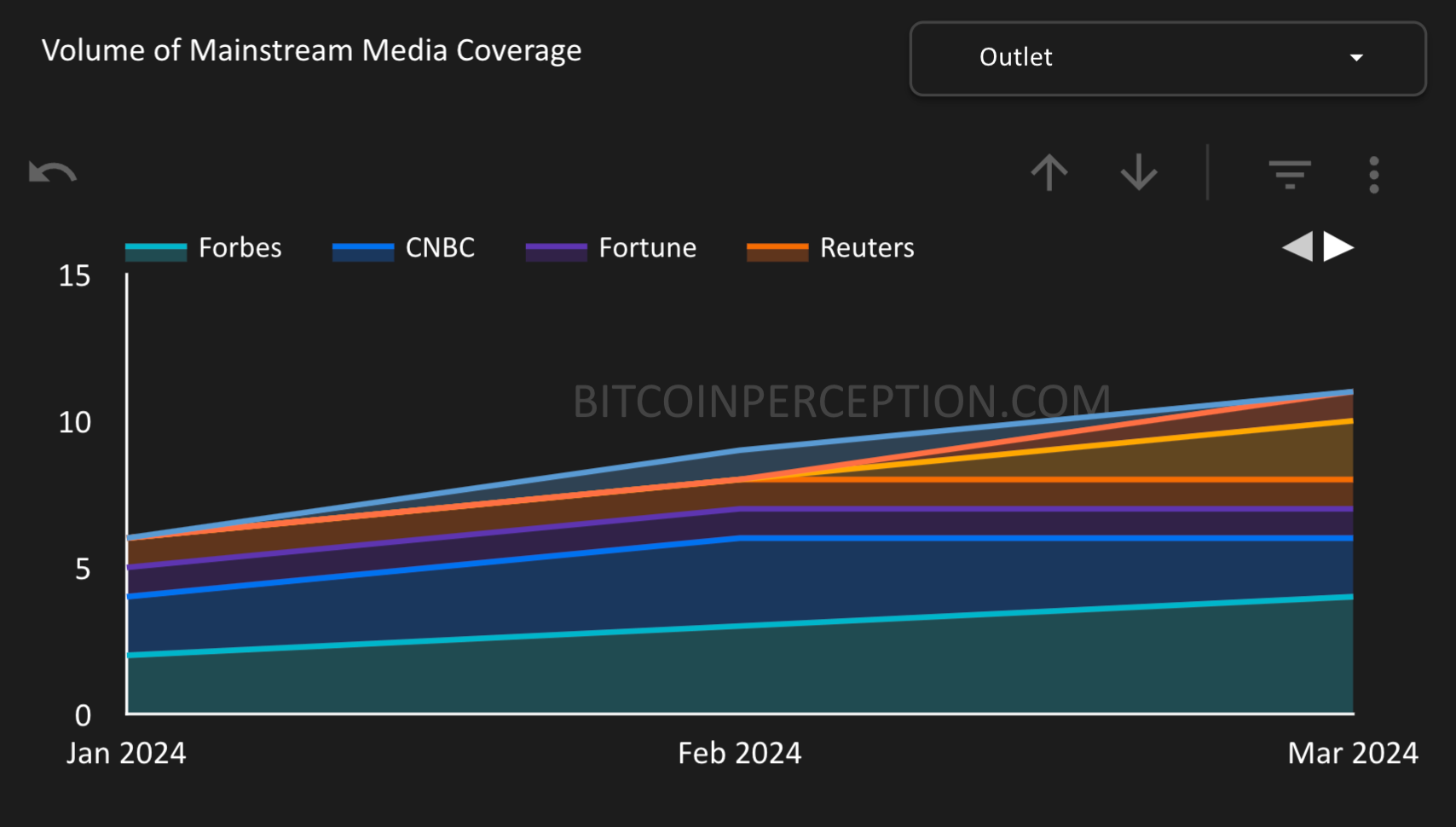

In terms of volume, most of the coverage predated the ETF launch on January 10th, but has consistently been part of the overall coverage in the weeks and months since.

The impact of institutions on Bitcoin's market dynamics was another focal point, examples including reports that Japan’s largest pension is considering investing in Bitcoin underscoring growing trust in Bitcoin’s legitimacy as an investment vehicle.

