EOW closing BTC price: $63,109

Date range: April 22 - April 28, 2024

In this report:

- Lines Drawn Between Outlets

- The Bitcoin Halving Hangover

- Samurai Showdown in Privacy Battle

Weekly Snapshot

Main Topics of the Week

They're struggling with balancing Bitcoin's significant potential against its volatility and regulatory uncertainties.

These were the most covered topics.

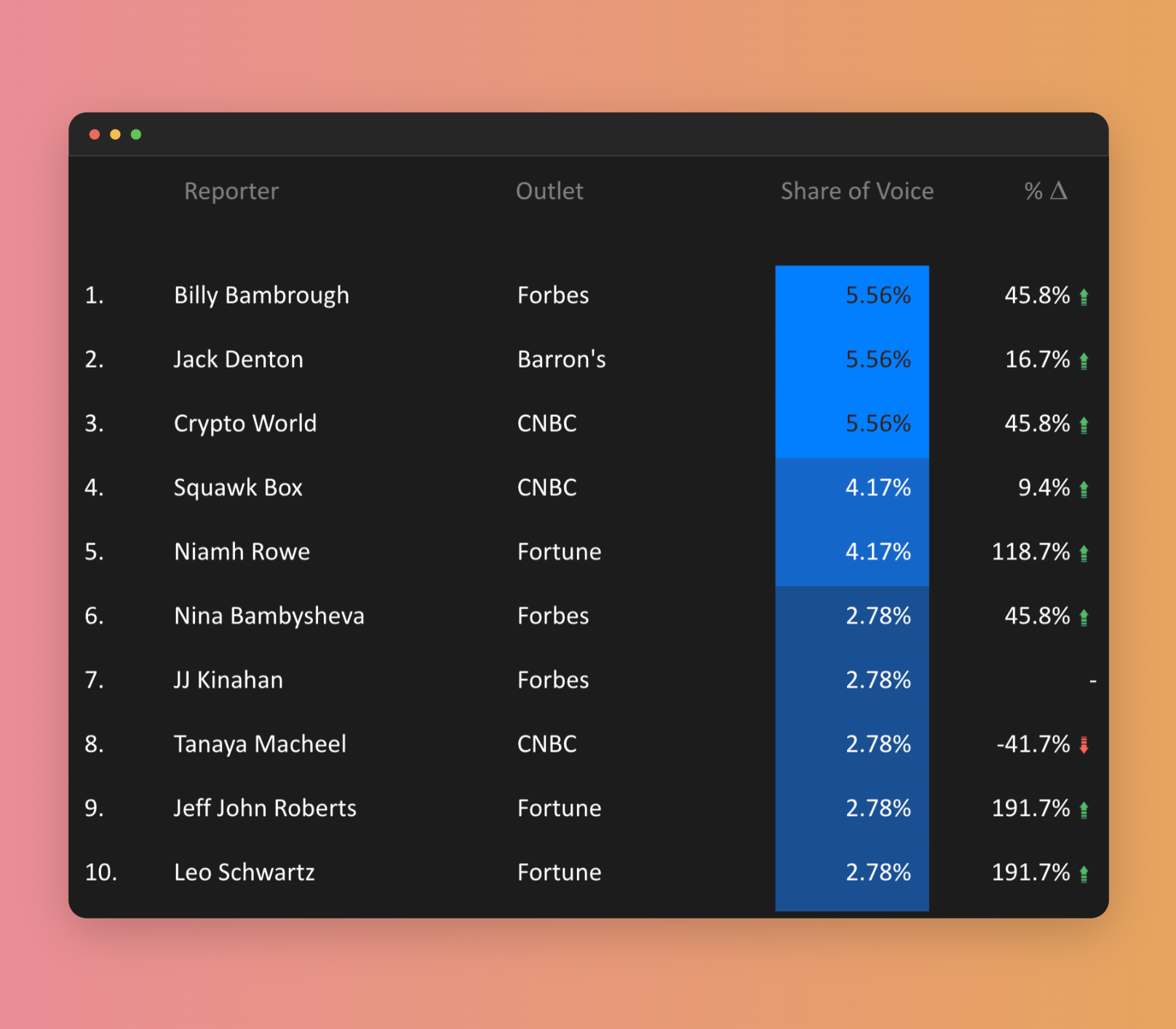

Lines Drawn Between Outlets

When it comes to Bitcoin's price movements, headlines will forever spotlight the ups and downs that define the market simply because the dramatic effects makes for great headlines. This will never change.