These stories provided a counterbalance to the typical price volatility discourse favored by mainstream media, suggesting a maturation in perspective of the overall financial sector.

Yet despite this evolving perspective, a fixation with price volatility remained a dominant theme.

Highlighted stories:

World's largest pension fund explores bitcoin as an investment (CNBC)

SEC Approves Bitcoin ETFs for Everyday Investors (WSJ)

Volatile bitcoin falls from record high as crypto frenzy hits pause (Reuters)

2. Volatility and Market Dynamics

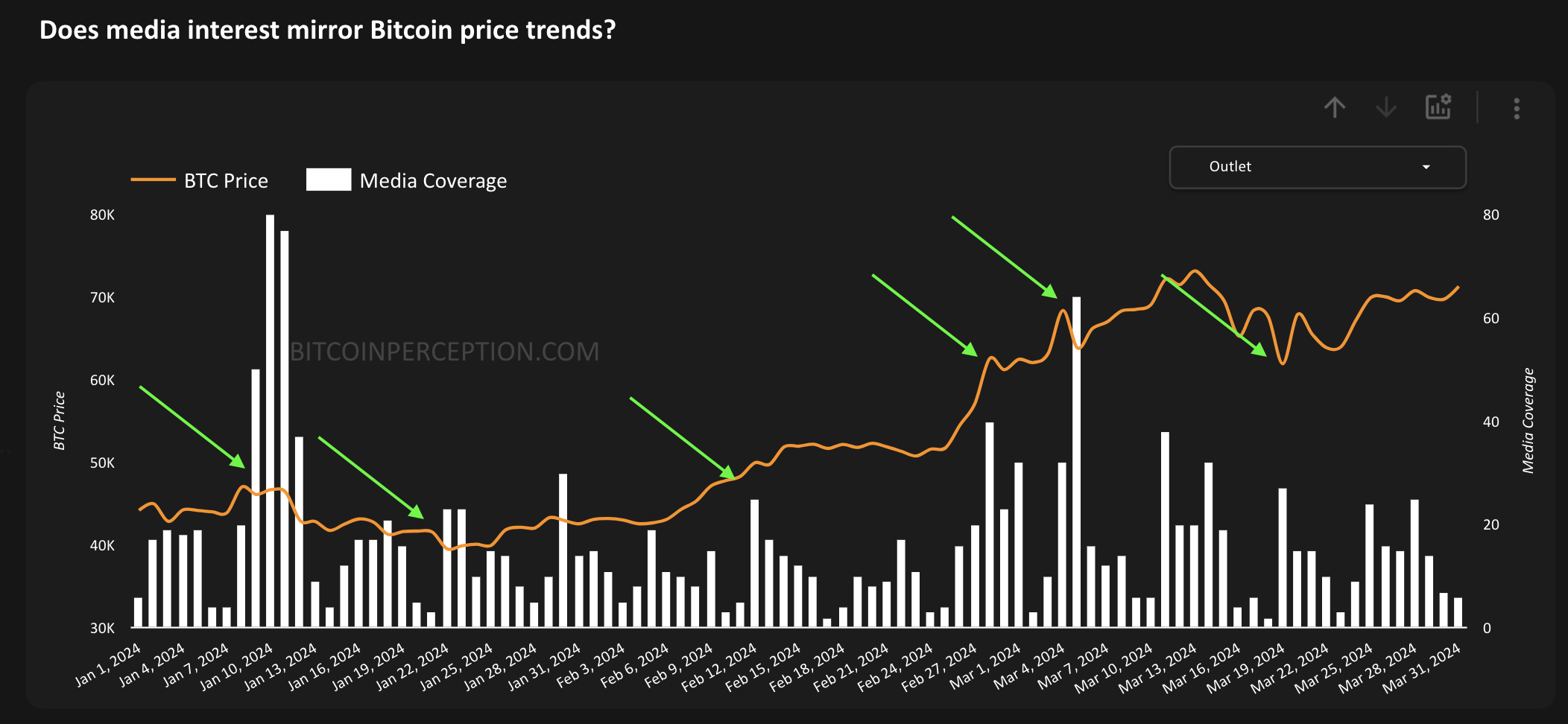

The mainstream media’s enduring focus on volatility underscores the complexities of Bitcoin's integration into mainstream finance.

Such coverage remained prolific in Q1, with media outlets quick to report on significant price movements.

There were some key examples, however, that show things might be starting to change.

CNBC's comparison of Bitcoin to "digital cayenne pepper,” for instance, served to creatively highlight Bitcoin’s valuable role in diversifying investment portfolios, suggesting that even a small allocation could significantly impact overall portfolio performance.

Fortune and Barron's added nuance to the volatility discussion by linking it to macroeconomic triggers such as U.S. Federal Reserve policies and broader global market shifts.

This coverage not only informed the public but also educated it on the intricate balance between Bitcoin and global economics.

Highlighted stories:

Crypto is ‘like cayenne pepper’ for investors, money manager says: ‘A little goes a long way’ (CNBC)

Bitcoin Rallies and Crypto Prices Roar Back as the Fed Comes to the Rescue (Barron's)

Bitcoin slumps toward $62,000 due to record GBTC outflows and Fed rate-cut waiting game (Fortune)

3. Controversies and Challenges

The Craig Wright saga continued to capture headlines, chronicling the latest developments and ultimate conclusion of the COPA vs. Craig Wright legal battle.

What was interesting is how the mainstream media’s coverage of the case evolved over the quarter, from a focus on the sensational aspects to a more nuanced discussion of the implications for Bitcoin's image.