So after the latest Bitcoin halving, it's no surprise to see Barron's Jack Denton pondering whether everything might be due for a fall after hitting $66,000, choosing to position BTC as a speculative asset.

To take the other side of the narrative, CNBC's Crypto World chose to highlight the rise past $66,000 following the halving as that underscoring the narrative of Bitcoin as both a promising and unpredictable investment.

This highlights that lines are already drawn between outlets, with dominant perceptions at each forming the basis for their editorial decisions. Some outlets are more transparent in their biases than others, though, but the trend is noticeable.

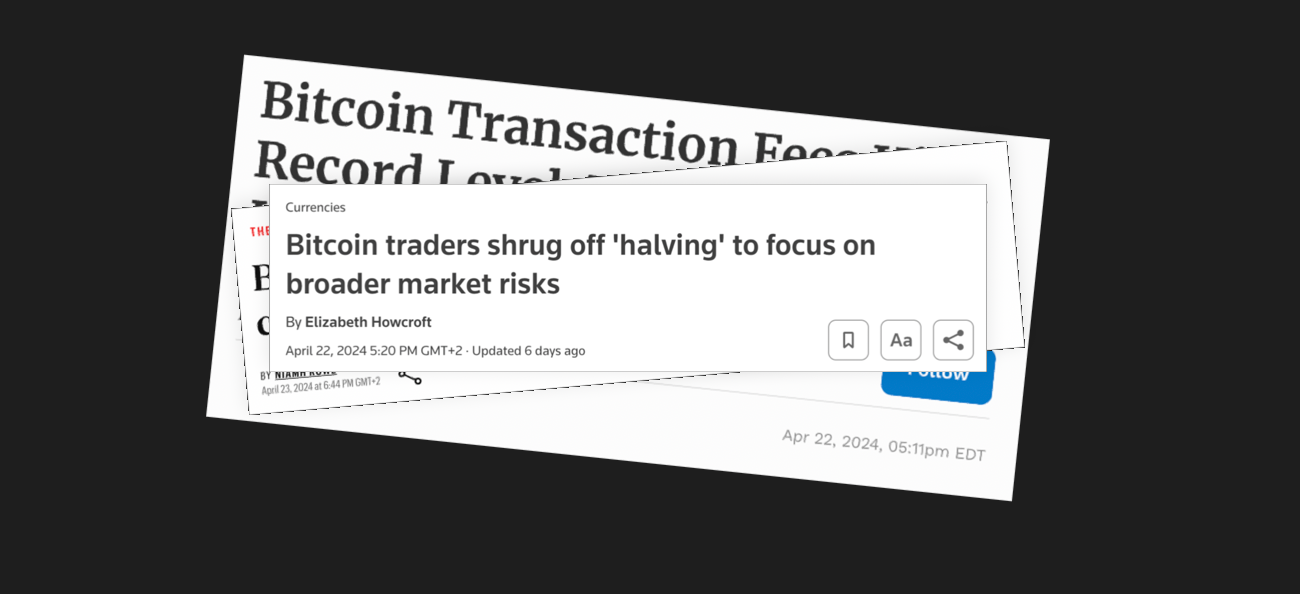

The Bitcoin Halving Hangover

The Halving has been a major focal point due to their potential impact on supply - and, consequently, price - and we have covered how intensely they covered it leading up to the event in the last week's issues.

Looking at the overall media coverage, it has been delving into the halving with a blend of technical explanation and market speculation:

- Fortune's Niamh Rowe pondered the broader market effects

- Reuter's Elizabeth Howcroft captured some strategic responses to the halving.

- Forbes' Colin Harper highlighted the effects of Runes on transaction fees.