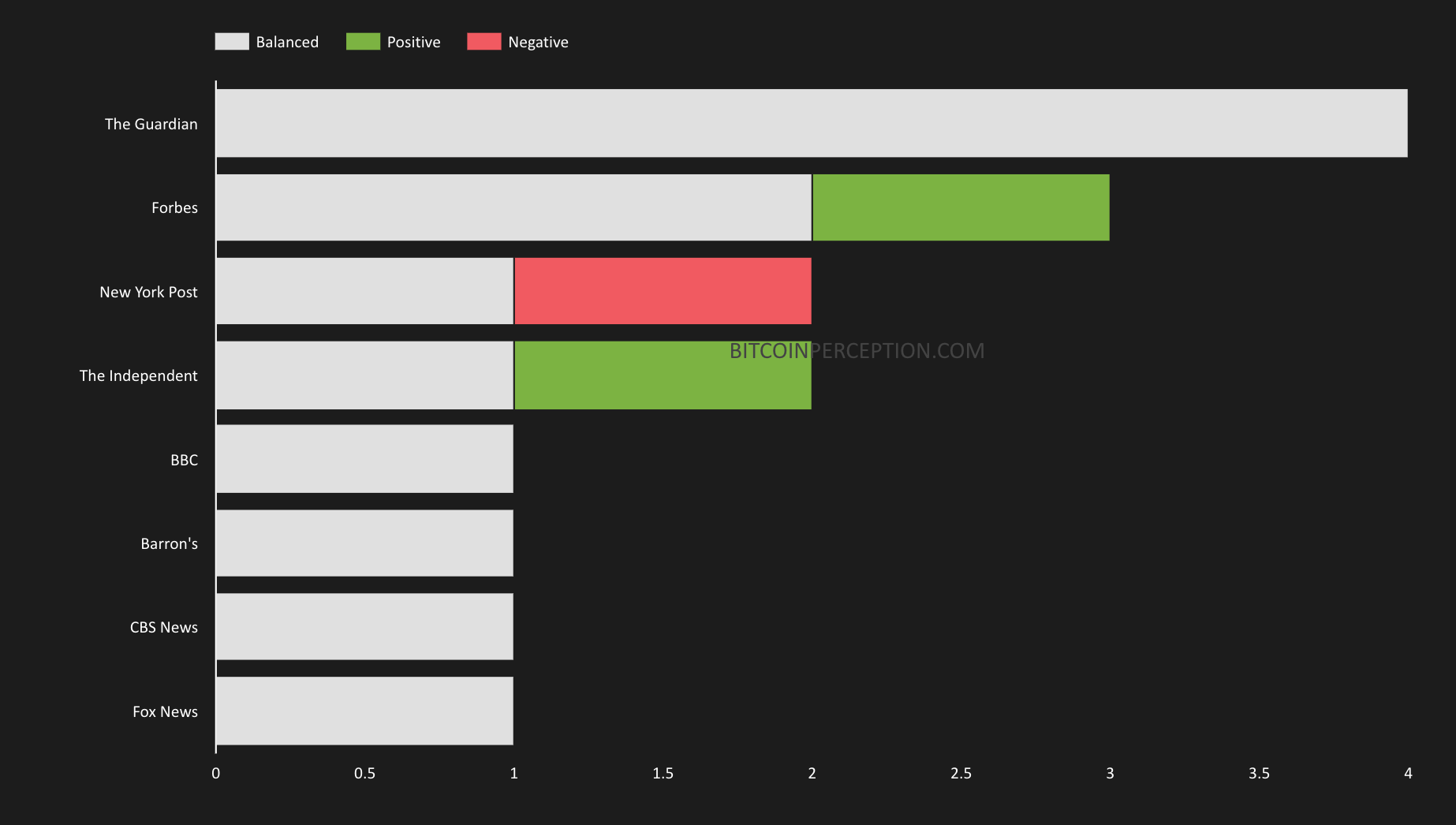

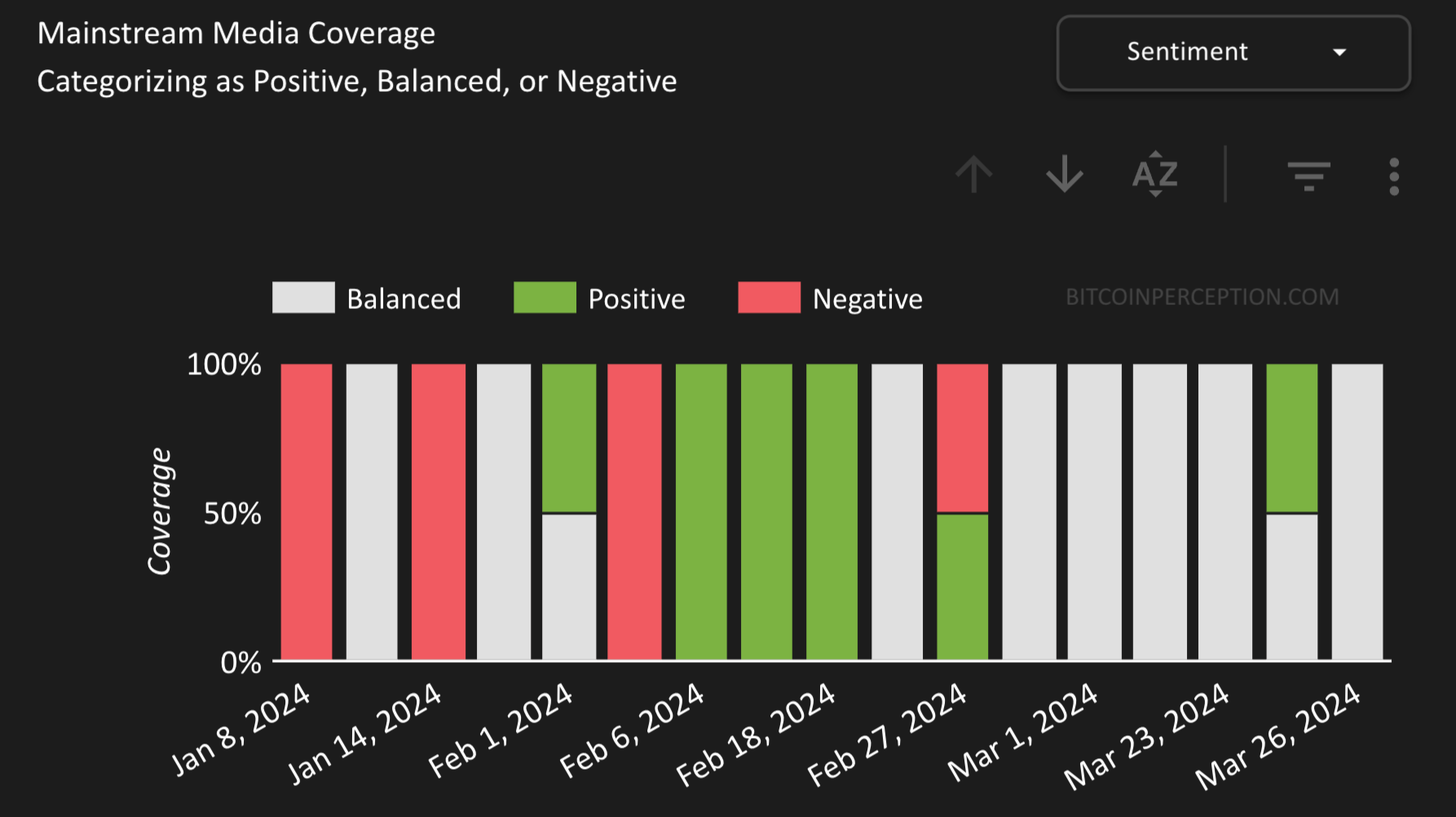

For the most part, the media shied away from overtly controversial angles, and the overall coverage of the COPA vs. Craig Wright case was 80% balanced.

One historically controversial topic that shows few signs of going away, however, relates to the environmental concerns surrounding Bitcoin mining highlighted across several Bitcoin Perception reports throughout the quarter.

Yet there does seem to be a narrative shift of sorts taking place.

Fox News reported on House Majority Whip Tom Emmer's claims that the Biden administration was overstepping by targeting 82 bitcoin mining firms for proprietary energy consumption data. They included insights from Sam Lyman, director of public policy at Riot Platforms, ensuring a balanced perspective by featuring expert commentary.

Forbes meanwhile explored Bitcoin mining’s increasing transition to renewable energy sources, illustrating the sector's response to sustainability demands.