These articles help break down some rudimentary technical aspects of the Halving, linking them to broader economic principles of supply and demand, making the complex workings of something like Bitcoin mining more accessible to the general public.

That's a huge net positive.

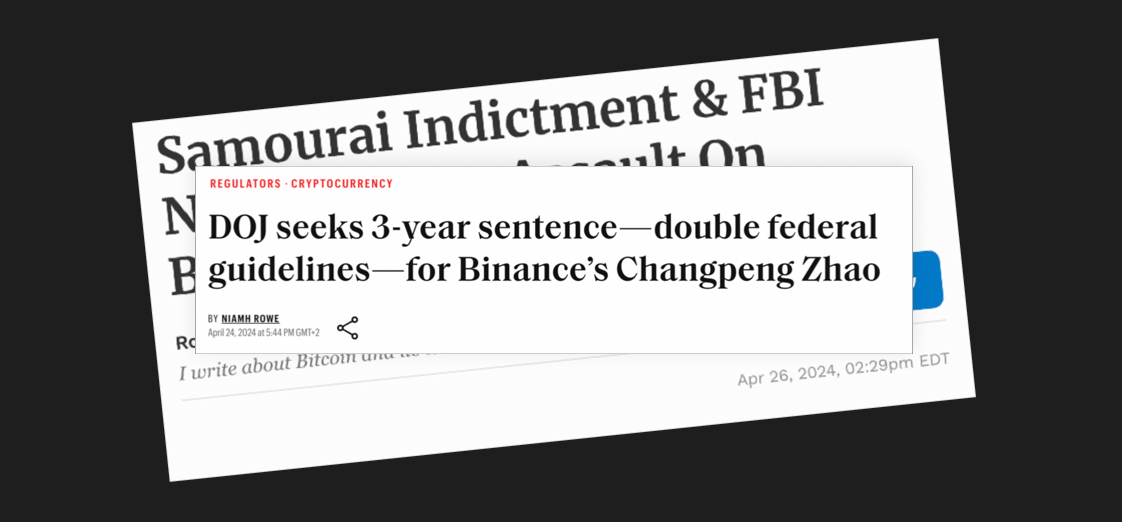

Samurai Showdown in Privacy Battle

If you're dialed into Bitcoin Twitter (maybe a bit too much?), you might think the arrest of the Samourai Wallet founders was the talk of the globe.

But while that story definitely stirred things up, last week’s broader media coverage had different tales.

On one side of the narrative, you've got ConsenSys pushing back hard against the SEC’s move to label ETH as a security.

Why is this included in a Bitcoin media research report, you say?

Well, just see how Fortune's Jeff John Roberts highlighted the debate, noting:

"The controversy over Ethereum has been especially heated since the SEC has signaled repeatedly in the past that the blockchain’s tokens, like Bitcoin, are not securities and therefore outside its jurisdiction."

This really heats up the conversation, in my opinion, since many in the crypto space and parts of the media have been likening non-Bitcoin protocols to Bitcoin ever since Bitcoin was given the nod and classified as a commodity.

Roberts goes on to say, "ConsenSys uses dramatic language to argue that the SEC’s efforts to exert jurisdiction over Ethereum are both illegal and a threat to blockchain technology more broadly."

But let's be real—it's not so much a threat to blockchain technology in general as it is a threat to the world of pre-mined ICOs. Those could really feel the squeeze if securities regulations tighten up.

Throwing more fuel on the regulatory fire, the actions against Samourai Wallet have sparked major privacy concerns and highlighted what happens when regulators might be overstepping their bounds.

Forbes contributor Roger Huang didn't hold back in his piece titled "Samourai Indictment & FBI Notice Are An Assault On Bitcoin And Privacy" spotlighting the ongoing struggle between maintaining privacy and navigating legal boundaries.

But it's not just about privacy.

There’s also the tightrope walk that big players in the crypto game have to manage amid these shifting regulatory sands.

Take, for instance, the DOJ's aggressive pursuit of Changpeng Zhao of Binance. Fortune's Niamh Rowe dived deep into this, illustrating just how tough the climate is getting for major figures in the industry who are finding themselves under increasing scrutiny.