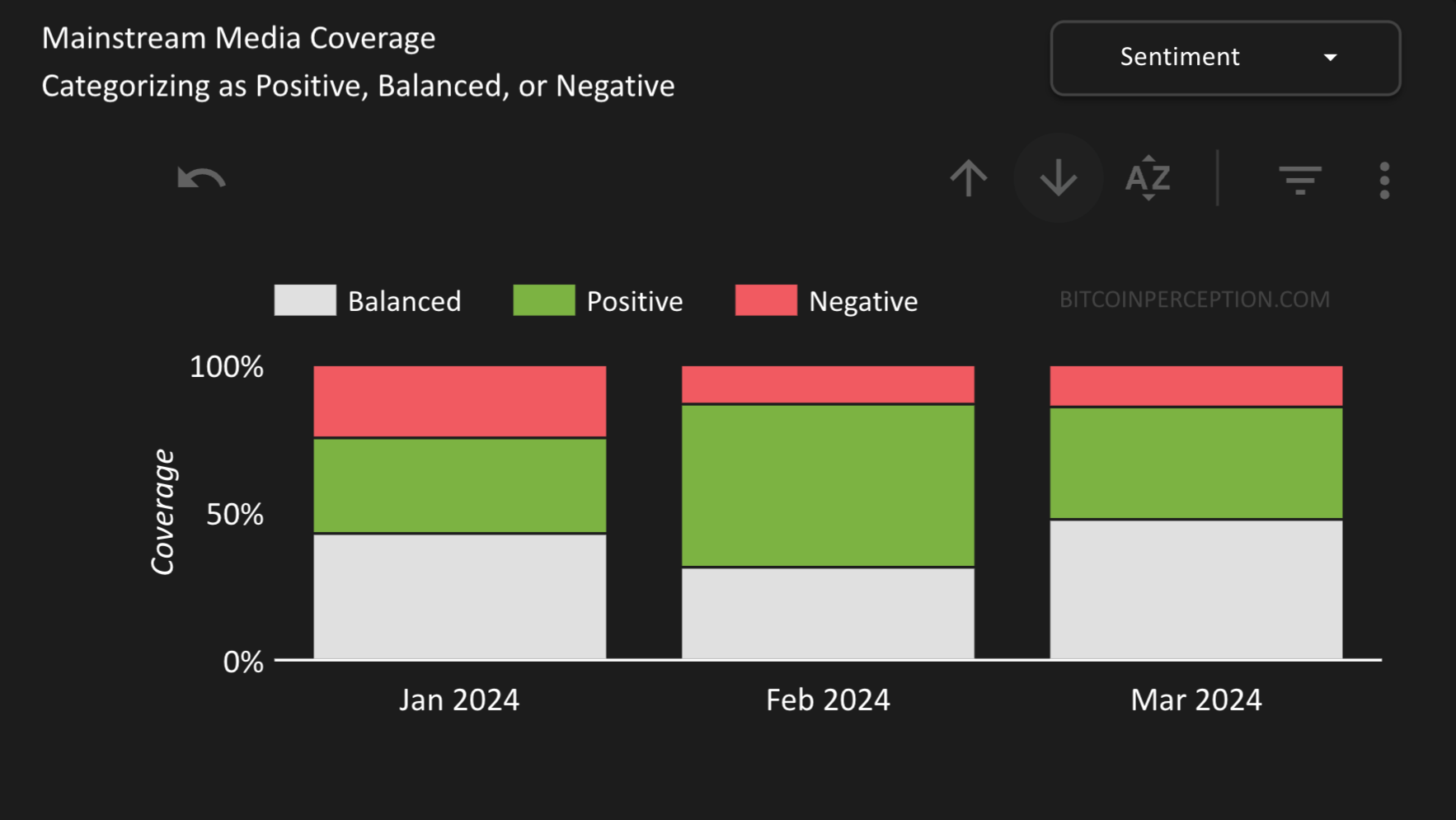

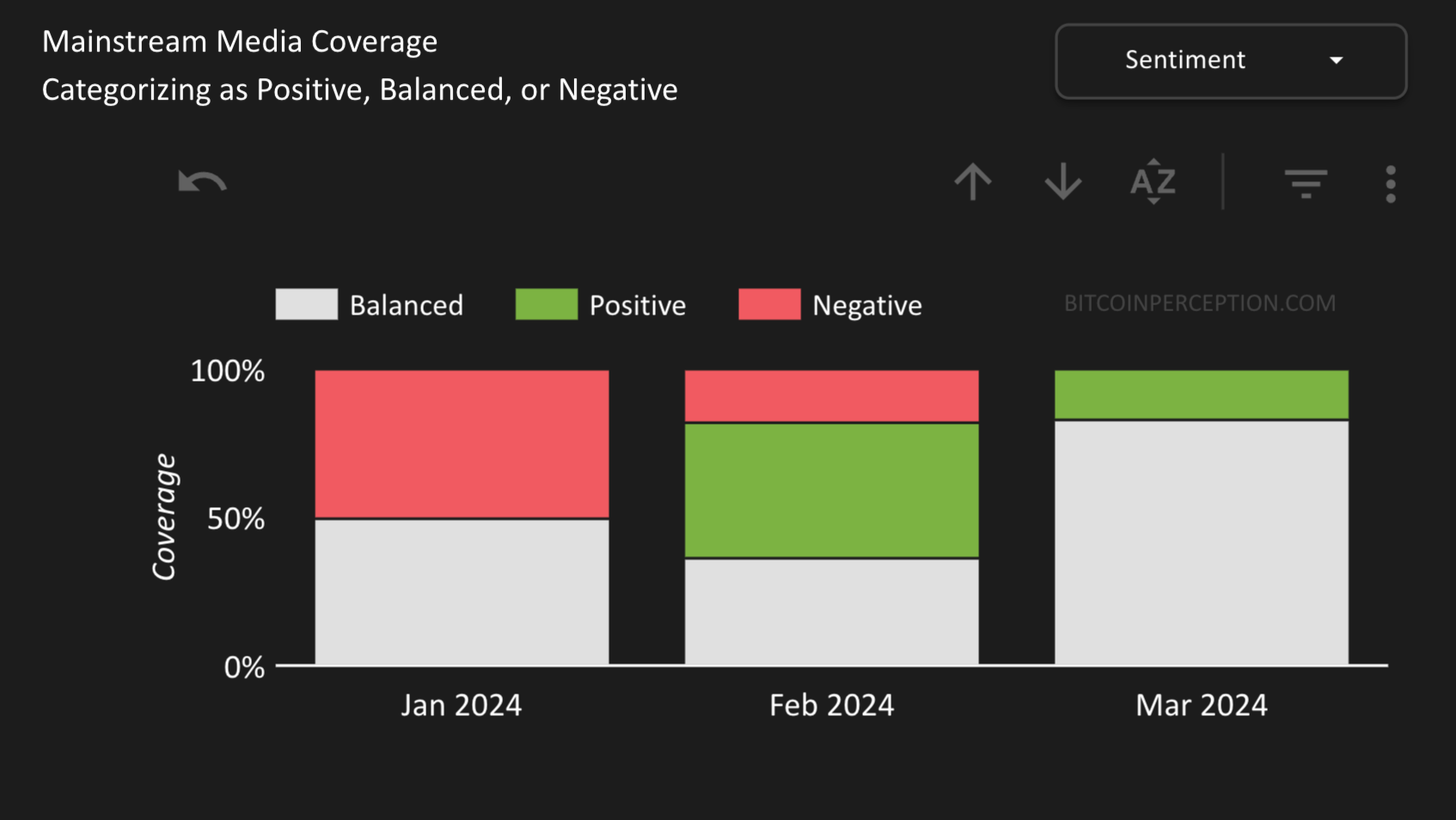

A look at the overall sentiment related to Bitcoin mining shows only January saw overly negative coverage, becoming increasingly positive following the approval of the ETFs.

Coincidence?

What's also important to highlight is that mainstream media coverage focused specifically on Bitcoin mining remained relatively low volume overall.

Highlighted stories:

Craig Wright’s claim he invented bitcoin a ‘brazen lie’, court told (The Guardian)

Ethiopia's $250 Million Tech Expansion In Bitcoin And AI (Forbes)

Top House Republican says Biden admin abusing power to target bitcoin miners (Fox News)

4. Cultural and Social Narratives

With the first quarter of the year being seen as the moment Bitcoin finally went mainstream, it was interesting to see pockets of the press using metaphors and analogies that resonate with a non-technical audience.

A prime example of this trend was the media’s increased focus on the Halving, a topic given minimal attention in the past.

This new interest not only sparked discussion about its potential impact on Bitcoin’s price but also provided an opportunity for all manner of creative explanations of what the Halving and mining actually entails.

Examples include the classic explanation that the miners who win a block are the first to solve a complex math problem, provided by Fortune:

Another curious one is how the Halving is labeled a 'software upgrade', courtesy of Bloomberg:

While great for newcomers wanting to know more about Bitcoin and the Halving, such efforts to educate were inconsistent to say the least.

The media’s persistent conflation of Bitcoin with altcoins and emerging technologies like AI tokens and upgrades to Ethereum reflect a broader fascination with the 'new' over the 'significant’ that arguably undermine efforts to educate about Bitcoin’s uniqueness and significance.

Despite these challenges, the trend towards more informative coverage is promising and, while there's still much progress to be made, things appear to be moving in the right direction.

Highlighted stories:

Asleep At The Wheel: The MSM's Fixation With Altcoins (Bitcoin Perception)

Bitcoin ‘Halving’ Spurs Exodus of Old US Mining Computers Abroad (Bloomberg)

The Bitcoin ‘halving’ will change crypto—again. Here’s everything you need to know (Fortune)

Conclusion

The first quarter of 2024 showcased a dynamic interplay between Bitcoin’s evolving market presence and its portrayal in the mainstream media.

While the coverage has grown increasingly sophisticated, discrepancies remain, particularly in the depth and focus of reporting.

This underscores the need for ongoing engagement between the Bitcoin community and journalists to ensure that coverage not only accurately reflects the current state of affairs but also educates and informs the public.

This report should serve as a foundational resource for media outlets, investors, and policymakers interested in the nuanced portrayal of Bitcoin in mainstream media, aiming to foster a well-informed public discourse around this transformative digital asset.

Disclaimer: This report is based on an independent analysis of Bitcoin coverage by selected mainstream media outlets up to the end of Q1 2024. It is intended for informational purposes only and does not constitute financial advice. While every effort has been made to ensure the accuracy and reliability of the information, the dynamic nature of media coverage and the Bitcoin market can lead to varying interpretations. Readers are advised to conduct their own research and consult professional advice before making any financial decisions based on this report.